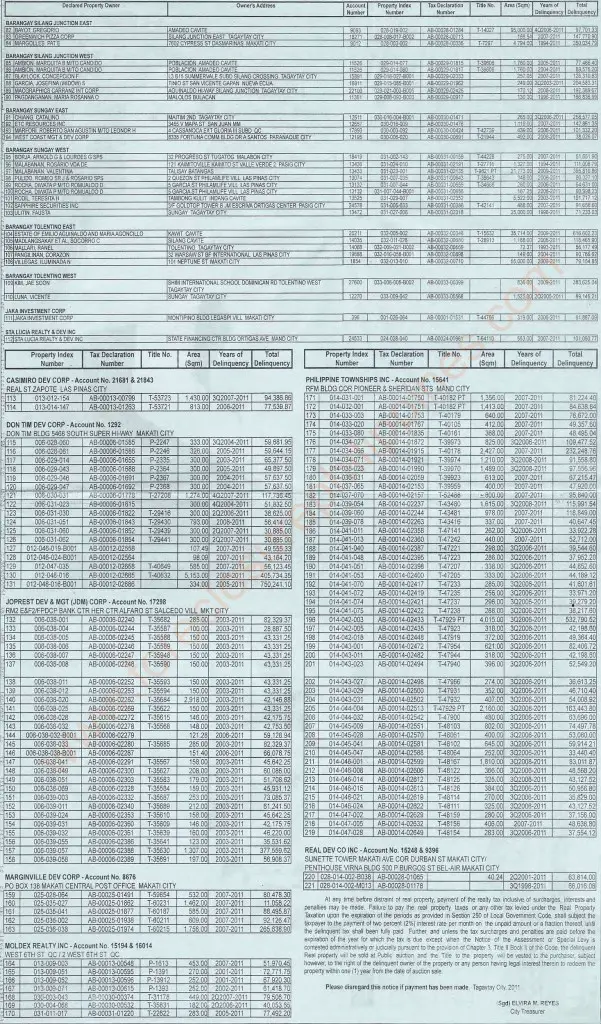

Tagaytay City recently published a first notice for tax delinquent real properties, by virtue of the provisions of Sec. 2A. 44 of the Codified Revenue Ordinance of Tagaytay City enacted from Section 254 of the Local Government Code of 1991.

Tagaytay City recently published a first notice for tax delinquent real properties, by virtue of the provisions of Sec. 2A. 44 of the Codified Revenue Ordinance of Tagaytay City enacted from Section 254 of the Local Government Code of 1991.

Nope, this is NOT a tax foreclosure auction sale. At least not yet.

This is just a first notice which basically gives the owners of these properties a chance to settle any real property tax arrears they may have, inclusive of any surcharges, interest, and penalties.

Let me quote the notice below:

“At any time before distraint of real property, payment of the realty tax inclusive of surcharges, interests and penalties may be made. Failure to pay the real property taxes or any other tax levied under the Real Property Taxation upon the expiration of the periods as provided in Section 250 of the Local government Code, shall subject the taxpayer to the payment of two percent (2%) interest rate per month on the unpaid amount or a fraction thereof, until the delinquent tax shall been fully paid. Further and unless the tax surcharges and penalties are paid before expiration of the year for which the is due except when the Notice of the Assessment of Special Levy is contested administritively or judicially pursuant to the provision of Chapter 3 Title II Book II of the Code, the delinquent Real Property will be sold at Public auction and the Title to the property will be vested to the purchaser, subject however, to the right of the delinquent owner of the property or any person having legal interest therein to redeem the property within one (1) year from the date of auction sale.

Please disregard this notice if payment has been made. Tagaytay City, 2011

(Sgd) Elvira M. Reyes

City Treasurer “

Download the first notice for Tagaytay Tax delinquent Real properties

Just click the images below to download the JPG version of the notice.

Also available in PDF format: Tagaytay Tax Delinquent Properties 2011 first notice.PDF

Source: Philippine Star, August 15, 2011

With the first notice above, I hope Tagaytay property owners who simply forgot to pay their real property taxes will settle their realty tax arrears so they won’t have to face the foreclosure of their properties.

~~~

To our success and financial freedom!

Jay Castillo

Real Estate Investor

PRC Real Estate Broker Registration No. 3194

Blog: https://www.foreclosurephilippines.com

Follow me in Twitter: http://twitter.com/jay_castillo

Find us in Facebook: Foreclosure Investing Philippines Facebook Page

Text by Jay Castillo and Cherry Castillo. Copyright © 2011 All rights reserved.

Full disclosure: Nothing to disclose.

Hi! If I will be paying the real property tax thru check, to whom I will be addressing the check to? Thanks.

Hi Karen, I would suggest that you check with the Tagaytay City Treasurer’s office who the payee should be. I would also suggest that you check if you should use a manager’s check. Thank you also for dropping by!

Pingback: Weekly wrap: A busy AND productive week