Have you ever played Robert Kiyosaki’s Cashflow 101 game and wondered how you can get out of the rat race with real estate, for real? Look no further, I’ll show you how to do it in real life, below.

“If only it were this easy in real life!” , a Think Rich Pinoy Seminar attendee exclaimed after buying his fifth property while playing Robert Kiyosaki’s Cashflow 101 game. I heard him say this as I helped facilitate the Cashflow 101 game at their table during the afternoon session of the Think Rich Pinoy seminar last February 27, 2010.

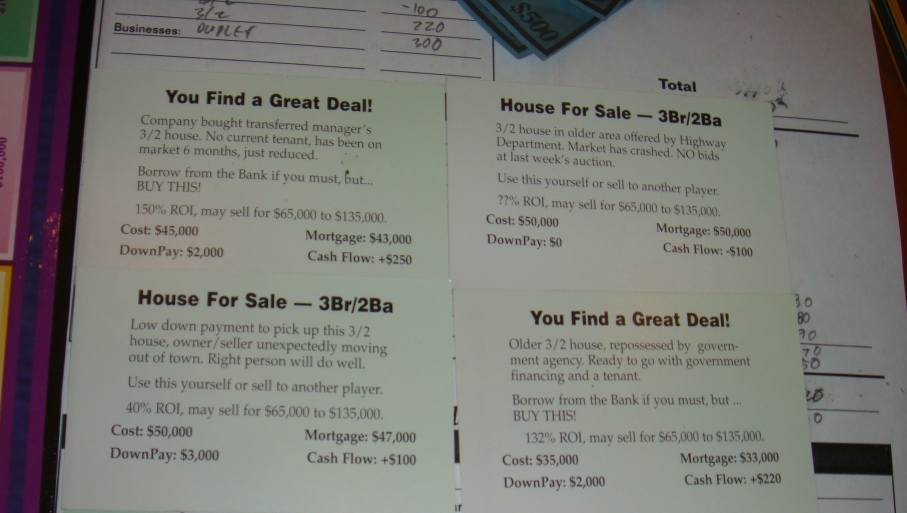

If you have played Cashflow 101, you would know that finding opportunities is as easy as picking an opportunity card during your turn. (Haven’t played Cashflow 101 yet? Learn more about the Cashflow 101 game by reading this article: Top 7 lessons learned from playing Rich Dad’s Cashflow 101 game)

In real life however, how do you find those “opportunities”?

It’s obvious that I get my opportunities from listings of foreclosed properties.

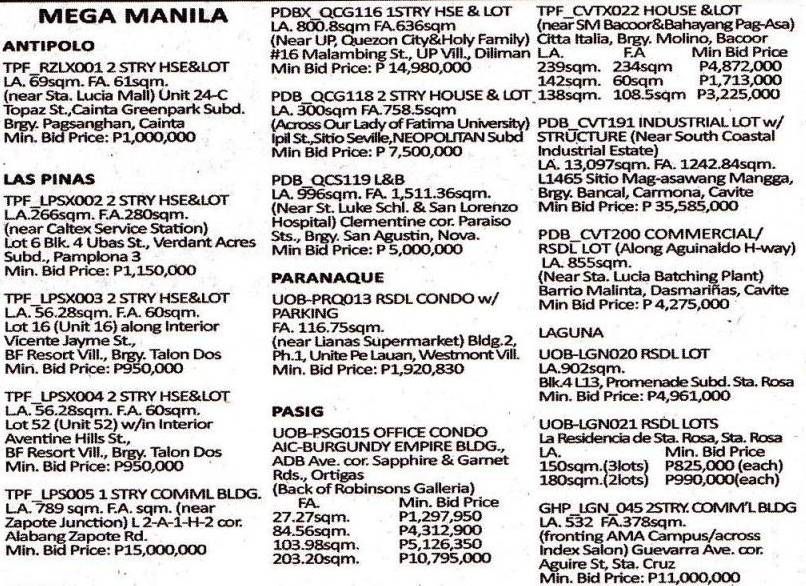

But how does one convert listings of foreclosed properties like this:

Into opportunities like these:

Let us first dissect an opportunity card.

If you will look closely at the opportunity cards above, aside from a brief description of the property, the projected ROI, Cost, Mortgage, Downpayment, and Cash flow are already given.

In real life, the only numbers you will often find on listings of foreclosed properties are the Cost (or the selling price or minimum bid price), Downpayment, Interest Rates, and the maximum loan term.

The mortgage amount is usually the Cost less the Downpayment (which is also equal to the loan amount).

You will have to come up with estimates or calculate for the projected ROI, and Cash flow. Without these numbers, you will have no objective way of telling if a foreclosed property has a good potential to be an income generating asset.

Return On Investment or ROI

According to the Cashflow 101 game rules, The ROI or Return On Investment on the opportunity cards can be calculated as follows

monthly cashflow x 12 months

ROI = ——————————————————

Downpayment

In real life, we can also get the ROI using the same formula above but we must first determine the projected monthly cashflow.

Determining Cash flow

An overly simplified way of determining the monthly cash flow would be to subtract the monthly amortizations from the monthly rental income. We therefore need to determine these two numbers first.

Note: In real life, you have to consider other things like vacancy rates, collection losses, property management, maintenance reserves, taxes and insurance, etc.

How to determine the monthly rentals

You can get the monthly rental income by asking around the same location of the target property and get rental rates for comparable or very similar properties. This would even be easier for condo units as you just have to check for the rental rates for units in the same building.

This can also be done online by checking advertisements of rental properties in the same building or area, but you have to remember that these are asking prices that have room for negotiations (most of the time).

For more information on how to check for rental rates, read this article: How I estimate market values of foreclosed properties

How to determine monthly amortizations

Monthly amortizations can be easily calculated using amortization calculators since we know the loan amount, interest rate, and loan term. You can use our very own amortization calculator which can be found here.

Putting it all together

Let’s use the following foreclosed property from the sample listing above and see if we can turn it into a real “opportunity”.

Let us also use the following assumptions*:

- Minimum downpayment required is 20%

- Balance is payable up to 15 years

- Interest rate is 12% interest p.a.

*Remember that these are just assumptions and are for illustrative purposes only. One should get the actual values by calling the bank.

Step 1: Determine rental rates

For the location of sample property above, I saw an ad for a smaller sized condo in the same building with an advertised rent at Php25,000 per month. I’m not entirely sure if the rental rate on the ad I saw was not overpriced but it will have to do for now. It would really be a big help if you focused in a particular area and became very familiar with rental rates, etc.

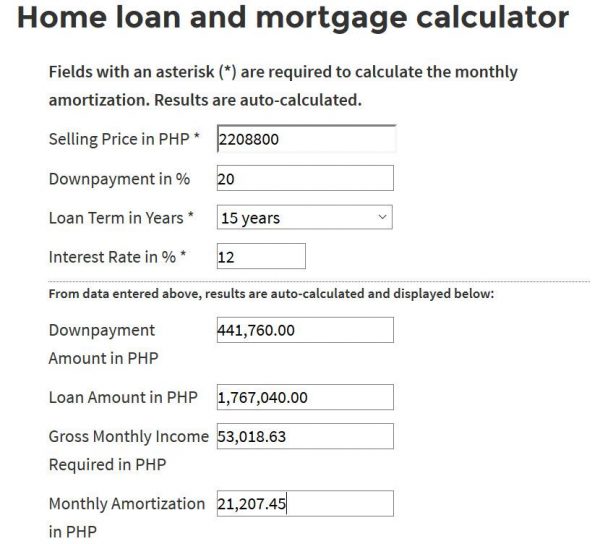

Step 2: Determine the monthly amortization

Using our mortgage calculator, the monthly amortization for a property with a minimum bid price of Php2,208,800.00 with a downpayment of 20% or Php441,760.00, and with the balance payable in 15 years at 12% interest p.a would be Php21,207.45 per month, as seen below.

Monthly amortization computed using our very own mortgage calculator

Step 3: Determine the monthly cash flow

The monthly cash flow would be equal to the monthly rent less the monthly amortization.

Monthly Cash flow = Php25,000 – Php21,207.45

= Php3,792.55/month

Step 4: Determine the ROI

Let us use the formula above for ROI:

Monthly Cashflow x 12 months

ROI = ——————————————————-

Downpayment

Php3,792.55/month x 12 months

= ——————————————————-

Php441,760.00

= 0.10302 or 10.302%

An investment “opportunity” for real

Based on the resulting numbers above, our opportunity card for our sample foreclosed property should look something like this:

You found a bank foreclosed condominium unit in Makati!

10.30% ROI, may sell for ????

Cost: Php2,208,800 Mortgage: Php1,767,040

Downpayment: 20% Cash flow: Php3,792.56

Points to remember

It really is possible to get opportunities in real life, just like the opportunity cards in Cashflow 101. All you need is just a little know-how in “doing the numbers“.

The “opportunity” we got above is an overly simplified example as we also need to consider property management, maintenance reserves, real property taxes, and other expenses when calculating for cashflow.

As to whether the “opportunity” we got above is a good deal or not still depends on each individual real estate investor’s preference or target ROI. Is 10% a good enough ROI for you?

The ROI can still drastically change when some numbers change and this can turn a mediocre deal into a great deal or it can also transform a good deal into a bad one.

What if the exit strategy was changed to rent-to-own instead of rental and the monthly rent-to-own income was Php28,000/month? Or what if the monthly dues plus other incidental expenses turned out to be Php5,000 per month and may thus result in a negative cash flow?

I suggest you run the numbers and check the results.

Remember, the numbers don’t lie.

So the next time you come across a listing of foreclosed properties, just do the numbers!

The more consistent you are with doing the numbers, the greater the chances that you may just find that “opportunity” you have been looking for!

Happy investing!

To our financial freedom!

Jay Castillo

Real Estate Investor

Real Estate Broker License #: 3194

Blog: https://www.foreclosurephilippines.com

Follow me in twitter:http://twitter.com/jay_castillo

Become a Fan in Facebook:Foreclosure Philippines fan page

Text by Jay Castillo. Copyright © 2016 All rights reserved.

PS. – Are you a new visitor? Click here NOW to start learning more about foreclosure investing in the Philippines.

![Why invest in foreclosed properties in the Philippines? + Top things to consider [Video] 7 Why invest in foreclosed properties in the Philippines? + Top things to consider [Video]](https://www.foreclosurephilippines.com/wp-content/uploads/2023/03/video-how-to-invest-in-foreclosed-properties-in-the-philippines-v3-728x410.jpg)

hi sir, im cathy, 21. at a very young age (16) i started a business (virtual and by contracts) and by the age of 20 have had a physical shop of my own. my family though has not been entirely supportive (with reason) of my unconventional venture. 2 months after i turned 18 i got my own pagibig contribution running but paid for only 2 months then stopped. 6 months ago i finally started a “more stable” way of earning by getting into the call center industry as an agent. for the fear of getting stuck in the rat race however i always see to it that i save atleast 40% of my salary monthly. at the age of 19 i had sub contracted a 4 bedroom apartment renting out 3 bedrooms having an ROI of about 300% (it was a very good deal id like to think, or my calculation is just really inaccurate)

by now i am looking into investing in real estate. this being said, i would really love to learn from you (and i have learned a lot by reading your blog this week) my main question now is, would you have an article for young people like me who basically have only about 5% knowledge on how the business works but would do a lot to learn? hopefully youd have an article about the basics of getting a loan for property, difference of pagibig and bank foreclosed property (if any) how to find a good 1st deal, how to start, articles for those real beginners like me starting from scratch not knowing basically anything.

thank you so much, looking forward to reading more of your articles

Just wondering, about the example above, how did you come up with the Mortgage of Php1,767,040?

Hi Benjamin, the mortgage amount of Php1,767,040 is equal to the selling price minus the 20% downpayment.

Pingback: Financial Education for Kids Part V: Getting Used To A Simple Lifestyle - ForeclosurePhilippines.com

Pingback: Financial Education for Kids – Part I

This is really useful. I used to play cashflow before and I find it easy because everything is laid out in the table, but in real life opportunities don’t present themselves as cards that are already calculated for you. Thanks for this!

You’re welcome and thank you also Arlet!

Pingback: FIP’s best of 2010 to help you get started in 2011

Pingback: Foreclosed properties for sale!

Pingback: Metro Manila and Luzon foreclosed properties up for grabs in RCBC’s Mega Property Auction

hi jay, got another situation here with a prospect and i need your advise. i like to purchase a foreclosed prop from bank A and would like it financed by bank B, since bank B is separate from bank A, bank B will still have to assess the property. if bank B assesses the property higher than bank A’s asking price, how will the loan proceed? bank B would still require equity share but since bank B’s loan is more than enough to cover the purchase price, should i still pay downpayment? or is this one example of no money down deals? thanks.

Hi Lorenz, if bank B’s approvable laon amount more than covers bank A’s asking price, then this would be a no money down deal! Cheers and good luck!

Excellent real estate blog. It was pleasant to me. Thanks for this.

.-= Homes for sale Miami´s last blog ..The Findire.com – A right place to locate your homes for sale in Miami =-.

Definitely one of your best posts Jay! 🙂

.-= Millionaire Acts´s last blog ..Paying Your Debts Through Structured Debt Settlement =-.

Thanks a lot Tyrone! You stayed at Citadel briefly after Ondoy’s visit right? Would you be able to confirm the rental rates there? Thanks again!

Take a look into the listing. Analyze the market and find great deals for the future

My point in a nutshell James, thanks for the comment! Again, another site about foreclosures in the US I want to emulate. Thanks for visiting!

Foreclosed properties can really turn into nice things. If your search well in listings, you can make good deals

Hi Tony, thanks for the comment. by the way, you have a nice site about foreclosures in the US. I look forward to organizing my site to be like yours!

Hi Jay!

Thanx for your unconditional sharing of this articles. Your such a nice person. It really help us to learn more and appreciate how to turn listings of foreclosed properties into opportunities. I SALUTE you for your contributions in real estate investing.

God bless you always and more good deals to come!

Hi Benjie, thank you so much for the kind words, always glad to help. A lot of people have helped me as well and I believe it’s just right for me to pay it forward. May God bless you and your family also!

Hi Jay,

Nice meeting you in the seminar. Your articles indeed help.

.-= Gladis´s last blog ..RUSH SALE – CONDO UNIT FOR 950K LOCATED IN VERY BUSY AREA OF CUBAO – 10% RETURN OF INVESTMENT — EARN PASSIVE INCOME 8K -10K RENTALS HERE =-.

Hi Gladis,

Please post your for sale condo on Haybol (http://www.haybol.ph) so that buyers/renters would know where your property is on a map. Thanks!

Thanks po!

.-= Gladis´s last blog ..RUSH SALE – CONDO UNIT FOR 950K LOCATED IN VERY BUSY AREA OF CUBAO – 10% RETURN OF INVESTMENT — EARN PASSIVE INCOME 8K -10K RENTALS HERE =-.

Hi Edge,

I think I should introduce you and your system to my team mates. When would you be free?

Hi Jay,

Thanks for getting back to me. How does 10:30AM this Saturday, Makati area sound? Let’s text/email for details.

Hi Gladis! Nice meeting you as well. Thank you also for the great job organizing the first Think Rich Quick seminar!

Hi Jay,

Ayos to ha. Thanks for sharing this information.

Hi Jay!

Thanks for sharing this post! You made the foreclosed property listing which might be difficult to understand look much better by putting it in the format of Cashflow 101’s Opportunity Card. That’s just great!

Salamat bro! Iba ka talaga mag-turo!

God bless!

.-= Bryan Uy´s last blog ..Love and Gratitude Will Work Wonders for You and Science Proves It =-.

Hi Bryan, thank you bro for the comment! If we look at properties this way, it would be easy to buy good deals or pass on not so good deals, just like in cashflow 101. We should play again one of these days!

Sige bro! Kelan ba planong maglaro? Thanks for the invite!

.-= Bryan Uy´s last blog ..Love and Gratitude Will Work Wonders for You and Science Proves It =-.

Sige, will text you the details. 🙂

You’re welcome Jun, thanks for the comment!

Pingback: Tweets that mention How to turn listings of foreclosed properties into opportunities