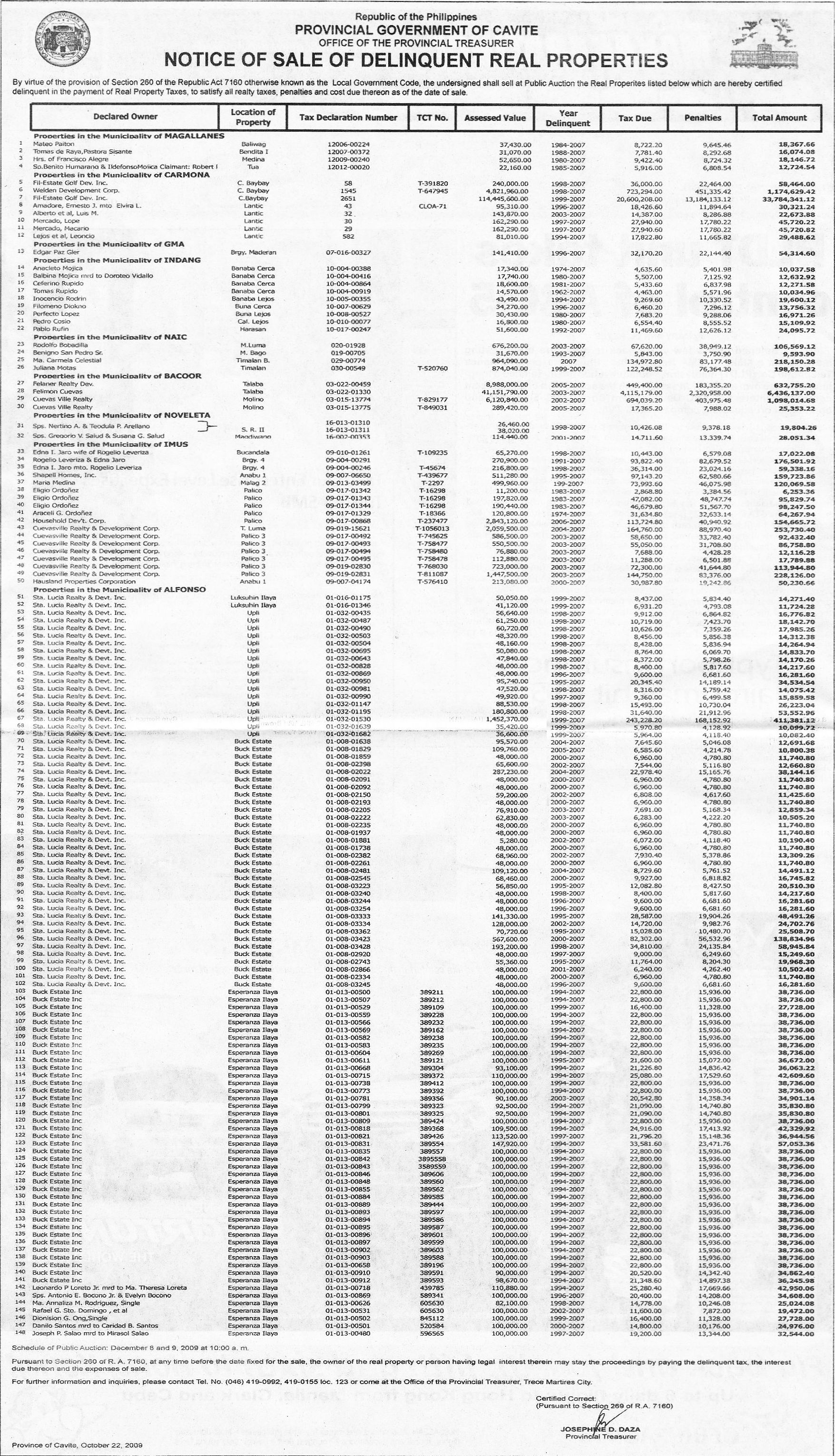

The Office of the Provincial Treasurer of the Provincial Government of Cavite recently published a Notice of Sale of delinquent real properties and as usual, I am sharing the list here for everyone’s reference. The notice of sale contains a list of tax delinquent real estate which are for sale through public auction on December 8 and 9, 2009 at 10:00 AM.

By virtue of the provision of section 260 of the Republic Act 7160 otherwise known as the Local Government Code of the Philippines, the Provincial Treasurer shall sell at public auction the real properties on the list which were certified to be delinquent in payment of real property taxes. The tax foreclosure sale shall be conducted to satisfy all realty taxes, penalties, and cost due thereon as of the date of the tax foreclosure sale.

Properties included on the list of tax delinquent properties are from the following municipalities in Cavite:

- Magallanes

- Carmona

- GMA

- Indang

- Naic

- Bacoor

- Noveleta

- Imus

- Alfonso

Click here to download the complete listing of Cavite delinquent real properties for sale through public auction on December 8 and 9, 2009 or just click on the image below:

Source: Philippine Star, October 22, issue, page B10

Pursuant to Section 260 of R.A. 7160, at any time before the date fixed for the sale, the owner of the real property or person having legal interest therein may stay the proceedings by paying the delinquent tax, and the interest due thereon and the expenses of sale.

Here is section 260 of R.A. 7160 for everyone’s reference:

SECTION 260. Advertisement and Sale. — Within thirty (30) days after service of the warrant of levy, the local treasurer shall proceed to publicly advertise for sale or auction the property or a usable portion thereof as may be necessary to satisfy the tax delinquency and expenses of sale. The advertisement shall be effected by posting a notice at the main entrance of the provincial, city or municipal building, and in a publicly accessible and conspicuous place in the barangay where the real property is located, and by publication once a week for two (2) weeks in a newspaper of general circulation in the province, city or municipality where the property is located. The advertisement shall specify the amount of the delinquent tax, the interest due thereon and expenses of sale, the date and place of sale, the name of the owner of the real property or person having legal interest therein, and a description of the property to be sold. At any time before the date fixed for the sale, the owner of the real property or person having legal interest therein may stay the proceedings by paying the delinquent tax, the interest due thereon and the expenses of sale. The sale shall be held either at the main entrance of the provincial, city or municipal building, or on the property to be sold, or at any other place as specified in the notice of the sale. acd

Within thirty (30) days after the sale, the local treasurer or his deputy shall make a report of the sale to the sanggunian concerned, and which shall form part of his records. The local treasurer shall likewise prepare and deliver to the purchaser a certificate of sale which shall contain the name of the purchaser, a description of the property sold, the amount of the delinquent tax, the interest due thereon, the expenses of sale and a brief description of the proceedings: Provided, however, That proceeds of the sale in excess of the delinquent tax, the interest due thereon, and the expenses of sale shall be remitted to the owner of the real property or person having legal interest therein.

The local treasurer may, by ordinance duly approved, advance an amount sufficient to defray the costs of collection thru the remedies provided for in this Title, including the expenses of advertisement and sale.

To get a general idea on what goes on during a tax foreclosure auction, you may refer to my post: 9 Lessons Learned From The Real Property Tax Foreclosure Auction Sale In Quezon City.

Please take note that I am posting this Notice Of Sale as a service to readers and subscribers of Foreclosure Philippines. For further information and inquiries, including but not limited to specific questions about any of the properties on the list, please contact the Office of the Provincial Treasurer directly through telephone no. (046) 419-0155 loc 123 or visit the Office of the Provincial Treasurer, Trece Martires City.

Of course if you have any general questions about tax foreclosure investing, please leave a comment below.

Happy Hunting!

—–

To our financial freedom!

Jay Castillo

Real Estate Investor

Real Estate Broker License #: 20056

Blog: https://www.foreclosurephilippines.com

Social Network: http://foreclosurephilippines.ning.com

Mobile: +639178843882

E-mail: ph.investor [at] gmail [dot] com

Text by Jay Castillo. Copyright © 2009 All rights reserved.

P.S. – If you are a new visitor, please start here to learn more about foreclosure investing in the Philippines.

P.P.S – If you feel that anyone else you know might benefit from this post, please do share this to them and don’t forget to subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips. If your inbox is getting full, you may subscribe instead to my RSS Feed.

P.P.P.S – Want to have your list of tax delinquent properties featured here? Contact me now and let me help you get your list to real estate investors, and that includes me!

Hello,

magkano fair market value sa Dasmariñas Cavite ngayon, anyone knows?

price range… for agri-land/raw land?

Thanks!

Cavite area po ba? Profriends has nice feedbacks and good quality affordable homes for OFWs and investors.

Hi Jay,

I am interested in Indang, Cavite properties but the auction was conducted last Dec 2009. In the event that there are stiil some lots available, how would I be able to know and what is the procedure to acquire such foreclosed proeperties then.

Thank you.

Please cal Imee 09291870449.

Indang Cavite Lots for sale

Price: Zonal Value

Hi,

Paano po ba yung payment terms kapag ganito? Cash lang ba or pwede rin sa pag-ibig?

Thank you.

Hi Ethan, sa tax foreclosure auction, cash payment lang ang available. To get a general idea of the rules and regulations that apply to tax foreclosure auctions, please refer to the Quezon City Rules, Regulations, and Conduct of the Real Property Tax Auction sale.

Sir Jay,

may nakuha ko info…nabasa ko lang… may plano pala mag tayo ng SM Mall sa Rosario City sa Cavite…I think ok din kumuha ng property malapit dun.

tnx

Hmmm, mukhang good news ito for those who live in that area. Thanks for the info Ronnie!

thanks sa info jay.

tulad ng previous post ko..

sa mga ganitong cases ba, yung buyer ang may responsibility ng unpaid taxes?

thanks

nhorvel

Hi nhorvel,

Actually for tax foreclosures like this, yung arrears sa realty tax plus penalties included na sa minimum bid price, so yes, lahat ng unpaid taxes is for the account of the buyer which he/she will pay through the wining bid price.