To transfer the ownership of a property title in the Philippines, transfer tax must be paid. In this blog post, I’ll share everything you need to know about transfer tax based on our experience with our own real estate transactions.

What is transfer tax?

A transfer tax is imposed on the sale, donation, barter, or any other mode of transferring ownership or title of a real estate property. It is a tax paid to the local government.

Please don’t confuse this with transfer taxes that are paid to the BIR (which are donor’s or estate taxes).

By the way, the acronym TT is often used for transfer tax.

How to compute for Transfer Tax

To compute for Transfer Tax, we must first find the Transfer Tax Rate we should use.

According to Section 135 of the Local Government Code of 1991, Transfer Tax is at most 50% of 1% or 0.50% (It is up to 75% of 1% or 0.75% in the case of cities and municipalities within Metro Manila) of the total consideration involved in the acquisition of the property or of the fair market value in case the monetary consideration involved in the transfer is not substantial, whichever is higher.

Here’s a copy of section 135:

“SECTION 135. Tax on Transfer of Real Property Ownership. (a) The province may impose a tax on the sale, donation, barter, or on any other mode of transferring ownership or title of real property at the rate of not more than fifty percent (50%) of the one percent (1%) of the total consideration involved in the acquisition of the property or of the fair market value in case the monetary consideration involved in the transfer is not substantial, whichever is higher. The sale, transfer or other disposition of real property pursuant to R.A. No. 6657[2] shall be exempt from this tax. xxx”

Source: Local Government Code of 1991 via Chan Robles Virtual Law Library

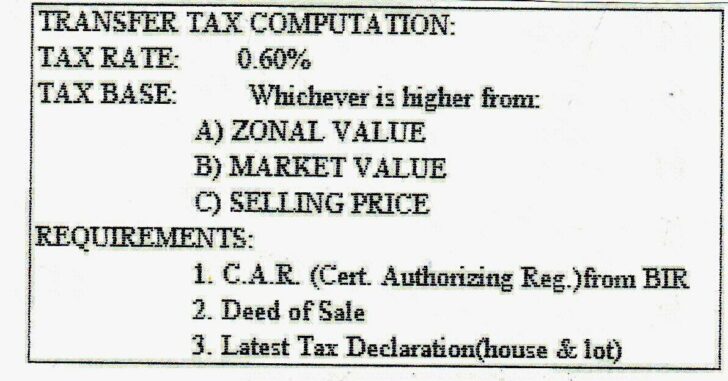

However, we have noticed that some LGU’s follow the tax rate for Metro Manila, even if they are outside Metro Manila. One example is Santa Rosa, Laguna (their tax rate is 0.60%). For better understanding, refer to sample computation below.

Transfer Tax Computation (actual transaction)

Let’s take for example a foreclosed residential house and lot in Santa Rosa, Laguna. The Selling Price (SP) was Php1.8M (as per deed of absolute sale). The existing market value (as per Tax Declarations) is Php480,000.00 for the land and Php979,316.93 for the improvement (The total market value is Php1,459,316.93).

I actually did the title transfer for this foreclosed property to the buyer and I am using actual values ~ Jay Castillo

Since SP of the property being transferred is higher than the Market Value, we shall use SP to compute the TT:

Santa Rosa, Laguna TT Rate: 0.60% [that is, 60% of 1%]

TT = 0.60% x 1,800,000

= 0.006 x 1,800,000

=Php10,800

Note: In addition, they added a certification fee of Php30.00 for this particular property

In the above transaction, the tax base was easy to determine because SP was higher than market value on the tax declarations.

Tax Base to use

To make it simple, the tax base is whichever is the highest of the following:

- Zonal Value (get this from from the BIR)

- Market Value (as stated in the tax declarations)

- Selling Price (on the deed of sale)

This was attached to the assessment we got, see below (from Santa Rosa, Laguna)

Why you need to pay

You need to pay transfer tax because the evidence of its payment is required by the Register of Deeds of the province concerned before you can register any deed or do a title transfer to get a new title under your name.

This is also required by the provincial assessor before they can issue a new tax declaration with the new owner (the old tax declaration is canceled).

Who should pay

The payment of Transfer Tax is the responsibility of the seller, donor, transferor, executor, and/or administrator.

However, the cost can actually be shouldered by either party, it depends on the agreement between the buyer and seller. I noticed that it is usually shouldered by the buyer or new owner, it seems this is the standard practice in the Philippines.

The legwork however is usually done by the seller. Don’t worry, the payment of transfer taxes may also be outsourced to a licensed real estate broker, or someone you trust who knows how to do this. For example title transfer companies like Conveyance Realty Inc. could transfer the title for you and the payment for TT is included.

Let me make it clear, while the cost for TT shall be paid or shouldered by the new owner, the seller is the one who does the legwork.

When to pay

The deadline for payment is sixty (60) days from the date of the execution of the deed or from the date of the decedent’s death.

Please note too that notaries public are required to furnish the provincial treasurers with a copy of any deed transferring ownership or title to any real property within thirty (30) days from the date of notarization.

Penalties and Surcharges for late payments

As per section 168 of RA 7160, here are applicable penalties, surcharges for late payments.

- Surcharge – No more than twenty-five percent (25%) of the amount of taxes, fees or charges not paid on time

- Penalty – No more than two percent (2%) per month of the unpaid taxes, fees or charges including surcharges, until such amount is fully paid, but in not to exceed thirty-six (36) months or seventy-two percent (72%).

Where to pay

The transfer tax is to be paid at the Treasurer’s Office of the city or municipality where the property is located.

Transfer Tax Requirements

In general, the requirements for making the payment (in addition to the money for payment of course) are the following:

- Certificate Authorizing Registration (CAR) from the Bureau of Internal Revenue;

- Realty tax clearance from the Treasurer’s Office; and

- Official receipt of the Bureau of Internal Revenue (for documentary stamp tax).

However, It would be wise to also have the following, which are also required in some cities/municipalities:

- Certified true copy of the transfer certificate of title (TCT) or condominium certificate of title (CCT)

- Deed of sale

- Latest tax declarations (land and improvment as applicable).

By the way, it’s really a must to check for any unpaid real estate taxes before buying a property because you will have to pay for any arrears before you can get a realty tax clearance from the Treasurer’s Office.

In addition, because of the requirement for the CAR from the BIR, the schedule can become too tight. This happened to us several times because of delays with the release of the CAR and we almost missed the 60-day deadline for the payment of TT.

Looking back, I’m just glad that the personnel at the concerned LGU accommodated our payment even without the CAR and we were able to avoid penalties.

What if you don’t agree with the Treasurer’s computation?

Assuming you disagree with the tax assessment made by a local treasurer, you may file a written protest thereof pursuant to Section 195 of the LGC, which provides:

“SECTION 195. Protest of Assessment. — When the local treasurer or his duly authorized representative finds that the correct taxes, fees, or charges have not been paid, he shall issue a notice of assessment stating the nature of the tax, fee, or charge, the amount of deficiency, the surcharges, interests and penalties. Within sixty (60) days from the receipt of the notice of assessment, the taxpayer may file a written protest with the local treasurer contesting the assessment; otherwise, the assessment shall become final and executory. The local treasurer shall decide the protest within sixty (60) days from the time of its filing. If the local treasurer finds the protest to be wholly or partly meritorious, he shall issue a notice cancelling wholly or partially the assessment. However, if the local treasurer finds the assessment to be wholly or partly correct, he shall deny the protest wholly or partly with notice to the taxpayer. The taxpayer shall have thirty (30) days from the receipt of the denial of the protest or from the lapse of the sixty-day (60) period prescribed herein within which to appeal with the court of competent jurisdiction, otherwise the assessment becomes conclusive and unappealable.”

Source: Local Government Code of 1991 via Chan Robles Virtual Law Library

In the case Romulo D. San Juan vs. Ricardo L. Castro, in his capacity as City Treasurer of Marikina City [G.R. No. 174617 dated December 27, 2007], one of the issues was the proper computation of the transfer tax base.

In this case, petitioner San Juan conveyed real properties to a corporation in exchange for its shares of stock[1]. Using as basis Section 135 of the LGC, San Juan wanted to pay the TT based on the consideration stated in the Deed of Assignment.

Respondent Castro, as the Treasurer, informed him that the tax due is based on the fair market value of the property. Petitioner Castro protested the Treasurer’s computation in writing, which the Treasurer also denied in writing.

Petitioner Castro then filed a Petition for mandamus and damages against the Treasurer praying that he be compelled to accept payment of the transfer tax based on the actual consideration of the transfer/assignment.

The bone of contention was the proper interpretation of Section 135 of the LGC.

Petitioner San Juan took the position that the transfer tax base should be the total consideration involved, because the intention of the law is not to automatically apply the “whichever is higher” rule.

He argued that it is only when there is a monetary consideration involved and the monetary consideration is not substantial that the tax rate is based on the higher fair market value.

His argument was that since he received shares of stock in exchange for the real properties, there was no monetary consideration involved in the transfer.

Respondent Castro, on the other hand, took the position that the transfer tax base should be the fair market value, because it is higher than the “monetary consideration” San Juan received in exchange for his real properties.

Castro argued that “monetary consideration” as used in the LGC does not only pertain to the price or money involved but also, as in the case of donations or barters, to the value or monetary equivalent of what is received by the transferor, which, in this case, Castro argued to be the par value of the shares of stock San Juan transferred in exchange for shares of stock.

As anticlimactic as this may sound, the Court did not rule squarely on the correct computation of the transfer tax base because it held that a Petition for Mandamus was not the correct remedy.

Mandamus lies only to compel an officer to perform a ministerial duty (one which is so clear and specific as to leave no room for the exercise of discretion in its performance) but not a discretionary function (one which by its nature requires the exercise of judgment).

In the case above, the Petitioner protested in writing against the assessment and Respondent denied it in writing as well. Petitioner should thus have either: 1) appealed the assessment before the court of competent jurisdiction, or 2) paid the tax and then sought a refund.

In my view, the Petitioner San Juan could have made another argument, that is, assuming that the “monetary consideration” would be equivalent to the par value of the stocks (which is still lower than the fair market value), that value is substantial and thus, there is no need for the “whichever is higher” provision to kick in.

Anyway, hopefully this issue would be decided upon squarely soon as there are really a lot of tax-free exchanges occurring and we really need guidance on the computation of transfer tax. Perhaps one day a taxpayer and his tax attorneys may decide to bring this issue up until the Supreme Court for a final decision.

Taking everything into consideration, personally, unless the difference in tax that you need to pay is really significant, it would be better to follow the computation of the Treasurer. Filing a case in court would require filing fees and fees for tax attorneys, not to mention taking up much of your time. If you will not pay the transfer taxes, you cannot transfer the title to your name and this would lead to problems with your buyer and the closing of your sale transaction. Weigh your options first before heading to battle. In real estate, as in everything, closing the deal fast is key.

Conclusion

The legal transfer of real estate property ownership can be tedious and costly. Transfer tax is just one of the many taxes and fees that need to be paid to do the transfer of title / ownership of a property.

Other transfer fees and taxes are as follows:

- Creditable Withholding Tax (CWT) or Capital Gains Tax (CGT), whichever is applicable (to be paid to the BIR)

- Value Added Tax (If applicable – to be paid to the BIR)

- Documentary Stamp Tax or DST (to be paid to the BIR)

- Business Tax (if applicable, depends on the LGU)

- Registration Fees (to be paid at the registry of deeds)

- IT Fees (to be paid at the registry of deeds)

Yes, while the cost to transfer the condominium or land title plus CGT or CWT, DST, transfer tax and registration fees can really add up, owning real estate in the Philippines can be rewarding and worth it… if chosen wisely!

[1] We will discuss the mechanics of a tax-free exchange in a later post

[2] Comprehensive Agrarian Reform Program

—–

Disclaimer: While great effort has been taken to ensure the accuracy of the discussion here as of its writing, this is not intended to replace seeking professional services. Always consult with your tax attorneys and read up on the relevant laws and regulations also.

To our financial freedom!

Jay (and Cherry) Castillo

Real Estate Investor

PRC Real Estate Broker License #: 3194

Blog: https://www.foreclosurephilippines.com

Text by Jay and Cherry Castillo.Copyright © 2023 All rights reserved.

I bought a property in 1991 but because we left the country soon after, we were not able to do anything with BIR. This year, after we returned to the Philippines, we decided to deal with it. Obviously, we paid a lot of money because of penalties, but we finally got our CAR.

Now here’s my issue. In computing the transfer tax, QC is insisting that they use the current (2020) FMV/ZV plus all the penalties and interests to compute our transfer tax . Shouldn’t this be computed instead on the 1991 FMV/ZV? If BIR used this format to compute our Capital Gains Tax, shouldn’t this be used also by the QC Treasurer?

Anyway, we already paid but i am struggling with the thought of contesting this and asking for a refund. The amount is quite big. Can anyone advice me?

Hi Ramon, sorry to hear you paid a lot due to penalties. Regarding the computation for transfer tax, I noticed the LGU’s always base it on the latest FMV/ZV, which is why delays can really cause bigger taxes when they update the FMV (I remember getting a letter stating this when the LGU was about to raise the FMV in that city).

Thank you Admin. I guess what you’re saying is we just accept the transfer tax as computed by the LGU. Well, it’s kinda painful but it gives me closure.

Hi Sir, tanong lang po…I bought a 60 sqm lot sa isang Investments company nung Dec. 2012 pa. Then hindi ko npatransfer agad ang title sa name ko. When I finally decide na ipatransfer na,nalaman ko na malaki na ung penalty…what should I do if I dont have enough money to process the transfer… pwede ba na wag nalang ipatransfer sa name ko? in the first place wala naman po akong balak ibenta ung lote. For sure time will come na baka mas malaki pa ang amount ng penalty en tax kaysa sa amount ng pagkakabili ko sa lote. What will happen sa lote ko kung wala talaga akong pangpatransfer ng title? I hope that u could give me some advice regarding this…thank u po sir.

The sample computation is wrong.

Really? What’s wrong with it? This is based on an actual transaction. I was the one who did the title transfer (which included paying for the transfer tax). These are actual data from the transfer tax assessment, official receipt, and certification for payment.

Carnal is the typical internet keyboard warrior, walang kwenta! Kung mali, sabihin mo kung bakit at i-correct mo! May masabi la ng tsk tsk

Pingback: With Online Credit Card Payments, Real Estate Transactions Just Got Easier

hi mr. jay I’m so happy to know you in this site.. gusto ko lang po sana magtanong may nabili po akong 600sq meters lot last month po at ngayon ko lang po nalaman na d pla nakabayad ng tax ang seller for years. and he owned 53,000 something sq meters kasama po dun ung nabili ko. pwde po ba akong magbayad ng tax dun lang po sa nabili ko? thank you po !

gud day mr jay.my partner buy a condo unit in edsa grand residences in qc but still he not fully paid when we get the paper for move in fee it show there that cost of transfer fee title is 208,000 peso for 48 square meter.we want to knw abt is taht too much to pay for the transfer fee title tey say also it times by 3% and already discounted is that true mr jay and also it say in paper that need to pay that in edsa grand realty.pls can u help me to xpalin abt cost of transfer title fee..

Pingback: Southridge Tagaytay House And Lot for Sale

sir may binili akung house and lot,,tax dec ng land is about 250,000 at ang building naman ay 600,000 then ang nakita ko sa website ng bir zonal value per square meter sa lugar namin ang 1,830 magkanu ba babayaran ko sa bir for transfer sa pangalan ko? pati ba ang building babayaran pa ba ang tax na 600k? kasi kung base aku sa zonal value kasi wichever is high ika nga ang deed of sale is 300,000 so ang babayaran ko lang ba sa bir 300k x 0.8 percent is equals 24,000 or pati ang building na 600k?thank u

Am I able to transfer my condo in the Philippines to my brother? How do I go about it?

hi Mr.Jay!.. i just want to ask kc po nkbli ako agricultural property,nagkaroon km deed of sale 2010 pa,but till now di ko pa napatransfer skin at nbgyan copy yung RD,my problma po ba dun?at nagissue uli new deed of sale skin yung seller but same date 2010 kaso diko pa napanotaryo,ano po ba mging basis pagnagpacompute ako ng capital gain,yung date of execution or date of notary?thanks po..hope you can help me po..thanks..worried lady

Hello po.meron npo ako ecar sa nabili naming lupa sa batangas. Pero wala pa po ako pambayad sa transfer tax at isa pa ay dp naman dn aprobado ang plano. Mag pe penalty po ba kung d ako makabayad agad at magkano po ang charge ng penalty

Hello Ms. Merlita, eto po yung nakalagay sa section 168 ng RA 7160:

Pingback: How to Compute Registration Fees - ForeclosurePhilippines.com

Hi Jay,

My father died on October 27, 1992. Estate tax was paid to BIR within 3 months. Sad to say my brother was not able to transfer the Property to our names ( sons and daugter). But from that time, Real property tax was diligently paid annually to the Quezon City Hall.

Recently, I was instructed by my brothers and sister to start the process of transferring the property to our name. I was able to secure C.A.R.(Certificate authorizing registration) from the BIR. I was able to secure tax clearance of the property. Then I had the property assessed for payment of Transfer Tax at the city treasurer’s office.

It was assessed for 0.75% of the zonal value of the property.

Then it an addtional amount for surcharge for late payment at 115% of the Transfer Tax based on current zonal value. The assessor said that 115% is the maximum penalty they can impose.

The computation was

transfer tax P11,000

+ Surcharge P13,000 (115% of transfer tax at current assessed value of

______ property)

P24,000

Is this reasonable? I believe the surcharge is not reasonable, The surcharge should be based on the property’s assessed value during the time of death of my father. (1992). 115% is also too high. It should only be 72%

Hope you can help us.

Hi, just wanna ask. What are the penalties? Or how much will be the penalties for not paying on the said date on the Deed of Sale? Like its almost 10 years ago? Does the computation still 60% of 1%? Thanks.

Hi April, the surcharge is 25% of the amount of taxes, fees or charges not paid on time and the penalties are 2% per month of the unpaid taxes, fees or charges including surcharges, until such amount is fully paid, but in not to exceed thirty-six (36) months or seventy-two percent (72%).

For example, if the transfer tax is Php15,000 (using the example above), the late payment surcharge would be 25% of Php15,000 or Php3,750. The interest penalty for 10 years late payment would be the maximum 72% of (Php15,000 + Php3,750) or Php13,500. The total tax due would then be equal to Php15,000 + Php3,750 + Php13,500 or Php32,250.00.

Hi Jay,

We are selling our condo in Taft, Manila, but our buyer wants us to facilitate the transfer of title. Can you help us or recommend somebody?

Thanks and God bless,

Edna

Hi Edna, you can try OMI Land Title Services, I outsource my title transfer needs to them. You can checkout their contact details through this page on their website: http://omilandtitle.smilds.com/content.php?id=17. They give free quotations anyway, just let me know if you need further assistance! I just remembered I need to follow-up with them on one property they are transferring for me right now, Thanks for reminding me!

hi sir jay, thank you 4 this explanation. it really help me to understand may report on tax. 🙂 but a little more explanation on 60% of 1%. what does this mean?

i hope you could fine time to answer my question. thank you very much. more power to you and ma’am cherry.

Hi Cath, you’re welcome and thank you also. 60% of 1% simply means 0.6%. 🙂

a single proprietor will join a corporation as a stockholder, he contributed his assets (vehicles and office equipment) in exchange for shares. is there any tax to be paid?

do we have to pay transfer tax with the treasurer’s office for the annotation of title?

Hi Jay,

Scenario:

Time of assignment of CTS by Old buyer to new buyer is during amortization of downpayment meaning there is still no deed of absolute sale or CCT from the developer so is transfer tax applicable in assigning the Contract to sell to the new buyer?

No, there’s no transfer tax in that case. Transfer tax only applies to title transfers not contract assignments.

hi good afternoon po.nais ko lang magkaroon ng sapat na impormasyon. may gusto ako bilhin na lupa. the seller aquire this lot thu bidding. because this is a tax delinquent property.pwede ba ito bilhin? pano procedure ng transfer nung title nito in my name? (yun title nasa pangalan pa ng previous owner) gaano po katagal proces. ty

Sir Jay,

is real property owned by semi gov’t controlled corp exempted from paying real property tax?

tnanks..

Speaking of tax, which do you think has more advantage? To declare the ownership of the property as corporation or as individual? We’re planning kasi to buy a 6 door apartment with my brother-in-law and his wife, can you tackle the advantage if the title was named after a corporation. Thanks Jay.

Hi jay,

Curious to know if you’ve ever contested a computation for taxes before? I can’t find anything on this, especially on contesting the zonal value plied to a property. Do you happen to know if there is any procedure for contesting a computation after. Doas has been signed? In other words, is there a venue for arguing your case, and if so, should the taxes be paid first to avoid penalties and then a refund sought?

Thanks!

Looove your blog by the way. Learned lots a things about real-estate purchases.

Just wanna ask po paano ang pwedeng gawin if ever na hindi pa naipa-transfer yung title ng nakabili after niyang mabili ang property. Let’s say 1 year na po ang lumipas pero di pa naipapa-transfer yung title sa name ng nakabili simply because ala pang enough money to pay the capital gain tax. Dahil base po sa kasunduan eh seller yung magbabayad ng capital gain tax. Thank you po.

Hi Herman!

We are required to pay the capital gains tax. Needed kasi ang original CAR(Certificate authorizing registration) sa pagtransfer ng title. Hihingin talaga yan ng RD. so walang kawala na di mabayaran yung CGT.

Kaya lang may ruling ang BIR na “CAR, upon issuance, shall have to be presented to the Register of Deeds within a max of not more than 2yrs, otherwise, the CAR shall be deemed permanently expired and therefore no effect”

meron namang option for replacement…medyo mahaba lang.

Hi jay, We got certificate Authorizing registration for the estate of our mother which says here valid until June 2011. Are we subject to transfer tax in the register of deeds when we want the properties in the name of the heirs?

Thanks

Sleepless in Manila

Hello Mr. Jay,i wrote to ask when did the tax on the transfer of real property began,i mean when did it start,is it July 1971 or July 1974?

Hi Jay,

We acquired a foreclosed property thru public bidding. We are now on the process of having the ownership transfered to us. Aside from the tranfer tax, do we still have to pay the delinquent yearly tax (about 16 years)including penalty, which the previous owner didn’t pay? Thanks.

Ralph E.

Hi Jay,

I am still a little bit confuse but here you go… Where do I pay the TT? At the provincial treasury or municipal treasury? I already paid the CGT and DST at BIR office (provincial) and just waiting for the CAR. Also where do I pay the registration fee? Thank you so much. ;-))

municipal treasury

DEAR JAY,

MY FAMILY HAS TASKED ME TO BE THE AUTHORIZED SELLER OF A COMMERCIAL LOT IN DAVAO.HOW WILL I COMPUTE THE CGT, DST,AND OTHER TAXES IF IM SELLING IT BY 20M NET.IM PLANNING OF OVERPRICING IT SO THAT I WILL SHOULDER THE TAX AND TRANSFERS ETC…( ZONAL VALUE OF 6500/SQM. THE HOUSE AND LOT HAS A COMBINED LOT AREA OF 830SQM.)BECAUSE MY BUYER DONT LIKE TO DO PAPERWORKS AND IM THINKING OF HIRING A BROKER BUT BEFORE DOING THAT CAN YOU GIVE ME AN OVERVIEW OR A SAMPLE COMPUTATION SO THAT I HAVE AN IDEA,, SOME BROKER TEND TO GIVE ME A DIFFERENT PRICE.. THANK YOU

sleepless in dc,

you did not mention about the market value of the improvements (house). that value (improvement ) is necessary because you have to add the said value from the zonal value of the land in order to get the taxable base. the combined value (zonal value -land plus market value of improvement ) will be compared among the selling price of the property and the fair market value for the land and building as determined by the assessor. the highest value among the three values shall be the taxable base upon which the capital gains and dst shall be based.

the same value of the improvement shall also be necessary in the computation of the transfer taxes.

as for the registration with the ROD, only the selling price is necessary.

Dear Jay,

I would be grateful if you can help me out with some information of taxes imposed by Philippine Government for my income outside Philippines.

The income I refer to is the income of Professional Fees that I had done as in part time basis. What will be the percentage?

Thank you

Hi, Mr. Jay C.

I just want to ask a question about a transfer of real property in consideration of shares of stocks of a new corporation.

the properties are located in different parts of the metro and some outside of manila. but company is located in Paranaque city. where do we base the fair market value and the computation of the tax. I know this kind of transaction is exempt from capital gains tax, what else? is it subject to Documentary stamp tax? transfer tax? or any other taxes im not aware of? like City tax, BIR or SEC.

from, Jay B.

Hi Jay B.

Honestly, I can only be sure that this transaction is exempt from CGT. DST and TT should be applicable but I need to get back to you on this and other applicable taxes and the tax base to be used.

Hi, Jay C.

Thanks for the reply and i hope to see a another reply from you soon. this site has been very helpful to me.

Thank you,

Jay B.

Hi I’m a first time buyer and I’ve already paid the purchase price for a foreclosed property listing sa Metrobank para magamit for personal use and not for investment.

Actually mali na ngayun lang ako nagreresearch but this site has become very useful for me.

I just have a question before I sign the deed of absolute sale.

Sabi kasi dun na “the VENDEE shall be solely responsible for transferring title/s to the property to her name”

hindi ba resposibility ng vendor/seller yung pag transfer ng title?

should I agree to this?

Your help will be greatly appreciated.

Hello First time buyer, this has become the trend for some banks where the transferring of the title is passed on to the buyer. This responsibility can either be with the seller or the buyer but in this case the bank has made it a prerequisite for the sale, which is okay as long as the buyer agrees. I can see that if you ask them why they are passing this on to the seller, they say that it is one reason why the property is low priced, etc. This is not written in stone so I believe you can negotiate this with them, unless they have made this into their policy.

Pingback: Buena Mano Yellow Tag catalogue of bank foreclosed homes in Metro Manila for Q3-2009

Hi Jay!

That was one of the very technical lessons you’ve posted so far and surely a very important one. Thanks a lot.

See you around..

Bryan

Investing Opportunities for Pinoys

http://www.investingpinoy.blogspot.com

Hi Jay,

Oh yeah, it looks like you did your homework. Congratulations for your efforts to increase your knowledge in tax laws and regulations! (and thank you for sharing this with your readers!)

If you will transfer your property to your newly formed corporation what are the costs that I expect to pay in relation to the transfer?

Thanks!

Reggie

Hi Reggie, thanks! Actually my wife is the one who made most of this post as she is the one good with taxes, I’m just the one who pays. 🙂

As for transfer taxes for properties transferred to a corporation, as far as I know the taxes are deferred but let me check and verify first.

It’s really magic when husband and wife work together! You get to work at half the time, energy and thinking required!:)

Bryan Uy

Investment Opportunities for Pinoys

http://www.investingpinoy.blogspot.com

Hi Cherry! It was nice finally meeting you (the woman behind the man) and your son.

Thanks for the legal stuff!

Investment Opportunities for Pinoys

http://www.investingpinoy.blogspot.com

Hi Mr. Jay!

I just want to ask if there are website showing the zonal value of a certain location.

I was just accidentally bump in to your site when I am searching for a property to buy (maybe a month ago), since then I am an avide surfer of your site.

Thank you so much for sharing your ideas and knowledge. I learned a lot.

More Power ! ! !

Aileen

Hi Aileen,

The zonal value is usually published in the BIR website: http://www.bir.gov.ph

Hi Jay,

Your discussion today is very interesting. It so happened that I am working as consultant of local government on local taxation. Maybe I can provide more information later when I am not too busy.

But a quick explanation regarding Caloocan’s 82.5% of 1% tax rate. Transfer is a provincial or city imposition (with the exception of a municipality in Metro Manila). They are allowed to increase by not more than 10% once in every 5 years. So, 10% of 75% is 7.5% which if you add the 75% will become 82.5%. Incidentally, I was consultant of the City of Caloocan when the city revised its city revenue code but it still the city officials that decided on the increase.

Thanks and I really hope to be able to contribute to the discussion later.

Tony

Hi Tony, thank you very much for the valuable information. Now I get it, thanks for taking time to explain why Caloocan had those figures and if I have more questions, now I know who to contact. You are actually making a big contribution right now and I really appreciate it and I’m sure the same goes for a lot of readers as well. Thanks!

Hi Aileen, first of all, thank you for being a frequent visitor, and you are most welcome, glad to be of service! As for Zonal values, just like what Tony said, you may find them at BIR’s website. Here is a shortcut to the exact page containing zonal values: http://www.bir.gov.ph/zonalvalues/zonalvalues.htm