A lot of people have been asking me about Philippine Veterans Bank’s Home Loan Free Home promo which promises that eligible borrowers will get back 100% of their loan principal in 20 years, which is like getting your home for free. Check out what we found out about their home loan promo below.

Is this for real?

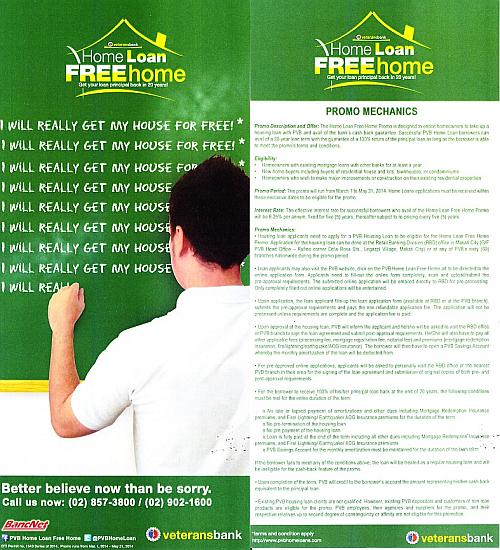

First of all, this is a legit promo being offered by Philippine Veterans Bank. We got a flyer from one of their branches (see below), and we also took a picture of the poster just outside the branch at Alabang Zapote Road in Las Pinas as pictured below. The promo is under DTI Permit no. 1543 Series of 2014.

Will borrowers really get their house for free?

The promo states that 100% of the loan principal will be returned to home loan borrowers, if the borrower is able to meet the promo’s terms and conditions. Since you will be getting 100% of the loan principal back when the loan is fully paid after 20 years, then it is like you will be getting your house for free (or at least, the loan amount). By the way, I have quoted the terms and conditions below:

For the borrower to receive 100% of his/her principal loan back at the end of 20 years, the following conditions must be met for the entire duration of the term:

- No late or lapsed payment of amortizations and other dues including Mortgage Redemption Insurance premiums, and Fire / Lightning / Earthquake Insurance premiums for the duration of the term.

- No pre-termination of the housing loan.

- No pre-payment of the housing loan.

- Loan is fully paid at the end of the term including all other dues including Mortgage Redemption Insurance premiums, and Fire / Lightning / Earthquake Insurance premiums.

- PVB Savings Account for the monthly amortization must be maintained for the duration of the loan term.

If the loan applicant fails to meet any of the conditions above, the loan will be treated as a regular housing loan and will be ineligible for the cash-back feature of the promo.

What interest rates do they offer?

According to the promo flyer, the interest rate would be

8.25% per annum, fixed for five (5) years, thereafter subject to re-pricing for every five (5) years”

What’s the catch?

You might be asking, If they will return the principal, what will they get out of this?

Short answer: Interest income.

Long answer: Check the totals of the sample amortization table below:

Note: The table below is based on the following assumptions:

- Home Loan/Mortgage amount: Php1,000,000.00

- Mortgage Loan Term: 20 years or 240 months

- Annual Interest rate: 8.25%

- Monthly payment: Php8,520.66 (Sample only includes principal and interest, excludes Mortgage Redemption Insurance or MRI, and other fees and charges that may be applicable). To compute for the monthly payment, you can use our mortgage calculator.

| Month | Monthly Amortization | Principal Paid | Interest Paid | Balance |

|---|---|---|---|---|

| 0 | 1,000,000.00 | |||

| 1 | 8,520.66 | 1,645.66 | 6,875.00 | 998,354.34 |

| 2 | 8,520.66 | 1,656.97 | 6,863.69 | 996,697.37 |

| 3 | 8,520.66 | 1,668.36 | 6,852.29 | 995,029.01 |

| 4 | 8,520.66 | 1,679.83 | 6,840.82 | 993,349.18 |

| 5 | 8,520.66 | 1,691.38 | 6,829.28 | 991,657.80 |

| 6 | 8,520.66 | 1,703.01 | 6,817.65 | 989,954.79 |

| 7 | 8,520.66 | 1,714.72 | 6,805.94 | 988,240.07 |

| 8 | 8,520.66 | 1,726.51 | 6,794.15 | 986,513.57 |

| 9 | 8,520.66 | 1,738.38 | 6,782.28 | 984,775.19 |

| 10 | 8,520.66 | 1,750.33 | 6,770.33 | 983,024.86 |

| 11 | 8,520.66 | 1,762.36 | 6,758.30 | 981,262.50 |

| 12 | 8,520.66 | 1,774.48 | 6,746.18 | 979,488.03 |

| 13 | 8,520.66 | 1,786.68 | 6,733.98 | 977,701.35 |

| 14 | 8,520.66 | 1,798.96 | 6,721.70 | 975,902.39 |

| 15 | 8,520.66 | 1,811.33 | 6,709.33 | 974,091.06 |

| 16 | 8,520.66 | 1,823.78 | 6,696.88 | 972,267.28 |

| 17 | 8,520.66 | 1,836.32 | 6,684.34 | 970,430.96 |

| 18 | 8,520.66 | 1,848.94 | 6,671.71 | 968,582.02 |

| 19 | 8,520.66 | 1,861.66 | 6,659.00 | 966,720.36 |

| 20 | 8,520.66 | 1,874.45 | 6,646.20 | 964,845.91 |

| 21 | 8,520.66 | 1,887.34 | 6,633.32 | 962,958.57 |

| 22 | 8,520.66 | 1,900.32 | 6,620.34 | 961,058.25 |

| 23 | 8,520.66 | 1,913.38 | 6,607.28 | 959,144.87 |

| 24 | 8,520.66 | 1,926.54 | 6,594.12 | 957,218.34 |

| 25 | 8,520.66 | 1,939.78 | 6,580.88 | 955,278.55 |

| 26 | 8,520.66 | 1,953.12 | 6,567.54 | 953,325.44 |

| 27 | 8,520.66 | 1,966.54 | 6,554.11 | 951,358.89 |

| 28 | 8,520.66 | 1,980.06 | 6,540.59 | 949,378.83 |

| 29 | 8,520.66 | 1,993.68 | 6,526.98 | 947,385.15 |

| 30 | 8,520.66 | 2,007.38 | 6,513.27 | 945,377.77 |

| 31 | 8,520.66 | 2,021.18 | 6,499.47 | 943,356.59 |

| 32 | 8,520.66 | 2,035.08 | 6,485.58 | 941,321.51 |

| 33 | 8,520.66 | 2,049.07 | 6,471.59 | 939,272.43 |

| 34 | 8,520.66 | 2,063.16 | 6,457.50 | 937,209.28 |

| 35 | 8,520.66 | 2,077.34 | 6,443.31 | 935,131.93 |

| 36 | 8,520.66 | 2,091.62 | 6,429.03 | 933,040.31 |

| 37 | 8,520.66 | 2,106.00 | 6,414.65 | 930,934.30 |

| 38 | 8,520.66 | 2,120.48 | 6,400.17 | 928,813.82 |

| 39 | 8,520.66 | 2,135.06 | 6,385.60 | 926,678.76 |

| 40 | 8,520.66 | 2,149.74 | 6,370.92 | 924,529.02 |

| 41 | 8,520.66 | 2,164.52 | 6,356.14 | 922,364.50 |

| 42 | 8,520.66 | 2,179.40 | 6,341.26 | 920,185.10 |

| 43 | 8,520.66 | 2,194.38 | 6,326.27 | 917,990.71 |

| 44 | 8,520.66 | 2,209.47 | 6,311.19 | 915,781.24 |

| 45 | 8,520.66 | 2,224.66 | 6,296.00 | 913,556.58 |

| 46 | 8,520.66 | 2,239.96 | 6,280.70 | 911,316.63 |

| 47 | 8,520.66 | 2,255.35 | 6,265.30 | 909,061.27 |

| 48 | 8,520.66 | 2,270.86 | 6,249.80 | 906,790.41 |

| 49 | 8,520.66 | 2,286.47 | 6,234.18 | 904,503.94 |

| 50 | 8,520.66 | 2,302.19 | 6,218.46 | 902,201.75 |

| 51 | 8,520.66 | 2,318.02 | 6,202.64 | 899,883.73 |

| 52 | 8,520.66 | 2,333.96 | 6,186.70 | 897,549.77 |

| 53 | 8,520.66 | 2,350.00 | 6,170.65 | 895,199.77 |

| 54 | 8,520.66 | 2,366.16 | 6,154.50 | 892,833.61 |

| 55 | 8,520.66 | 2,382.43 | 6,138.23 | 890,451.19 |

| 56 | 8,520.66 | 2,398.80 | 6,121.85 | 888,052.38 |

| 57 | 8,520.66 | 2,415.30 | 6,105.36 | 885,637.09 |

| 58 | 8,520.66 | 2,431.90 | 6,088.75 | 883,205.19 |

| 59 | 8,520.66 | 2,448.62 | 6,072.04 | 880,756.57 |

| 60 | 8,520.66 | 2,465.46 | 6,055.20 | 878,291.11 |

| 61 | 8,520.66 | 2,482.41 | 6,038.25 | 875,808.71 |

| 62 | 8,520.66 | 2,499.47 | 6,021.18 | 873,309.23 |

| 63 | 8,520.66 | 2,516.66 | 6,004.00 | 870,792.58 |

| 64 | 8,520.66 | 2,533.96 | 5,986.70 | 868,258.62 |

| 65 | 8,520.66 | 2,551.38 | 5,969.28 | 865,707.24 |

| 66 | 8,520.66 | 2,568.92 | 5,951.74 | 863,138.32 |

| 67 | 8,520.66 | 2,586.58 | 5,934.08 | 860,551.74 |

| 68 | 8,520.66 | 2,604.36 | 5,916.29 | 857,947.38 |

| 69 | 8,520.66 | 2,622.27 | 5,898.39 | 855,325.11 |

| 70 | 8,520.66 | 2,640.30 | 5,880.36 | 852,684.81 |

| 71 | 8,520.66 | 2,658.45 | 5,862.21 | 850,026.37 |

| 72 | 8,520.66 | 2,676.73 | 5,843.93 | 847,349.64 |

| 73 | 8,520.66 | 2,695.13 | 5,825.53 | 844,654.51 |

| 74 | 8,520.66 | 2,713.66 | 5,807.00 | 841,940.86 |

| 75 | 8,520.66 | 2,732.31 | 5,788.34 | 839,208.54 |

| 76 | 8,520.66 | 2,751.10 | 5,769.56 | 836,457.45 |

| 77 | 8,520.66 | 2,770.01 | 5,750.64 | 833,687.43 |

| 78 | 8,520.66 | 2,789.06 | 5,731.60 | 830,898.38 |

| 79 | 8,520.66 | 2,808.23 | 5,712.43 | 828,090.15 |

| 80 | 8,520.66 | 2,827.54 | 5,693.12 | 825,262.61 |

| 81 | 8,520.66 | 2,846.98 | 5,673.68 | 822,415.64 |

| 82 | 8,520.66 | 2,866.55 | 5,654.11 | 819,549.09 |

| 83 | 8,520.66 | 2,886.26 | 5,634.40 | 816,662.83 |

| 84 | 8,520.66 | 2,906.10 | 5,614.56 | 813,756.73 |

| 85 | 8,520.66 | 2,926.08 | 5,594.58 | 810,830.65 |

| 86 | 8,520.66 | 2,946.20 | 5,574.46 | 807,884.46 |

| 87 | 8,520.66 | 2,966.45 | 5,554.21 | 804,918.00 |

| 88 | 8,520.66 | 2,986.85 | 5,533.81 | 801,931.16 |

| 89 | 8,520.66 | 3,007.38 | 5,513.28 | 798,923.78 |

| 90 | 8,520.66 | 3,028.06 | 5,492.60 | 795,895.72 |

| 91 | 8,520.66 | 3,048.87 | 5,471.78 | 792,846.85 |

| 92 | 8,520.66 | 3,069.83 | 5,450.82 | 789,777.02 |

| 93 | 8,520.66 | 3,090.94 | 5,429.72 | 786,686.08 |

| 94 | 8,520.66 | 3,112.19 | 5,408.47 | 783,573.89 |

| 95 | 8,520.66 | 3,133.59 | 5,387.07 | 780,440.30 |

| 96 | 8,520.66 | 3,155.13 | 5,365.53 | 777,285.17 |

| 97 | 8,520.66 | 3,176.82 | 5,343.84 | 774,108.35 |

| 98 | 8,520.66 | 3,198.66 | 5,321.99 | 770,909.69 |

| 99 | 8,520.66 | 3,220.65 | 5,300.00 | 767,689.04 |

| 100 | 8,520.66 | 3,242.79 | 5,277.86 | 764,446.24 |

| 101 | 8,520.66 | 3,265.09 | 5,255.57 | 761,181.15 |

| 102 | 8,520.66 | 3,287.54 | 5,233.12 | 757,893.62 |

| 103 | 8,520.66 | 3,310.14 | 5,210.52 | 754,583.48 |

| 104 | 8,520.66 | 3,332.90 | 5,187.76 | 751,250.58 |

| 105 | 8,520.66 | 3,355.81 | 5,164.85 | 747,894.78 |

| 106 | 8,520.66 | 3,378.88 | 5,141.78 | 744,515.90 |

| 107 | 8,520.66 | 3,402.11 | 5,118.55 | 741,113.79 |

| 108 | 8,520.66 | 3,425.50 | 5,095.16 | 737,688.29 |

| 109 | 8,520.66 | 3,449.05 | 5,071.61 | 734,239.24 |

| 110 | 8,520.66 | 3,472.76 | 5,047.89 | 730,766.48 |

| 111 | 8,520.66 | 3,496.64 | 5,024.02 | 727,269.84 |

| 112 | 8,520.66 | 3,520.68 | 4,999.98 | 723,749.16 |

| 113 | 8,520.66 | 3,544.88 | 4,975.78 | 720,204.28 |

| 114 | 8,520.66 | 3,569.25 | 4,951.40 | 716,635.03 |

| 115 | 8,520.66 | 3,593.79 | 4,926.87 | 713,041.24 |

| 116 | 8,520.66 | 3,618.50 | 4,902.16 | 709,422.74 |

| 117 | 8,520.66 | 3,643.38 | 4,877.28 | 705,779.36 |

| 118 | 8,520.66 | 3,668.42 | 4,852.23 | 702,110.94 |

| 119 | 8,520.66 | 3,693.64 | 4,827.01 | 698,417.30 |

| 120 | 8,520.66 | 3,719.04 | 4,801.62 | 694,698.26 |

| 121 | 8,520.66 | 3,744.61 | 4,776.05 | 690,953.65 |

| 122 | 8,520.66 | 3,770.35 | 4,750.31 | 687,183.30 |

| 123 | 8,520.66 | 3,796.27 | 4,724.39 | 683,387.03 |

| 124 | 8,520.66 | 3,822.37 | 4,698.29 | 679,564.66 |

| 125 | 8,520.66 | 3,848.65 | 4,672.01 | 675,716.01 |

| 126 | 8,520.66 | 3,875.11 | 4,645.55 | 671,840.90 |

| 127 | 8,520.66 | 3,901.75 | 4,618.91 | 667,939.15 |

| 128 | 8,520.66 | 3,928.57 | 4,592.08 | 664,010.58 |

| 129 | 8,520.66 | 3,955.58 | 4,565.07 | 660,054.99 |

| 130 | 8,520.66 | 3,982.78 | 4,537.88 | 656,072.22 |

| 131 | 8,520.66 | 4,010.16 | 4,510.50 | 652,062.06 |

| 132 | 8,520.66 | 4,037.73 | 4,482.93 | 648,024.33 |

| 133 | 8,520.66 | 4,065.49 | 4,455.17 | 643,958.84 |

| 134 | 8,520.66 | 4,093.44 | 4,427.22 | 639,865.40 |

| 135 | 8,520.66 | 4,121.58 | 4,399.07 | 635,743.82 |

| 136 | 8,520.66 | 4,149.92 | 4,370.74 | 631,593.90 |

| 137 | 8,520.66 | 4,178.45 | 4,342.21 | 627,415.45 |

| 138 | 8,520.66 | 4,207.18 | 4,313.48 | 623,208.27 |

| 139 | 8,520.66 | 4,236.10 | 4,284.56 | 618,972.17 |

| 140 | 8,520.66 | 4,265.22 | 4,255.43 | 614,706.95 |

| 141 | 8,520.66 | 4,294.55 | 4,226.11 | 610,412.41 |

| 142 | 8,520.66 | 4,324.07 | 4,196.59 | 606,088.33 |

| 143 | 8,520.66 | 4,353.80 | 4,166.86 | 601,734.53 |

| 144 | 8,520.66 | 4,383.73 | 4,136.92 | 597,350.80 |

| 145 | 8,520.66 | 4,413.87 | 4,106.79 | 592,936.93 |

| 146 | 8,520.66 | 4,444.22 | 4,076.44 | 588,492.72 |

| 147 | 8,520.66 | 4,474.77 | 4,045.89 | 584,017.95 |

| 148 | 8,520.66 | 4,505.53 | 4,015.12 | 579,512.42 |

| 149 | 8,520.66 | 4,536.51 | 3,984.15 | 574,975.91 |

| 150 | 8,520.66 | 4,567.70 | 3,952.96 | 570,408.21 |

| 151 | 8,520.66 | 4,599.10 | 3,921.56 | 565,809.11 |

| 152 | 8,520.66 | 4,630.72 | 3,889.94 | 561,178.39 |

| 153 | 8,520.66 | 4,662.56 | 3,858.10 | 556,515.84 |

| 154 | 8,520.66 | 4,694.61 | 3,826.05 | 551,821.23 |

| 155 | 8,520.66 | 4,726.89 | 3,793.77 | 547,094.34 |

| 156 | 8,520.66 | 4,759.38 | 3,761.27 | 542,334.96 |

| 157 | 8,520.66 | 4,792.10 | 3,728.55 | 537,542.85 |

| 158 | 8,520.66 | 4,825.05 | 3,695.61 | 532,717.80 |

| 159 | 8,520.66 | 4,858.22 | 3,662.43 | 527,859.58 |

| 160 | 8,520.66 | 4,891.62 | 3,629.03 | 522,967.96 |

| 161 | 8,520.66 | 4,925.25 | 3,595.40 | 518,042.71 |

| 162 | 8,520.66 | 4,959.11 | 3,561.54 | 513,083.60 |

| 163 | 8,520.66 | 4,993.21 | 3,527.45 | 508,090.39 |

| 164 | 8,520.66 | 5,027.54 | 3,493.12 | 503,062.85 |

| 165 | 8,520.66 | 5,062.10 | 3,458.56 | 498,000.75 |

| 166 | 8,520.66 | 5,096.90 | 3,423.76 | 492,903.85 |

| 167 | 8,520.66 | 5,131.94 | 3,388.71 | 487,771.91 |

| 168 | 8,520.66 | 5,167.22 | 3,353.43 | 482,604.69 |

| 169 | 8,520.66 | 5,202.75 | 3,317.91 | 477,401.94 |

| 170 | 8,520.66 | 5,238.52 | 3,282.14 | 472,163.42 |

| 171 | 8,520.66 | 5,274.53 | 3,246.12 | 466,888.89 |

| 172 | 8,520.66 | 5,310.80 | 3,209.86 | 461,578.09 |

| 173 | 8,520.66 | 5,347.31 | 3,173.35 | 456,230.78 |

| 174 | 8,520.66 | 5,384.07 | 3,136.59 | 450,846.71 |

| 175 | 8,520.66 | 5,421.09 | 3,099.57 | 445,425.63 |

| 176 | 8,520.66 | 5,458.36 | 3,062.30 | 439,967.27 |

| 177 | 8,520.66 | 5,495.88 | 3,024.77 | 434,471.39 |

| 178 | 8,520.66 | 5,533.67 | 2,986.99 | 428,937.73 |

| 179 | 8,520.66 | 5,571.71 | 2,948.95 | 423,366.02 |

| 180 | 8,520.66 | 5,610.02 | 2,910.64 | 417,756.00 |

| 181 | 8,520.66 | 5,648.58 | 2,872.07 | 412,107.42 |

| 182 | 8,520.66 | 5,687.42 | 2,833.24 | 406,420.00 |

| 183 | 8,520.66 | 5,726.52 | 2,794.14 | 400,693.48 |

| 184 | 8,520.66 | 5,765.89 | 2,754.77 | 394,927.59 |

| 185 | 8,520.66 | 5,805.53 | 2,715.13 | 389,122.06 |

| 186 | 8,520.66 | 5,845.44 | 2,675.21 | 383,276.62 |

| 187 | 8,520.66 | 5,885.63 | 2,635.03 | 377,390.99 |

| 188 | 8,520.66 | 5,926.09 | 2,594.56 | 371,464.90 |

| 189 | 8,520.66 | 5,966.84 | 2,553.82 | 365,498.06 |

| 190 | 8,520.66 | 6,007.86 | 2,512.80 | 359,490.20 |

| 191 | 8,520.66 | 6,049.16 | 2,471.50 | 353,441.04 |

| 192 | 8,520.66 | 6,090.75 | 2,429.91 | 347,350.29 |

| 193 | 8,520.66 | 6,132.62 | 2,388.03 | 341,217.67 |

| 194 | 8,520.66 | 6,174.79 | 2,345.87 | 335,042.88 |

| 195 | 8,520.66 | 6,217.24 | 2,303.42 | 328,825.65 |

| 196 | 8,520.66 | 6,259.98 | 2,260.68 | 322,565.67 |

| 197 | 8,520.66 | 6,303.02 | 2,217.64 | 316,262.65 |

| 198 | 8,520.66 | 6,346.35 | 2,174.31 | 309,916.30 |

| 199 | 8,520.66 | 6,389.98 | 2,130.67 | 303,526.32 |

| 200 | 8,520.66 | 6,433.91 | 2,086.74 | 297,092.40 |

| 201 | 8,520.66 | 6,478.15 | 2,042.51 | 290,614.26 |

| 202 | 8,520.66 | 6,522.68 | 1,997.97 | 284,091.57 |

| 203 | 8,520.66 | 6,567.53 | 1,953.13 | 277,524.05 |

| 204 | 8,520.66 | 6,612.68 | 1,907.98 | 270,911.37 |

| 205 | 8,520.66 | 6,658.14 | 1,862.52 | 264,253.23 |

| 206 | 8,520.66 | 6,703.92 | 1,816.74 | 257,549.31 |

| 207 | 8,520.66 | 6,750.01 | 1,770.65 | 250,799.31 |

| 208 | 8,520.66 | 6,796.41 | 1,724.25 | 244,002.90 |

| 209 | 8,520.66 | 6,843.14 | 1,677.52 | 237,159.76 |

| 210 | 8,520.66 | 6,890.18 | 1,630.47 | 230,269.58 |

| 211 | 8,520.66 | 6,937.55 | 1,583.10 | 223,332.02 |

| 212 | 8,520.66 | 6,985.25 | 1,535.41 | 216,346.77 |

| 213 | 8,520.66 | 7,033.27 | 1,487.38 | 209,313.50 |

| 214 | 8,520.66 | 7,081.63 | 1,439.03 | 202,231.87 |

| 215 | 8,520.66 | 7,130.31 | 1,390.34 | 195,101.56 |

| 216 | 8,520.66 | 7,179.33 | 1,341.32 | 187,922.23 |

| 217 | 8,520.66 | 7,228.69 | 1,291.97 | 180,693.54 |

| 218 | 8,520.66 | 7,278.39 | 1,242.27 | 173,415.15 |

| 219 | 8,520.66 | 7,328.43 | 1,192.23 | 166,086.72 |

| 220 | 8,520.66 | 7,378.81 | 1,141.85 | 158,707.91 |

| 221 | 8,520.66 | 7,429.54 | 1,091.12 | 151,278.37 |

| 222 | 8,520.66 | 7,480.62 | 1,040.04 | 143,797.75 |

| 223 | 8,520.66 | 7,532.05 | 988.61 | 136,265.71 |

| 224 | 8,520.66 | 7,583.83 | 936.83 | 128,681.88 |

| 225 | 8,520.66 | 7,635.97 | 884.69 | 121,045.91 |

| 226 | 8,520.66 | 7,688.47 | 832.19 | 113,357.44 |

| 227 | 8,520.66 | 7,741.32 | 779.33 | 105,616.12 |

| 228 | 8,520.66 | 7,794.55 | 726.11 | 97,821.57 |

| 229 | 8,520.66 | 7,848.13 | 672.52 | 89,973.44 |

| 230 | 8,520.66 | 7,902.09 | 618.57 | 82,071.35 |

| 231 | 8,520.66 | 7,956.42 | 564.24 | 74,114.94 |

| 232 | 8,520.66 | 8,011.12 | 509.54 | 66,103.82 |

| 233 | 8,520.66 | 8,066.19 | 454.46 | 58,037.63 |

| 234 | 8,520.66 | 8,121.65 | 399.01 | 49,915.98 |

| 235 | 8,520.66 | 8,177.48 | 343.17 | 41,738.49 |

| 236 | 8,520.66 | 8,233.70 | 286.95 | 33,504.79 |

| 237 | 8,520.66 | 8,290.31 | 230.35 | 25,214.48 |

| 238 | 8,520.66 | 8,347.31 | 173.35 | 16,867.17 |

| 239 | 8,520.66 | 8,404.69 | 115.96 | 8,462.48 |

| 240 | 8,520.66 | 8,462.48 | 58.18 | (0.00) |

| Monthly Amortization | Principal Paid: | Interest Paid: | ||

| Totals | 2,044,957.57 | 1,000,000.00 | 1,044,957.57 |

Sample Amortization Table

If you will notice, the total monthly amortization payments made after 20 years would be Php2,044,957.57, where Php1,000,000.00 is the principal amount, and Php1,044,957.57 is the total interest paid by the borrower, which is also the interest income of the bank.

So even if they return the 100% of the principal, which amounts to Php1,000,000.00, they still have Php1,044,957.57 in interest income.

It’s similar to insurance with Return of Premium

Personally, this promo reminds me of insurance that comes with a “Return Of Premium” rider where the insured person will get back all the premiums paid when the insurance is fully paid.

What if the interest paid was tax deductible?

I can’t help but imagine – what if the Home Mortgage Relief Act (Senate Bill 2148) was passed into law, and this promo was extended, then aside from the 100% cash back for the principal, you can also claim a tax deduction from the interest payments made (assuming your housing loan will not exceed Php2.5 Million). Now that would be awesome right?!

Can this be used to refinance an existing loan?

According to the flyer, “Homeowners with existing mortgage loans with other banks for at least a year” are eligible. I believe the loan should be in good standing. So the answer is yes.

Until when can you avail of this promo?

According to the flyer:

Promo Period: The promo will run from March 1 to May 31,2014. Home Loans applications must be received within these exclusive dates to be eligible for the promo.”

How to get more information

To get more information, please refer to the flyer from Philippine Veterans Bank which I have posted above. This flyer is the source of information for this post. You can also download it through this link: Philippine Veterans Bank Home Loan, Free Home Promo Flyer (PDF)

Home Loan Interest Rates Comparison Chart Updated

With information about Philippine Veterans Banks Home Loan Free Home Promo, I also updated our Home Loan Interest Rates Comparison Chart. You can check it out through the link below.

Home Loans Philippines Comparison Chart

Full disclosure: Nothing to disclose, we are not accredited with the Home Loans Department of Philippine Veterans Bank

Thank you very much! this enlighten me.

Hello Jay, first, thank you for such informative site, I am sure this helped a lot of people just like it helped me.

I called PVB, and they are asking for 3K appraisal and C.I. fee, is this normal for a bank housing loan? And they are not giving assurance of the amount of the appraisal of the property.

Again, thank you very much!

Hi Kim, thanks for the kind words!

I wasn’t aware of the 3K appraisal fee, but it sounds reasonable. Other banks charge 5K. Good luck!

I inquired in PVB and I am quite surprised. This is the sample given to me-

Loan Amount : P2M

Rate : 8.25% fixed for 5 years

Term : 20 years or 240 months

Monthly Amortization : P17,041.31

Don’t you think the monthly amortization is too high? Say the minimum interest rate I get for 20 years is 8.25%, I would be then paying more than 4M!

17,041.31 x 240 = P4,089,914.4

Hi Cherryl, the computations are correct, we get exactly the same monthly amortization using our own mortgage calculator: https://www.foreclosurephilippines.com/mortgagecalculator

And you are correct, after 20 years you would have paid more than double, and this is the same with almost all home loans out there (of course the figures would be different depending on the actual interest rates).

That’s the real cost of borrowing money, which is why getting back your loan principal is a big deal for me. In your example, you will get back 2M after 20 years. Compare that to other banks where you would get nothing after you have fully paid-off the loan.

sir jay, i would like to ask regarding taxation on my case. I bought a lot last year october worth 2M and build a townhouse out of it costing me 2M and sold it for 8M. I am an employee who just thought of this to earn extra money. How much tax do I need to pay and what are the taxes? thanks

Wow, that’s a good deal Love, congrats! At the very least you will pay CGT(6% of selling price), VAT(12% of the selling price), and other applicable taxes. I would suggest you get a CPA to help you with this to ensure you are paying the right taxes, especially since your profit is very significant, the BIR will surely notice this.

informative & hopefully, can help us in our plans! thank you!

You’re welcome and thank you EJ!

The bank can reprice after 5th year at a high interest, so if lender is unable to keep up with repayment, bank need not pay back the principle amount. Scary scheme…..

Hi Jeff, actually, what you mentioned is the norm with bank loans. And it goes without saying that if a borrower is unable to cope with the payments, foreclosure will follow. The cashback would be the least of the borrowers’ concerns.

is there any protection for borrowers that banks cannot use absurdly high interest rates after the fixed period? this sounds really ok but my fear is what if the bank decides to use 20% interest after the fixed period?

Some banks usually have a maximum interest rate they can impose, much like pag-IBIG, but this would depend on the bank. I’m not sure if PVB has this in place though, it would be best to check with them. Thanks.

I think your conclusion that after returning P1M and the income of the bank is still P1.044M is wrong because the collections made is P2.044M while your cash outflow is P1M at the start of the loan and another P1M after 20 years is = P2M, leaving behind an income of only P44T plus. Thanks

Cecille C. Pauig, CPA

Thank you Ms. Cecille for sharing your thoughts, but I believe your conclusion that I said the income of the bank is Php1.044M is wrong. I only said “Php1,044,957.57 is the total interest paid by the borrower, which is also the interest income of the bank. So even if they return the 100% of the principal, which amounts to Php1,000,000.00, they still have Php1,044,957.57 in interest income.” Let me reiterate, I only said “interest income” in both of those sentences, which is totally different from “income of the bank”. Yes, you are correct, the initial cash outflow of Php1M at the start of the loan will result in an income of only Php44Tplus for the bank.

Jay, when the bank extended the loan they gave 1M to the real estate company ( the loanable amount of the property acquired or P 1M to the bank( if its for refinancing). So when they extended the loan they already gave out P 1M. So if they will give back the 1M at the end of the term of the loan, that leaves them with only 44k just like what cecille said. I think the catch is on the interest rate repricing after 5 years, who knows how much they will charge you. They are in business you know. They can reprice it at a much higher rate so they can raise the 1M which they will give to you at the end of 20 years.

So, for you, sir Jay, do you think it is a good deal?

Hi Cherryl,

Yes, in my opinion, this is by far the best home loan deal one can get right now. A cashback equivalent to 100% of the loan principal is hard to beat. 🙂

Thanks for dropping by, cheers!

nice read

thanks for the explanation

You’re welcome RJ, thank you also for dropping by!