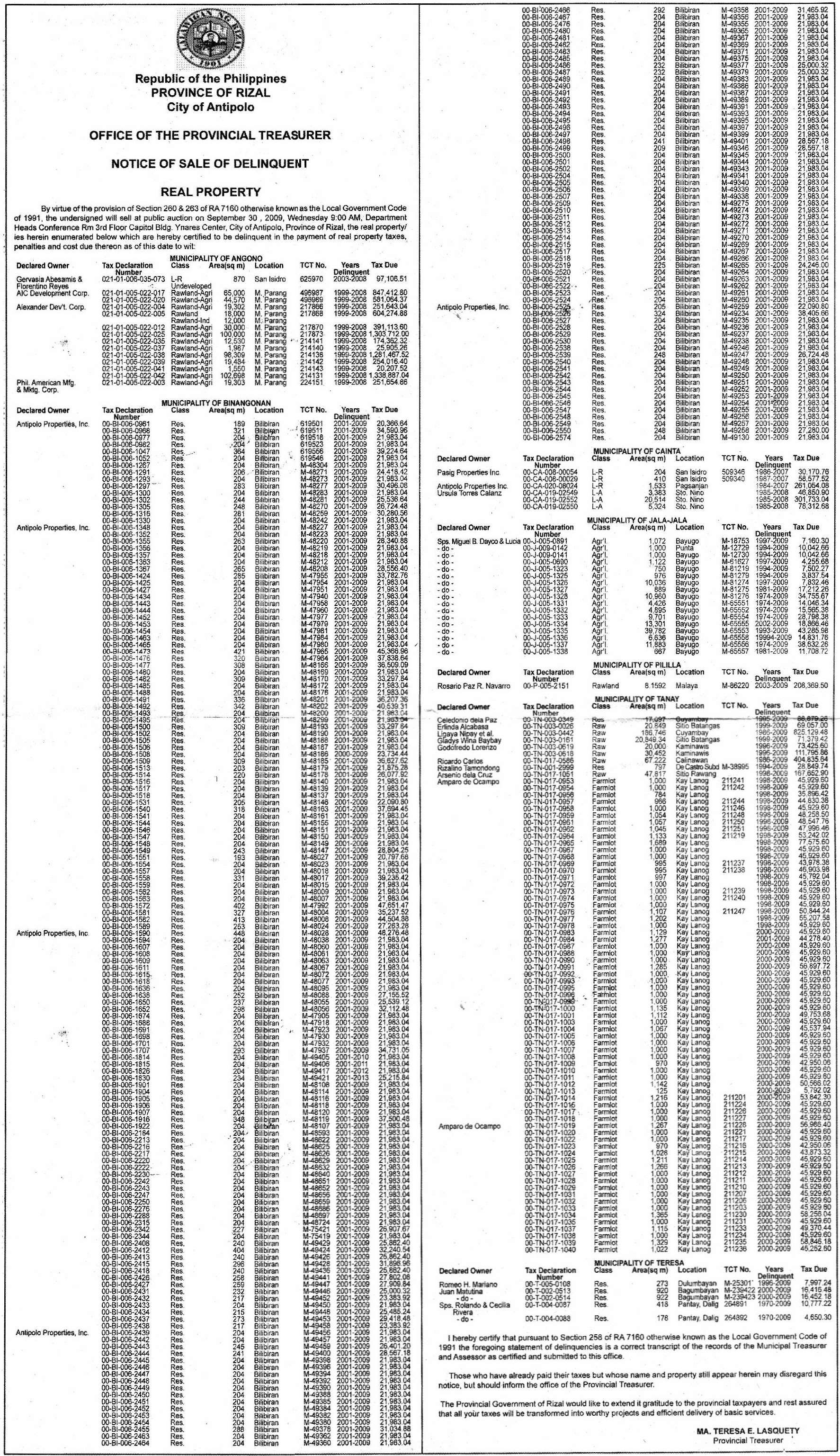

The Office of the Provincial Treasurer of the City of Antipolo recently published a notice of sale of tax delinquent properties. The notice of sale for the tax delinquent properties were published in the September 7, 2009 issue of the Philippine Star. I’m just glad my mom was able to find the notice of sale not just for me but for all of us. Thanks Mom!

According to the notice of sale, the Office Of The Provincial Treasurer will be selling the tax delinquent properties through public auction on September 30, 2009, Wednesday 9:00 AM, at the Department Heads’ Conference Room, 3rd Floor Capitol Building, Ynares Center, City of Antipolo, Province of Rizal.

The tax delinquent properties listed on the notice of sale were said to be delinquent in payment of real property taxes, penalties and cost due thereon as of the date of publication of the notice of sale.

Click here to download the Notice of Sale for Tax Delinquent Properties in Antipolo City for public auction on September 30, 2009. (or click on the image above)

The most recent foreclosure auction of tax delinquent properties I attended was in Quezon City and you can read more about it here and here. Speaking of Quezon City,they shall also be holding their own real property tax foreclosure auction on October 8, 2009. I’ll share more details about this in my next post.

Happy hunting!

—–

To our financial freedom!

Jay Castillo

Real Estate Investor

Real Estate Broker License #: 20056

Blog: https://www.foreclosurephilippines.com

Social Network: http://foreclosurephilippines.ning.com

Mobile: +639178843882

E-mail: [email protected]

Text by Jay Castillo. Copyright © 2009 All rights reserved.

P.S. – If you are a new visitor, please start here to learn more about foreclosure investing in the Philippines.

P.P.S – If you feel that anyone else you know might benefit from this post, please do share this to them and don’t forget to subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips. If your inbox is getting full, you may subscribe instead to my RSS Feed.

Pingback: Quezon City Tax Delinquent Properties public auction sale on October 8, 2009

Hi Jay, It’s good to know that you and your family are ok now despite the tragedy happened. Btw, i’d like to correct the Title of the auction you posted. It’s not “Antipolo Tax Delinquent Properties for Public Auction”, but rather “Rizal Tax Delinquent Properties for Public Auction”. It’s just so happened that the Provincial Capitol of Rizal and the venue for the auction is in Antipolo.

The city of Antipolo conducted their own Tax Delinquent Real Property for Public auction. Fyi.

Regards,

Jun Tagle

This is a good site. Keep it up!

Hello Idol Jay,

May importanteng katanungan lang ako tungkol sa Tax Delinquent Properties, let say nanalo ako sa auction tapos after a year hinde na tinubos ng may ari ang property nya. So it means maging akin na ito, subalit may nakatira na pala ibang tao not related to the owner nito at ayaw nilang umalis. Ang tanong, sino ang gagawa ng legal process nito?

Maraming salamat at lagi ko pong nagsubaybay sa inyong website. Mabuhay po kayo!!

Hi John!

Yes, kung nag lapse na yung 12 months at hindi tinubos nung may ari, at ikaw yung nanalo sa bidding for that property, magiging sayo na yon. If for example ikaw yung winning bidder, ikaw na ang mag fa-file ng ejectment case, etc.

Isa ito sa dahilan ko para laging isuggest na pagdating sa tax foreclosures, piliin lagi yung property na mukhang tutubusin nung may ari at ang magandang objective lang ay mag earn lang ng interest, nakatulong ka pa sa may ari dahil nagkaroon siya ng 12 months to redeem the property. By the way, pag walang nagbid sa property, ang winning bidder eh ang local government by default.

Salamat rin John!

There are really gold finds in auctions done by the local municiplaities through these tax delinquent properties.

Such a waste for the owners of these properties. They will possibly lose their properties by not properly paying real estate taxes.

Hi Tyrone,

Yup, one can find great bargains in tax foreclosure auctions although personally I would only bid on properties where the owner is likely to redeem the property.

When one bids and wins, you are actually buying some time for the owner(12 months to be exact) to settle his arrears and redeem the property. There is a return of course to the auction winner and this is the 2% per month interest earned on his winning bid .

Hi Sir Jay,

I’m a newbie and still on the process of learning how this real estate works. I’m not yet investing this year because we still don’t have the knowledge to engage in this business. However, I’m really interested with the process of buying Foreclosed Tax Delinquent Properties. I hope you can Post the Process of how to buy this properties (Foreclosed Delinquent Tax Properties), process of earning, Taxes, etch. I’ve read all your post on your starter page and it’s very helpful but I still need to know more on how to invest.

I’m also looking for a mentor I can learn from as said By Bo Sanchez and you sir. I would like to some how learn from you and hopefully be one of my mentors.

Thanks,

Jeffrey Baclangen

Hi Jeffrey,

Excellent idea! I will come up with a process flow and include it in an upcoming post about investing in tax foreclosures.

At the very least I can be your “virtual mentor” through this blog but you may also contact me directly using the contact details posted at the bottom of each article.

I’m really glad to see that you are really taking the initiative to learn more about real estate investing and I would be more than glad to help. All the best!

Hello Jay,

Thank you so much. I also have another question. I have noticed in one of your post, I think it was the lesson learned when you we’re supposed to buy your first real estate investment. My question is, how did you get to know all those persons that are seasoned Real Estate investors? And where can I find Real Estate Seminars and Coaching? My Wife and I has already decided to invest next year and this will be our first venture into business and we just wan’t to make sure that we know everything before we get into it and we also want to know the best suitable area in Real Estate we can start investing. I hope you can post some of the schedule of seminars and I hope you can suggest where we can start. More Power to your Website. It’s Very Helpful!

Thanks and God Bless,

Jeffrey Baclangen

Sana next time may Taguig foreclosures/public auctions kang offering Jay! 🙂

Hi Snow!

There was an auction of tax delinquent properties in Taguig last year and a friend of mine did not have a pleasant experience because he couldn’t even find the property he was interested in that was up for auction. Anyway, I will of course post any info for any tax foreclosure auction in taguig I may find.

I have a question po.

Just in case that a person will buy a property on the

listing.

1.)Is he also going to pay the “Tax Due” of the property?

2.)If there is a current resident of the property. Who will evict them? The city hall? or the buyer?

Hi Gio!

Actually the minimum bid price is often equal to the Tax Due plus penalties, etc. In effect, the buyer is paying the taxes instead of the property owner in exchange for the interest he may earn which is usually 2% per month for a maximum of 12 months. By doing this the buyer is also giving the property owner another 12 months to settle his back taxes.

If in case at the end of the 12 months and there is still an occupant, the buyer will be responsible for the eviction of the occupant. As a general rule, I would not invest in tax foreclosures with the goal of getting the property, especially if there are occupants. I would rather bid for properties that are more likely to get redeemed by the owner. You can read more about my learnings from the Marikina tax foreclosure auction

So bale ang basic goal nyo po pala eh ang 2% per month. And not acquiring the property it self.