Here are several listings of foreclosed properties from UCPB Savings Bank available for negotiated sale as of April 15, 2024. This is courtesy of Rellina “REL” C. Bulabog of UCPB Savings Bank. More details below.

Please take note that this list comes from UCPB Savings Bank (USB), which is different from UCPB which has merged with Landbank.

Table of Contents

UCPB Savings Bank foreclosed properties listings

You may view the listings from UCPB Savings Bank in PDF format below. (There are 4 separate lists).

I will upload the listings into my foreclosed real estate database as soon as possible.

Note: You can view the PDF files online below (downloading is optional).

UCPB Savings Bank Acquired Properties Metro Manila, Luzon, VisMin

==> Download UCPB Savings Bank Acquired Properties Metro Manila, Luzon, VisMin (pdf)

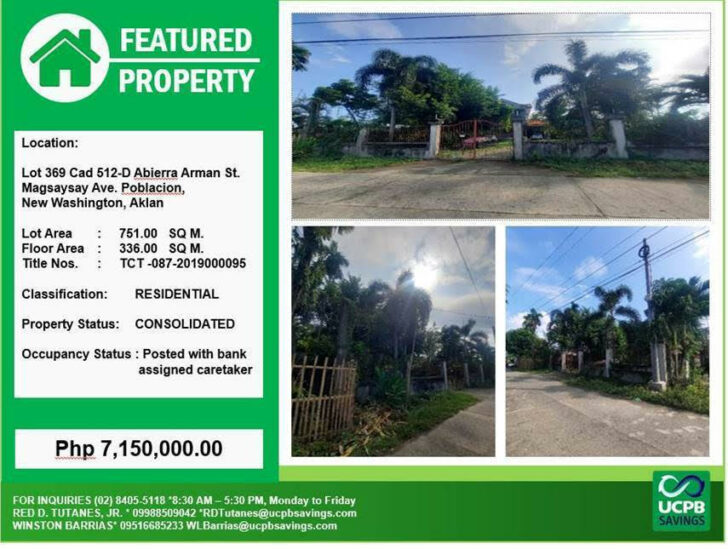

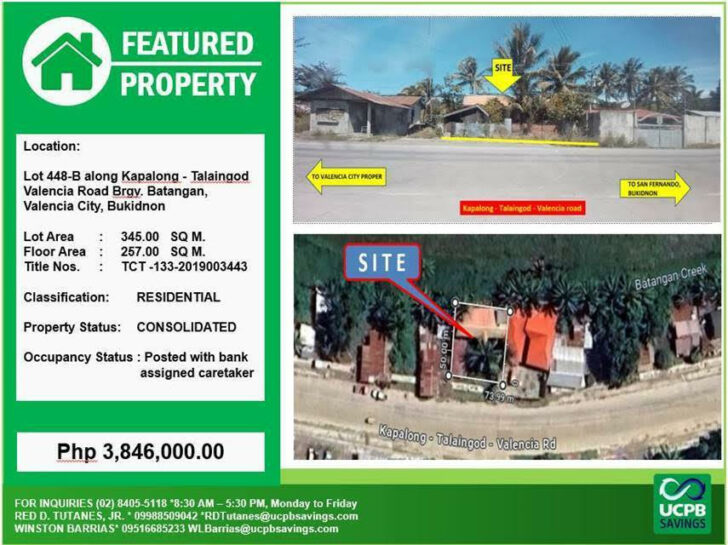

Featured Properties

UCPB Acquired Real Estate in Carmel Village Calamba, Laguna

==> Download UCPB Acquired Real Estate in Carmel Village Calamba, Laguna (pdf)

UCPB Savings Bank Acquired Assets for sale in Bukidnon from DE ORO REALTY

==> Download UCPB Savings Bank Acquired Assets for sale in Bukidnon from DE ORO REALTY (pdf)

UCPB Savings Bank Acquired Assets in Santa Elena, Camarines Norte

==> Download UCPB Savings Bank Acquired Assets in Santa Elena, Camarines Norte (pdf)

Contact Info

For inquiries, assistance and all other concerns, please contact UCPB Savings Bank DIRECTLY (8:30 AM – 5:30 PM, Monday to Friday)

Winston L. Barrias – Real Estate Sales Officer

- 0918-8119864 or email at [email protected]

Rolando D. Tutanes Jr.

- 0998-8509042 or email at [email protected]

- Special Asset Management Department

- 2nd floor, UCPB Savings Bank Extension Office

- 106 Neptune St. Kalayaan Avenue corner Makati Avenue, Makati City

Customer Assistance and Management Center (CAMU)

- 0998-5919006 or email at [email protected]

List of requirements

For Cash and Installment Buyers:

- Letter of Intent

- 10% reservation/earnest fee (may form part of the payment if sale/transaction will be approved or can be refunded without interest if sale/transaction will be disapproved)

- But will be forfeited in favor of the bank if the buyer/s back out after the approval of the sale/transaction

- Filled up Customer Information Sheet (CIS) form

- Two (2) Valid legal/government issued identification card (ID) with three (3) specimen signatures

- Certificate of Employment (COE)

- Latest ITR

- 1 month payslip (For installment buyer or in case to case basis as needed)

- Updated bank statement (latest 3 months) (For installment buyer or in case to case basis as needed)

- Proof of Billing (Meralco, water utilities, cable, credit card statement, etc.) (For installment buyer or in case to case basis as needed)

If source of income is through business:

- SEC/DTI registration

- Business permit / Barangay permit

- Audited Financial Statement

- Latest ITR

Forms:

- ucpb-savings-bank-customer-information-sheet-with-govt-and-inst.-(for-companies).pdf

- ucpb-savings-bank-customer-information-sheet-with-individual-and-sole-prop.pdf

- ucpb-savings-bank-customer-privacy-and-data-protection-notice.pdf

- ucpb-savings-bank-offer-to-buy-cash.pdf

- ucpb-savings-bank-offer-to-buy-installment.pdf

- ucpb-savings-bank-sales-contract-receivables.pdf

- ucpb-savings-bank-updated-list-of-requirements.pdf

Disclaimer

Note:

THE PROPERTIES ARE BEING SOLD ON AN “AS IS WHERE IS BASIS“. PRICES ARE SUBJECT TO CHANGE WITHOUT PRIOR NOTICE.

UCPB SAVINGS BANK MAY, AT ANY TIME, WITHDRAW ANY OF THE PROPERTIES LISTED ABOVE WITHOUR PRIOR NOTICE.

MISPRINTS ARE NOT MISREPRESENTATION OF ANY PROPERTY.

Source: Rellina “REL” C. Bulabog of UCPB Savings Bank

Full disclosure

Nothing to disclose. We have stopped brokering foreclosed properties at the moment, so please contact UCPB Savings Bank directly to inquire. Thank you for understanding!

For real estate brokers/sales persons who want to market these properties, please contact UCPB Savings Bank directly using the contact info above.

Please feel free to share this listing to your friends and associates.

Search for more foreclosed properties in our database…

You can also search from over 30,000 foreclosed properties in our database.

This includes other banks and lending institutions that have foreclosed properties for sale.

Use this to quickly search for all foreclosed properties in a subdivision, village, condominium project, city, etc.

==> Click for advanced foreclosed properties search

All locations with foreclosed properties by Province/City

You can also browse all locations within the Philippines with foreclosed properties available from ALL banks/lending institutions inside our database, grouped by Province/ City, on this page:

==> Click to browse all foreclosed property locations

Note: The “Foreclosed Properties Database” is a work in progress. If you have comments/ suggestions, please do let me know by leaving a comment below.