After inspecting a bunch of foreclosed properties recently, I was to drop-off my real estate broker at her house. Her grandson who was around 7 years old, approached us after I parked, while we were still inside my car.

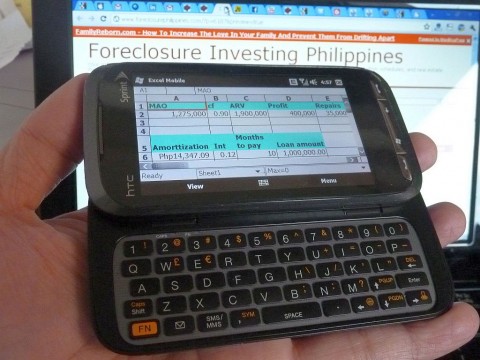

He signaled me to open the window, which I did, and he noticed I was using my HTC Touch Pro 2 while I was texting someone and he said “Wow, you have a nice phone! Are you rich?”.

Both my broker and I answered without hesitation “Yes of course, we are rich!”. (If someone asks you the same question, you should always say yes, and let the Law of Attraction do its magic!)

He then sarcastically said “Yeah, you must be rich, it’s probably the reason why you have such an expensive car”. Take note that my car is an SUB… a subcompact! It’s a turbo-diesel Hyundai Getz.

I said “Well, because this was the car I bought, I was able to buy three houses the following year…”.

He then said to his grandma “Lola, let’s buy Jollibee…”. 🙂

I guess my answer did not sink in and he was more interested with satisfying his craving for burgers and fries, which is totally understandable for a kid his age.

In retrospect, I believe that my broker’s grandson was just frank enough to ask me the very same question which I believe some people who see my car dare not ask me, why did I buy my car, when I could have bought a more expensive or bigger one?

When I availed of the car plan offered at the company I used to work for way back in 2008, I could have bought the newly released 8th generation of the Honda Civic or a Ford Focus. I knew some people at the office back then had this question in mind, according to some of my close friends.

Why did I buy my car?

One of the reasons why I bought a diesel powered subcompact was to manage my cashflow, which in turn helped me buy three foreclosed properties the following year. Hard to believe right?

Aside from the lower monthly amortizations, which was less than two-thirds of what I would have paid for on a monthly basis if I had bought a Civic, my monthly expenses for diesel fuel was just less than Php2,000 per month. Compare that to my wife’s 1998 Honda Civic for which I had to spend more than Php4,000 for unleaded fuel per month.

Maintenance for my new car was also easy on the pocket, at about Php6,000 per quarter. Our old car needed about Php25,000 per quarter on the average for maintenance and repairs (new problems were always being found that needed to be repaired… that sucked big time!). By the way, I forgot to mention that my car is covered by a 5 year warranty… nice!

It’s hard to believe but the net effect of my choice of buying my car was it lowered my monthly expenses by about Php5,000 per month, as compared to buying a more expensive car, or maintaining the old car we had.

Php5,000 per month may not sound much but that is already comparable to the positive cashflow of one rental property. It is also just about equal to 10% of my take home pay back then, which meant I already had enough to fulfill my target of setting aside at least 10% of my total monthly income for my Financial Freedom Account or FFA.

Instead of draining my savings, buying a car actually helped me increase my savings by lowering my expenses. Who wouldn’t want to have that?!

Delayed gratification

Even if I could have bought a more expensive car back then, I chose not to do so, and bought a small car instead. I simply needed a car that can take me and my family safely and comfortably from point A to point B (It did just that when we drove from Antipolo to Baguio and back to Mandaluyong with just 1 full tank of diesel back in 2008).

I believe what I did was an example of delayed gratification. My logic here was I can buy a small car for now, and it would not hinder my goal to build my Financial Freedom Account, which I will use to buy real assets that put cash in my pocket.

After I buy real assets first, I can then use any excess cashflow or money from capital gains to buy a bigger or more expensive car, if I wanted to. So far I am very happy with my Getz.

But wait, you might be thinking I did not practice delayed gratification when I bought my mobile phone. Not really, the HTC Touch Pro 2 was released more than a year ago and the one I bought last October was a second hand unit, although it was good as new. A brand new unit at malls would retail for around Php35,000 but I bought mine for less than a third of the retail price, from a reputable seller at tipidcp.com.

Instant gratification

Imagine if I had bought a more expensive car first. That would have resulted in little or no money left for me to invest in real estate. I probably would not have been able to buy the three foreclosed properties I acquired last 2009.

Who knows, maybe I would not have been able to save enough money for my emergency fund, and I would not have had the courage to resign and get out of the rat race.

Buy assets first, liabilities second

Another great example of delayed gratification would be to buy assets first, liabilities second, just like what Robert Kiyosaki mentioned in the video below.

He bought a Porsche by first investing in a storage facility, and then he used the cashflow it generated to pay for the Porsche. The cashflow remained even after the Porsche was already fully paid. Now that’s a smart way to buy a liability!

Let me see… a Hyundai Tucson, a Ford Fiesta, or even a Toyota Prius would be nice. I guess I should be asking myself “How many good real estate deals do I need to buy first?”. What do you think?

Happy investing!

To our success and financial freedom!

Jay Castillo

Real Estate Investor

Real Estate Broker License #: 20056

Blog: https://www.foreclosurephilippines.com

Follow me in Twitter:http://twitter.com/jay_castillo

Find us in Facebook:Foreclosure Philippines facebook page

Text by Jay Castillo and Cherry Castillo. Copyright © 2010 All rights reserved.

PS. Don’t be the last to know, subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips. Mailbox getting full? Subscribe through my RSS Feed instead!

![Why invest in foreclosed properties in the Philippines? + Top things to consider [Video] 5 Why invest in foreclosed properties in the Philippines? + Top things to consider [Video]](https://www.foreclosurephilippines.com/wp-content/uploads/2023/03/video-how-to-invest-in-foreclosed-properties-in-the-philippines-v3-728x410.jpg)

If only I discovered your website much earlier I wouldnt be tied up paying 3 cars but now I can start all over again and be more focus. Thanks I am one of your many followers.

Thanks a lot Che! Yes, go for it! We can always start over, it’s really just a matter of choice. Good luck!

wow! thanks for this wonderful post sir!

this would help me in choosing the right kind of car to buy..

thank you.

You’re welcome mark, and thank you also! Good luck with your new car!

Hi Jay, there was this argument between instant and delayed gratification. One of my friends who favors instant gratification said: “Live life to the fullest because you won’t know when will you die.” On the other hand, delayed gratification dictates one of my favorite mottos in life: “I will do today what other people won’t so that I can have tomorrow what other people can’t.”

There is a battle between the present and the future, between the known and the unknown.

Personally, I loosen up a bit in terms of frugality but having been known as the blogger behind the personal finance and investments blog “Millionaire Acts”, I still know how to determine between “enough” and “too much”, between “neccesity” and “luxury”. 🙂

Hi Tyrone, thanks for the insights! Yes, it’s a balancing act.

It’s perfectly okay to live life to the fullest, but I believe recklessly spending most of one’s money in the guise of “living life to the fullest” is foolish. It’s common to hear those that are for instant gratification say that we never know when we will die.

On the other hand, what if we end up living to be a hundred years old and yet lived most of it in dire need of money? I suppose it really is a balancing act where we still need to reward ourselves without spending all our money and sabotaging ourselves.

Anyway, we can still live life to the fullest, even if we hold back a bit and buy assets first and strive to win the money game.

I like your motto, it’s very similar to what Wade Cook said: “If you will do what people won’t do for the next few years, then you can do what most people can’t do for the rest of your life.”

Thanks again and cheers!

Hi Jay,

I sure haven’t taken life from this perspective and it feels good to have come from someone like you. So before, I thought that delayed gratification only meant stopping yourself from buying things but instead I felt like I was being cheap. So I really agree with you that we can buy and reward ourselves small first and go for the bigger rewards once we truly can. Thanks!

Hi Tim, thanks for the comment! Yes, I guess that sums it all up. It’s just a matter of timing. 🙂

You are most welcome Master! And thank you as well for the auction schedules and advices.

I thought time has really come to have one.

Magiging “anim” na kami e. 🙂

A decent cashflow from at least 2 assets should be enough for a top of the line Ford Fiesta 😉

Thanks for dropping by bro! You’re a perfect example for delayed gratification. Bought a lot of assets and a business before getting your car, idol! I saw a white Ford Fiesta the other day, was that you… hehe! Cheers bro!

great write up

Thanks Tina!

It was 2008 when I first know Jay.

He even offered me a ride from that auction in Manila to Kamias Q.C

If you’re inside the car, you won’t even know its a Hyundai Getz… felt it was a Honda Jazz 🙂

More Power Jay!

Hi Ferdie, thanks for dropping by! That was the Unionbank auction right? Hehe, thanks for reminding me! Kamusta na?!

Hi Jay, this article is informative and inspiring. I have always believed in delay gratification rather than instant gratification because as i have observed here in my work place most of the guys here were buying everything that comes in mind hahaha. I’m proud to say that I have not the slightest desire to obtain for the moment things to take away cash from my pocket. I have already acquired still one asset here in novaliches but i’m planning to mortgage this to use in acquiring more. It’s a one door apartment which i bought for 500 k from my mom’s friend, i dont actually know if I bought it high. I’m very new with this kind of investment. i want to know the market value for this so incase i decided to mortgage this and use the lump sum to take new opportunities. how can i know this? Thanks!

Thanks Noel! Please checkout the following articles which should help determine the market value of your properrty:

https://www.foreclosurephilippines.com/2010/09/how-to-compute-for-the-arv-of-foreclosed-properties.html

https://www.foreclosurephilippines.com/2009/07/how-i-estimate-market-values-of-foreclosed-properties.html

It’s always refreshing to read your blogs Jay.

There are countless others blinded by instant gratification and blaming it on ‘low salary’. I guess most people don’t consider investing in debt assets and work on liability debts first. I hope this inspires others to save and INVEST in the right money vehicles.

Thanks for sharing your insights on why you’re where you are — and the others just want Jollibee. 🙂

Keep it up Jay and God bless.

We have properties below market value with 10-15% ROI

Visit: http://www.dynamicrealtyphilippines.blogspot.com

We’ll help you find solutions to your property needs!

Thanks a lot Kristine for sharing your thoughts! really appreciate it!

Good one. A few months ago, I was thinking about getting a big house from my mom as a dowry for settlement next year. But after searching for a property for a few months, I started thinking about the idea again. Should I get a liability first and live in a bigger house after newly married or should I take the capital for business and investment instead? That seems like a simple decision after I think about the Rich dad books I have read. I should not be confused by the traditional idea that settle down with a big house and stable career. Business and investments which will help me to get out of rat race should have the priority above all.. Looking forward to learn more stuffs from you. Thanks. 🙂

I agree, prioritize business and investments, the bigger house can come after. It will be a lot harder the other way around. Thanks for the comment!

Another great article Jay, with so many lessons to learn. Keep it up. God Bless you and your family

Thanks a lot Mike, cheers!

Hi Jay,

I prefer delayed gratification over instant gratification like you bro!

The temptation of people like us who want delayed gratification is when we look at the ‘things’ that our relatives, friends or officemates have and how we wish we could buy it right now, too since we have the funds. It would help if we use God’s Word to protect ourselves from buying liabilities just because we want what others have… God says “Thou shall not covet thy neighbors’ good.”

I see a lot of people also who have better cars and bigger houses than I but I also wonder how much harder they need to work for these, taking a lot of time from the wife or husband and their children. It’s really sad when I see people who spend only the last one to two hours of every week day with the spouse and kids because they have to go to work early. They can’t even spend an hour in the morning with their spouse and kids because all of them have to rush to work (I’m happy for those parents who serve as their children’s driver to school).”)

Bro, I commend you for being a very good cash flow manager.:)

God bless!

Bryan Uy

Thanks a lot Bryan. It’s like you described the practice of “Keeping up with the Jones’s” which really traps people in the rat race. Thanks for dropping by!

Thank you for this post Sir Jay. I’m at a crossroad today, should I buy a car already or save it to buy an asset (real estate, start up business). But I’m weighing the benefits of having a means of transportation at my whim to look and find good deals immediately (in your case, it already happened).

Thank you for this article and I’ll continue to weigh my options. More power Sir Jay!

In all things, persevere,

Anthony Verrick Dones

Hi Anthony, my advice is if the benefit of having a car far outweighs the cost, then go for it. Although a car is a liability, there is nothing wrong with buying it if you really need it, and it becomes a necessity.

By the way, when I bought my car, the actual cost I had to pay on a monthly basis was the monthly amortization of Php5500(half was subsidized by the company as part of the car plan) plus the average monthly cost for diesel at Php2000 plus the average monthly cost for maintenance at Php2000 for a total of Php9,500, which I was able to recoup with my real estate investing activities which is definitely easier to do with a car. Having a car also helped me save time, and also provided safe and reliable transportation for me and my family(take note that my son was only 3 years old back then) and that for me made it worth it! 🙂

If I didn’t buy a new car or bought a more expensive car, my average monthly car related expenses would have been around Php15K/month.

Just like real estate investing, decide using the numbers. Good luck!

Pingback: Tweets that mention Instant gratification versus delayed gratification