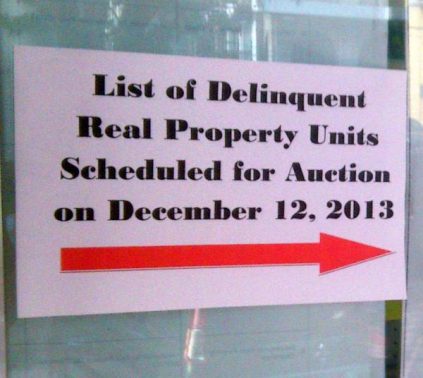

The Quezon City Office of the Treasurer has recently issued a notice with regard to tax delinquent real properties that will be up for sale through public auction on December 8, 2011, at 10:00am.

The venue of the public auction will be the Ground Floor, Taxpayer’s Assessment and Payment Lounge, City Hall Complex, Quezon City, Philippines.

This tax foreclosure auction sale is to be conducted by virtue of the provisions of Sections 260 and 263 of RA 7160, otherwise know as the Local Government Code of 1991.

Complete list of Quezon City Tax delinquent real properties

The complete list of Quezon City Tax delinquent real properties can be found below. Click to view/right-click to save. Please take note that due to the large file sizes (around 1.2Mb each), it may take some time to view/download these files, depending on your internet connection speed.

By the way, I apologize if some parts of the list are hard to read, the print quality of the notice of sale was not so good.

Also available: Click here to download a PDF version of the complete list of Quezon City tax delinquent properties for sale on December 8, 2011 (this contains all 4 pages in a single PDF file)

Source: Philippine Star print edition, November 21, 2011, page B-14 to B-17

*Please take note that as the auction draws near, many of the owners of the properties on the list will have already settled the arrears on the properties. This means the actual list of properties for sale during the auction will contain fewer properties than the list above.

Note: As per notice of sale above, prospective bidders on the Public Auction Sale are required to post cash bond of ten thousand pesos (Php 10,000.00).

Interested parties who need more information may visit or call the Quezon City Treasury Department.

Contact numbers for the Quezon City Treasurer’s Office can be found in the official website of the Local Government Quezon City through this link:

~~~

To our success and financial freedom!

Jay Castillo

Real Estate Investor

PRC Real Estate Broker License No. 3194

Blog: https://www.foreclosurephilippines.com

Follow me in Twitter: http://twitter.com/jay_castillo

Find us in Facebook: Foreclosure Investing Philippines Facebook Page

Text by Jay Castillo and Cherry Castillo. Copyright © 2011 All rights reserved.

Full disclosure: Nothing to disclose.

Hello Randy,

My father acquired a parcel of land within Quezon City since May 1994 by executing a Deed of Absolute Sale. Signed by both the vendee and vendor, acknowledged and duly notarized by a notarial public except it was not transfered nor the sale was not annotated at the back of the title of the above. Owners copy of Tct still registered to the previous owner and Original Deed of Absolute Sale are in my possession.

Now, the same parcel of land which was auctioned on April 2012. I believed, as a Heirs or as the landowner, do I have the right to redeem within one (1) year, the property that was put in auctioned, Regardless of there is a bidder or none. Can i exercise the “right of first refusal” if i still want to redeem the auctioned prop., pay all the tax arrears, incl. ineterest and penalties of the property and eventually transfer the title.

sa city hall po ba ng qc pdng maginquire ng mas detail na impormasyon tungkol po sa mga list ng properties… San po bang department ng QC hall? Kadalasan, magkanu po ba ang downpayment? at pd rin po bang ipasok to sa Pagibig loan?

Hi Randy,

Ss City Treasurer’s office po kayo pwede mag inquire, dun po yon sa may tax payers lounge.

Cash basis po and terms ng tax delinquent properties, hindi po pwede sa pagibig.

Salamat po!

Hi Sir Jay. I’m interested also. It means na pwede ko mabili ang property na naka enlist dito as as possible? Paano if occupied, pwede ba sila mapa alis??

sir jay ask ko lang, ung prices indicated sa list un ba ung payment for the tax? then iba pa ung price ng property? sensya na bago palang po ako sa real estate. thanks

Hi Addcs, yes yung prices indicated sa list ay yung amount to settle the taxes, penalties, interest, etc. Yun na rin bale ang price nung property. They are selling the property with a starting bid equal to the tax delinquency(plus penalties, interest,etc)

Thanks for posting the list.

I’m sure Pacquiao does not have any tax delinquent property. I just saw this FUNNY video of Mexicans stepping on him before the fight. Check it out!

http://www.youtube.com/watch?v=fPPTZS0TOJY

I like this blog very much.Thanks for sharing such a valuable information.

Prescription of real estate taxes:

Local governments can collect real estate taxes for only five (5) years. Recently, I was able to reduce the real estate tax assessment of my client by 70%. If you need help, please email me at [email protected]. Thank you.

Thank you Atty. Rey for sharing this info!

sir anu po ba difference ng foreclosed sa delinquent property? Salamat po

Hi Buildbcs, ang tax delinquent property ay mafoforclose pa lang dahil hindi nakababayad ng real property tax. Ang bank foreclosed naman ay naforeclose na ng banko dahil hindi nakapagbayad ng mortgage payments.

so sir pwede po bang akong maki-bid l dito sa mga delinquent property then i can buy it just like in a foreclosed property? Newbie here po kasi on this type of investment. More power sir! thanks!

Yes, pwedeng pwede, just be sure to do your due diligence before you bid, and get ready when you win your bid. Iwasan mo ang occupied properties kung ang goal mo eh makuha yung property. If ang goal mo is to earn the 2% per month na interest, pili ka ng property na mukhang magbabayad yung owner ng arrears niya sa taxes. Please checkout the following post for more tips:

https://www.foreclosurephilippines.com/2008/11/marikina-public-auction-of-real.html

https://www.foreclosurephilippines.com/2009/07/9-lessons-learned-from-the-real-property-tax-foreclosure-auction-sale-in-quezon-city.html

Sir ,

Yung foreclosed po ba ng banks, hindi po occupied?

Hi Leahn, kahit foreclosed ng banks, meron din na occupied. Sasabihin naman ng bank pag occupied ang property nila.