According to the public notice, at any time before distraint of real property, payment of the Real Property Tax, inclusive of surcharges, interests, and penalties may be made. This means that delinquent real property owners can make payments up to the time just before the public auction sale. Expect changes on the actual list of properties at the time of public auction as property owners make last minute payments.

As I have experienced during a similar tax foreclosure auction in Marikina, a significant number of properties were removed from the final list of properties for public auction, including properties I intended to bid on. I had to choose among the remaining properties at the last minute for other properties to bid on.

I therefore advice bidders to come early to have ample time to make choices among remaining properties in case your original target property is no longer for public auction.

Pre-registration of interested bidders

There will be a pre-registration of interested bidders one (1) week before the date of auction sale where they will be assigned their permanent individual bidder’s number. Duly registered bidders will be given their copies of lists of properties for auction, rules and regulations and bidding form upon payment of non-refundable amount of One Thousand Pesos (Php1,000.00) only, to cover the costs of printing, miscellaneous and other incidental expenses during the auction sale.

For example, let’s say you won on your bid for a property for Php100,000, you will earn a monthly interest of 2% which means you earn Php2,000 per month. You are paid this interest along with the winning bid amount when the property is redeemed by the owner of the property. Since the owner is given 1 year to redeem the property, you can receive a maximum return of 24% or Php24,000. If in case the owner does not redeem the property by failing to pay the Real Property Tax, inclusive of surcharges, interests, and penalties, then the property is yours for a mere Php100,000, which in most cases is just a fraction of the market value of the property!

Do take note that tax foreclosure auctions often require the winning bidder to pay the entire bid amount on the day of the auction. This is one major difference with public auctions of bank foreclosed properties where only 10% to 20% of the winning bid are required as downpayment.

If you would like to learn more about tax foreclosures, do read my post about the Marikina Public Auction of Real Properties with Tax Delinquencies last November 13, 2008.

To our financial freedom!

Jay Castillo

Real Estate Investor

REBL#: 20056

Blog: www.foreclosurephilippines.com

Social Network: foreclosurephilippines.ning.com

Mobile: +639178843882

E-mail: [email protected]

Is there a way to pay the Tagaytay real property tax online or thru a bank/agency here in the US?

Thanks very much

Hi Vfermn, unfortunately they have no online payment facility as of now. The only local government I know with such facility is Paranaque(although it was offline last time I checked late last year).

Hi Jay,

This is a bit off-topic but still about properties in Tagaytay.

Im considering a land in Tagaytay but it has no land title only tax declaration; and the owner has died years ago, and one of the grandchildren is paying for the property tax.

How can I verify that they are the true owners of the land and that I would not have problems taking ownership of the land?

We tried checking with the city hall and we’ve been told that most lands in that area only have tax declaration, and transactions (selling and buying land) can be made using that document. Is this true?

Do you think it is safer to bid on foreclosed land than this kind of property in terms of validity of land title?

Thanks!

Hi Theresa, here’s one thing that came to mind: since the owner has already died, you first need to know if they have settled the estate taxes. This is the first thing that would really hinder you from taking ownership of the land just in case the taxes have not been settled. Were the estate taxes already settled?

Hi Jay,

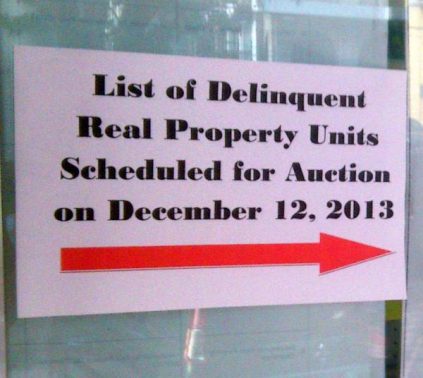

Its going to be almost 1 year for Tagyatay Delinquent Real Property was released last year.

Will there be any new listing or new declaration on this?

Please do update us, as we missed this last year.

Thank you so much.

i am interested in tagaytay properties for the next bidding.please keep me update.thanks.

Hi Jay ( I say property Guru),

Very glad to find this. I learned a lot. Actually I was finidng auctioned properties in google anf found your site and very much happy the way you are sharing your knowledge! Your answer is even very clear and address every issue that others asking!

I’m interested for tagaytay properties but so sad that its already passed. Do you know or any idea when the nest aution will be? Or where can I get this information?

Also do you know any auction news in boracay? Also interested in that area.

All the best and more power, God bless you!

Mr. Jay, I still haven’t had the COS annotated on the titles, don’t want to pay the CGT yet… but i will try to work it out, I am also waiting for some news from other auctioners who won and already made their petition with LRA regarding this matter…

Dear Jay,

I know I’m a little to late!

But I’m still interested in Tagaytay properties, I sent you an e-mail for queries kindly please reply back.

Thank you so much.

Hi Laine, okay, will reply to your e-mail as soon as possible. You’re welcome and thank you also for visiting!

Hi Grace, you’re welcome and thank you also for dropping by. Congratulations on your 2 properties! Did you already have the certificate of sale annotated at the Tagaytay RD?

Mr. Jay,

good day. came across ur site by accident and i am very much thankful i did. ur site is very informative, very helpful…

Got 2 properties from tagaytay tax delinquent properties auction. Thank you…

Hi Jun, congratulations! I’m so glad you got 3 properties and I hope and pray for all the best for you and your investments. I am also very thankful to you for sharing your insights and experiences as well, I am learning so much in the process and I’m sure other readers are also very thankful to you!

By the way, will you be paying for the CGT immediately so that the Tagaytay RD can already annotate the COS and the 1 year redemption period can start? If you do pay the CGT, what if the delinquent property owner redeems the property? What happens to the CGT that was already paid? Sorry for the many questions but another reader also has the same questions and we both have these questions in mind. Thanks Jun in advance!

Hi Jay, Id like to thank you for the info regarding the auction in Tagaytay. Just to let you know that i won 3 properties in the recently concluded auction.Again, thank you and more power to you.

Jun

Hi ems, I’m so sorry for the late reply as the auction has already started by now. Anyway, yes you can pay the fee in advance but I believe you will have to attend the bidding to choose the property you want to bid on. Sorry I have no copy of the auction rules and guidelines. I was supposed to get it at the Tagaytay City treasurer’s office but I realized that Tagaytay is really too far away to become part of my areas of focus so I did not get a copy of the auction rules and guidelines anymore.

By the way, you may be referring to the owner’s address indicated on the notice. These are not the properties up for auction. You should refer to the property number and tax declaration number listed on the notice so that you can check for further details about the said properties at the Tagaytay City Treasurer’s office.

Normally you will have to pay for the whole amount of the winning bid. Sorry I really can’t give further details as I am not participating in this particular auction in Tagaytay. I will however be participating in the property tax sale in Quezon City on July 2, 2009.

I’m gaining infor to enter in the auction for foreclosed properties just reading your articles,. Thanks so much. But of course such knowledge is not complete unless we experienced to be one of those bidders. May I ask one more thing, if we will join this June 24th bidding can we apply this Monday to pay the P1,000 and select our property to whom? I noticed that they properties located at Manila are they really part of the auction sale? Can we bid for them. How about the PAYMENT of each winning bidders, are we oblidged to pay on that day or can we pay a week after, what is the ruling here. Can you tell me more infor needed for the bidding. thanks so much

How do you find what properties the tax decs are related to. The list only includes the owners and not the properties.

Please clarify.

THanks

@aji, thanks, you’ve got a very nice blog yourself! Right now I’m hesitant in going into joint ventures due to not so good experiences of some of my friends who fell victim to one sided JV’s and lost money. We will probably consider this when my wife an I are able to formulate a very good JV contract and/or investing mechanism that protects interests of all parties. We also plan to setup our own corporation first.

@Jun, thank you so much for the very valuable pointers. I’m just wondering, if the Tagaytay RD will only annotate the COS after paying the CGT, then does it mean one has to pay the CGT in advance? What if the delinquent property owner redeems the property? What happens to the CGT that was already paid?

It’s unfortunate that more than 4 years has passed and you still have no hold on your 3 properties. This is probably the reason why I was adviced by other investors not to buy properties with the intent of owning them and I should look instead for properties that appear to have a big chance of getting redeemed.

@Anonymous, the property details can be found at the city treasures office. you may also call them up first using the contact details on their website: http://www.tagaytay.gov.ph/Directory.html

Hi Jay. Just to advise everyone who wants to join the auction for delinquent real property in Tagaytay. Please do take note that after you have won you need to go to the Register of Deeds for the annotation of your Certificate of Sale. Failure to do so, you might get frustrated that after one year of waiting the Treasurer's office will not issue the Final Deed of Conveyance. They will ask a copy of the annotation at the back of the TCT to verify if the one year redemption period had lapsed based on the inscription date (Not the date of the Certificate Of Sale).Fyi

Hi Hay, Jun here again. I forgot to mention that after the one year redemption period had lapsed this is the time that you have to pay all the necessary clearance taxes plus Doc Stamps (DS) and Capital Gain Tax(CGT). Then after paying the taxes required you have to file a petition to the court for the cancellation of the old TCT and for the issuance of the new TCT in favor of your name. This is necessary just in case the original TCT is not in your possesion. This is usually the case whereby the original owner failed to surrender the TCT upon issuance of demand letter. You see, it may take 2 to 3 years or more before you get hold of the property transferred under your name. In my case i still have 3 properties which i won on public bidding since Dec 2004 still pending from the RTC-Tagaytay. FYI

Good day Jay. Just to add some pointers when joining an auction for delinquent relaty prperty tax. Please do take note that the one year redemption period starts not on the date of the certificate of sale issued by the LGU, but on the date of the inscription on the TCT. This means that you have to go to the Register of Deeds for the annotation of your Certificate of Sale (COS). Take note also that some RD's accept the COS for immediate annotation on the TCT but unfortunately the RD in Tagaytay will only annotate your COS after paying the CGT. Btw, the auction in Tagaytay is always done through sealed bidding. Fyi.

hi jay! you've got a very nice blog, haha i'm interested in foreclosures as well, this will be a very great help/source of info for me. you do joint ventures for real estate properties as well? regards 🙂

aji santiago

http://pinoyinsideinvestor.blogspot.com

@Larry, yes, if the property is redeemed in 3 months, you will get your cash plus 2% per month. If not redeemed, the property is yours and the transfer can be done after 1 year from the auction date. As far as I know, all transfer fees and taxes are for the account of the buyer, better confirm when you get the rules and regulations. Yes, the city treasurer will be the one to return your winning bid plus interest when the property owner redeems his property.

"The 2% interest per month is also applicable in the Tagaytay auction as it was indicated in the notice that the delinquent real property owner shall shoulder a 2% penalty per month". Ok, so the owner will redeem the property plus 2% interest per month to the city treasurer and the city treasurer will pay the winning bidder? Did I get it right? Larry

ok, let's take the first prop for example. tax delinquency from the list is 58830.00. Should I win the bid, I will pay this in cash and if the property is redeemed let's say in 3 months, I will get my cash back + 2% interest per month? If not redeemed, the property is mine. Is the transfer of title done after a year? Dun lang din ba ko magbabayad ng doc stamps, notary, registration etc? Who shoulders CWT/CGT? I believe some auctioneers make the winning bidders pay the CWT just like unionbank if I am not mistaken. Sorry if I have a lot of questions, I am new to tax delinquent property auctions. Larry

@vanny, sorry I have no information about those corporations as of now. Thanks for dropping by!

@Larry, the indicative price is actually equal to the tax delinquency, which of course may go up during the auction. After the redemption period, you no longer need to pay for the indicative price again, you have already paid for it on the day of the auction, and the property is now yours in exchange for paying for the tax delinquency. The 2% interest per month is also applicable in the Tagaytay auction as it was indicated in the notice that the delinquent real property owner shall shoulder a 2% penalty per month. Do let me know if you need further clarifications. Thanks for visiting!

mejo naguluhan ako jay kaya pakiclarify naman :

"then the property is yours for a mere P100,000 which in most cases is just a fraction of the market value of the property"

when you say 100k in this example, 100k is the indicative price of the property? or is it the tax delinquency? I thought kasi once you paid the tax delinquency, after a year when the property is redeemed, you will still have to pay for the indicative price?

also, it seems this tagaytay auction doesn't offer the 2% per month interest that marikina auction offered. am I correct? Larry

hi jay… do you know anything about the properties listed under different corporations?thanks