A successful investor is often a proactive investor. We often hear it, but do we really know what it means to be proactive? How can we apply this to real estate investing? Read on to find out my ideas on how we can be proactive and successful real estate investors.

Definition of proactive

Wikipedia defines proactive behavior as follows:

“Proactive behavior (or proactivity) by individuals refers to anticipatory, change-oriented and self-initiated behavior in the work place. Proactive behavior involves acting in advance of a future situation, rather than just reacting. It means taking control and making things happen rather than just adjusting to a situation or waiting for something to happen. Proactive employees generally do not need to be asked to act, nor do they require detailed instructions.”

In his book “The Seven Habits of Highly Effective People”, Doctor Stephen R. Covey defines it as something more than just taking initiative, as it means that we are ultimately responsible for our own lives. We behave based on our decisions, not based on the conditions around us, where we take the initiative and the responsibility, and make things happen.

For me, it simply means we always have a choice, and through the choices we make, we are giving ourselves the ability to respond accordingly to whatever comes our way, and that includes the challenges that we face as real estate investors.

We cannot blame others because everything is a matter of choice and these choices dictate our ability to respond, and not just react.

Rich Dad was proactive

In the book “Rich Dad Poor dad” by Robert Kiyosaki, Rich Dad’s way of thinking where he forbade words like “I cannot afford it…”, and encouraged words like “How can I afford it?” was really a perfect example of being proactive. He wanted Robert and Mike to make a choice to find ways and the means, rather than just blame the lack of money.

Proactively investing in real estate

In real esate investing, there are countless ways of being proactive. I would even look at being proactive as a prerequisite as I believe that it is needed at the very start of one’s real estate investing career.

The mindset of believing that real estate investing can really be done here in the Philippines and taking the initiative to do what needs to be done to turn this into reality is being proactive. Deciding and taking action is being proactive. If you want to start, I encourage you to first learn the habit of being proactive.

Examples of being a proactive real estate investor

Here are just a few examples of being proactive when it comes to real estate investing

When looking for suitable foreclosed properties

Instead of saying “If only there were really cheap properties that can produce positive cashflow…” why not ask “How can I find properties that can produce positive cashflow?” Why not take charge and analyze more properties instead of giving up after looking at just a few listings of foreclosed properties?

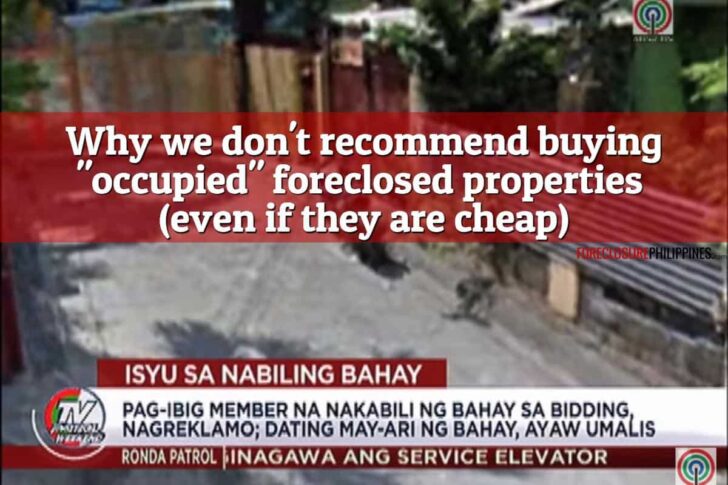

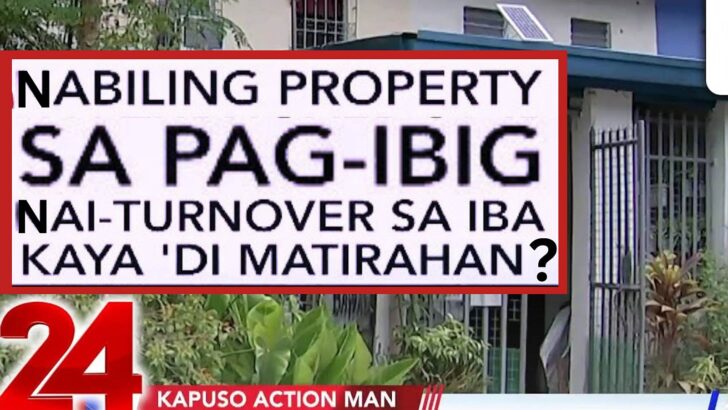

Instead of saying that “If only ejecting tenants was easy and not costly…”, why not avoid properties that are occupied to begin with? There are just too many unoccupied properties out there and the proactive thing to do would be to decide to focus only on unoccupied properties.

We should take the initiative and set the criteria for properties that we would be looking for, along with the options that we can take.

Want to get notified when this is updated? Subscribe for free updates!

Get new/updated foreclosed listings, auction schedules, property buying tips, and more, sent straight to your email inbox. It's free!

When buying a foreclosed property

When we intend to buy a property using our own money, we can take proactive steps like making sure that the numbers work, checking the physical and legal condition of the property, finding out what we can or what we can’t do, with regards to our contract with the bank, finding out if we can we assign the contract, finding out exactly what taxes do we need to pay, what expenses are for the account of the bank and for the buyer, etc. This is part of due diligence and doing due diligence is really being proactive.

When dealing with contractors

Proactively ask for quotations from several contractors before you even consider buying a foreclosed property. Check for their track record by talking with other investors who got their services in the past, and look at their past projects, etc. Make sure everything is itemized and as detailed as possible in a written agreement that gives you more than adequate protection.

When paying for a foreclosed property

Proactive steps to take when paying for a foreclosed property would be through post-dated checks, ensuring the checking account is funded accordingly, and replenishing the post-dated checks before they run out. This prevents surprises that might happen if due dates happen to fall on holidays or if a typhoon has made it impossible for you to pay over the counter.

When investing on other people’s deals

Whether we are looking at partnering with an investor as an equity partner or just funding other people’s deals by loaning them money, we should take the initiative to check if a deal really makes sense, if we can really get the return of our investment(the return of our capital), if it can produce the returns being promised to us(the return on our investment), and making sure all parties are more than adequately protected through a contract that is duly notarized.

We should also take the initiative and check the track record and the credibility of the person asking us to invest in his/her deal. We can ask for feedback from other people, who have invested their money in the past, or you might even consider asking for an NBI clearance, one can never be too careful right?!

Accepting that you made a mistake

Being proactive also means being able to accept that you have made a mistake, accept that one cannot change past mistakes, and move on and just keep moving forward. I suppose the only thing one can do is take action to correct things which are still within your control, learn as much as possible from the mistake, and take steps to avoid such mistakes in the future.

How about you, do you have anything in mind that is a good example of being a proactive real estate investor? Please share them below. Thanks!

Happy investing!

To our success and financial freedom!

Jay Castillo

Real Estate Investor

Real Estate Broker License #: 20056

Blog: https://www.foreclosurephilippines.com

Follow me in Twitter:https://twitter.com/jay_castillo

Find us in Facebook:Foreclosure Philippines facebook page

Text by Jay Castillo and Cherry Castillo. Copyright © 2010 All rights reserved.

PS. Are you a new visitor? Click here NOW to start learning more about foreclosure investing in the Philippines

PPS. Don’t be the last to know, subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips.

Pingback: How To Find Opportunities And Get Started With Real Estate Investing With The "Matthew Effect" (Part 2)

Pingback: Low home loan rates - what you need to know before it's too late

There’s a P1M 1BR 28 sqm condo right in smack of Buendia & SSH that is walking distance to SM hypermarket & cash carry that is being sold to me. I plan to renovate, furnish & sell with additional 200K. How much do you think I can sell it? Will it be a good investment?

Pingback: FIP’s best of 2010 to help you get started in 2011

Pingback: "The reason I must be rich is because I have kids" – a Father’s Day reflection — Foreclosure Investing Philippines

Hi Jay! Its me again. How much is the suitable cash or liquidity of a person if one wants to venture in Foreclosure Buying?

Pingback: AMA Bank foreclosed cars sealed bidding on July 23, 2010

I believe your website has all the basics and as i said “secrets” of this business. Even the books of L.Gamboa & T. Trajano have all the guidelines. But why are there so many seminars, webinars,mentorings, franchise etc etc that a starting investor need to pay for?? It looks like this business branched out into countless money-making activity all for the cause of money and not for helping. They are sometimes confusing and it’s giving us the impression that this foreclosure investing is for those who already have big money to invest. In your website, you disclosed every inch of what u know, exposed true-to-life experiences and lessons. I think these are enough tools to start with.

Good day!

I just want to share my insights regarding those seminars and mentorings, etc. I think this is important for continuous learning and updates with regards to investing. Mentoring is just like having a tutor or assistant which will guide you in your investment. As Sir Jomar H. said, the price on the mentoring will measure the willingness of an individual to focus on the chosen investment.

Hi Robi, I agree with you. It’s actually part of self-renewal or “Sharpening the saw”, the 7th habit enumerated by Stephen Covey in his book. My wife calls me a seminar junkie because I am, but for each seminar I attend, I make sure that I get value for money and a return on my investment. I believe that i need to attend seminars because i need to review and re-learn stuff that I may have forgotten and also to learn new things. I am sure i still have a lot of things to learn out there, but then again, I must be prudent with which seminars I choose to attend.

Hi Marise, thanks for the comment. Actually I still have a lot of things to share as I have focused mostly on the “How to buy” aspects, and I agree with you that these are enough for one to get started and buy his/her first property. However, I have barely touched financing deals, negotiating for deals, rehabbing, marketing, exit strategies other than rent-to-own, and a whole lot more.

With regards to so many seminars, webinars, mentorings, franchising, etc, i must admit that these tend to be information overload for some, and might also become counterproductive and confusing. However, these are not for everyone as i know that there are those who can already start without them, but there are also those who actually clamor for this, which is why they are being offered.

I guess it would be best to be prudent and just run the numbers where we should determine the ROI for seminars, mentorings, etc. If it does not make sense, then just avoid them.

As I have often said, only little capital is needed to start investing, just 20% of the selling price of a foreclosed property that is ideally at least 40% below market value, so i don’t think it is a rich man’s game, so to speak. However, there is also a way of spending zero at the start and that is through selling other investors’ properties by acting as a broker, agent, or referrer, and this is for those who really don’t want to invest any money to get started.

I hope this helps. Cheers!

Thanks Sir Benny!

With regards to you answer, will the deed of absolute sale between me and the bank be enough to remove the hesitations of some buyers?

it would be more advisable if you transfer the title in your name. buyers nowadays are hesitant to transact business if the title is not in your name.if the bank as the vendor, pays for the capital gains tax, docs.stamps and updated the realty tax, then you will have to pay only the transfer tax and the registration fee at the Reg. of Deeds.

Hi Benny, thanks for answering Robi’s question!

good day!

patulong naman po sa isang newbie..

I am planning to purchase a property from a bank and I plan to flip it up. Do i need to transfer it first the title to my name or is it mandatory? or could i just let the next buyer (from me) do the transfer of the title to his/her respective name without having to transfer the title to myself? thanks a lot.

the property has the title with the bank as the owner in the title

Hi Robi, if the bank will allow you to assign the contract, this would be a good option, no need for you to transfer the title to your name. If not, you will have to transfer the title to your name first and then your buyer will have to transfer it to them. I hope this helps!

Hi Jay!

Thanks a lot for sharing this post. Indeed it is in the attitude and not the magnitude. It’s how you perceive things. One might say a particular situation is a stumbling block but a proactive person would say it’s a stepping stone.

It’s really hard to make the right and difficult choices when you are not used to it. But it just gets easier and easier the more you do it.

Thanks again bro!

Bryan Uy

Hi Bryan, thanks for the comment. I guess we just have to accept that we are ultimately the scriptwriters of our lives, and accepting that is being proactive. 🙂

@ Become Rich,

I also would like to read the ff:

Sir Jay Castillo’s

– Your first real estate deal

– How you financed your first real estate deal

– Was it put to rent or sold to another buyer?

sounds interesting…

Hi Helen, thanks! Please refer to my reply to Tim above. Cheers! 🙂

Thank you Jay for this article and your generosity.

Hi Gladis, you’re welcome and thanks for dropping by!

Pingback: Tweets that mention How to be a proactive real estate investor

Hi Jay! I’m a proactive commenter! 🙂 I would like to share a simple phrase that I always keep in mind whenever I get disappointed over a particular thing, person, or situation…

“Don’t cry over a spilled milk”

I just tell myself this during such situations. I’m currently tied up with a 30 year loan with pagibig. I’m not sure if I made the right decision but me and my wife decided to get a condo about a year ago to live in and eventually, put it on rent because we have a plan to go abroad to earn more and invest in a business eventually…

Jay, do you have a post that tells how you started in the real estate business? I would like to read about your story, if you don’t mind… I’m interested in things such as…

– Your first real estate deal

– How you financed your first real estate deal

– Was it put to rent or sold to another buyer?

Sorry if that sounds too demanding. Just hungry for knowledge. If you don’t feel comfortable discussing here in your blog, you can send it to my e-mail. 🙂

Thanks!

~Tim | Every Peso Counts

Hi Tim, thanks for the comment! I like you said about not crying over spilled milk, a perfect example of being proactive. 🙂

About your 30 year loan with Pag-Ibig, getting the maximum term is okay. Although it appears you are tied-up for so long and pay a huge interest in the long run, you can always offset this by paying more than your monthly amortization, and the excess goes direct to principal. Having a 30 year loan gives you the flexibility of paying for the least amount per month(and increases your chance to get positive cashflow if you rent it out in the future) if that is what your budget permits, while having the option to pay more, when there is a surplus or windfall of funds.

I am drafting an updated “About me” page and it will include how I started. Here’s an outline to give you an idea,

2005 – I first read Rich Dad Poor Dad but did not know how to start…

2006 – Spent the whole of 2006 reading more about real estate investing and was able to read Think Rich Pinoy last December 31, 2006…

2007 – Started seeking mentors and actually found some and I even made passive investments. I also attended Bo’s How to be truly rich seminar, Larry’s think Rich Pinoy Seminar, a lot of real estate seminars under Engineer Cruz, and I passed the Nov 2007 broker’s licensure exam…

2008 – Had to do some soul searching and started investing in mutual funds… until I met Jon Abaquin who helped me see real estate deals that were right in front of my eyes but I could not see, and I eventually got a negotiated bid approved soon after that. After a few months I also won my first bid in an auction…

2009 – I bought 3 foreclosed properties through public auctions, one per quarter, the first I sold through a rent to own scheme, the second through installment, the third through a deed of assignment.

The above is just a sneak preview of my new “About me” page and the final version should be ready in a couple of weeks. I’ll make a post about it when it is done. 🙂