Have you seen the low interest home loans being offered by a few banks out there lately? in 2011, the lowest home loan rate I have seen was 5.99% per year. As I update this, it is now even lower at 5.25%. Personally, I believe these are the best home loan rates I have ever seen in my lifetime. This even beats the 6.0% interest rate offered by the GSIS before.

Note: To find the lowest home loan rates, view our Home Loan Interest rates Comparison Chart

This sounds tempting , not just for real estate investors, but also for home buyers.

But wait, before you apply for a home loan, you need to know that the low interest rate is fixed only for the first year and can be quite risky…

Lower home loan rates mean…

Before I discuss the risks, let me first focus on the positive. Obviously, the biggest impact of having a low interest rate on your home loan would be a significant drop in the monthly amortization payments.

Let’s say you are going to buy a foreclosed property and the loan amount is Php2,000,000. If we use the usual 12% as the annual interest rate, at 10 years to pay, that would mean a monthly amortization of Php28, 694.19. (I used our very own mortgage calculator which can be found here: Home Loan / Mortgage Calculator).

In contrast, if we used an interest rate of 5.25%, using the same loan parameters above, the resulting monthly amortization would be just Php21,458.43. This means a discount of Php7,235.76 per month in monthly amortization payments.

The savings in monthly payments is quite significant right? Imagine if you had several rental properties. This could translate to more positive cashflow.

In addition, I checked one of the banks that offer these low interest rates, and found out that the same rate is also applicable if one wants to refinance a home loan. I was surprised because I was expecting different home loan refinance rates.

This could be useful for real estate investors who want to get some cash out of their equity through refinancing, provided they are in good standing. I guess getting a new home loan for people with bad credit is out of the question.

Here’s the fine print

As with most things, there’s a fine print. In this case, the low interest rate is only fixed for the first year, and is subject to yearly repricing thereafter. This means that after the first year, one is at the mercy of interest rate fluctuations.

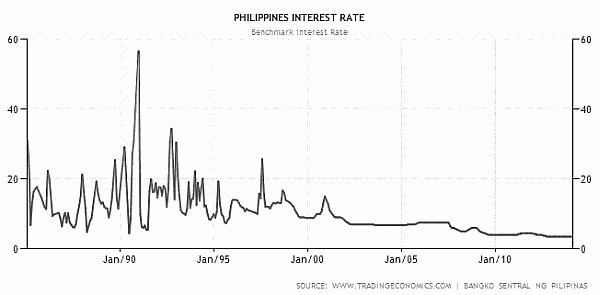

What if there was another financial crisis (knock on wood), and interest rates suddenly went up?! If that happens, there would be an increase in the interest rate to be used come repricing time, and would result in a corresponding increase in the monthly amortization payments.

By the way, some banks also offer some form of rate protection where the increase of the interest rate is limited to 2%. This is similar to the practice of Pag-IBIG. However, if one chose the option to have the interest rate fixed for only a year, it’s possible that the interest rate will be increased yearly right?

Scenarios

If you are a real estate investor and have rental properties purchased through home loans, the increase in monthly amortization payments can turn a nice positive cashflow generating property into one that is negatively geared, which is like a money pit. It can swallow up all of your money.

To illustrate, if interest rates jumped to 20%, the monthly payment for the example above would become a staggering Php38,651.13 per month. This is really possible and has actually happened during the Asian financial crisis in 1997 when the interest rates exceeded 20%. It is well-settled that history repeats itself, and real estate is cyclical, so it is possible that this will happen again.

Raising rents to cover the additional monthly payments can only work up to a certain extent and may not be enough, especially if a property is covered by the rent control law. Besides, market forces dictate rental rates and increasing it might drive tenants away, making the situation worse.

The same applies to non-investors. Unless one’s source of income, which is usually just one’s salary, more than covers any sudden increase in the monthly amortization payments, he is in danger of defaulting on his mortgage loan payments. A salary increase would help, but usually the opposite happens during bad times as businesses also try to save on expenses.

This can even lead to foreclosure down the road. In such harsh economic conditions during a financial crisis, the usual steps one can take to avoid foreclosure may offer little help and not work at all.

Nevertheless, I believe that the scenarios described above can be easily avoided by simply going for fixed interest rates.

Why go for fixed interest rates?

I believe that the proactive thing to do would be to go for fixed interest rates for the longest term possible. This eliminates the risk of being subject to sudden interest rate fluctuations, all throughout the loan term.

Sure, the interest rates usually become higher, the longer they are fixed, but at least, you are protected just in case prevailing interest rates shoot up due to economic conditions.

Anyway, If you are really concerned about the higher fixed interest rates for longer terms, my suggestion would be to have something in the middle, let’s say 5 years for example, provided you are prepared to have the loan fully paid before the end of the 5th year, if needed.

This seems to be a more balanced approach as you still get protection, but the interest rate at the start should not be too high.

What the heck, if you believe you can pay in full for a property in one year, then by all means, go for the lowest home loan rate you can find, even if it is just fixed for a year.

My point is simple, I suggest going for a fixed interest rate, with the longest term possible, so that at the very least, you will have enough time to pay-off the home loan to avoid any repricing, if interest rates really do go up.

This will help minimize your risks, and have peace of mind, which I believe is priceless.

Happy investing!

To our success and financial freedom!

Jay Castillo

Real Estate Investor

Real Estate Broker License #: 3194

Blog: https://www.foreclosurephilippines.com

Follow me in Twitter: http://twitter.com/jay_castillo

Find us in Facebook: Foreclosure Investing Philippines facebook page

Text by Jay Castillo and Cherry Castillo. Copyright © 2014 All rights reserved.

PS. Don’t be the last to know, subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips.

Image courtesy of cooldesign / FreeDigitalPhotos

Pingback: Security Bank's 6 for 5 Home Loan Promo Extended To June 15, 2017

Pingback: How To Proactively Prevent Foreclosures (and NOT lose everything) - Part 2

Hi Jay

I just want to ask , how to get a loan from the bank to build a property? And which bank offering low interest rate ? thank you

hi sir jay, i have a 10 years existing home loan from a certain bank, i already paid for about 5 years, is it possible to pay the remaining in full, as in prepay? will it lower the interest? will it be adjusted? would it cost me?

Hi Sir jay!

What is the current repricing rate/fixed rate for the existing home loan borrower on the different banks now? especially rcbs, pnb and bdo.

– Xale

Hi Sir jay!

What is the current repricing rate/fixed rate for the existing home loan borrower on the different banks now? especially rcbs, pnb and bdo.

Pingback: Home Loans In The Philippines Interest Rates (FEB 2015)

Hi Sir Jay, i am about to start my bank loan for house and lot and thinking of what bank is better for it, BDO or Bank of Commerce. Based on housing developers list, BOC offers 8.25% interest rate for 15years payment term while BDO offers 11.25% interest rate and we all know that there’s no such term as fixed rate. Interest rates may fluctuate, so based on your analysis of banking strategies, which is better BDO or BOC? Thanks! Geraldine

Hi Sir Jay,

I just want to know how does the bank guaranty applies to the developer, do we have to stop our monthly amortization payments since the bank had already forwarded a bank approval letter. (take note that we have paid the down payment already) I know that transfer of title procedures would take time and the developer told me that it would take 3-4 months. I’m thinking sayang ung 3-4 months payments with interest under in-house financing scheme.

Hi Sir Jay,

Been reading your blog for months now and I find it very helpful and informative.

Just need your enlightenment with our current situation.My husband and I purchased lot in a subdivision. We have it fully paid last June 2012 but until now (2015 ) the title is not yet given to us. We also paid them the title processing fee last September 2014.

All we got from the developer are empty promises.

What are the actions that we can take for them to process our lot title quicker.

hi jay. thank you for your web site. it really helps… i have a residential lot i wanted to acquire. its a 150 sq metrs. the owner sells it at 800k. i have only 300k. any idea where i can borrow the 500K? personnal loan? boboy.

Bank loan po sakto para diyan. Salamat po!

Hi jay.

We are planning to apply for a house loan in bdo. We are ok with requirements and all. But our problem is that our title has a stamp republic act no. 26 which according to a lawyer we need to have it cancelled first. Will it bw the same with the banks?

My worry is that instead of paying the 3500 immediately we might as well pay it for cancellation then proceed with pagibig loan instead. Do you wncounter a case like this?

I hope you will be able to help me. Thanks

Hi Sir Jay, i was planning to get a house cost 2.1M my monthly income is 50k, and im willing to pay the 20% downpayment on the spot. But i was told that i cannot apply the housing loan on my own bank which is BPI. Because they said they have tied already with PS Bank. Will the bank can offer me to shorten the payment to 10yrs.? also if i have some extra income can i pay more than my monthly amortization to shorten my payment years? Im kinda new to this things i hope you can enlighten me more on waht the things i need to do. Thanks in advance : )

Question: does amortization fee applies even you haven’t move in to the property yet?

Hi Dina, usually once the sale is consumated, you start your monthly amortizations, regardless of whether you have moved in or not.

Hi Jay…Very nice Article. I Just got a 20yr housing loan through BPI with a 5yr fixed rate of 6.5%. But I have a Question: There is this new promo of Veterans Bank known as HOME LOAN-FREE HOME –> Your Principal Loan back to you 100%! Here’s their site: http://www.pvbhomeloans.com/ – Their promo is only open for two months (Mar 1 to May 31st). Their 5-yr fixed interest is at 8.25%.

I need your advise if this is a good promo by Veterans Bank? I couldn’t believe it at first, but this is really true. 🙂

Same here I’m very curious, bordering skepticism. This is just too good to be true

Hi jay, would you suggest to loan in veterans bank home loan promo?

Pingback: Table of amortization factors updated with low home loan rates

hi sir jay!I am a newbie on real estate investment.I have a concern regarding my plan to build and sell.I have a raw lot and I want to build a house through housing loan from ucpb which has a 6% interest rate per annum.The manager said that they can allow me to borrow up to 1.5M for the refinancing and construction.What can you say about my plan?is it good for a newbie to start with?thanks!

Hi Elaine, build-and-sell is a good investment strategy, although I have not tried it yet myself, but we plan to do so soon.

As long as the numbers make sense, it would a good way to start. Just make sure you have cash reserves and the location is really good and the newly built properties can be sold quickly.

Very helpful. Thank you.

You’re welcome!

Can a bad credit score that was listed 1999 will affect my chance of getting an approved home loan? Can my name be cleared? I already settled and it was dismissed by the court already. I have clearnce now. . It was a bounced chk. It was a mistake, i was young then. how can i rebuild my credit score?

Hi Ella, I believe you can have this checked for you. No harm in having it checked to make sure your credit standing is already okay.

Pingback: Find The Best Financing With Our Home Loan Interest Rates Comparison Chart - ForeclosurePhilippines.com

Pingback: How to finance your residential real estate investments through banks

Pingback: Interest Rates: Its Effect on Individuals and Businesses « financialintermediaries

Hi,

is ITR really important requirement from the bank? Do they check it with the BIR? Or the Certificate of Employment (COE) and payslip is more important?

Hi Jason, yes, those are their requirements for employed individuals. They can at least verify with the BIR if your ITR is authentic. COE and payslips are verified with the employer.

Hi Sir

May I ask of the risk if the bank you mortgaged you house will be bankrupt?

How will i be sure of the stability of a certain bank institution sir?

Is PSBank a good one?

Thanks and more power.

Hi Claire, if a bank becomes bankrupt, the PDIC will takeover, and your mortgaged house will be safe. In fact, you might get a few months where you can defer payment until the takeover of PDIC has been finalized. PSBank is one of the strongest banks and is under the Metrobank group, so yes, it’s a good bank.

Hi

Very informative website you have here. I would just like to inquire about a few things before I do apply for a housing loan.

A) normally , how long does an approval for a housing loan expires ( meaning you cant avail it anymore after being approved )

B) I have paid more than 20 percent of the purchase price of the house already, if I move in prematurely ( before approval of the loan ) will this have any effect on the approval of the housing loan ? the developer gave the go signal to move in since I paid more than 700K already. But I have not applied for a housing loan yet.

C) If I do opt for a variable interest rate on a housing loan, do you have an average figure on how much the pretermination charge is nowadays ?

Thanks

Flip

Hi flip, thanks for the kind words!

With regards to your questions, let me try to answer them below:

1. Normally an approved loan needs to be used within 3 months of approval. After 3 months, the borrower needs to re-apply and resubmit loan requirements.

2. The amount you have paid should have no bearing with regard to loan approval as this is between you and the developer. The bank is only concerned with your loan amount, your capacity to pay, collateral, etc.

3. The highest pretermination charge I have seen is a Php25K preterm fee (this is for a housing loan with RCBC Savings Bank – different from the the loan for their acquired assets)

I hope this helps!

Kudos to a very wonderful site that has has been very informative regarding foreclosed properties. I should admit that i am one owner that has a property that has been issued a Notice of Foreclosure, since my ex-hub failed to pay the monthly amortization of our house (townhouse unit) apparently for 6 yrs. an info. i personally gathered when i reported to the Natl. Home Mortgage office regarding the letter. I’m actually an OFW, bought the property on my name, has paid my monthly payment diligently since 1994, for about 12 yrs before it has been neglected by my estranged hub who did not care about at least providing a house for our 2 daughters, while i worked myself to death just to provide 12 yrs paying the same and shouldering all the other school & monthly exp. of my children. Unfortunately after all these hardships, my 2011 ended being jobless, back to phils. and a house that was served with this NOF. I honestly don’t have the money to solve the prob and left with no choice but to give it up, but God is good ‘coz a close aunt of mine was willing to help me out to save my property. However, if i am to repay my account, it will be at amount too far expensive that will triple its original TCP and my supposedly balance when the last mo. amortization was paid off. 6 yrs back. So, this led to a solution that to let it be finally foreclosed and buy it at a new price base on its appraisal will be the best way to get it back at a not so hefty price. Question: how come when i asked the Natl. Homes that a family of mine is interested and willing to buy my property in cash as long as it is on a reasonable price, they told me that i still have to report and pay 70k to their head office, legal department to proceed with the processing to foreclose my property before they can finally appraise my house. Is this the proper requirement for me as the owner who had failed to pay its amortizations due to incapacity of my ex-hub who was supposed to have covered those failed payments? While the fact is that they said that my property is already out for sale to the public. And if that is the case, that another individual i do not know would come to them and declare interest to to buy my house, should i still be required to pay the 70k litigation fees and report to their legal department to voluntary foreclose my house? how long is the procedure before i will be advised to vacate my house in case there is already a new buyer/owner. I will appreciate your help to give me some of your opinions regarding this situation. Thanks and more power to your site.

Pingback: Goodbye and thank you 2011! Hello 2012! — Foreclosure Investing Philippines

Hello!Which is better to get a housing loan?Thru Pag ibig,Bank financing or in house financing?Why do they need this collateral for bank financing?Which bank have a better offer of housing loan?Thanks!

hi sir! do you know what bank fees and charges (i.e. insurances) apply after loan is approved? is there such a fee called registration of mortgage? thanks!

thank you for the reply. i found a property from bpi that i really like. their listed price is 2.9M, but they re-appraised it (external) for 3.040M and re-appraised again (internal) for 2.45M. the officer told me that i should make an offer for that price bcoz his boss wants to stick to their internal appraisal.

is it true that i can’t negotiate anymore? i have read from Larry’s TRP that we should be the one in charge and not the bank. How can i get a 30-40% discount? do i have to pursue or postpone?

i had it appraised by metrobank and still waiting for the report. If metrobank appraised it higher, then maybe i don’t have to cash out for the 20% DP. but i’m also thinking of getting an appraisal from east west bcoz of their 5.88% interest rate for the 1st year with a plan of taking out the loan to other bank after a year if the increase will be too high.

am i doing the right thing?

your insight will be highly appreciated.

Note: this property is not a house and lot but a vacant lot with improvements that i will use for my business, but i told the bank that this is for residential purposes only so i can get a lower interest rate for housing loan versus business loan.

Blessings! ^_^

based on my computation, i can save more than 60,000 pesos from the fist year as a benefit from 5.88% from east west.

from your experience, how much pre-termination charges does the bank give?

hi there!

if the bank will increase the interest rate on 2nd year, can i take out the loan to another bank which has a lower interest rate? does the bank approve to refinance after a year?

thanks,

ann

Hi Ann, yes you may take out the loan, but you need to check if you will have to shoulder any pre-termination charges. This would depend on the bank.

Very nice posts!

My wife and I, both 31yrs of age, are planning to avail of a construction loan worth Php5,000,000. Both of us have stable jobs and as per gross monthly requirements we are qualified for the loan amount in a 20 years term.

We’ve talked to Chinatrust, HSBC, BPI and now planning to talk to Metrobank and BDO. All these talks with the banks made me more indecisive and somehow confused as to which bank we should go for. This is the first time that we are availing for a loan that’s why we are not very familiar with the “banking language”.

I’ve been searching the net for intelligent forums about loans and so far this is the only forum I can find worth reading. I do hope that you can suggest was is the best approach I should make. And share your experiences (good and bad) with the banks I mentioned.

Is it 1yr, then every 5yrs? Or for security go for the 20yrs fixed rate immediately? BPI or HSBC or BDO.

Thank you in advance.

Hi JM,

Thanks for the question and compliment! My opinion is to go for the longest term possible with fixed rate(which is 20 years in your case), provided, the bank will allow excess payments to go direct to the principal (so you can shorten your term and in effect lower the interest that you will pay, just in case you have excess cashflow) , and if they will allow you to take out your loan to another bank just in case interest rates drop and they become low enough to make it worth the effort to move your loan to another bank, if it will significantly lower your monthly amortizations.

I have no existing loans in any of the banks you mentioned so i really can’t give any feedback about them at the moment. Just stay away from banks that might close for whatever reason in the near future, like BF for example, which was recently closed by the Bangko Sentral.

Thank you Jay for adding me in your FB list of friends…could I possibly consult you

regarding an interested buyer for a house or apartment in our area ( Bgy. N. S. Amoranto) in La Loma, QC and since I have found a foreclosed propery, worth 3.3M ( PNB ) can you help on the steps how to negotiate with the bank? Hoping we could work together thank you and more power!!!God Bless

A home equity loan can help you obtain money for anything you need and you may be able to borrow an amount that is equal to how much equity you currently have invested into your home. You should always apply for the home equity loan, when you are strictly in need of cash money or want refinancing for your first mortgage. Therefore, the home equity loans are often termed as the “second mortgage loans”. Home equity loans also allow you to tap the equity, so that you can get the cash without getting refinanced.

Nice read. Very useful. all along I though loans were fixed for the entire duration chosen so it was a matter of chosing which bank offered the lowest rate for the same lenght of time. Now, with all the “low interest” advertisements, deciding which bank and what type of loan to take really need a lot of thinking and study although it’s really unpredictable. Thanks for the tip!

Thank you Christian for visiting my blog, and I’m glad you found this post very useful! Yup, even with applying for a housing loan, you need to do your due diligence. Cheers!

Pingback: RCBC Savings Bank foreclosed properties auction slated on April 9, 2011

Pingback: The risks of real estate investing and how to manage them

Question: In case of a fluctuation, how much increase would a 5.75% interest rate have? and in a worst case scenario?

Hi JM, in case the bank does not have any cap on how much they can raise the interest rate, it can go as high as a double-digit increase. For Robinsons bank and pag-ibig, they have a maximum increase of only 2% on the following year.

Hi Jay,

I was glad meeting you yesterday in TRP seminar and knowing we’re living at the same area. I hope you can find some time to send the template of contracts that you promised, like the rent-to-own contract, deeds of sales, etc. Since we’re living at the same area, do you know of a good real estate lawyer here that doesn’t charge an arm and a leg?

Also, do you know of any townhouses for sale within Pasig? It should be near the Ortigas Center. I have 3 buyers looking at the same area. Who knows maybe we can do business someday 🙂

Many thanks and best regards,

Joel

Hi Joel,

It was a pleasure meeting you during the seminar! Actually you can get the legal form templates from this link: https://www.foreclosurephilippines.com/2009/04/19-free-legal-forms-and-contracts-from.html

By the way, regarding your buyers, please enter the details of their property requirements in this form: http://bit.ly/findaproperty

This will help me know exactly what kind of property they need. Yes, I look forward to working on a deal with you soon! thanks!

Great exchange of sensible thoughts.

I believe it boils down to balancing the capacity of the buyer with the recent offerings plus the impact of future (ascending) fluctuation.

Btw, which bank/s offer this low rates?

Currently the 5.75% rate is being offered by HSBC. Robinsons Bank and Eastwest Bank both offer 5.88%.

I was told by a bank manager that this is still a good offer since one can change to having a fixed interest rate after a year without penalty.

This means borrower could just take advantage of the low rate for a year and if the following or succeeding year would show an increase in interest rates, then they could have it changed.

But I guess the only downside is the borrower should make a close monitor on the changes.

Hi Liza, yes I agree, the borrower should proactively monitor the prevailing interest rates and take necessary action before the fixed term lapses. Thanks for the comment!

Hi Jay,

Got your point there Jay particularly with the investors. As long as your cashflow is positive, you wont mind paying interest.

And, it would be better if you get a 10-yr loan and then your buyer is paying you on a 15-yr term.. Just like what you did with your previous deals.. 😉

Hi DJ,

Case in point, my loan for that deal has a fixed rate for the first 5 years, that’s the maximum fixed term that they offered me. Either I will have that loan fully paid before the 5th year ends, or I will take it out to another bank (or even a private money lender) where I can get a better rate which is fixed up to the end of the 10th year. 🙂

When it comes to getting the longest term possible, I cannot agree 100%.. Based with my knowledge and understanding in numbers, it will just give you bigger accumulated interest.

It only helps the buyer/investor to get a lower monthly amortization but in the end, you end up paying a big interest.

For buyers that can afford a higher monthly amortization, go for the shortest term that you can afford.

This is my own opinion. Still the decision will still be based on the buyer’s financial capacity

Hi DJ,

From an investor’s point of view, I really won’t mind if the accumulated interest is big, as long as I have a positive cashflow. The interest is passed on to the tenants, and this can only be possible if a property is really a good deal.

From a home-buyer’s point of view, I would have to agree that the accumulated interest becomes huge with a longer term. I guess that’s the trade-off with getting a longer term to have smaller monthly payments, which is more manageable and affordable.

I good solution would probably be to choose the longest term, while ensuring payments in excess of the minimum monthly payments are credited towards payment for the principal.

With the above in place, a buyer that has excess cashflow can then make excess payments, thereby lessening the interest and the loan term as well. But in case the buyer’s cashflow becomes not so good for whatever reason, he can just pay the minimum payments, which should be smaller and more affordable if he got the longest term.

The net effect is he can have the same lower accumulated interest as if he chose the shorter term, while having the flexibility of paying smaller monthly amortizations that come with a longer term.

Thanks for the comment, cheers!

in other words, don’t swallow what you can not chew you will end up being choked….

Hi Jay,

I guess what should be asked is how one see the interest rate in the following years?

How about you sir?

Hi Ian,

With the things happening right now in the middle east, and with our own BSP making a forecast that our inflation rate will increase, interest rates might go up as well, though I believe it won’t be a big increase.

Cheers!