Foreclosed properties might seem attractive at first. But if you are not careful, you might end up buying a property that is actually overpriced and not worth buying. You might realize this only when you consider a lot of issues that must be factored in. So here are my top 5 things you should consider before you start buying foreclosed properties.

But before I proceed, here’s a background of why I came up with this list…

With thousands of foreclosed properties for sale in the Metro Manila area alone, I found it overwhelming to choose which properties to purchase as real estate investments. To get around this, what I initially did was to identify particular areas that I am familiar with so I can focus only on them. The areas I identified included Marikina, Pasig, Quezon City (excluding Novaliches), San Juan, Mandaluyong, and Makati. However, I am still left with several hundreds of properties.

To shorten my list further, I chose to apply the 5 criteria below when evaluating prospective foreclosed property investments. By the way, I did not come up with these criteria. These came from Robert Allen’s book “Road To Wealth” (previously published as “The Challenge”). I decided to use these because two of my mentors have also shown me very similar methods of evaluating properties. I figured that since it worked for them, it would also work for me.

I built on their set criteria and enhanced them to include things that I have learned to look for and avoid in real estate investing.

Here are my top 5 things to consider when evaluating foreclosed properties:

1. Location

I guess everyone has heard the saying that there are only 3 things to consider when buying real estate — location, location, and location! Well, location really is a major criterion one should consider when buying a property, whether foreclosed or not. In most cases, location dictates the profitability of your property since it directly affects the following:

a) the selling price that you may get if you decide to sell the property

b) the rental rates if your strategy is buy-and-hold.

When considering a property, one should check if the location is in a high growth area or will soon be in a high growth area (for example, an SM mall will be built in the area in a few years) as this indicates a high potential for appreciation. Other factors like accessibility, security, and availability of utilities like electricity and water are standard things to look for.

It is also essential that the location is close to convenience stores, schools, churches, hospitals, malls, grocery stores, wet and dry markets, or even business districts. Locations that are in flood-prone areas, near fault-lines, areas with high incidence of crime, squatters, piggeries, slaughter houses, garbage dumps, and the like will fetch lower selling prices and rental rates.

2. Selling price plus other costs

Quoting Robert Kiyosaki in his book Rich Dad Poor Dad, “You should make money when you buy, not when you sell”. I often asked myself before how the heck can I make money when I’m buying a property and obviously letting go of money? The answer is really simple. One makes money when buying a property if it is bought at a price below market value. If this approach is used, you help ensure that you will make money without depending on appreciation.

Relying on projected property appreciation where you hope a property would appreciate in value so you can sell it later for a profit is purely speculation and is no different from gambling.

Other than the selling price, one should also consider the major taxes like Capital Gains Tax (CGT) and Documentary Stamps Tax (DST), just in case the seller decides to pass these on to the buyer. Other taxes such as transfer tax, real property tax, and VAT (if applicable), should be factored in as well. When all of these taxes are factored in, they can turn what had initially looked like a bargain into a deal not worth pursuing.

Other expenses such as association dues (in case a property is a condo unit), homeowners’ association dues (in case a property is in a subdivision), property maintenance costs, property management costs (if you are an investor who wants a truly passive real estate investment), etc. should also be factored in to see if the property is really a good buy for the long term.

I also set a maximum limit of 2.0M for my investment properties but I can increase this as I get more experienced.

3. Property Condition

When investing in real property, one should look for a structurally sound investment that is preferably made of concrete and other durable materials that would last for years. When dealing with foreclosed properties, however, it is not unusual to see quite a number that are not well maintained and would need repairs. Put in mind that the repairs should bring significant value to the property which would cover the related cost. A property which would need extensive repairs that are too costly should be avoided.

For example, a property that has horizontal or diagonal cracks could have a major structural flaw that may prove to be too costly to repair. Vertical cracks might only need superficial patching. Many properties only need a new paint job.

Other things to things to watch out for include termite infestations, rotting wood, water stains, flood lines and water damage, etc. It is also a must to check the condition of the electrical, water, and sewage systems of a property to see if major repairs are needed or if they even exist. It would be best to let professional contractors evaluate a property’s physical condition, just to be sure, before actually purchasing a property.

When a property needs repairs, it can actually be good for real estate investors as it can be the basis for low-ball offers. In case these low-ball offers do get accepted, having a contractor that can do quality repairs cheaply can lead to bigger savings and margins. I envy those investors that have friends or relatives that are contractors. If anyone who happens to read this would like to refer anyone, please leave a comment below.

4. Financing

Aside from a favorable selling price, availability of financing that offers very flexible payment terms and low home loan rates are also a big consideration. Imagine finding what seems to be a bargain property but then you find out that you need to pay in cash and you only have until the end of the week to come up with the money.

Compare that to another property that may have a higher selling price but with very flexible terms that could include a low down payment, low interest rates that are fixed for at least five years (always remember to negotiate for this – this protects you from soaring interest rates and gives you time to refinance your mortgages if needed), and long payment terms that result in lower monthly amortizations.

I’m sure a lot of you would choose the property with the flexible terms, unless you have a lot of partners or investors that are ready and waiting to finance your deals.

When the monthly amortization is lower than the rentals, you will have a property that can generate positive cashflow, a true “asset” using Robert Kiyosaki’s definition that “an asset puts money in your pocket”.

By the way, you should also check if financing is through a mortgage loan or through a contract-to-sell. Mortgage loans requires the buyer to submit financial documents and not everyone can get approved, while financing through a contract-to-sell is easily approved by banks. I’ll discuss these further in another article.

Want to get notified when this is updated? Subscribe for free updates!

Get new/updated foreclosed listings, auction schedules, property buying tips, and more, sent straight to your email inbox. It's free!

5. Seller Motivation

A motivated seller is a seller that badly needs to sell his or her property at the soonest possible time. Banks are a good example as their inventory of Real and Other Properties Owned or Acquired (ROPOA) or Real Estate Owned (REO) are non-performing assets that they need to dispose quickly.

Some may find it too good to be true but some banks really sell properties way below market values and others also accept offers that are also way below the original asking price indicated on their foreclosure listings. This is because when a seller is highly motivated, they tend to be willing to sell a property at a huge discount, with little or no money down, and at very favorable terms.

For example, I once submitted an offer for a 9-door apartment complex in Pasig for only 1.9M while the original price was 3.4M. To my surprise, they accepted it! Turns out that the loan amount that they needed to recover was about 1.8M (I actually offered too much for this real estate investment property) and they just wanted to remove that particular property from their inventory of non-performing assets.

What to do next?

For each of the criteria above (which you can also modify for your own use), I can give a property a score of 1 to 3, with 3 being the highest. I then get the total of all of the criteria. If a property gets a score of 11 and below, I move on to the next property. A score of 12 or above warrants further evaluation of a property.

I am then supposed to apply the 100-10-3-1 rule which I got from the audiobook entitled “6 Steps to Becoming A Successful Real Estate Investor” by Robert Kiyosaki and Dolf De Roos. The same ratios were also mentioned in Larry Gamboa’s book, “Think Rich Pinoy!”.

- Once I get to analyze 100 properties that scored 12 or above, I can further trim down by calculating the return-on-investment (ROI), the monthly cashflow, and the cash-on-cash returns, which I will be discussing in greater detail in another post.

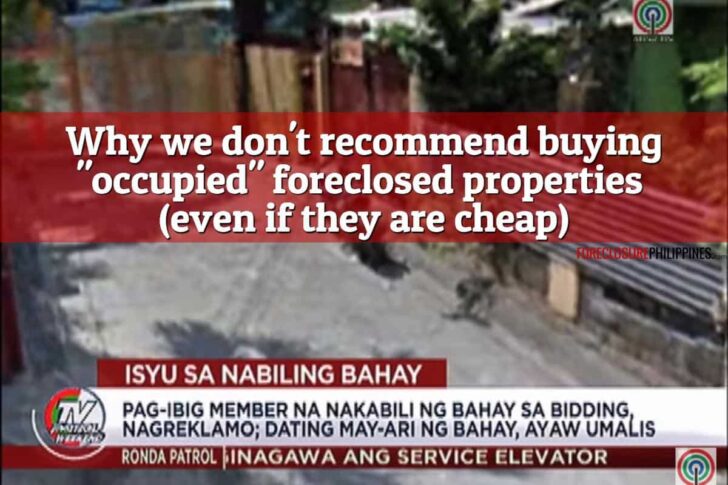

- I then get the resulting top 10 properties and do further due diligence like checking the legal documents of a property, checking with the bank if it is still occupied by the previous owner or a stubborn renter, etc.

- I then make written offers on the top 3 that appear to be free of any problems.

- From the offers accepted, I proceed to buy one property.

Sounds simple enough right?

However, it may still sound tedious for the average Joe. Well, there’s no such thing as a free lunch.

Let me know if you have any questions or if you may have anything to add that should be considered by leaving a comment. Thanks!

Good luck and Happy Hunting!

Hi there! Thank you very much for posting all this useful information. I have a question.

For bank-foreclosed properties, why is there a need to check the legal documents? Are not banks supposed to have done this beforehand, for their own security? I mean, don’t they have in their possession the original legal title of the property while it is yet to be fully paid by buyer of the property?

Hi Paul, unfortunately, not all foreclosed properties are in the possession of banks. Those without caretakers can get broken into and will get illegal occupants which can lead to ejectment cases, which you need to check, among other possible issues. As the saying goes, you can trust the bank, but you have to verify if the property has no issues.

When it comes to investing and renovating, don’t forget that there is usually a cost in disposing of debris etc after the renovation. It isn’t usually big amount. But it is something to budget for during renovations.

What books do you recommend to read and what are the most important thing in real estate investing???

I’ve been working for 4 years and these past 2 years I have realized the needs to invest on my future. Kudos to you Sir. I learned a lot on your posts. I am still in the process of saving money and was planning to buy a foreclosed property cos its the cheapest. I know I need to weigh things and the assurance that the property I am buying is indeed a security in my future not pain in the ass. Thanks Sir!

Regards,

Billy

You’re welcome and thank you also Billy, good luck on your house hunting. While most of the time foreclosed properties are cheaper, you still need to verify on a case-to-case basis. Yeah, make sure you are buying a good deal, not something you will regret later on.

Hello, I am planning to buy a bank foreclosed property I have read all your tips and all are very informative. I have question to ask…1. HOW TO CHECK THE LEGAL DOCUMENT OF THE PROPERTY 2. HOW TO KNOW WHAT ARE THE TAXES OF THE PROPERTY TO BUY? looking forward on your response.

Thanks,

Henry

Hi Mr. Henry, this is covered in item #8 to item #14 in the following article:

https://www.foreclosurephilippines.com/31-questions-you-need-to-ask-when/

good day Mr. Jay!

This site is indeed informative and interesting, i just wondering perhaps you can send me the ABC’s on how to acquire the very first forclosure property, how and what is your strategy for negotiating the price how you pay your intial deposit assure the owner that the property kept in your name, later on have them rented to generate income.

My Best Regards

Hi sir jay, im planning to buy a foreclose house and lot in BFS? i just want to know what is the most important things to look out before the actual payment, because i dont have any background in any property law so i just want to make sure that my transaction to BFS in buying a house and lot is legit..thanks i hope you can give me advice regarding this.

Sir jay may bidding po ba kau n aattenan by May kng pede sana maka sama, gusto ko sana m experience muna kng panu..if ever okay lng p email nlng po aq. Interested aq s real estate mg aatend din aq ng seminar dyan pg uwi ko. Salamat

hi Jay! Can you elaborate more on “financing through contract to sell” as an alternative to financing through mortgage loans? Also, in a contract to sell, can the buyer already acquire possession of the property even though title or ownership to said property is transferred only upon full payment of the contract price? Thanks in advance Jay. I would really appreciate your answers.

Very good reading material Jay, thanks. I am trying to buy a property in Cavite and it is a foreclosed property. It seems the owner(title is still in her name) will not let go off the property. She is still collecting the rent, I learned, but the property had been consolidated last year as I informed by the real estate agent. She was given 1 year to redeem the property from the bank (more than a year has pass). It is now being sold by an asset management company where I got the info from. If I will proceed to buy this property which I think is a good investment will I have any problem with the title transfer or by court case filed by the old owner to recover the property. Will wait for your valued reply. t.y.

Sir Jay, is it OK to buy property acquired by PDIC from a closed rural bank. The subject property, strategically located in Manila, I believed can be bought 60% below prevailing market price. However, the former owner are known to me & still residing in it. I’ve searched & found out that the title now (by certified true copy from RD, City of Manila) is in the name of the closed bank since 1981. Pls advise how can I deal with this wisely, many thanks!

Hi!! i am avid follower of your site right now i started investing in foreclosed i got one before a vacant lot, then the second one is the townhouse unfortunately i didnt do due diligence i just rely to the bank coz its my second purchase to them. its good that i got my money back right now i am on the process of acquiring a second one from different bank a house and lot lets say i submit an offer of 1,300M coz the price is 1,370M but the bank told me that if no other offer for 5 days thats mean were on the negotiated sale hopefully this time gonna be ok….

Thank you and congratulations, it’s great to hear you are actually doing it! I’m glad things worked out on your aborted deal (you got your money back!), and you are now in the middle of acquiring another one. Good luck on your offer, let us know how it goes!

so, you made 3 offers to 1 bank only. i guess we shouldn’t make 3 offers to different bank all at a time, right?

thanks a lot!

Personally, I have never made more than 1 offer per bank, at the same time. However, I have experienced making 8 offers for a client ( I acted as their real estate broker) for several properties in one bank and the bank just asked me if my client would really buy all of them if all got approved or only some of them. I answered “only those that would pass due diligence” and the bank was perfectly okay with that.

“I then make written offers on the top 3 that appear to be free of any problems. From the offers accepted, I proceed to buy one property.”

i thought when the bank accepted your offer, you must proceed to buy that property. what did the bank told you when you didn’t push through?

Hi Ann, I forgot to mention that one should always tell the bank upfront (in case you made more than 1 offer), that you only intend to buy one in case all get approved. Sometimes the bank will be the one to ask this when they notice you made an offer for more than one property. Thanks for the excellent question!

hi! I know your into real estate investment, I just hope I could ask you for this since I know no one to ask..when buying a house and lot what are the things to be consider? is it better to buy a foreclosed property or buying a lot and build a house afterwards ( by doing this I can just build it little by little considering my budget)? alin po ba mas makakatipid ka? because for a regular filipino it seems owning a house is very difficult and expensive with the terms from buying townhouse paying huge DP, monthly amortization for 30 long yrs through pag-ibig. they said it still depends on assessment of pag-ibig on how much you will be loaned aside from what is presented by the developers computation you will pay.

thank you in advance!

hi… we are a tenant of a land before its foreclosure,, and we are now almost 30 years living there. and just recently we found out that the foreclosed land was sold without prior notice from the bank. We are interested to buy the land but as we inquire it in the bank they told us to wait for the notice. Until we discovered now that it was already sold. What should we do. Pls. help us.

DEARI JAY,,

i read some of your article, and i want to invest in the real state. i am a fulltime mom, and my husband is ofw…

in our area , there is a property /lot for foreclose , and i am the one to go for bidding on Nov. 13 at DAP,

if i win in this bidding , i want to build a 4 door apartment that the money i use would be borrow or loan at a bank ,, is this a good start of investment,, or help me in pursuing this investment when i win in this bidding thanks florence

Hi Florence,

Thanks for the question. My only concern with building apartments is the amount of capital needed and the time it would take to finish the construction. You will also be having a negative cashflow while the apartments are being constructed. You would need a lot of capital reserves to sustain this. I would rather buy a property that requires minimal repairs so that it can be turned around faster, and earn money in less time, using less capital. I hope this helps.

Cheers!

Hi! I’m so glad to have browsed through your site. I’m just trying to research about buying properties and stuff and I stumbled upon this page. Very inspiring & informative. I’m 26 and doesn’t have any properties yet. So I’m actually torn between investing on a condo unit in Fairview through Pag-Ibig or investing on a foreclosed property / bank or Pag-Ibig acquired assets. The condo unit is 25sqm and MA is about 7k+. Gusto ko sana pa-rentahan sya after some time but right now, I’m just so confused. Naisip ko kasi na mas maganda kung sa house & lot na ako mag invest if I’m going to loan from Pag-Ibig. Any suggestions? Also, a friend told me na ang transfer of title daw should be shouldered by the developer at hindi buyer? How true is this? I was told by my other friend (who’s the realtor I’m dealing with dun sa condo) that it actually depends sa developer. Should I go for the condo & just loan from a bank for a house & lot or what? I didn’t know that getting into real estates is this hard! I hope you can help me. 🙁

Hi Shiela, thank you for visiting and for the compliments! In my opinion, it would depend on the numbers. Just go for the investment where the numbers make better sense. Which one would offer a bigger cashflow for you? Just consider all the expenses+monthly amortization and compare that to the monthly rentals you can get. Which property is more in demand as rental units? Go for the one which is more easier to get tenanted.

Transfer costs are usually shouldered by the buyer but can also be shouldered by the developer depending on what is agreed upon.

No, I should be the one to thank you for the response, Jay. It may still be a little confusing but your advice helped me re-assess everything. Oh well, I’ve actually decided to go for the condo for now since I got a cheaper unit 🙂 I’m sure I’ll be able to execute my other plans in the future & be just as successful as you are. 😉 I’ll keep visiting your site for other tips / info and maybe to help me reflect on my decisions. Thanks and God bless! =)

hi, so happy to find your site… i’m trying my best to save so i can invest soon … is it better to pay in cash? what are the pros and cons of buying foreclosed properties by cash? how about mortgage? sorry if this has been answered before 😉 if i have a little over 1m, what type of properties can i expect? where?

i’m dreaming of having a few door apartment in manila and bulacan… hopefully, soon. 😀

Hello Mr. Jay,

I’ve just happened to browsed thru your blogs now. I remembered because of our earlier sms exchange. Just like the first time, I was impressed, the difference now is I was inspired, specifically to seriously consider “managing my finances”. This is not just to pay the house we’re “renting-to-own” from you but to eventually gain financial freedom through this venture.

More power!!

Hi Noreen, thanks for visiting and for the kind words! Managing finances is not only a good place to start your journey to financial freedom, I believe it is mandatory. 🙂 I look forward to showing you more information related to our discussion on how to effectively lower your monthly payments and also shorten the payment period with the help of Pag-IBIG. Thanks again!

Pingback: How To Easily Calculate The Return-On-Investment (ROI) For Rental Properties

Pingback: Unionbank to hold 144th special public auction of foreclosed properties on October 17, 2009

Pingback: To all OFW’s: Need To Earn Passive Income And Come Back Home For Good? Try Investing In Foreclosed Properties!

Pingback: How I Estimate Market Values Of Foreclosed Properties

Hi Jay,

My brother, Archt. Tyrel John (TJ) Uy, works as the architect of Jaka Group. He also has a group of young architects who have good experience in house construction, remodeling and repair.

You can contact him at his mobile (0915 1940405) or email (tyrel_uy@yahoo.com).

Bryan Uy

Use Internet Marketing to Sell Your Product

http://www.newbies-internet-marketing.blogspot.com

Hi Bryan, thanks for the referral. As mentioned in my e-mail to you and for the benefit of other visitors, I’ll setup a page that would serve as a directory for real estate service providers like contractors, appraisers, brokers, property managers, real estate lawyers, etc. Please do watchout for it! By the way, nice blog!

@Aldrin, banks will definitely assist you, don’t worry about the background checks as they will only do this when you are already applying for bank financing for a property you are buying.

You negotiate for a lower price by submitting offers that would indicate the price you are willing to pay. These are applicable to all banks that have properties for negotiated sale(not through auction) like BPI and BDO for example. For RCBC and Unionbank, it seems they don’t entertain offers anymore as they are mostly selling through public auctions.

@Lanzer,congratulations on your first property! Thank you for visiting and the kind words!

HI MR. JAY THANKS FOR YOUR TIME IVE LEARN A LOT .IM ALSO AN AVID FOLLOWER OF MR. ROBERT KIYOSAKI .hIS ONE OF THE GREATS I ADMIRE AND IM ALSO INTO REAL ESTATE .I ALREADY ACQUIRE MY FIRST AND ILL GET MY SECOND NEXT YEAR THANKS FOR THE INFOS AND KNOWLEDGE YOUVE SHARED. ILL ALWAYS SEE YOUR SITE TO LEARN SALAMAT SIR JAY . TILL NEXT GOD BLESS

Hi, I’m so blessed to finally find someone here who I hope aho could help me. I’ve been running around in bookstores to bookstores on how could i learn wholesaling and to learn to find the steps on how to buy foreclosures. I’m also a R. Kiyosaki fan and a Larry Gamboa’s as well. I just want to ask you some of these questions:

– when you happen to drop by a bank and ask for foreclosure lists and would tell them that you are interested, will they assist you? or ask you some requirements instead for background check?

– how could you negotiate for a lower price?

– if yes, are these applicable in most banks? and what are those in particular?

I’m sorry if I asked so much, it’s just that I’ve been thinkinmg about this since last year, and my inactivity was somewhat followed up by the latest book i bought from R. Kiyosaki, “Guide to Investing”. I was really shocked when it says on the end part, “Just do it. Even if you don’t know anything just put yourself into action. Don’t wait for another time or opportunity to pass”. Geez, I think it was talking directly to me, heheheh… I hope you could help me po and be my coach as well. More power, and God Bless.

Hi Jay,

Very insightful advice. Thank you very much.

Hi Ria,

Since you are an OFW and you have your family with you, I suppose the only way for you to invest in real estate here back home would be to have a property manager that would do the property management for you. He/she would take care of everything and you just need to check if your monthly rentals are deposited to your bank account. Actually this is one challenge for me right now as I too am looking for a property manager that would handle 2 condo units owned by a friend of a friend but I haven’t found any up to now.

But before thinking about property management, we have to think about how you can buy a property. An option would be to purchase through negotiated sale since you can’t attend public auctions. This means you will just have to submit an offer which can be faxed or e-mailed to the bank. However, when your offer does get approved, you or someone representing you with an Special Power of Attorney (SPA) will have to facilitate the purchase of the property. I often hear of OFW’s buying real estate while they are not here through an SPA and I believe you can do the same, provided you have someone that you can really trust with your SPA. Another option would be to just time the closing of a deal with a bank while you are in a 1 week vacation but I guess you would have to do the same when you close a deal with a tenant/buyer.

Another challenge would be how would you check properties if they are wothy investments? Hmmm, let me think about this first.

I’m very honored and glad that you are convinced with investing in foreclosures! Sooner or later, you will have to invest in real estate here in the Philippines unless you have plans to migrate. If you can do it sooner, why not?! Thanks again for your comment and for patiently reading my blog posts!

Hi Jay,

I’ve been following your website for a while and you had me convinced that investing in foreclosure is a smart thing. One concern though. I’m a 27 year old OFW. My whole family is with me (which means to say no one can check the property out for us). Obviously, I can’t attend auctions. We have enough funds to start the venture. I had our bank in the Philippines assessed me for eligibility and I passed. I have listened to Robert Kiyosaki’s audio book a lot of times and have taken your advise and read Larry Gamboa’s Think Rick Pinoy book. The question is how the heck should I do it when I am not there, or can I even do it?!

You are one of those smart persons in real estate investing whose blog I am reading on a daily basis. Please tell me if it is also possible for me to invest in foreclosures or not. If it is, would you kindly advise me on the how?

Thank you very much,

Ria

Hi Joy, you could try to give them a “relocation allowance”, which is the same practice done by one bank I know who has successfully convinced occupants to leave voluntarily. Of course you should only give the “relocation allowance” when the occupant has left. The usual method is to have a sheriff eject the occupants but i am not aware how much this would cost. It can also get ugly.

hi jay, e purchased a foreclosed property at the bank, someone is occupying it, can you help me hat moves e can do…..

thanks,

joy

Hi Harry, thanks for visiting all the way from Dubai, please give my regards to those with you there!

Basically, once your offer is approved, the bank and you will have to meet to finalize the terms of the loan which will then be placed either in a contract-to-sell or a deed of mortgage.

Hi jay im just starting to venture this real state investment..im in the process of learning thru reading books like Rich dad poor dad..well ust wanted to ask with regards in closing the deal with the bank if in case your offers approve with the bank..how do you manage to take the leverage..?pls advice… thank you harry from dubai..

Hi Daisy, in a nutshell, submitting offers through a letter of intent is better because you can negotiate for the price, terms, etc., depending on the bank. In contrast, in public auctions you are obligated to follow the bid terms and all bids start at the minimum bid price(you can’t go lower), and if there are other bidders for the same property, the price can increase significantly. However, with public auctions, the whole transaction is faster. I continue looking at public auctions because I still find bargains, in fact, my most recent acquisition was through a public auction. May I ask what other problems or “challenges” did you encounter so that we can tackle them, I can even devote an entire post for these as I’m sure a lot of investors (including myself) encounter roadblocks along the way and we can all help each other by sharing and discussing how we can overcome them. Thanks for visiting my blog!

Hi Jay Finally I found someone whom I can consult my concerns with. I really would want to start investing in foreclosed properties but with my two attempts I encountered problems with the property which eventually made me lost my interest. which is better and faster? To join bidding or to submit a letter of intent (for banks with no bidding required)? Hoping for your reply. Thanks Daisy

Hi Franz! Nice to see a fellow fan of rich dad. =)

With regards to taxes, the seller(the bank) usually pays the capital gains tax (CGT) OR creditable withholding tax (CWT) depending on the bank. There are also banks that pass this on to the buyer so it would be better to confirm with the bank that has the property you are looking at.

Documentary Stamps Tax (DST), transfer tax, and other taxes applicable(depending on the location of the property) are usually for the account of the buyer.

Hi Jay! Finally, I found your site that answers most of my questions in real estate investing! I’m a fan of Robert Kiyosaki and has read most of his books. Would just like to know the taxes required when purchasing foreclosed property. 🙂

Great to hear that, I’m glad it worked out for you then. I agree on acquiring whatever knowledge there is on the subject, although like most people, it was just my grandfather who taught me to drive around the neighborhood till I mustered the courage to sneak the car out on longer trips – without a license. 😉 Anyway, I guess this is to say someone mentored me the basics on the subject and I took it a step further na lang.

Forgive me, I don’t quite follow the second part. I apply for a new loan while I still have a previous ongoing loan? 3 years of payment from the 1st loan?

I got that from Riyosaki’s 6 steps wherein he said that an option would be to refinance the house and get a higher mortgage amount that is based on the additional rental cash flow so that you have no money of your own invested in the property and still have positive cash flow each month from rent.

🙂

Personally, I feel you don’t need to become a licensed broker to become an investor, I just chose that path kasi nasanay nako mag pa certify, sa I.T. kasi ganun.=)

However, attending seminars is recommended to educate yourself with the basics, much like when you attend a driving school to learn to drive. Just like in driving, the key is practice. Try to start with small deals as your practice.

Refinancing means you apply for a new loan to replace your existing loan, usually from another bank with better terms and after completing 3 years of payment.

Thanks for the kind accomodation sir Jay, most of my questions cover only the basics, but some of the integral inquiries I have were already answered in the post above. Anyway, on to the remaining points:

1. Given the obvious necessity that research and studying the basics are prerequisites before going into this field, can someone with practically no real estate selling experience(except stubborn will and persistence) dive right into it? Of course having considered the pointers mentioned above, but is it possible to just start from nothing and work your way through? Or do I have to attend seminars or take exams first?

2. What does it mean when you say “refinancing the house” – as if you invested no money at all?

🙂

Hi Dragoro, I’ll do my best to satisfy your needs and I’ll share as much as I can. I really enjoy answering questions so you can either send them here through the comments section so that all readers can learn as well, or you can e-mail me at ph.investor@gmail.com. I will also feature e-mailed questions and try my best to answer a bunch of questions through a post. We can exchange contact info through e-mail. I am also very thankful to you for visiting my site and it’s an honor really to be of help. Coming up next will be “doing the numbers”. To our success!

So I can communicate my inquiries through here? Or should I give you my landline number? I just have basic questions really, nothing that would mark me as a nuisance. Just need a jump off point on where to start. Will be waiting for the “monthly cashflow, and the cash-on-cash returns” post. Much thanks 🙂

What matters to me is that you have something to share, my education doesn’t only come from the learned and degree holders but from simple folks as well. As long as I learn something I am indebted to you. Thanks in advance 🙂

Hi Dragoro, when it comes to real estate investing, I myself am still seeking mentors that would take me under their wings as an apprentice, so I don’t believe I can already mentor apprentices at the moment. What I can do is share as much info that I have already learned with you through this blog. However, you can throw me any questions you may have with regards to real estate in general, I’ll try my best to answer using what I learned when I studied for the real estate brokers’ licensure exam last Nov 2007. Is that okay?

Do you accept apprenticeship? 🙂