As a property owner, one of our obligations is to pay our real property taxes. It’s a given, we really have no choice but to include it on our list of real estate expenses, unless we would want our properties to get included in tax delinquent property auctions.

But did you know that you can get up to 20% off your real property taxes? Yes, it’s possible, and it is really quite simple… all you need to do is pay your real property taxes early!

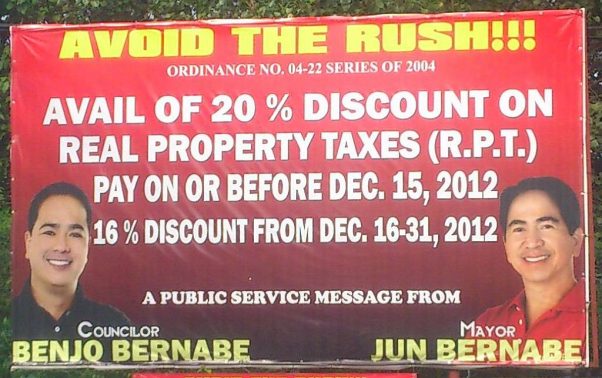

In Paranaque City for example, to avail of a 20% real property tax discount, you just have to pay in full on or before December 15, 2012, as per City Ordinance No. 04-22 series of 2004. By the way, sorry for the short notice folks!

Anyway, if you can’t make the December 15 deadline for the 20% discount, you can still get up to 16% off if you pay on or before December 31, 2012. Checkout the tarp below which I saw at President’s Avenue in Paranaque City.

Just prepare yourself for any hitches you might encounter when you pay your real property taxes in Paranaque. I heard from a friend of mine that she tried to pay her property taxes recently but it turned out her property needed to be re-assessed. This resulted in a higher tax bill for her property… what a bummer!

Real property tax discounts in other cities and municipalities

I believe other cities and municipalities also offer discounts for prompt and early payments of real property taxes. As mentioned in my post about the recently held tax delinquent property auction in Quezon City, residents can also get 20% off their real property tax bill if they pay in full on or before March 31, 2013.

In Marikina City and Antipolo City, I know for a fact that they also give discounts if you pay in full for next year’s real property taxes, before the current year ends. So if you want a discount for your 2013 real property tax, all you need to do is pay in full on or before December 31, 2012… just make sure their offices are open when you do decide to pay.

How about you?

Have you already paid for your real property taxes for 2013? If so, how much discount did you get? Which city/municipality? Please let us know by leaving a comment below. Thanks!

To our success and financial freedom!

Jay Castillo

Real Estate Investor

Real Estate Broker License No. 3194

Connect with us:

Facebook | Twitter | Blog RSS | Google +

Text by Jay Castillo and Cherry Castillo. Copyright © 2008 – 2012 All rights reserved.

Full disclosure: Nothing to disclose.

PS. Don’t be the last to know, subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips.

thanks so much

thanks on some important infos….. but Sir jay i have few questions po sana .. i think your the right person to ask: 1, my dad died 10 years ago and his death cert addressed was in Bacolod, for the past years we were paying the RPT here in Bocaue Bulacan )where the property is located)… 2013 my mom(co-owner) left country and entrusted the land title (original)/owners copy) to my auntie, NOW unfortunately the bag where our land titles are place was snatched/lost. in short the land title was literally lost. to go further we already have the affidavid and everything from the RDO.

= at present i have the certified true coppy of the title,,

QUESTION: 1,- where can i pay the RPT since my dad died in bacolod and address at death cert is in bacolod will i pay it there or i can pay it here in our place, and IAM paying it in brhalf of my mom POA is provided po..

2: do we have an online payment for the real property tax in philippines?

3: the last tax paid was last of 2013 pa po. if the total assesed value po is 37,580 nung 2013… mag kano na po babayaran ko if ill pay before JUNE 30 2015…?

4. and paano po ako makakakuha ulit ng owners copy original ng land title po.? and how much po pag kuha nun? ako na po kc nag lalakad ng papers and ngguluhan ako sa mga sinasabi sa rdo po eh.. pls help me po my : email address is [email protected] , contact 09102000339 thanks po and am looking forward ….

Hi Jay, I was wondering if you could advise if there are facilities to make payment online on property and land tax in the Philippines. Thank you!

Pingback: How Safe Is Your Property From Being Repossessed?

Pingback: What You Need to Know About Real Property Tax (RPT)

I just bought two adjacent lots amounting to less than 1.5M each. my real estate agent told me that if i can have the properties transfered to my name in separate year I will be vat exempt. Is this true? Pls explain further. It will be of help. Thank you.

Can you recommend a company or individual who can look after paying for our real estate taxes in the Philippines?

Thanks for the info Sir Jay. I have a question, is the Php. 175,000 worth value of a house still exempt of the Real Property Tax to date? I able to read that from an old book about appraisal. Thanks again, Merry Christmas! and Happy New Year!

Hi Jerome, I didn’t know that, I will have to do some research to confirm. Thanks for the info and I also wish you a blessed Christmas Season!