Here are 4 foreclosure prevention tips for those who are facing the foreclosure of their homes.

Before we dive into the foreclosure prevention tips, let me add that while it’s true that I have been focusing on investing in foreclosures, I have never wished that anybody’s home would be foreclosed so that I may buy it as an investment property.

I consider foreclosure investing as “making the most out of a bad situation” – that is, a property has already been foreclosed and there’s nothing more we can do about it. Of course there are also other good reasons for foreclosure investing, aside from investing purposes, and these are:

- We are helping people who can’t qualify for bank financing to buy homes by providing housing they can rent or rent with an option to purchase with seller financing;

- We are helping people buy homes at lower prices as compared to new and retail houses for sale; and

- We are helping banks reduce their portfolio of non-performing assets, hence enabling them to have more money to lend to people who want to buy homes or start their own businesses, which in turn helps the economy.

But at the end of the day, I still believe that prevention is better than cure. In other words, once you realize there’s a problem that can lead to missed mortgage payments and foreclosure down the road, you need to act fast, and act accordingly, before it’s too late and nothing can be done anymore!

If you are asking “What can be done?…”, here are just a few “suggestions” that might help you stop, or at least delay, the foreclosure of your property.

1. Keep the communication lines open

It is always good to let your creditors know of your current situation which prevents you from fulfilling your loan obligations. By letting your creditors know what’s happening and keeping the communication lines open, you are showing them that you really intend to fulfill your obligations. You just encountered a temporary setback in your finances.

For sure, banks will appreciate your good faith and will try to help you. Bank officers have hearts too. Besides, banks and other lending institutions will also incur significant foreclosure costs if they foreclosed properties (like lawyers’ fees, eviction costs, caretaker expenses, etc.) and they are required to have only a certain percentage of bad loans or non-performing assets so they may be willing to negotiate with you.

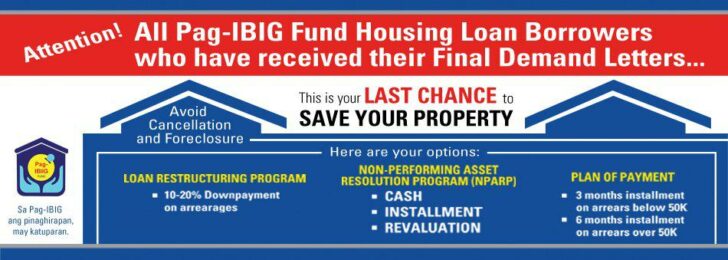

For example, I believe Pag-IBIG will not readily foreclose a property if the buyer sends a letter explaining his circumstances and offers to renegotiate his loan. I believe this can be done because I know someone who has done it. Pag-IBIG even went to the extent of waiving the interest that was due. So you see, it pays to come clean to creditors.

2. Restructure your loan

As earlier noted, foreclosure entails costs. Thus, creditors would rather go for a loan restructuring than outright foreclosure. Getting longer payment terms would help lower one’s monthly amortization while the creditor maintains a performing and earning loan.

Some institutions have come out with such programs that are meant to help stop the foreclosure of their borrowers’ homes and one example would be the GSIS loan condonation program which the GSIS implemented last April 16, 2009 and will run for 18 months. This program intends to help borrowers get out of foreclosure and is very commendable.

In other countries like the U.S., they often refer to this approach as Loan Modification, if I’m not mistaken.

3. Refinance your loan

If you are not yet in default, you may opt to refinance your loan with another bank or lending institution. and go for longer payment terms and lower interest rates. These would translate to lower, more manageable monthly amortizations. This will work if you have enough time to do the refinancing.

If your property’s market value has already appreciated, you may even get to earn some money when you refinance a property as I have mentioned in my post about 9 ways to invest in foreclosures. Please note, though, that if you have already defaulted on your payments, this option may no longer be available.

4. Sell your property before it gets foreclosed

When a loan is in default, the entire loan amount becomes due and demandable due to the acceleration clause in the loan contract. In this case, the only remedy is to settle the entire loan. The obvious question of course is:

“Where can I get the money to pay my housing loan?”

In this case, as painful as it may be, you will have to accept that you have to sell the property. The proceeds of the sale will be used to pay the entire loan amount – that is, assuming that the property can be sold for an amount that would at least be equal to the entire debt.

There are real estate investors who focus in this area, which is also called pre-foreclosures. As I have often mentioned, in these situations, an investor should never take advantage of other people and their misfortunes, like someone who is facing foreclosure, and should offer a win-win solution for everyone.

If you have a property nearing foreclosure, due to time constraints, you may not have the option to wait for the best price. Most of the time, the property can only be sold for a price that is below market value because you do not have the luxury of waiting for the best cash offer.

Since full cash payment is needed, interested buyers also don’t have the option to apply for bank financing and can only offer so much if they were to give an all cash offer, again due to time constraints.

If you wait too long however, foreclosure may overtake you, and you may end up with nothing. Better decide early on so that there would be enough time to salvage your equity or at least some of it, which can be used to start anew.

When there’s nothing more we can do

You will be surprised to know that a lot of foreclosure situations happen when the homeowners are at a deadlock and will simply allow the foreclosure it to happen.

Take for example couples who have gone their separate ways due to a third party. The guilty party (let’s say the husband, for example purposes only) wants to sell the property to prevent foreclosure but the other party (the wife, in our example) doesn’t want to cooperate since she feels that the third party will benefit. Because of the deadlock, the foreclosure happens.

Another example is when a philandering husband or wife buys a home for his/her paramour and when things go awry, the benefactor ceases to pay the monthly amortizations. The paramour cannot sell the property to prevent foreclosure because the property is not in his/her name. The benefactor may choose to simply let foreclosure push through.

I also encountered situations where the owner simply has lost interest with the property and is willing to just let it go. This can be due to a number of reasons.

One example would be they are leaving for abroad for good and they have no time to dispose their property.

Others realize that they simply made a mistake in buying a property that they really can’t afford, and they just cut their losses and let the foreclosure happen, especially if they have little or no equity.

Sometimes it is also not worth it to stop the foreclosure of a property because the house itself is not worth saving. It could have deteriorated so much and fixing it up would be too costly. It also might be located in a place that is no longer suitable as it might be prone to dangerous flooding (remember Ondoy?) or the place is simply crime infested.

In the above examples, there’s really nothing we can do and we often learn about such properties after the property has already been foreclosed.

~~~

Do you have any other tips that may help stop foreclosure? Please share it here by leaving a comment. Thanks!

To our success and financial freedom!

Jay Castillo

Real Estate Investor

Real Estate Broker License # 3194

Text by Jay Castillo and Cherry Castillo. Copyright © 2010 All rights reserved.

PS. New visitor? Click here to get started with learning more about foreclosure investing in the Philippines.

Image courtesy of cooldesign / FreeDigitalPhotos.net

Pingback: Avoid the cancellation and foreclosure of properties under Pag-IBIG housing loans

hi Sir Jay ano po ba ibig sabihin ng Dacion en pago may pinadala kc na sulat ang Pag ibig nakalagay if u are not enterested in your property and wish to be relieve from your mortgage obligation you may apply for DACION EN PAGO arrangement with Pag ibig fund matagal na po kc d nababayaran low cost housing po ung bahay ano po ba ang gagawin

Sir Jay

We are on the complicated situation and a difficult miss align budget. We are not definite about the information and added conflict that we are far to regle our responsibility concerning the re or pre verification, failed to receive pre avis accounts from the authorize associates. We are no longer a PAG-IBIG member to resolved cover payments, When head of the family deceased the whole table turned and changed. Maybe you can suggest person can help us get through and how to sustain never end up to foreclosure. A right person can go re asses our accounts with assitance. before due dates starts to count infact that begins today.We are indeed foresee an apt procedure so to legalize as well the title on the next step by your help and the others.Reference would be needed whom your proffession. The least, a step by step prove instruction for foreign workers like us. Thank you

Hi Jay!

I’m just sharing some personal tips on self assessment in the buying process to prevent foreclosure.

http://www.zipmatch.com/blog/avoid-home-foreclosure

I hope this helps your readers as well as I have found this helpful. Sometimes it’s the foundation you create at the begining that can make a world of a difference. 🙂

hi po..nakakuha po ako mg fore closed at nakapag down payment napo pero parang ayaw po umalis ng nakatira at gustong ipaglaban ang property priority pa rin ho ba sya kahit nakuha ko na?

Pingback: Ways to Avoid the Threat of Foreclosure

Hi Mr. Jay. I just want to consult ung case ng house ng father ko. 10 years na po nilang hinde pala na nababayan ang amortization nito sa NHMFC. then nakareceive kame ng statement of account about dun sa loan father ko. Then pinagbigay alam ko rin agad to sa father ko at dun rin lang namin nalaman magkapatid na ganun na ang sitwasyon ng bahay. May 300K+ na outstanding balance ang bahay. Kaya nakipag coordinate kaagad ako sa NHMFC and asked if pwede pang i apply sa restructure program ung case ng bahay ang sabi nde na raw pwede dahil matanda na raw ang father ko (69 years old). Sinabi pa na kahit kami pang ng kapatid ko ang magtuloy ay nde pa rin daw maaaprove for restructure of loan. Ano po kaya ang dapat namin gawin? ayaw naman po namin mawala ang bahay dahil eto na lang po ang napundar ng father ko. Natatakot kame na bigla na lang i-sheriff ang bahay sa Feb 2016. Willing naman po kaming magbayad kahit paunti unti hanggang sa masettle. Pwede po ba naming i-apply ang ASSUMPTION OF MORTGAGE. Pano po ba ang procedure nito. Maglalabas po ba kame ng malaking halaga ng pera dito? Sana po mabigyan nyo po ako ng advise kung ano ang dapat namin gawin. Maraming Salamat in advance.

Hi. this is Benjamin. The best thing to do is to know first how much is the cost of the full payment require to buy back the property. Then, upon knowing, go to a separate bank, any bank that provides lesser rate of interest, and request that bank to buy back the property, restructure your mortgage payment terms, and you may continue paying that bank as per your new contract. Good luck.

Hi, ask ko po sir, kasi may balak po kami kunin na foreclosed property thru pag-ibig as residential house. May nakatira pa po ngayon dun na nangungupahan lang. Yung foreclosed property po na ito ay pina-public auction at first pero hindi po ito nakuha. Gusto ko po malaman kung how soon ko sila pwede paalisin sa house. Kung na public auction na po ito at nakalagay po na “acquired property” , ang titulo po ba nito ay parang sa brand new na house and lot (kung saan my contract to sell na binibigay sa purchaser/loaner). Mukha naman po mabait yung umuupa pero nag woworry po ako na baka hindi pa sila umalis agad e. Need din po namin yung house na yun para malipatan namin agad. Thanks in advance!

My dumating po sa akin ng foreclosure ngpunta po ako sa pag-ibig kaya lang nasa accuaredasset na po sa cya.52k bayaran ko bayaran ko pa sna kaya lang d na daw po pwd sayang nman po almost 12yrs.na po akong nagbabayad.ano po ba pwd kong gawin para d mawala hauz nmin.

Kausapin niyo po sila agad at baka pwede kayo mag propose ng payment plan, etc.

My property is soon to be foreclosed by the bank ,may babayaran pa po ba ako sa bank due to foreclosure? Salamat po and Mabuhay po kayo!

Hi Ms. Neng, I’m sorry to hear your current situation at sana po ay maging maayos pa ang lahat. Bale kung babayaran niyo po in full yung balance niyo para hindi matuloy ang foreclosure, penalties, surcharges, and attorney’s fees po ang madadagdag. Pero kung is-su-surrender niyo po ang bahay niyo, sa alam ko po wala na kayong babayaran.

May one year redemption period pa po kayo, pwede niyo pa po ma-save, or mabenta ang property para may makuha po kayong equity kahit papaano.

Good day sir, may nabili po kaming bahay 3 years ago, since kaka-resign lang ng asawa ko sa work nya, ako po ang nag-apply sa pag-ibig ng housing loan. naapruhaban naman ng pag-ibig pero namatay ang asawa ko last year. Hanggang ngayon hindi pa po nmin natitirhan yung bahay kasi kailangan palagyan ng gate o pader at ayusin ang bahay. Inaantay ko na lang malipat sa pangalan ko ang titulo ng bahay. Kung ibebenta ko po ang bahay, maibabalik po ba kaya sa akin yung tatlong taon na hulog ko sa pag-ibig? Pwede ko po ba isama yung nagastos o nabayad ko sa pag-ibig sa buyer ng bahay? maraming salamat po

Quote: “”I also encountered situations where the owner simply has lost interest with the property and is willing to just let it go. This can be due to a number of reasons.””

> I hope this site is still active. I feel my situation belongs in this category, what are the negative impacts (to me) if I decide to have the property foreclosed?

Hi Boy, yes of course this site is active, although a lot of other stuff have been eating up my time lately.

With regard to your question, I’m sorry to hear your in current situation. The first thing that comes to mind is, you will get blacklisted by the banks/lending institutions and getting another home loan down the road would be extremely difficult.

sir patulong nman hanap ako property house ung mga foreclosed by PAG-IBIG. kc iaaply ko din s PAG IBIG

kc mahal s mga dvelopers kya mas gusto ko un san site po b mkikita un or contact no. pag ng search kc ako sulit.com lumalabas lage.. salamat po

Pingback: Low Home Loan Rates - What You Need to Know Before It's Too Late

Sir jay,

May email address po kayo? Doon ko sana sasabihin ang problema ko.

Jhunix

Pingback: Last chance to stop foreclosure: Pag-IBIG Housing Loan condonation program ends on June 30, 2012 - ForeclosurePhilippines.com

hi jay, may way pa b para maprolong ung payment period na 1 year kase naforeclosed ung property ko.ndi ko kase kaya bayaran in full.please advise.tnx

may nabili kami tonwhouse, 7 months na kami delay.. kahapon nakatangap kami ng notice of cancellation dhl default payment. ano dapat namin gawin aside from bayaran ng buo un arrears, para d ma foreclosed un bahay namin.

Hi Cathy, have you tried to ask for a restructuring of the loan through a written letter explaining the circumstances? This should buy you some time. Another thing you can do is to sell the townhouse to a trusted relative or friend from whom you can buy it back later when things get better. I hope this helps.

Hi Jay,

My mother signed a housing loan with the GSIS. A few months before she left for abroad, she decided that the family would have no use for such home. Based on her explanation (and her vague memrory of the details), she discussed the matter with somebody from the GSIS office in the province where she is from. Not fully understanding of the technical and legal consequences of her actions, she has agreed to let go of the property and allow foreclosure, with the understanding that the loan will be terminated. She was asked to sign a paper, which from her description was a list of names and a small space for signature, which appeared to be a list of property owners who agreed to foreclosure.

My mother left the country a few months later in good faith that the loan no longer exists. Looking back at this, I thought she has made a mistake of assuming that there is no more loan to pay without any legal document in her hands to prove such assumption.

About 2 years later, she went back to the Philippines to apply for pension. Upon application she discovered that she is not entitled to any pension because of outstanding loan, which now is more than double the amount of the original loan.

She is now 67 and not collecting pension after many years of government service.

What I would like to know is, what happens to the property that is foreclosed? Does the government appraise the property and assign the value against the loan to reduce the amount of the loan? Is my mother supposed to receive a statement or any notice of bidding, assignment of the property to the loan or any document that would explain the outstanding amount? Does the interest on the loan continue to accumulate even after taking over the property?

I would appreciate if you can answer questions I have posed and if you can point us to some office or individual who can help us to find resolution to this issue.

Thank you very much!

msbc

Good day, isa po akong seaman/ofw. bakasyon po ako at wala pang kasiguraduhan kung kailan uli makakasakay.. may nakuha po ako na house and lot sa rizal. 3 mos na akong hindi nakakabayad sa pag ibig. ma foreclose kaya ung property na nakuha ko?meron bang special benefits for ofw kung ikaw ay nakabakasyon??sana po ay masagot nyo po ang aking katanungan..salamat po..

Good day jay, may nabili kmi na property nun 2008 nang may work pa husband ko. Then 2009 he had a stroke. For 3 years maayos naman un aming pagbabayad hanggang recently lang ay di na kmi nakakapag update and may notice na kmi ng foreclosure this coming september 27. I contact them para sa extension pati un nag ahente namin para matulungan kmi pero wala na reply. Iniisip ko lang pwede ko ba cla idemanda kasi nun binibili namin un bahay before lahat ng documents namin ay fake un signature ng asaw ko kc kasalukuyan NASA abroad sya nun kasal na kmi 2001 pero pinalabas nla na single ako at un asawa ko kino LNG ang magfifinace dahil di naman ako qualified dahil wala akong work nun pati un spa ay false LNG ang signature. kasi naisip ko Kung naipangalan LNG sana sa asawa ko at sakin ng tama ay sana covered sana sa sa MRI dahil permanent dissability na sya ngayon. Sana po ay matulungan nyo ako sa mfa katanungan ko. God bless po.

Good day Ms. Cathlyn, I’m sorry to hear what happened to your husband and I hope and pray everything will get better.

Sa sitwasyon nyo po, unang-una, dapat niyo po munang linawin kung ano ang gusto nyong mangyari. Sa pagkakaintindi ko sa kwento niyo, gusto niyong ma-cover ng MRI ang kaso nyo, and therefore ang insurance ang magbabayad ng utang nyo para in effect ay fully paid na kayo. So, dapat basahin nang mabuti ang inyong insurance contract at kausapin ang humahawak sa inyong account sa insurance company, at alamin kung ano ang dapat gawin para makapag-avail kayo ng insurance benefits.

Pangalawa, sa pagkakaintindi ko sa kwento niyo, gusto iforeclose ng seller ang bahay nyo on Sept 27, at siguro ang makakapag-pipigil lang nito ay kung makapagbayad kayo ng utang in full. Sa kasalukuyan, medyo gipit ang sitwasyon nyo dahil nga na-stroke si mister, pero gusto nyo na mapigilan ang pag-foreclose. Sa point of view ng seller, ano naman po kaya ang pwede nyong ma-i-offer para di nya ituloy ang pag-foreclose? On your part naman, basahin niyo muna nang mabuti ang mga nakasulat sa dokumento na sumusuporta sa transaksyon, Deed of Absolute Sale/mortgage contract/promissory note, etc, at iba pang mga provision doon, at alamin kung ano ba talaga ang pwedeng gawin ng seller. Sa dokumento makikita ang karapatan at responsibilidad niyo as buyer at ng seller. Pahabol po, mas maganda kung sulatan niyo at ipareceive niyo ng maayos (pwedeng through registered mail) para may proof kayo na nakikipagusap naman kayo sa kanila at gusto niyo rin naman ayusin ito.

Kung foreclosure talaga ang mangyayari, mahabang proseso pa po yon, pwede po kayo mag-explain pag dinemanda na kayo (pwedeng antayin nyo na lang po, mas mahirap po kasi kung kayo ang magdedemanda, kasi sabi nyo nag po kayo ang di nakakapagbayad). Tandaan niyo rin po na laging may 1-year redemption period.

Yung pag-peke ng signature etc, masalimuot at komplikado po yan, dapat kumonsulta po kayo sa abogadong talagang humahawak ng ganyang klaseng kaso. Kung medyo gipit po kayo, pwede po kayo lumapit ka sa Office of Legal Aid (OLA) sa UP College of Law sa UP Diliman, o di kaya naman sa Public Attorney’s Office (PAO), at pwede din po kayo tumawag para magtanong kayo kay Atty. Mel sa radyo, 92.3 FM, napakagaling po ni Atty. Mel sumagot sa mga tanong tungkol sa Real Estate transactions (lunch time to mid afternoon po ang programa niya).

Good luck po at sana maayos na ang lahat. (Tinulungan po ako ng misis ko sa pag reply sa inyo)

Hi! Sir Jay,

I’ve been an avid reader of this informative blog of yours since 2008, and it has been very helpful indeed!

I got the courage to post a comment here, as I haven’t encountered one like what we are facing now, regarding our downpayment and financing with its tie-up bank.

We got a house and lot in Cavite and paid monthly its required downpayment of 12.5% for 15mos. without interest and on the 16th month thereafter, we will be paying the mortgage balance thru their Tie-up bank for the rest of the Mortgage Loan Term. We are on our 10th month today of paying the downpayment.

Although we were able to pay the monthly downpayment religiously for 10mos. now, we have fears that any time next month or thereafter we can no longer pay it. What if we decide to cancel it, what will happen to our monthly payments for 10months + reservation fee? Are we entitled for a Refund? It’s really painful for us should we decide to cancel it, worst if there will be no Refund entitled to us at all, but with the financial unstability we are facing now, am afraid the worst has yet to come.

Another thing that bothers us, does Tie-up banks like UNION BANK, will they grant us for the financing considering they are tie-up with the developer, and we have been paying the downpayment promptly for the past months.

We are somewhat on a hanging situation here whether to continue it or drop it totally. Our most fear is if the Bank willing and ready to give us the loan, now that the family’s business has been closed. Will the bank still conduct a thorough CI? What are the tie-up banks procedure on approving the loan?

Sir Jay, I hope you could help us enlighten and advise us on this matter and the agony of thinking about this is almost unbearable as the end of the 15th month and turn over to the bank for financing draws nearer.

(Although we can barely handle to pay the monthly downpayment, we are still making both ends meet to pay it religiously until its 15th month for the downpayment, and it would be a little lesser burden then for us if the tie-up bank will grant us the loan for financing because we can opt for a longer term.)

Holding on here to hear from you.

God Bless!!!!

hi po! paano po ba kung gusto ko na icancel o pwede po ba na iswap namin ang bahay sa pag ibig kasi malapit po kami sa ilog at nacra ang creek dito.please advice kung paano ang magandang gawin since 10yrs na kami nagbabayad at updated naman kami ng hulog sa pag ibig? thanks

Hi Sir, thank you for this informative blog. Bago lang kami pumirma ng Promissory Note for our pastdue account kasi hindi kami nakabayad for 9 months. We just paid a downpayment of more or less 30K and and our monthly amortization is 42K for 6 months. Pinirmahan namin ang PN knowing na tutulungan kami ng kapatid ko who is an OFW. Unfortunately, we just learned they’re company is almost on the verge of bankruptcy and delikado work nya. Hindi namin kaya ang 42K. Sabi ng Pagibig sa amin, pag e foreclosed daw ang property, kailangan naming magbayad ng attorney’s fees at saka e published daw ito sa newspaper na foreclosed na ang property namin. Ano po ang dapat naming gawin? Hope to hear your advice…Thanks a lot!

Good day sir,

Unemployed po ako for more than a year. Medyo hindi po ako nakapagbayad at for foreclosure na daw po ang bahay ko. Since wala po akong trabaho mukhang hindi ako qualified para sa restructuring ng Pag-Ibig. May tips po ba kayo kung ano ang pwede kong gawin para po ma-stop ang foreclosure. Napakaganda pa naman po ng property ko. 5 minutes away from malls, palengke, etc. Any help would be very much appreciated.

Hi Pia, how about i-offer mo siya sa mga kamag-anak mo para at least sa family niyo pa rin yung property kesa naman talagang mawala na siya pati yung nabayad mo na nuon? Pwedeng loan lang, sa kanila mo na babayaran later pag may work ka na.

Sir Jay,

Good day! Pinadalhan na kami ng letter from a law firm ng NHMFC pero ang laki nung kailangang bayaran. Nangyari yung mga 2 months ago na. Tapos may mga umaaligid-aligid sa lugar namin na gusto daw “tumulong”. Kailangan daw namin magbayad ng at least 170K. Akala ko for processing at bayad sa lawyer yun pala 70K para sa abogado at 100k sa mga nangongomisyon na mga ahente. Parang ang laki ng komisyon ng mga ahente, daig pa yung abogado. Kakagatin ko ba offer nila or mas magandang dumeretso na lang ako sa NHMFC?

Sana matulungan niyo po ako. God bless!

Hi Mary, mas maganda dumeretso ka na sa NHMFC para sigurado ka. Mahirap na at mabuti na ang mag ingat kesa magsisi.

Hi Sir,

May letter po Kasi ako na received from a Law firm regarding po sa Utang ko sa HGC pinababayaran po sa kin ang more than 2M na amount..ask ko Lang po Kasi di ko naman po kayang bayaran yun e pwede po bang ma sheriff yung mga gamit namin sa Bahay?..o kaya po ay Makuha ang property naming mag asawa…dalaga pa po pala ako ng Makuha ko yung Bahay..pwede po ba ako mademanda ng hgc? Kung di naman po ma sheriff ay Iniisip ko po Kasi na wait na Lang ma foreclosed yung Bahay namin at ibenta uli ng HGC sa murang halaga..Baka Sakali po na makuha ko uli..maraming salamat po..God Bless po..

Hi Kelly,

Sa pagkakaalam ko, yung ejection ng sheriff ginagawa lang pag may writ-of- possession na at usually after yon ng pag lapse ng redemption period.

Usually din po, pag naforeclose na ang bahay, may buyback option pa rin and former owner pero iba ang buyback price. Paki confirm na lang sa HGC.

Na try niyo na po bang mag pa restructure ng loan para hindi niyo kailangan na Php 2M in cash ang bayaran? I hope magawan pa po ng paraan. God Bless din po!

hi jay,

My mother and step father’s house has been foreclosed a couple of days ago. the real estate bought back the property from pag ibig. They were asking for payment plan, but the collector was only asking for a 1 time payment. Ofcourse they could’t afford it. My question is, can they still ask for an extension of the payment? Will they be forced to vacate the residence asap? what if they don’t have a place to move in to yet?

Hi Riza, I’m really sorry about what happened you your Mom and Step Dad. They still have a year to redeem the property though, and as far as I know they can stay until the redemption period lapses. The redemption period should buy some time to find enough funding for a full payment. I suggest to negotiate for the reduction of of interest, penalties, surcharges, legal fees, etc.. better if these can be waived. I hope everything turns out well.

hi jay,

My mother and step father’s house has been foreclosed a couple of days ago. the real estate bought back the property from pag ibig. They were asking for payment plan, but the collector was only asking for a 1 time payment. Ofcourse they could’t afford it. My question is, can they still ask for an extension of the payment? Will they be forced to vacate the residence asap? what if they don’t have a place to move in to yet?

Hi Riza, I’m really sorry about what happened you your Mom and Step Dad. They still have a year to redeem the property though, and as far as I know they can stay until the redemption period lapses. The redemption period should buy some time to find enough funding for a full payment. I suggest to negotiate for the reduction of of interest, penalties, surcharges, legal fees, etc.. better if these can be waived. I hope everything turns out well.

Great tips you have here. I found your post very useful, thanks for sharing good informations it was a big help.

can i avail a discount on my property so that i can full it now .

Hi Carolyn, it would really depend on the policy of the bank/lending institution where you got your loan if they will allow this. My suggestion is to just talk with them and be upfront, and keep the lines of communication open. I suppose you also need to check for any penalties or interest that may have accrued that you would need to pay.

can you help me what to do if im going to full my house payment on my property is now foreclose .

Our property had been foreclosed by Pag-Ibig and we are willing to buy it back. We were told we are entitled to 20% discount and we are thankful for that. However we are still hoping that the amount can be further reduced. We wrote to the foreclosure dept. and they referred our letter to the office that determines the valuation. We are awaiting their reply. Can it still be done (reduce the valuation)?

The valuation of the property would depend on current market values. What the can reduce would be reduction of interest, penalties, surcharges, legal fees, etc. if these are waived, the reduction can be substantial.