In my previous post: How to compute for the monthly amortization payment without a mortgage calculator, Tyrone of Millionaire Acts asked through his comment: “How about if we don’t have access to the amortization factors table? Is there a way to compute it?”. The answer is yes, and I’ll illustrate how to do it through this post.

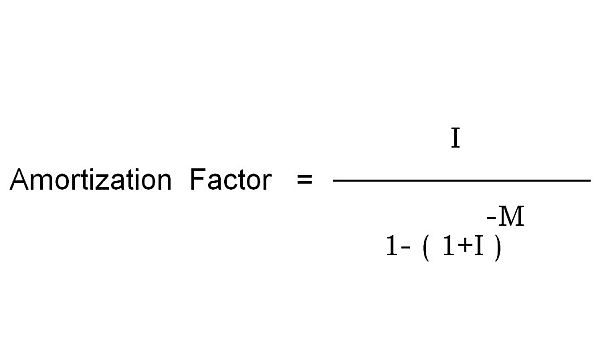

I got the following amortization factor formula when I reviewed for the November 2007 Real Estate Brokers Licensure Exam under Engineer Enrico Cruz:

Where:

I = the monthly interest rate. You can easily get this by dividing the annual interest rate by 12

M = the loan payment term in months. Just multiply the loan term by 12.

Let us use the same example in my previous post.

A foreclosed property is being sold for Php 1 Million and you can purchase it with only 20% down payment, with a maximum payment term of 10 years, at an annual interest rate of 12%. What would be the amortization factor you will use to compute for the monthly amortization?

First, let us compute for the Monthly Interest Rate (I) and the Loan payment term in Months (M)

I = Annual Interest rate/12

= 12%/12

= 1%

M = 10 years x 12 months/year

= 120 months

Now we can compute for amortization factor using the formula above. I’ll just substitute the data below:

1%

Amortization Factor = ———————————–

-120

1 – ( 1 + 1% )

0.01

= ———————————–

-120

1 – ( 1+0.01 )

= 0.01434709

As you can see, we arrive at the same value for the amortization factor we used in my previous example. Of course I would only use the formula in excel as I would not want to compute this by hand, it would be very difficult to calculate for a number with a negative exponent like that in the example right?! 🙂

I would still prefer to keep a copy of the amortization factor table in my wallet so I don’t need to bring my laptop with me everywhere. I can then compute by hand or use the calculator on my cellphone. By the way, I believe there is also a built-in function in excel that can do this calculation but I haven’t tried it yet.

Easy right?!

—

To our financial freedom!

Jay Castillo

Real Estate Investor

PRC Real Estate Broker License #: 3194

Text by Jay Castillo. Copyright © 2018 | All rights reserved.

P.S. – If you are a new visitor, please start here to learn more about foreclosure investing in the Philippines.

P.P.S – If you feel that anyone else you know might benefit from this post, please do share this to them and don’t forget to subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips.

![Why invest in foreclosed properties in the Philippines? + Top things to consider [Video] 6 Why invest in foreclosed properties in the Philippines? + Top things to consider [Video]](https://www.foreclosurephilippines.com/wp-content/uploads/2023/03/video-how-to-invest-in-foreclosed-properties-in-the-philippines-v3-728x410.jpg)

how do I put this formula in excel?

Hi Stephanie, please see my reply to Gil B. below. Thanks for dropping by!

Can you please show an illustrative example that shows how ADVANCE payments on the Principal may decrease the number of years of payments. Please show us how to compute that too. Also, instead of decresing the number of years of payments, is it possible that ADVANCE payments on principal will decrease the monthly amortization while maintaining the original term period of the loan? Thank you very much for your very instructive blog. More power to you!

Hi Jaelin, will create a table for this when I have time, or I’ll just create a calculator that illustrates this.

Hi Jay,

This would actually be helpful, as I’m looking to get a 15-year fixed with lump sums every year. I want to know the # of years that will be remaining relative to the lump sum amount per year that I will be paying.

Anyway, this site is AWESOME! Initially I was just looking at PH bank rates and went up to learn amortization rates in as fast as 15mins! KEEP IT UP!

What about if monthly interest is applied on diminishing balance?

Hi Cynthia, the formula above is already for what you said. Thanks.

Hi Jay. how do you derive the factor using the scientific calculator? thanks

Hi Gigi, please see link to wikipedia in my answer to Thales for the same question. Thanks.

hi jay,

how did they derive this formula? thanks..

Hi Thales, wikipedia has an article on how the formula was derived. Please check the following link:

http://en.wikipedia.org/wiki/Mortgage_calculator

Hi Jay,

I appreciate very much the knowledge you’re sharing. I just want to find out how to do the formula you gave (the one with a negative exponent) on Excel. Thanks so much.

Hi Gil, to enter a negative exponent in excel, you can use ^-X where X is the exponent. You can also download this file to see an example: Sample_amortization_table(Unionbank).xls

By the way, you can also use the PMT function in Excel:

PMT function: Calculates the payment for a loan based on constant payments and a constant interest rate.

Syntax

PMT(rate,nper,pv,fv,type)

For a more complete description of the arguments in PMT, see the PV function.

Rate is the interest rate for the loan.

Nper is the total number of payments for the loan.

Pv is the present value, or the total amount that a series of future payments is worth now; also known as the principal.

Fv is the future value, or a cash balance you want to attain after the last payment is made. If fv is omitted, it is assumed to be 0 (zero), that is, the future value of a loan is 0.

Type is the number 0 (zero) or 1 and indicates when payments are due.

Set type equal to If payments are due

0 or omitted At the end of the period

1 At the beginning of the period

Remarks:

The payment returned by PMT includes principal and interest but no taxes, reserve payments, or fees sometimes associated with loans.

Make sure that you are consistent about the units you use for specifying rate and nper. If you make monthly payments on a four-year loan at an annual interest rate of 12 percent, use 12%/12 for rate and 4*12 for nper. If you make annual payments on the same loan, use 12 percent for rate and 4 for nper.

Tip To find the total amount paid over the duration of the loan, multiply the returned PMT value by nper.

This is very instructive. God bless you.

you are so helpful and selfless! thanks for putting up this blog 🙂

Thanks Mildred, I really appreciate your kind words!