“Amilyar” or Real Property Tax (RPT) in the Philippines is a tax that owners of real property need to pay every year. If you don’t pay, the local government unit (LGU) can include your property in their next tax delinquent properties auction. Details below.

Table of Contents

Amilyar Meaning And Etymology

“Amilyar” comes from the Tagalog word amilyaramyento which means “buwis sa lupa” or property tax. Amilyaramyento was borrowed from the Spanish term amillaramiento meaning tax assessment or register of assessed assets. Introduced during the Spanish colonial period, amilyar remains important today because non-payment can lead to penalties, interest, and foreclosure.

The legal basis for amilyar is inside Title II of the Local Government Code (Republic Act No. 7160). This annual tax accrues on January 1st, and it is a superior* lien which means it takes precedence over other liens, mortgage, or encumbrance of any kind whatsoever, and shall be extinguished only upon payment of the delinquent tax.

*Note: I believe this is the reason why banks/Pag-IBIG require housing loan borrowers to submit receipts as proof of payment for amilyar/RPT every year. More on this below.

The implementing rules and regulations of R. A. 7160 can be found here.

If you have prior years’ delinquencies, interests, and penalties, your RPT payment shall first be applied to them. Once they are settled, your tax payment may be credited for the current period.

Here’s a video that discusses amilyar:

Importance of Amilyar or Real Property Tax (RPT)

As a homeowner, You would not want your property to end up in a tax delinquent property auction right?

Which is why you should pay for amilyar/ Real property tax or RPT.

More about tax delinquent property auctions below.

Tax delinquent property auctions

Non-payment can actually lead to an investment opportunity where real estate investors buy tax-delinquent real properties by participating in auctions held by LGU’s.

Tax foreclosure auctions are held by virtue of sections 260 and 263 of RA 7160 otherwise known as the Local Government Code of 1991.

Buying tax delinquent properties is one of the many ways one can buy properties at low prices.

We also publish schedules and lists of tax-delinquent real properties of different cities – they are classified under the category tax-delinquent properties.

In the past, we have discussed what happens during these LGU auctions. You may want to read them should you be interested in this type of investment:

- Marikina Public Auction of Tax-Delinquent Real Properties (one of our very first posts)

- Four tips for investors who plan to invest in tax-delinquent real properties in Quezon City

- 9 lessons learned from the real property tax foreclosure auction sale in Quezon City

Who should pay Amilyar / Real Property Taxes?

The owner or administrator of the property should pay for amilyar / real propert tax.

We often get this question:

“Hi Jay/Cherry, should I pay amilyar/RPT even if my property is not yet fully paid?”

Yes, even if a property is not yet fully paid (you either bought through installment or through a real estate mortgage loan and you still have an unpaid balance), you already have to pay.

Sometimes, landlords will require their tenants to pay for the amilyar/RPT. If you are renting a property, better check your lease contract to be sure.

Want to get notified when this is updated? Subscribe for free updates!

Get new/updated foreclosed listings, auction schedules, property buying tips, and more, sent straight to your email inbox. It's free!

Where to pay

To pay for amilyar/ RPT, simply go to the City or municipal treasurer’s office where your property is located.

When to pay

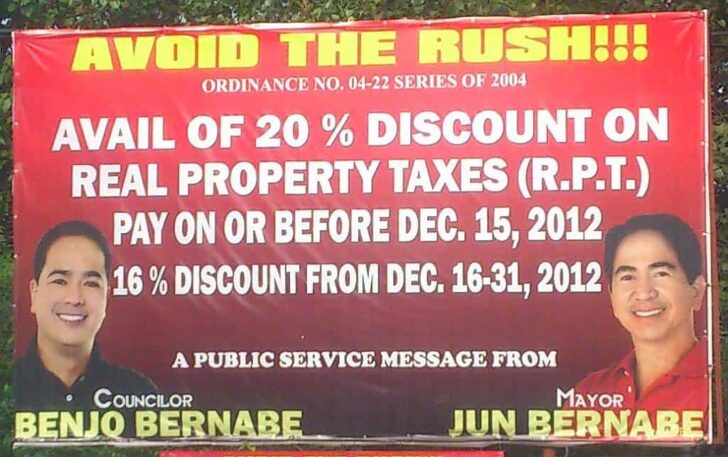

If you choose to pay for one whole year, the payment is due on or before January 31. If the basic RPT and the additional tax accruing to the Special Education Fund (SEF) are paid in advance, the sanggunian concerned may grant a discount not exceeding twenty percent (20%) of the annual tax due. Jay wrote about the discount on RPT recently in his post How To Get A 20% Discount on Real Property Taxes.

If you choose to pay in installments, the four quarterly installments shall be due on or before the last day of each quarter, namely: March 31, June 30, September 30, and December 31.

In case of failure to pay the basic RPT and other taxes when due, the interest at the rate of two percent (2%) per month shall be imposed on the unpaid amount, until fully paid. The maximum number of months is thirty-six (36) months, so effectively, the maximum interest rate is seventy-two percent (72%).

What to bring when paying amilyar

You need to present a copy of your tax declarations. Make sure to bring the tax declarations for land and or improvements as applicable to your property.

How to compute for amilyar or real property tax (RPT)?

Here’s a formula for RPT:

|

RPT = RPT Rate x Assessed Value |

Here’s a sample computation

Data:

Actual use of property: Residential

Location: City within Metro Manila

FMV per assessor’s officer (based on Tax Declaration):

Land – P350,000

Improvement – P350,000

Assessment Level for Land: 20%

Assessment Level for Improvement: 20%

Note: The assessment levels are fixed through ordinances of the Sangguniang Panlalawigan, Sangguniang Panglungsod, or the Sangguniang Pambayan of the municipality within the Metro Manila area. We will be using the maximum rates for sample computation purposes.

Computation:

Assessed Value of Land = P350,000 x 20% = P70,000

Assessed Value of Improvement = P350,000 x 20% = P70,000

Basic Real Property Tax for Land and Improvement

= (P70,000 + P70,000) x 2% = P2,800

Special Education Fund (SEF) for Land and Improvement = (P70,000 + P70,000) x 1% = P1,400

If you simply want to know how much is your amilyar, just get a statement of account or SOA at the City or municipal treasurer’s office.

What are the RPT rates?

Maximum RPT rates

|

Coverage |

RPT rate |

| Cities and Municipalities within Metro Manila |

2% |

| Provinces |

1% |

How to compute for Special Education Fund (SEF)

In addition to the basic RPT, the LGU’s may levy and collect an annual tax of one percent (1%) of the assessed value, which shall accrued exclusively to the Special Education Fund (SEF).

How to compute Assessed Value in the Philippines?

Assessed value is basically the property’s fair market value multiplied by its assessment level.

|

Assessed Value = Fair Market Value x Assessment Level |

What is Fair Market Value?

Sec. 199 (l) of the LGC defines “Fair Market Value” as the price at which a property may be sold by a seller who is not compelled to sell and bought by a buyer who is not compelled to buy. In practice, however, the Fair Market Value is based on the assessment of the municipal or city assessor as written in the Real Property Tax Declaration (Land and Improvement).

What is assessment level?

The Assessment Level shall be fixed through ordinances of the Sangguniang Panlalawigan, Sangguniang Panglungsod, or the Sangguniang Pambayan of the municipality within the Metro Manila area.

To get this data, look for the tax Ordinance of the city or municipality where your property is located.

Maximum Assessment Level Rates

The following are maximum rates for the assessment levels of different types of real property in the Philippines

I. Land

|

Class |

Assessment Level |

| Residential |

20% |

| Timberland |

20% |

| Agricultural |

40% |

| Commercial |

50% |

| Industrial |

50% |

| Mineral |

50% |

II. Building and Other Structures

- Residential

|

FMV Over |

But Not Over |

Assessment Level |

|

0.00 |

175,000.00 |

0% |

|

175,000.00 |

300,000.00 |

10% |

|

300,000.00 |

500,000.00 |

20% |

|

500,000.00 |

750,000.00 |

25% |

|

750,000.00 |

1,000,000.00 |

30% |

|

1,000,000.00 |

2,000,000.00 |

35% |

|

2,000,000.00 |

5,000,000.00 |

40% |

|

5,000,000.00 |

10,000,000.00 |

50% |

|

10,000,000.00 |

60% |

–

2. Agricultural

|

FMV Over |

But Not Over |

Assessment Level |

|

300,000.00 |

25% | |

|

300,000.00 |

500,000.00 |

30% |

|

500,000.00 |

750,000.00 |

35% |

|

750,000.00 |

1,000,000.00 |

40% |

|

1,000,000.00 |

2,000,000.00 |

45% |

|

2,000,000.00 |

50% |

–

3. Commercial/Industrial

|

FMV Over |

But Not Over |

Assessment Level |

|

300,000.00 |

30% | |

|

300,000.00 |

500,000.00 |

35% |

|

500,000.00 |

750,000.00 |

40% |

|

750,000.00 |

1,000,000.00 |

50% |

|

1,000,000.00 |

2,000,000.00 |

60% |

|

2,000,000.00 |

5,000,000.00 |

70% |

|

5,000,000.00 |

10,000,000.00 |

75% |

|

10,000,000.00 |

80% |

–

4. Timberland

|

FMV Over |

But Not Over |

Assessment Level |

|

300,000.00 |

45% | |

|

300,000.00 |

500,000.00 |

50% |

|

500,000.00 |

750,000.00 |

55% |

|

750,000.00 |

1,000,000.00 |

60% |

|

1,000,000.00 |

2,000,000.00 |

65% |

|

2,000,000.00 |

70% |

–

II. Machineries

|

Class |

Assessment Level |

| Agricultural |

40% |

| Residential |

50% |

| Commercial |

80% |

| Industrial |

80% |

Special Classes of Real Property

All lands, buildings, and other improvements thereon actually, directly and exclusively used for hospitals, cultural, or scientific purposes, and those owned and used by local water districts, and government-owned or controlled corporations rendering essential public services in the supply and distribution of water and/or generation and transmission of electric power

What are the assessment levels for special classes of real property?

|

Actual Use |

Assessment Level |

| Cultural |

15% |

| Scientific |

15% |

| Hospital |

15% |

| Local water districts |

10% |

| Government-owned or controlled corporations engaged in the supply and distribution of water and/or generation and transmission of electric power |

10% |

What is Ad Valorem Tax on Idle Lands?

In addition to the basic RPT, the LGU’s may collect ad valorem tax on idle lands.

The maximum idle lands tax is 5% of the assessed value of the property.

What are Idle Lands?

1. Agricultural lands more than one (1) hectare in area, suitable for cultivation, dairying, inland fishery, and other agricultural uses, ½ of which remain uncultivated or unimproved.

- Exceptions

i. Lands planted to permanent or perennial crops with at least 50 trees to a hectare; and

ii. Lands used for grazing purposes (Note: put goats or cows on your property).

2. Lands Other than Agricultural, located in a city or municipality, more than 1,000 sqm. in area, ½ of which remain unutilized or unimproved

3. Residential lots in subdivisions, regardless of land area

Frequently Asked Questions about Amilyar/RPT

Q: What is the deadline for property tax payment in the Philippines?

A: The deadline for the payment of real property tax is typically by the end of the first quarter of each year. It may vary slightly depending on the guidelines set by the LGU. Late charges and penalties may be applied if you miss the deadline.

Q: How do I pay my real property tax?

A: The payment process is simple. You can pay real property tax at a physical payment center such as your city hall or proceed to your LGU’s online payment portals, if available. You will need to present your latest real property tax receipt and if you are a new owner, you will also need a copy of your property title.

Q: Do I need to declare my real property?

A: Yes, as a property owner, it is your duty to make a declaration of real property for taxation purposes. It is the basis for the assessment of the property for taxation purposes under the Real Property Tax Code.

Q: Are there any discounts or exemptions for property tax?

A: Yes, there are specific tax exemptions provided by the local government code. These may include, but not limited to, farms, fish ponds, and charitable institutions. Also, you can avail of discounts if you pay early.

Q: What happens if I have already paid my real property tax but lost my official receipt?

A: If you have already paid your property tax but lost the official receipt, you can request a duplicate from the city government office. The city hall can verify the payment based on their records and issue a replacement receipt.

Note: As mentioned above, banks/Pag-IBIG require housing loan borrowers to submit receipts as proof of payment for amilyar/RPT every year.

Q: Can a real estate broker help with paying property taxes?

A: Yes, a real estate broker can assist you in paying your real property taxes. They are very familiar with the process and can guide you through the necessary steps, required documents to bring, and making the actual payment.

~~~

Do you have any questions, comments or reactions? Just let me know by leaving a comment below, thanks!

~~~

Cherry Vi M. Saldua-Castillo

Real Estate Broker, Lawyer, and CPA

PRC Real Estate Broker License No. 3187

PRC CPA License No. 0102054

Roll of Attorneys No. 55239

Text by Jay Castillo and Cherry Castillo. Copyright © 2008 – 2024 All rights reserved.

Full disclosure: Nothing to disclose.

Image courtesy: of renjith krishnan / FreeDigitalPhotos

Should an operating lessee have to pay also RPT on the leasehold improvements made?

Hi Atty.,

For condominium parking with Assessed value of P152,000.00 is there a need to pay for the RPT? Our property is in Makati and we were asked to pay for the RPT for the requirement of transferring the title to our name. I’m just confused in regards with the table shown above FMV = >175,000 = 0% Correct me if I’m wrong, does this mean there’s no assessed value for RPT?

BOTH MY PARENTS ARE NOW DECEASED. MY FATHER BEFORE HE DIED ALREADY GAVE MY TWO BROTHERS THEIR SHARE OF HOUSE AND LOT TO AVOID PROBLEMS. AND THAT I WILL EQUALLY SHARE THE FAMILY HOME WITH MY MOM UNTIL HER DEATH. MEANING AT HER DEATH, I GET 50% OF THE FAMILY HOME. UPON HER DEMISE, THAT ALL THREE OF US SHARE MOM’S PART EQUALLY. I LIVE FAR FROM HOME AND NEVER KNEW OF THE TRANSACTIONS MY BROTHERS DID WITH THE OTHER PROPERTIES. I ONLY KNEW RECENTLY THAT A NUMBER OF OUR PROPERTIES HAVE BEEN SOLD WITHOUT MY KNOWLEDGE, AND THAT THEY HAVE DIVIDED THE SALE AMONG THEMSELVES. MY QUESTION IS….IS THERE ANY POSSIBILITY THAT I CAN STILL DEMAND FROM THEM MY SHARE?

Pingback: What You Need to Know About Real Property Tax

If property is under Bank loan, who is liable to pay the RPT?

The borrower should pay the RPT.

Hello! I have just acquired a condo unit from CDC (44 sq. meter). This is my first time to pay the RPT and was surprised to see it amounting to 25k ( 15k for basic principal and 10 k for SEF). May i ask what this SEF is for and why is it added to my RPT. Note. The unit is still under the developers name, CDC, and i am still paying it through Pag Ibig HDMF.

Hi! We just moved in to our new house last July 2014. We wonder how and when we should pay the tax? Thanks.

Hi! what will be the tax on the real property donated to the donee ? Will it be subject to income tax ? Thank you

Hi, is there a way to pay for RPT without having to visit multiple municipalities if you have properties in different provinces??

Hi Charlie, you can check if the city/municipality has any online payment system, or you can outsource it to OMI. You can check them out through the banner on the right sidebar of this blog

How about the taxation for real property on sale on SBMA?

Hello. We’ve got a subdivision unit (house & lot) particularly here in Cotabato Province. It was awarded to us by the Pag-ibig last June 2013 and we immediately resided there. Then just very recently this March 2015 we received the Billing from Assessor’s Office showing that we have those unpaid RPT’s for 3 years now, and its quite big amount due to its interest penalties. But still the name of the owner in the billing is the Developer. Question #1. Who will pay the RPT since the owner’s name is still the Developer?

Question #2. Who will pay the interest penalty since RPT declaration was not yet transferred to the buyer’s name up to this time and we just received the billing this March 2015?

Question #3. I’ve noticed also that the Building is already in Residential use, but the Land/Lot is still in Agricultural use. What is the implication of this set-up?

Hope to hear from the soonest.

Thanks.. Fred

Pingback: With Online Credit Card Payments, Real Estate Transactions Just Got Easier

Hi Cherry,I have a house & lot so do I need to pay 2 taxes,my wife say must pay 2 separate taxs for house & lot?

Hi Cherry. Is it possible to have timberland property titled?

Good day,

I am confused with our RPT here in Siquijor Island. Our property is located in a village which is belongs to municipal of Larena. I am paying installments, sometimes its over the deadline. I paid this on March 20, 2014. They calculated like these:

Residential Building 300,000 x 30% = 3,000

Penalty Total

1/2 of 2013 1,500 450 1,950

1/4 of 2014 750 (75) 675

SEF 2,250 375 2,625

______________________________

4,500 750 P 5,250

as I understood, the SEF is 1% annually, so for the whole year I have to pay 3,000 also, do the taxpayer pays penalty also on SEF? So for this year I paid already 750 for SEF?

Hope to have help from you! Thank you very much!

Fritz

Bakit psti bahsy may bayad insurance ba yan? -lei-

Hello. If in case the condominium is owned by a foreigner, are they still entitled to pay the RPT?

Yes, they still have to pay RPT, even if they are foreigners.

Hello, I was wondering why small business have to pay annually to BIR but yet also pay quarterly? what is the difference, please explain. Thank you!

Hi atty. What can I do if I found out that building tax is not being paid upon by the building administrator (leased property) for more than 10 yrs? However as lot owner, we are updated in payment of the lot RPT. Can we file a case? Will BIR chase us the lot owner? or the building admnistrator?

Good Day Madam! Tenant ang aking mga magulang sa sinasakahang palayan dito sa aklan since 1972 at naka agrarian po ito. mahigit kumulang sa 3500 to 4000 sq. m. lamang po. dahil po taga maynila ang may ari ng lupa at ang aming bahay ay nasa gitna ng palayan nahihirapan po syang tumawid sa pilapil tuwing magbabakasyon sya dito sa aklan. Inutusan ng may ari ng lupa ang mga magulang ko na gumawa ng bahay dahil po ang lupa ay may kalsada. Since 1997 tumawag ang aking mga magulang sa may ari ng lupa na pag patayo ng bahay kung papayag sya o hindi. Pumayag ang may ari ng lupa, at hindi na rin sya mahihirapan pumunta sa bahay namin. Ang bahay na pinatayo ng mga magulang ko 25sq.m. ang lapad at ang haba ay 25 o 28 sq. m. Estimated ko lamang ito. Hindi naman po malaki. May dalawang kwarto may sala at kusina. kalahati hollow blocks at ang kalahati ay kawayan at ang bubog ay nipa. Last 2013 at dumaan ang napakalakas na bagyong YOLANDa nasira ang bahay namin. at ang natira ay pondasyon na hollow blocks. Dahil po sa pag susumikap ko dito sa middle east, ang mga kapatid ko din at lahat lahat din kaming pamilya nag tulungan para magawa ulit ang bahay namin dahil hirap na hirap ang mga magulang ko tuwing umuulan, dahil nga wasak na wasak ang bahay namin. February 2014 pinagawa ang bahay namin at naging hollow blocks na lahat at naging yero na rin ang bubog. Dahil nga po wala rin mabiling light materials. Ganu parin may dalawang kwarto. May sala at kusina. Ganun parin po ang laki at lapad. At naaawa na rin ako sa mga magulang ko sa pag titiis tuwing umuulan. sa ngayon unfinish ang bahay namin.

Ang problem namin ngayon lahat na mag anak nagalit po ang administrator ng lupa o napagkakatiwalan ng may ari ng lupa sa amin. Kung bakit daw pina hollowblocks namin ang bahay namin. At ipapasira nya daw ito. At ang isa pang problem ay ang titulo ng lupa ay totally damage nabasa at nag kapunit punit dahil sa Napakalakas na bagyong YOLANDA. Gusto ko po ipa register ang bahay namin sa BIR para po mag babayad kami ng tamang buwis sa bahay namin. Pero ang aking mga magulang ay walang utang sa may ari ng lupa. Nag babayad kami ng 7bags na palay every anihan. wet and dry seasons.

ano po ang magadang gagawin namin? Dahil po galit na galit talaga ang pinagkakatiwalaan ng lupa sa amin. Lalo na sa mga magulang ko. Tama po ba na E pa register ko ang bahay namin sa BIR? Ano po ang mga Requirments dahil po tenant lamang po kami. Sana po mapaliwanagan nyo po ako ng mabuti. At humihingi po ako ng advice sa sitwasyon namin tungkol sa bahay namin na pinagawa.

Maraming maraming Salamat po!

Lubos na gumagalang,

Jury G. Retiro

My cousin has already paid the delinquent taxes for the improvement of their property which no longer exists since 1982 but per records of the treasurer and assessor offices in quezon city, it still exists. The said property was posted in the bulletin board of the qc hall as one of those sked for public auction on May 15, 2014. The qc inspector conducted an ocular inspection of the place of the improvement and found out that there was no structure erected on it. My cousin wants to know if on top of the delinquent taxes he paid, will he pay p4,000 for putting his name in the list sked for auction? Isnt it unreasonable to slap p4,000 when posting was placed on the bulletin board of the qc hall real property division and not in a newspaper of general circulation?

Hello, what’s the purpose of SEF? Thanks!

gud day to you.. madam, madam pwede bang makahingi ng real property tax rates sa 16 cities sa NCR? pwede nyu po ba akong e update? cuz my dad is planning to buy land in manila and im trying to find someting cheaper na land which has low real property tax rates.. pki update po ako..tnx e send nlng po sa email ko kingheart2588@gmail.com

Hi! How much is the RPT of a residential house with a assessed value 3million with lot area of 850sq.m. provincial area? thank you.

Hi Cherry, I would like to know where could I get the rates of the properties so I could compute for the tax? thank you.

pwedeng makuha no.ninyo mam,,

Why do condo associations pay real property tax on their common grounds when the condo units’ assessed value depend on the common grounds and get taxed on it as well? That means a condo unit value is higher because of the nice pool and gym and thus the owner gets taxed more; additionally, the owners get taxed through the association AGAIN with the common areas real estate tax. How can that be? Thanks!

Pingback: How Safe Is Your Property From Being Repossessed?

Hi Jay & Cherry,

Hope you can also post an article on the taxes imposed on income derived from rental properties.

An avid follower,

Joane

Hello.

Thanks for coming up with this blog about real estate tax, it helped a lot.

My question is:

Will the Condo Corp responsible for paying the RPT of the common area and machineries even if the TCT is still under the developer or it is not yet conveyed? I read somewhere that you said “It depends on whether the lot has already been delivered by the developer to, and accepted by, the Buyer.”. What kind/Title of document it this? I am a member of the Board of Directors in a condo corp and the developer is in the process of conveying the property to the assoc but they wanted us to pay for the RPT starting from the time the condo was built, sometime in 2005. Is this fair? How can we go about this?

Can you please shade some light on this one?

Pingback: Our Top 10 Real Estate Investing Blog Posts For 2013

Hi Atty Cherry,

If I pay my RPT on land but not on building improvements (RPT arrears on building improvements from 8 years ago), what would be the consequence(s)? Will my land including the improvements therein be auctioned by the city government?

Hi Ma’am Cherry,

I purchased a house and lot on installment payable in 10 years. i am still into my 3rd year of paying and the developer turned over to me the assessment on Real Property Taxes saying that because we have already taken possession physically of the house, we are obligated to pay for the RPT even if we are not yet fully paid. am i really responsible being an installment buyer to pay for RPT? Thank you for your time and inputs. MRS. M. ONG

Hi, I just got a house and lot from a sub-division in the Philippines. The construction is just done and the moving-in is very soon. One of the requirements is, I need to pay the real property tax value for the said loaned property. My question is, do I need to pay/shoulder the real property tax despite the property is still my liability and not yet my asset?

Hi Roney,

For banks, the common practice is for buyers to shoulder the real property taxes from the date they bought the property from the bank, regardless of the mode of payment (installment or cash), which means even if a property is not yet fully paid, the buyer will already shoulder the real property taxes.

I believe the same practice is quite common to private sellers as well.

Hi ma’am! Can you help us with our tax declaration pf real property?

I’m from Balagtas Bulacan and masyado pong malaki yung sinisingil sa amin na tax sa bahay to think na sa probinsya kami nakatira. May rooftop po yung bahay namin at yun daw po ang dahilan bakit napakalaki ng tax namin sa bahay. Nakakapagtaka lang po kasi ang tax namin yearly is P9,360.00 bale P3,120 per floor. 65 sqr/meter lang po ang laki bawat floor.

hi, good pm. i have a question. we have this house situated on a lot where we have no title on hand at all. the land is supposedly divided into three for 3 brothers. but the one who have the original title is our neighbor. I was wondering what i can do to have or acquire ownership of my dad’s share on the land. no one has been paying the real property tax for more than 3 years now. is it true if i pay the real property tax, i have the right on that property even if the land is not under my name and the title is owned by our neighbor?

what is the tax due? is it the assessed value multiplied by tax rate? or is it all taxes including basic, sef, idle taxes less discounts or add penalties?

Thank you

Hope you can help us with this because were taking the licensure exam this march..

Good day po! I bought a house po tpos nlaman ko na 15 yrs ng tax delinquent ang house and lot? Kailangan ko po b bayaran lhat ang 15 yrs unpaid rpt? thanks po!

hello’

thank you very much for your blog, (been searching for quite sometime)

i have a question regarding a certain property located in project 4 q.c.

it is a 200 m2 lot with 4 small door apartment (2 storey at 33 m2 each) which is now being rented out and are currently occupied, and a 3 storey residential house (around 80 m2 per floor), and are occupied by the owner, at this stage the whole property is around 98 % completed

the payment of taxes for the lot is updated (the house and lot is under a bank loan)

when it was about 85 % completed a QC assessor knocked on its door and talked to the owner and she claims that based on her calculation the yearly payment of tax would cost around 60 thousand pesos.

however she claims that she can reduce it to more than half (20K to 30K) provided that the owner pay the first 60K to her and then for the next year it will be 20 to 30K, this time, payment will now to be made by the owner directly to the QC assesor office.

my question is the tax for the above property would really cost that much?

the owner tried to deal directly with the assessor office in QC hall and upon seeing the Lady Assessor inside the office, the owner have backed out, since the owner is being directed to see her since the owners property belong to the Lady Assessor jurisdiction.

your reply to the my question is greatly appreciated while for the other concerns (how to deal with lady assessors) will be highly appreciated.

thanks

I am inquiring on the Machinery being subject to real property tax. Does this mean all PC of a call center company and BPO would need to pay for such tax? I am assuming that Machinery refer to equipment being used by Manufacturing Firm. Your assistance is much appreciated.

Is it possible that a city assessor can issue a tax declaration over a land considered as timberland? within the geothermal reservation block? and declared as national park? What are the bases to consider it(tax dec) as legal or illegal?

Who will pay for the rpt of the common area in a subd.the property is not yet turned over in the association..the homeowner association does not have the tct of the common area.the owner declared in the receipt are still under the developers name not on the homeowners assoc. name.

For example I bought a house and lot in Cavite for installment. Is the RPT still separate from my monthly payments? Or is it already included?

Thanks!

Hi! i’m just curious how much is the RPT for a condo unit roughly 27 sqm? thanks in advance!

Hi lam also curious too if l buy a unit before top about 42sq m how much is the total tax per month

from the article, i believe it depends on the FMV of the lot and the building. question is if the formula also applies to condos

How soon is a land auctioned if no realty tax is paid particularly for one unused land in one of the villages in Las Pinas City? Is there an online system where i can check it myself since i’m living abroad.

hello po, I find this blog of yours educational, Can I ask if there’s a chance that a residential owner would have to pay 9,000 for her real property tax if the house is not yet fully furnished (1st floor is the only part which is completed) and the land area is only 32sq.m?

Hello Cherry and Jay,

First, I’d like to express my appreciation for your blog which I find both enlightening and educational.

I narrowly missed joining the December auction of RPT-delinquent properties in QC as I was out of the country, but an old friend was successful in joining and was able to win one lot from the auction.

With this experience, I was wondering if LGUs have a regular schedule of auctioning off RPT-delinquent properties? I’ll find this useful in case there is so I do not miss the next scheduled ones.

Thanks!

Hi Johnson, so far only Quezon City does this quarterly, for other LGU’s you will have to call regularly to know if they have a schedule. I believe if they knew they can submit their schedules, just like how most banks do so, we will have regular schedules posted here. As of now, I post all schedules I see, and I also get tips from other investors and post them as well. 🙂

in addition to our association dues, the Property Management Office for our Condo (Dansalan Gardens in Mandaluyong) is asking us to pay for Property Tax for the land, the building and machinery. Is this right?

It depends on the practice of your condo corporation. In many condos, RPT for the land, building and machinery (which are parts of the common areas of your condo) are usually paid by the Condo Corporation because it is a fixed cost that is already built-in the association dues. However, in some condos, RPT is separately assessed as a special assessment not part of the regular dues. You must ask the condo’s management body or Board of Directors. But regardless how it is to be assessed, RPT is a cost that will ultimately be shared by all the unit owners. 🙂

Hi Cherry,

If the TCT is already under the name of Juan dela Cruz but the Tax Declaration under Juan dela Cruz is still not available (still under the name of the developer), who should be paying the RPT?

thanks,

jules

It depends on whether the lot has already been delivered by the developer to, and accepted by, the Buyer. If so, the Buyer is liable to pay RPT the year after delivery since the title is already in the name of the Buyer. Even if the title is not yet in the name of the Buyer (as in the case of an amortizing buyer), the Buyer will also be liable to pay RPT if he has accepted delivery and taken possession of the property. In some cases, the Developer advances payments for the RPT and requests a refund from the Buyer who has accepted delivery and is already in possession of the property.

How do you get discounted RPT when you have more than 1 hectare unused/ idle land? Is it true that you need to declare some part of the land as loan to get discount? Thanks in advance.

Hi Alfred,

I’m not sure if I understood your question correctly. Make sure you fall under the exceptions to idle land.

Re: loan, I have never heard of that. I don’t see any legal basis for it.

Best regards,

Cherry

Hello

Is a Condo “real property” ? and thus pays RPT?

Hi Darren,

Yes.

Best regards,

Cherry

Is it true that private schools dont have real property tax?

Hi Rico,

Under Sec. 234 (b) of RA 7160, all lands, buildings, and improvements actually, directly, and exclusively used for educational purposes are exempt from RPT.

Best regards,

Cherry

Being exempt from RPT, why are private school still required to declare real properties? What are the consequences of failure to declare? Thanks much.