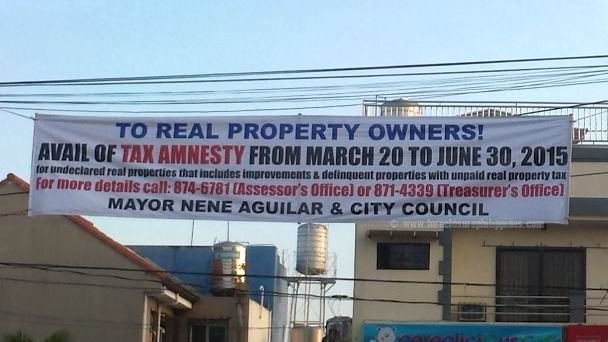

The Quezon City Office of the City Treasurer has recently issued another notice of sale of delinquent real properties which shall be sold through public auction on July 8, 2010, 10:00am, at the main entrance of the Taxpayer’s Assessment and Payment Lounge, Quezon City Hall, Quezon City.

If you plan to invest in tax delinquent real properties in Quezon City, I have here four tips for you. But before that, let me share a brief overview on tax delinquent real properties.

What are tax delinquent real properties?

Tax delinquent real properties are properties that have been certified by the City Treasurer to be delinquent in the payment of real property taxes, penalties, and cost due thereon as of the date of publication of the notice of sale. These shall be sold through a public auction by virtue of the provisions of Section 260 and 263 of RA 7160, otherwise known as the Local Government Code of 1991. This can also be referred to as a tax foreclosure auction.

- Image via Wikipedia

The notice of sale for this particular tax foreclosure auction in Quezon City was published last June 14, 2010 in the Philippine Star, pages B-12 to B-15. Due to the large listing of tax delinquent properties, I have split them into four parts which can be downloaded below.

Want to get notified when this is updated? Subscribe for free updates!

Get new/updated foreclosed listings, auction schedules, property buying tips, and more, sent straight to your email inbox. It's free!

Four tips for real estate investors

Here are my four tips for real estate investors who plan to participate in the Quezon City Tax foreclosure auction on July 8, 2010:

Tip #1

Disregard the address that you will find on the list under the column “Declared Owner”. This is the address of the declared owner, NOT the address of the tax delinquent property that will be auctioned. To determine the address of the property, proceed to Tip #2.

Tip #2

To get the actual address of the property for visual inspection as part of due diligence, refer to the Transfer Certificate of Title(TCT) or Condominium Certificate of Title(CCT) number on the list of tax delinquent properties, just get a copy at the registry of deeds. “What if a property has no TCT/CCT number on the list?” Just get the tax declaration number and the name of the registered owner and bring this to the tax mapping section so that they can give you property details like the exact address, location, and the TCT/CCT number.

Tip #3

The actual list of tax delinquent properties will surely become smaller as the auction draws nearer because most of the owners of the real properties will pay the delinquent tax, interest due thereon, and the expenses of sale. Because of this, be sure to get the most updated list of tax delinquent properties for auction at the Quezon City Treasurer’s Office and have a list of backup properties during the auction.

Tip #4

If after doing your due diligence you decide to bid for a property and win, have the Certificate of Sale (COS) registered with the registry of deeds as soon as possible as the one year period of redemption shall begin to run once the COS has been registered. Winning bidders shall be issued a COS by the City Treasurer upon full payment of the winning bid price. For more details, please refer to the auction guidelines which can be found here.

Got more tips? Please share them here by leaving a comment. Thanks!

Happy hunting!

Jay Castillo

Real Estate Investor

Real Estate Broker License #: 20056

Blog: https://www.foreclosurephilippines.com

Follow me in Twitter:http://twitter.com/jay_castillo

Find us in Facebook:Foreclosure Philippines facebook page

Text by Jay Castillo and Cherry Castillo. Copyright © 2010 All rights reserved.

PS. Are you a new visitor? Click here NOW to start learning more about foreclosure investing in the Philippines

PPS. Don’t be the last to know, subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips. Inbox getting full? Subscribe through my RSS Feed instead!

Pingback: What You Need to Know About Real Property Tax (RPT) - ForeclosurePhilippines.com

Great Blog u have here, I have been reading ur blog for no more than a year now..looking for a piece of property i can call my own.. until i came across this part..

i have to tell u frankly,im on the other side of the fence regarding this issue..which u can refer to as the occupants leaving in a certain property in qc (not ours,no title or paper what so ever,its just that it has been with us since 1986 0r 87 not sure)…

until a note last year around nov came to us that the property will be included in the dec 2011 auction in quezon city hall..the note came in with a total tax pertaining to 30years of unpaid dues to the goverment..i have check with the list who the owner was,and i pertained to the developer that is not existing anymore..

Not sure on what to do cause we have no proof to tell it was ours. members of our extended fam ,senior to me,or the ones running the property did nothing…. so i went on to join the auction,thinking it was the right thing to do(brought enough or just right money)–unfortunately,i came in 8 properties late,from the part they were pertaining to us(our location)..and somebody did just got ours for a dirt cheap tag of 100k..

2 months ago they requested for a meeting (with the auction winner and an attorney which holds office in qc,and they, from my point of view ,knows each other for so long and had been doing this together ahead of us before)

Attorney tells us to hold talks(with the winner) to agree on (if we like) that the property be divided (equivalent to the number of our the heads living in the property which was around 10)…

i suggested the we buy back the property and all i had was a smile from both of them..

I suggested that we leave right away and did so ,and left them with a polite notion that we are not interested on their offer and we will look for better options than talking with them..

i will ask you sir..where do i (we) stand here..

i will appreciate any advise you can give me..thank you for reading this..

Hi Jay!

I have bought a property last year from the Cebu City Tax Auction. I am still in the process of transferring the title to my name as there was no redemption after 1 year. I would like to ask you then for your experience regarding the payment of Capital Gains Tax in the BIR. What tax base is going to be used for this kind of sale by the City Government? Is it computed from the bid price or is it the zonal value or market value, whichever is higher?

I am interested to know based on your actual experience and not based on what is stated in the NIRC. Please let me know. Thank you.

Sir Jay,

I am a young follower of the most popular Real Estate Website of yours. I am very much inspired with all the topics found in your website. Thank you very much for all the efforts.

Sorry for this topic I am going to ask which is out of the discussions above. I just want to know if any website we can check prices of land ( per square meter) in the Philippines in a particular province.

Thank you.

Hi Gerry,

As of now I am not aware of any site that has a database of prices of land per location. What I would suggest is for you to do a search for current prices of comparable properties on online classified ad sites. The closest possible to your target area, the better. You also need to consider that online prices are the sellers’ “wish price” or asking price with allowance for negotiation.

Goodluck!

Pingback: San Juan Tax Delinquent Real Properties auction slated on February 9, 2012 — Foreclosure Investing Philippines

Good Day…

Sir, It’s good to know that there is a site or forum like this one. interesado po ako sa pab bili ng maliit lang na property kahit lot lang, could you please give some advise for new comers like me..

Thank you so much and God Bless…

if you decide to join the bidding, be sure that you have enough patience and extra money because it does not end when you win, you have to do a lot of things, after you have been awarded the cos you have to annotate the sale in the original title, then wait for one year, then if not redeemed by the owner,you have to file a consolidation of title in court(you need a lawyer), then the court will conduct hearing, if the owner contends, the case will be prolonged for years, if you win in the case, the title will be transferred to your name, if the property is occupied or tenanted you have to eject the tenants, this is another case you have to file in court, hearings will again be held, if you win, sheriff will implement the writ of execution. then you can finally say the property is yours, hehehe hirap, naranasan ko,

Hi Diego, thanks for sharing your experience. I agree with your sentiments which is why I would rather invest on properties that have a higher possibility of being redeemed. Sure, if a property is not redeemed, you may have gotten it for a fraction of the actual market value, but you will have to do all the things you mentioned above, and may take years to complete.

As for tenanted or occupied properties, I would rather avoid them.

Thanks for the comment, cheers!

If the property is vacant , do ou still have to get writ of execution?

Sir Jay, I would like to ask if you buy a foreclosed property, then how much would be the possible cost of transferring the title to your name from consolidation of title etc.?

“have the Certificate of Sale (COS) registered with the registry of deeds as soon as possible as the one year period of redemption shall begin to run once the COS has been registered.”

I’d like to make correction on that point. The redemption period starts to run immediately after the sale and the winning bidder has been recognized and has paid the bid price and this is regardless of whether or not the COS is registered with the RD. This situation differentiates the tax delinquency sale under the Local Government Code, which governs the delinquency sale conducted by the City Treasurer from the foreclosure sale conducted by the Sheriff in case of foreclosure of mortgage

Hi Renz, based on the experience of investors I know who who have bought tax delinquent properties and the redemption period has supposedly lapsed, they were informed that the one year period of redemption shall begin to run once the COS has been registered. I could be wrong.

Nevertheless, the auction guidelines state that the COS should be registered with the RD so might as well register it as soon as possible, just in case the interpretation that the redemtion period starts on the date the COS has been registered is true. Thanks for the comment!

thank you sir.

very informative! =)

You’re welcome Deep, thanks for dropping by!

Good Tips Jay. See you on July 2 & 3 Wealth Summit Expo.

Thanks Jun, see you there!

Jay, I am not familiar much with tax delinquent properties. Any other writings, articles or books you could recommend about this?

Thank you!

Hi Liza, please read our experience with the Marikina Tax foreclosure auction last 2008: https://www.foreclosurephilippines.com/2008/11/marikina-public-auction-of-real.html

You can also read the book “Riches in Foreclosures” by Dinna Revilla where a chapter is devoted to this. She wrote this prior to the controversies that led to her becoming a “fallen guru” as some people would put it. I believe someone in sulit.com is still selling copies, mine got destroyed by Ondoy.

Hi Jay!

Haha! This is how it feels pala to be the first one to comment, particularly in a very popular blog like yours!:)

Thanks for the post bro.

See you soon.

Hi Bryan, you’re welcome and thanks for being the first commenter! See you soon bro!

Pingback: Tweets that mention Four tips for investors who plan to invest in tax delinquent real properties in Quezon City