I first played Rich Dad’s Cashflow 101 game way back in 2007, after I found Think Rich Pinoy Seminar attendees who organized their own cashflow 101 game sessions.

I was hooked ever since. I play cashflow 101 whenever I get a chance to do so as part of “sharpening the saw”.

I believe that the cashflow 101 game effectively simulates one’s journey out of the rat race and I would like to share here what I have learned from playing what I consider to be a “life changing game” and its practical applications in real life.

Here goes my Top 7 lessons learned from playing Rich Dad’s cashflow 101 game…

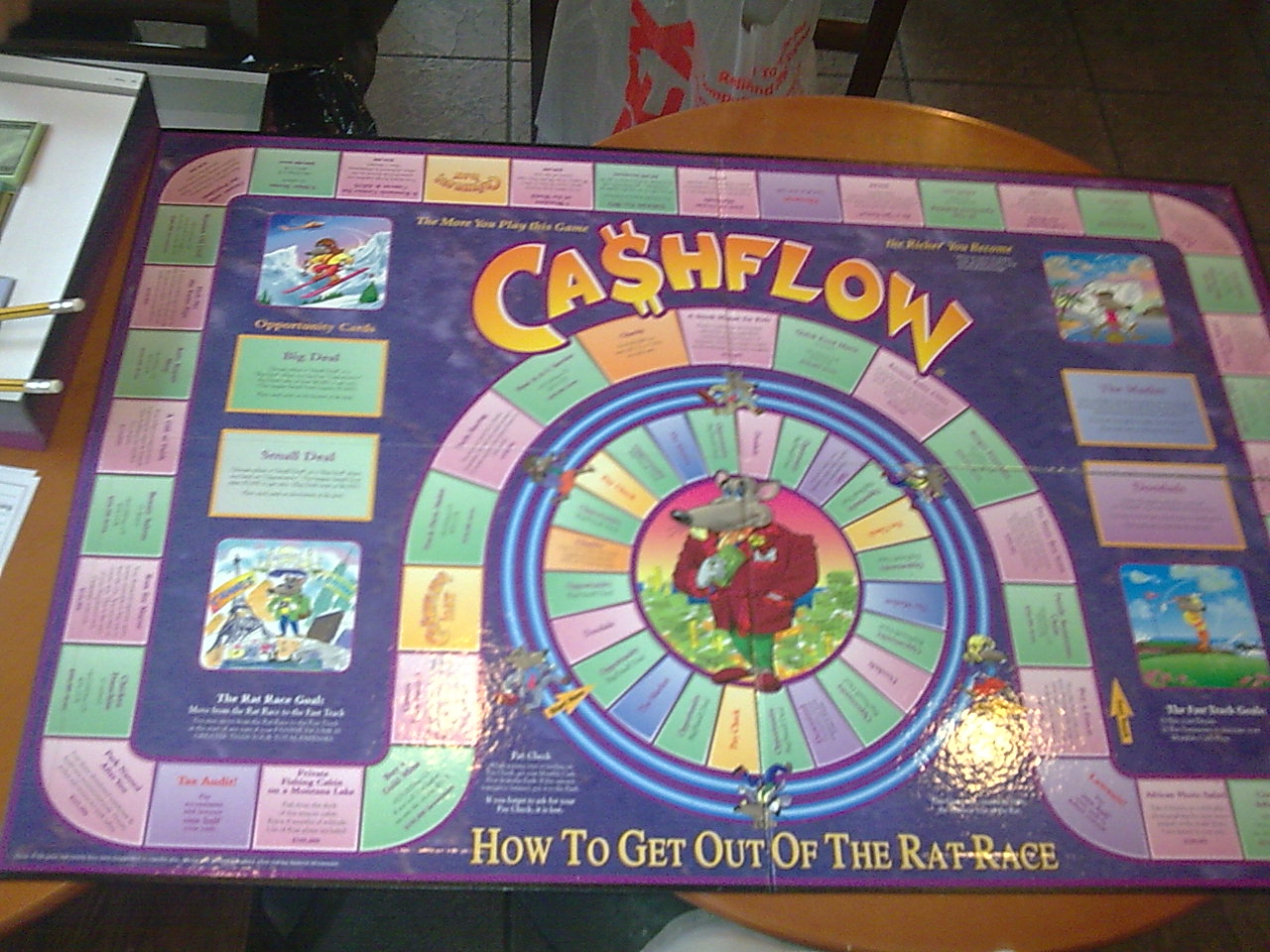

A photo of the cashflow 101 board game courtesy of Earth del Mundo

1. Simplify and get out of the rat race faster

I noticed that whenever I played the cashflow 101 game and was able to choose a “simple” profession like a truck driver for example, I was able to get out of the rat race faster. This happened during the Think Rich Pinoy Seminar I attended last August 2007. As a truck driver, although my salary was low, my monthly expenses were also very low.

Because I had low monthly expenses, I already had a positive cashflow and all I needed to do was just get those passive income generating deals. After each payday, I had more money to invest, and with just a few passive income generating deals, I had enough passive income that exceeded my monthly expenses, and I was able to get out of the rat race faster.

In real life, I am applying the same strategy by reducing my monthly expenses by leading a simple life. This was also described by Bo Sanchez in his book “Simplify and Live the Good Life” and T. Harv Eker in his book “Secrets of the Millionaire Mind”. My family and I lead simple lives, which explains my very low target monthly passive income which is why I know I am going to get out of the rat race in real life very soon!

2. Start with small deals first, and the big deals will follow

In the beginning of the game, I always chose small deals even if they produced little cashflow. Later on, when the market presents good opportunities, I was able to sell or “flip” these small deals and then I used the profit to buy the bigger deals that produced greater cashflow, allowing me to get out of the rat race.

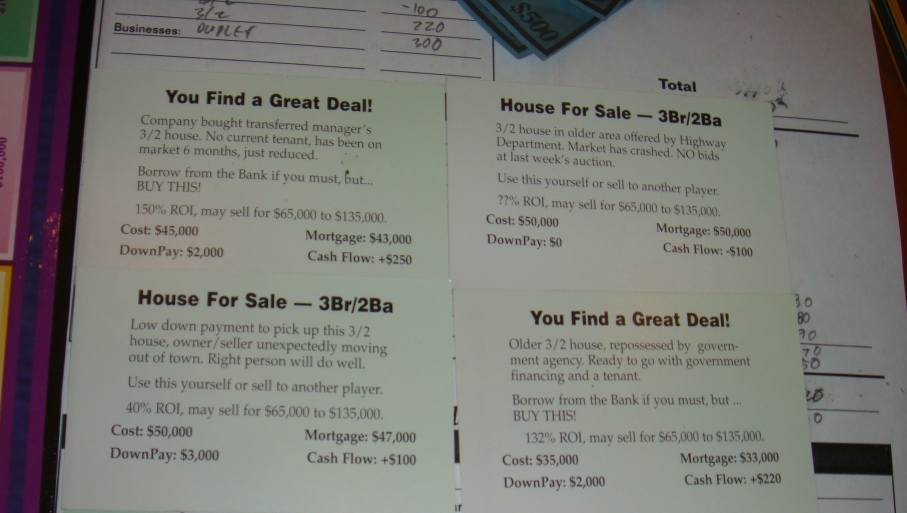

My four “green houses” which I’ll exchange for a “red hotel” during a recent game I played with Earth. I was not able to get out of the rat race during this game but we only played for an hour due to time constraints.

My four “green houses” which I’ll exchange for a “red hotel” during a recent game I played with Earth. I was not able to get out of the rat race during this game but we only played for an hour due to time constraints.

In real life, I am also following the same path. I focus on single family homes or properties which may produce little cashflow at the very least, but can actually generate significant profits if “flipped” or sold through “rent-to-own”. I can then use the profit later when they are enough to get bigger deals that can produce bigger positive cashflow.

3. Over-leverage often leads to bankruptcy

During the game, we often encounter great deals that produce a lot of positive cashflow but require a big downpayment and it is tempting to borrow money from the bank just to be able to buy those great deals. However, there is such a thing as becoming over-leveraged which can produce negative cashflow situations because of the high monthly payments for those loans.

Even if one’s passive income is enough to cover the monthly payments for those loans, imagine if something happened and the monthly income of one’s investment properties were affected, suddenly the monthly payments for the loans cause a negative cashflow and can lead to bankruptcy. The same can also happen when one is downsized. This is the reason why one should avoid deals that lead to too much exposure or over-leverage.

Applying this is real life is a no brainer. I would not dare buy those multi-unit apartments unless they were in the same price range as the single family homes I focus on. As mentioned in lesson number 2 above, I can go for those bigger deals later when profits from my small deals are enough.

4. It is better to wait for a good opportunity than settle for those not so good deals

In the game, good opportunities come in the form of deals that have big ROI potential, and can be bought with little or no downpayment, while producing positive cashflow. If any of these elements are missing, I consider a deal as “not so good” and I pass them up and just wait for the good deals.

In real life, I do the same and patiently wait for good opportunities. If a not so good deal comes my way, I can either look for ways to make it into a good deal, or I just pass it up and wait for another more worthwhile deal to pursue.

5. Learn how to spot a good deal and grab it

One of the biggest challenges one faces in the game is how to spot those good deals so that you can grab them. Sometimes a good deal is right under your nose and it slips away because you didn’t realize soon enough that it was a good deal.

I believe spotting good deals is a skill and you can only learn this skill by continuously analyzing deals. Once you get the hang of it, you will start seeing those good deals more often. Normally those deals would have slipped away without you knowing it. If you see good deals often, it’s just logical that you will eventually grab one of those deals right?!

6. Learn how to protect your investments

I distinctly remember games where apartment buildings getting toppled by mud and all the cashflow generated by these properties are gone, unless I am covered by insurance.

Does Ondoy and Pepeng ring a bell? Who would have thought that a game like cashflow 101 actually teaches us to protect our investments from such disasters and calamities. Better get your investments insured with “Acts of God nature” coverage pronto!

7. Net worth is worth less, cashflow is king

Once you play cashflow 101, you will notice its emphasis on the importance of cashflow over one’s net worth. You will see that it really is more important to have positive cashflow from passive income. What is the use of having a big net worth if you don’t have any positive cashflow?

In real life, we should apply this by focusing on building our positive cashflow with income generating assets. Even if we have to use leverage to buy these assets, it really is okay. We call this good debt. Don’t be afraid to have good debts that buy real assets that produce the cashflow we need to get out of the rat race for real!

Get out of the rat race in the game, and in real life!

So you got out of the rat race when you played cashflow 101. So what?! That’s useless if you don’t take action and apply the lessons you have learned from the game in real life. But playing a game is one thing, doing it in real life is an entirely different thing… or is it?

I can truly say that Robert Kiyosaki’s Cashflow 101 game is a “life changing” game because my life has really changed ever since I decided to apply in real life the lessons I have learned from it. Take note that I only listed the top 7 lessons I have learned and I can assure all of you that there are more lessons one can learn from this game.

People may find it hard to believe that one can learn so much from a game and can have such a huge impact in life. I guess you just have to play the game and experience it for yourselves.

How about you, have you played Rich Dad’s cashflow 101 game? What did you learn? Are you applying them in real life?

—

My vision – financial freedom for all!

Jay Castillo

Real Estate Investor

Real Estate Broker License #: 20056

Blog: https://www.foreclosurephilippines.com

Twitter:http://twitter.com/jay_castillo

Facebook:Foreclosure Philippines fan page

Text by Jay Castillo. Copyright © 2009 All rights reserved.

PS. If you are a new visitor, please start here to learn more about foreclosure investing in the Philippines.

![Why invest in foreclosed properties in the Philippines? + Top things to consider [Video] 5 Why invest in foreclosed properties in the Philippines? + Top things to consider [Video]](https://www.foreclosurephilippines.com/wp-content/uploads/2023/03/video-how-to-invest-in-foreclosed-properties-in-the-philippines-v3-728x410.jpg)

Pingback: Financial Education for Kids Part V: Getting Used To A Simple Lifestyle - ForeclosurePhilippines.com

Pingback: Financial Education for Kids – Part I

Pingback: My Think Rich Pinoy Seminar experience and how it changed my life

Pingback: Play Cashflow 101 – 23 Lessons You Can Apply In Real Life — Living Cashflow 101

Hi Sir Jay,

Where can I play cashflow here in ortigas? Any cashflow event this December?

Thanks

Hi,

I tried playing the game cashflow 101.

It’s seems so easy to buy assets everytime the oppurtunity comes along. I only have one question about it.

How is it that the rat can acquire a down payment to the deal always when he actually hasn’t have a savings yet to every oppurtunity of assests he buys that’s not shown in the game? Does it mean he has lots of saving already to aquire those down payments for all the assets? when you have no savings, how did he pay the down payment of 16000 thousand when he actually only earning has a saving each month of 1200 thousand? does it mean save first before you can acquire assets everytime? well,, if can comment just send me an email, I’m really curious about it..thanks

[email protected]

Hi Paul,

Thanks for your comments and questions! Let me try to answer them here so that everyone with the same questions can also benefit from the answers.

Players can buy an asset by paying the downpayment either with the cash he has already saved or by taking out a bank loan. i usually accumulate savings first by making sure i have a positive cashflow which comes from earned income at the start. After enough paychecks, one can get enough cash to get small deals which are worth 5K and below in the game. In real life, this is done through proper management of finances and saving enough capital to buy an investment property.

A small deal can then be sold later for a hefty profit if a player is able to land on a Market space and gets a market card where buyers are willing to buy those small deals. the propfit can then be used by the players to buy more costlier deals. in real life, this is when a property is eventually sold and the profit is used for bigger investments.

I hope I have answered your questions, just let me know if you need further clarifications. Take note that this post is in reference to the Cashflow 101 boardgame.

Pingback: How to turn listings of foreclosed properties into opportunities

Hi Jay,

I agree with all the things you wrote here.

CASH FLOW is really King.

But having cash on hand higher than your expenses is a must.

You’ll never know when you will be downsized.

The rule of having an emergency fund applies here.

More Power!

PS:

We PRAY to close our 1st deal soon w/o glitches!

Hi Ella, thanks for the comment and goodluck on your 1st deal!

Hi Jay,

After ko magplay ng Cashflow 101 naka-save ako ng 120K sa fisrt real estate deal ko. Here is the story..

http://denizwants2share.blogspot.com/2009/05/i-saved-php12000000-because-of-cashflow.html

Hi Dennis, thanks for sharing how you saved 120K, that’s a lot! As Robert Kiyosaki often mentions, it’s not how much money you make, it’s how much you keep.

Congratulations and keep it up!

.-= Jay Castillo´s last blog ..BDO acquired assets for sale updated as of November 23, 2009 =-.

HI Jay,

Im also new here. Thank you so much for creating this blog. As a newbie and aspiring Real Estate Millionare, this blog is realy a good place to start. Medyo marami na rin akong nabasa sa mga blogs mo. Gusto ko rin i-share ang experience ko sa Cashflow 101. Medyo mahaba kaya nilagay ko na lang dito ang link.

http://denizwants2share.blogspot.com/2009/05/i-saved-php12000000-because-of-cashflow.html

.-= denizvoi´s last blog ..WHY INVEST IN YOURSELF? =-.

Hi Dennis, you’re welcome and thank you also for dropping by!

.-= Jay Castillo´s last blog ..BDO acquired assets for sale updated as of November 23, 2009 =-.

Nice lessons Jay! I haven’t played the real cashflow game but I already played it’s e-game version in the computer a lot of times. I agree with the over-leverage. I also experienced being bankrupt because of buying and buying more investments to the point that I am over-leverage and my debts have ballooned enough.

.-= Millionaire Acts´s last blog ..Do’s and Don’ts When Buying Stocks =-.

Hi Tyrone, thanks! Maybe you should join us and play the boardgame! 🙂

Hi Jay,

Is the boardgame available in local stores? I would like to play the game. Thanks.

Hi Karen, yes it’s available locally but at a very steep price. Last time we checked it was at Php14K at toy kingdom. I bought mine from a friend who was leaving for Canada at only Php5K. 🙂

Hi SIr. Jay.. I notice that one of your cards have a house that has negative cashflow …. your loosing $100…

Hi Red, you’re attention to detail is excellent! Although one house has a negative cashflow of $100 per month, its okay because my intention is to “flip” the property for capital gains. The negative cashflow can be looked at as the holding cost while I wait for the market opportunity to come and find a buyer. If you will notice the house has the potential to be sold for $65K for a gross profit of $15K, which can produce a cash-on-cash return of infinity because it is a nothing down deal. 🙂

ay oo nga… I’m looking kc for the cashflow.. nakalimutan q ung capital gains…

Hi Sir Jay,

Are there any opportunities like that card here in the Philippines? (properties with no down payment)

Thanks,

Zushi

http://btjunkie.org/search?q=cashflow+101<—-link, you need to have torrent and a virtual cd program.. no to piracy ^_^..

Dragoro, i also have the e-game.. have u notice, pag mas mabagal ka makaalis sa rat race or mas madami kang loan mas maliaki ung salary mo sa fast track… ewan ko lang kung sa physical board game ganun din…

pwede bang download sa internet yung cashflow 101 e-game

Hi, Jay. Great game last Saturday. I total agree with you…

To everyone who wants to play Cashflow101 Board Game, We invite you to come and play with us.

When: Nov. 18, 2009, Wednesday, 6pm.

Where: Makati Area. I will update the final venue in Makati

with Jay. Hope to see all of you there.

Maximum of 6 players(Fee: Php150.00 pax).

1.

2.

3.

4.

5.

6.

The 1st winner of the game will have a special gift from us.

Earth Del Mundo

09218231987

[email protected]

http://sulit.com.ph/304447

Thank you Earth for the meetup and for the cashflow board game. See you tomorrow and the rest who want to play!

Hi Jay, Good to post here again. I’ve been continually monitoring your posts despite my lack of commenting but as always its a great help. I’ve got the PC version of the game and I’ve noticed the same pointers you mentioned. I lost a lot quicker when I tried grabbing more and earned much when I took my pace with the smaller deals. Great learning experience.

Regards 🙂

.-= Dragoro´s last blog ..Manny Pacquiao :: Filipino From The Lowlies =-.

pwede bang download yung cashflow 101 e-game for free sa internet? pa send naman ng site kung san ko pwede madownload

Hi Carlo, I believe Kamotechunks posted a link here: http://www.millionaireacts.com/650/cashflow-101-e-game.html#comment-5935. Please check it out. Thanks!

Hi Dragoro, nice to see you here bro! How have you been?