This time, I will share tips related to making your monthly payments. Failure to do so can result in the foreclosure of your property (if with a real estate mortgage loan), or the cancellation of the contract (if purchased via a contract-to-sell).

This is part 2 of a 3-part series about how to proactively prevent foreclosures and not lose everything.

If you haven’t yet read the part 1, you can do so from the following link:

How to Proactively Prevent Foreclosures (and NOT lose everything) – Part 1

Let’s continue with part 2 below…

Proactive foreclosure prevention tips (continued)

6. Make sure your payments are reaching the bank/lending institution – This may sound obvious, but this is very important, because sometimes payments end up in other people’s hands.

The best way to be sure that payments reach the bank would be to pay directly, don’t let the money pass through someone else who might have other plans, or is simply unreliable.

You can pay directly via post-dated checks, just make sure you monitor your checking account to ensure all checks are funded, You also need to monitor when the checks will run out and need to be replenished.

You can also setup direct payments through an Auto-Debit-Arrangement where payments are auto-debited from a bank account. Just make sure that bank account is funded accordingly.

Lastly, make sure the payments are credited accordingly by checking your monthly statements. You can even monitor these online with most banks, and even Pag-IBIG.

Tip: You can use Pag-IBIG’s Online Housing Loan Payment Verification System to verify your housing loan payments, check your housing loan balance, and enroll to their paperless billing service so you can receive billing statements via email (I use this myself!)

Of course, you need to make sure you actually have funds to make the payments, which brings me to my next tip…

7. Make sure you have emergency funds – This is simply a must. It gives you a buffer to tide you over during hard times.

The norm I see recommended right now is at least 6-months worth of emergency funds.

This means if you lose all your income today, you have enough funds to pay for all your obligations and day to day expenses for the next 6 months.

Having emergency funds gives you time to take corrective action and recover.

If the property is simply too expensive to keep, then 6 months should be more than enough time to sell the property if priced right. Again, I want to reiterate that it’s better to sell than lose everything, if the property gets foreclosed or if the contract is cancelled.

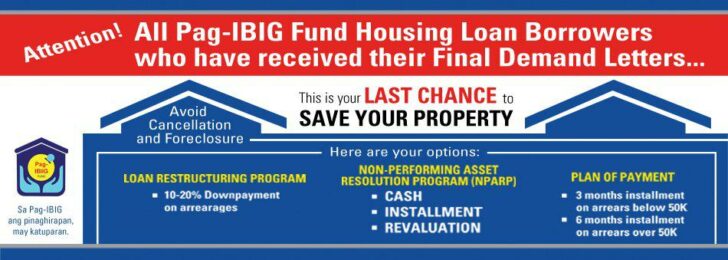

Another thing you can do is to restructure the loan to have lower monthly amortizations, which can further stretch your emergency funds, provided you have not yet missed any payments, or you are not yet in default.

Actually, you don’t have to wait for an emergency to happen before you can restructure your loan. You should do this proactively, which is actually my next tip.

8. Restructure or refinance your home loan – I have an existing loan with Pag-IBIG, and several years ago, I restructured it (they refer to it as repricing) as suggested by my buyer (they bought the house from me by assuming the loan).

It turns out that Pag-IBIG has lowered their interest rates significantly, and I was eligible for repricing.

We were all surprised when the monthly amortization was lowered from Php15,189.36 to Php8,938.08. This was the result when the interest rate was lowered from 12% to 6.985% for a 20 year term. Nice!

Obviously, getting a lower monthly amortization means payments are more affordable, and the borrower is less likely to miss any payments and face foreclosure down the road.

You can also refinance a home loan by getting a “loan take out” from another bank/lending institution that offers lower interest rates and longer payment terms. Remember, you can only refinance your home loan if your loan is in good standing.

Actually, you should aim to get the lowest monthly amortizations possible at the very start. You can do this by getting the longest payment terms, and increasing your downpayment, in addition to getting the lowest interest rates as mentioned in my example above. This leads me to my next tip.

9. Get the longest payment terms, but pay as much as you can – If you get the longest payment term, you will obviously get lower monthly amortizations. To save on interest, you should still pay as much as you can, just make sure that the excess goes directly to the payment for the principal.

Tip: When making excess payments, you should specify that it should be applied to the principal. Otherwise, it might be credited as advanced payments, which will still incur interest. You should also check in advance if the bank/lending institution will allow this.

Having a low monthly amortization gives you the flexibility to pay the low monthly amortization during those hard times, or you can pay more when you have excess funds to shorten the term and save on interest.

Of course, my advice is to get fixed interest rates, even if it means higher rates. At least, you will have peace of mind because you won’t be affected by market rate fluctuations caused by a financial crisis, as explained in my article: Low Home Loan Rates – What you need to know before it’s too late

To be continued…

There goes part 2, and I’ll conclude this series with part 3. Don’t forget to subscribe to get notified via email.

Did you find these tips helpful? Got something to add? Let me know by leaving a comment below. Thanks.

Hi sir can I ask for your help

How Ms. Janice, how may I help you?

Hi sir jay

Thankyou for this kind of tips,article,blogs.i also want to add a question here you said something about restructure of loan morgage, is it also applicable banks to that?, can i talk to them and discuss about restructure of loan morgage to lessen my monthly ammortization?

Thankyou

Hi Patrick, please see my earlier reply, thanks!

How does a bank foreclose properties, my land was foreclosed by a rural bank and the Title and the Tax Dec of the land where change to the name of the bank, but the 4 Tax dec on improvements where left under my name. does this mean I still own the improvements. why did the bank failed to change the improvements tax dec to them.

Hi Wilbert, sorry to hear your situation. Regarding your question, it really depends on whether the loan collateral includes the improvements. If the improvements are part of the collateral, there just might be a delay in the consolidation (transfer to the bank’s name) of the tax declaration.

Is seller financing the same with the “owner to avoid foreclosure will look for a 3rd party buyer to assume the payment of the loan and pay a certain amount then just execute a separate CTS without involving the lender” ?

Seller financing usually means that the buyer will not have to get a loan/financing from any bank as the seller is willing to sell via installment, in effect, the seller shall provide the financing.

What you mentioned is more like the assume balance approach where the buyer will take over with the bank loan payments, and the existing loan is not altered in any way (the buyer and seller will have an “internal” agreement between them), which is what I did with my buyer as mentioned in #8 above. Thanks for the question and for dropping by!

Thank sir.

Welcome!

Hi sir jay, i just want to say thankyou for making this kinds of blog helping and sharing your knowledge..i also want to add a question, you said here in this article about the restructure of morgage loan is it also applicable in bank loan? Can i also ask the bank about it?

Thanks

Hi Patrick, thank you for the kind words. Yes, it is possible for a bank to be open to restructuring of a mortgage loan. If you are not yet in default (you have no missed payments), it would be easier to get loan restructuring approved. If you already missed payments, it is still possible, but unless the foreclosure process has already started.

Hi Jay,

What happens to the credit standing of people with foreclosed properties? Are they not allowed to loan again in any bank (black listed?) assuming they are in a better financial condition? Say, I have a property that got foreclosed some years ago but I still have other properties that I can use as collateral for a new loan (business loan), will the bank not grant me another loan?

Thank you very much for sharing your knowledge.

I acquired knowledge for my future reference when buying a house under a housing loan.

You’re welcome Mariciris, please watch for the final part of this series… it’s turning out to be another long post…

Thank you very much! This was very enlightening.

You’re welcome and thank you also Raymund!