With so many banks and lending institutions out there, it would be nice if you can easily know which one offers the best home loans in the Philippines.

This has been a challenge for me when I’m asked which bank has the cheapest mortgage rates (and whether it is better to get a loan from a bank or Pag-IBIG) and I couldn’t give a straight answer. Not anymore!

After much research and effort, we finally have our very own mortgage and home loans in the Philippines with interest rates comparison chart which compares all available home loans and mortgage rates here in the Philippines (this is a work in progress… more on this later), including Pag-IBIG and other lending institutions (coming soon).

If you want to know where to get the cheapest mortgage rates and lowest home loan rates, just click on the “Lowest Interest Rate” column header below to sort from the lowest to the highest.

Go ahead, try it out. You can also click on the details to enlarge.

Home Loans In The Philippines Interest Rates Comparison Chart (as of June 04, 2015)

| Bank / Lending Institution | Lowest Interest Rate | Details | Where to get more info | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Allied Bank | 6.0% |

| Updated as of February 11, 2015 Source: Allied Bank Website |

|||||||||||||||||||||||||||

| Banco De Oro (BDO) | 7.0% |

| Updated as of February 11, 2015 Source: BDO Website |

|||||||||||||||||||||||||||

| BPI | 6.0% |

| Updated as of February 11, 2015 Source: BPI Website |

|||||||||||||||||||||||||||

| EastWest Bank | 7.5% | 1st year fixing at 7.5%, 30 year tenor, for loans starting at P1.5M | Source: EastWest Bank Flyer | |||||||||||||||||||||||||||

| HSBC | 5.5% |

| Updated February 11, 2015 Source: HSBC Website |

|||||||||||||||||||||||||||

| Metrobank | 6.00 |

| Source: Metrobank Acropolis Branch as of February 2015 Note: According to the bank officer that gave this to me, these are regular rates for loans booked on or before October 30, 2014, but the rates were still applicable. However, just like all the rates on this page, they are all subject to change without prior notice. |

|||||||||||||||||||||||||||

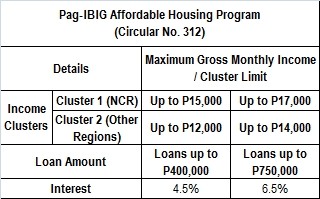

| Pag-IBIG | 4.5% |

| For more details, please refer to the following Pag-IBIG circulars: |

|||||||||||||||||||||||||||

| Philippine National Bank (PNB) | 5.25% |

| Updated February 11, 2015 Source: PNB Website |

|||||||||||||||||||||||||||

| Philippine Veterans Bank | 8.25% | 8.25% per annum, fixed for five (5) years, thereafter subject to re-pricing for every five (5) years | Added on May 6, 2014 Promo Period: March 1 to May 31, 2014 Source: PVB Home Loan, Free Home Flyer |

|||||||||||||||||||||||||||

| PSBank | 6.0% |

| Updated February 11, 2015 Source: PSBank Website |

|||||||||||||||||||||||||||

| RCBC Savings Bank | 8% |  | Source: RCBC Savings Bank, G/F, Pacific Place Building, Pearl Drive, Ortigas Center, Pasig City |

|||||||||||||||||||||||||||

| Security Bank | 5.25% |

| Source: Emy Arceo of Security Bank | |||||||||||||||||||||||||||

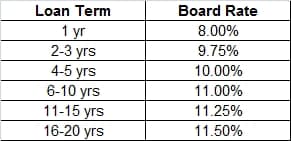

Note: We will update our amortization factor rates accordingly to ensure it includes all interest rates quoted above. Alternately, you can also use our mortgage calculator.

Are the lowest interest rates the best interest rates?

It depends. If you have played around with the chart above, you will notice that Pag-IBIG has the lowest interest rates for housing loans up to Php400,000, which is just 4.5% per year. However, what if you need a housing loan that’s more than that? Based solely on the interest rates, a number of banks beat Pag-IBIG for loans above Php400K. So it really depends on the loan amount, among other factors.

You need to check the details of what they are offering like fixing terms and corresponding interest rates (see the “Details” column), or just visit their website for more information (see the “Where to get more info” column).

Reminders about the quoted interest rates above

Please take note that the interest rates quoted in the chart above are indicative rates, which means they are subject to change without prior notice, and the actual interest rate will be the prevailing rate during the time of loan availment.

While getting the cheapest mortgage or home loan rates sounds great, there are things you should be aware of. The lowest rates usually come with yearly repricing, while fixed interest rates are often higher, but can help give you peace of mind that you won’t be affected by the next financial crisis. Learn more by reading the following article:

Updated home loan interest rates

Nope, this isn’t a one-time thing as we intend to keep this home loan and mortgage rates chart updated.

For now, these include banks and lending institutions that either have their interest rates published on their websites, or they furnished us with their interest rates. These are publicly available and can easily be verified.

In the future, we will update this to include interest rates for in-house financing offered by some banks for their foreclosed properties. We also plan to include interest rates for refinancing so that the best refinance rates can be seen at a glance. At the moment, the chart only includes interest rates for new home loan accounts/purchases.

Of course, we will also continue to add more banks and lending institutions, and information related to housing loans and mortgage rates being offered here in the Philippines, as they become available. We could also use some help.

Please help us keep this list updated

If you work for a bank or financial institution who provides housing loan products, and your bank/institution is not yet included in our home loan interest rates comparison chart (or if you have updated info, promos, etc.), please contact us and send us details so we can include your info here. The same applies even if you don’t work for a bank/lending institution, but you have information worth sharing here.

We value your feedback and inputs so if you have any comments and/or suggestions, just let us know by leaving a comment below. Thanks!

~~~

To our success and financial freedom!

Want to get notified when this is updated? Subscribe for free updates!

Get new/updated foreclosed listings, auction schedules, property buying tips, and more, sent straight to your email inbox. It's free!

Jay Castillo

Real Estate Investor

PRC Real Estate Broker License No. 3194

Blog: https://www.foreclosurephilippines.com

Connect with us – Subscribe | Facebook | Twitter | Google+

Text by Jay Castillo and Cherry Castillo. Copyright © 2008 – 2013 All rights reserved.

Full disclosure: Although I am an accredited broker of BPI Loans, we included other banks/lending institutions in the chart above. My goal is to create a very objective and unbiased home loan comparison chart, and I intend to keep it that way.

Image courtesy: of ddpavumba / FreeDigitalPhotos

Hi Sir Jay,

Can you please elaborate what does it mean to have the Fixed Pricing Period ng PAG-IBIG?

Does that mean na if ever, 3years 6.50% rate ung kinuha namin, and at the end of the 3rd year, may panibago na nman interest rate na iapply sa remaining loan balance?

If so, can you give me a foresight sa trend/fluctuation ng housing loan interest rate ng PAG-IBIGif ever you have that idea?

Thank you po.

Hi jay,

Thanks for the list. It is very helpful.

You’re welcome Jammer! I will have to update this very soon. So many things to do lately. 🙂

Hi mr jay,

Im 28yrs old and planning to get a housing loan.. my friend offered me her house for 1.9m.. i have 500k on hand sana na pang down.. my problem is 25k/m lang gross ko.. where can apply po ng loan na pwede ako ma approve? Hope you can help me.. thanks

Hi Khay, most banks would have the same gross income requirement, so my suggestion would be for you to find a co-borrower instead. With a co-borrower, your capacity to pay will be the total for you and your co-borrower. Goodluck.

Hi, Jay. I am planning to avail home loan for the condo unit that I purchased but since first time ko to get a loan. I would like to hear a professional’s comments. I have been approved by 3 banks – Chinabank, PS Bank, Robinson Bank. Here are the terms.

Chinabank – 15 years / fixed for 5 years 5.75

PS Bank – 20 years / fixed for 3 years 6.50%

Robinson Bank – 20 years / fixed for 5 years 6.75%

Thank you!

Best Regards,

Victoria

Hi Victoria,

My suggestion is to check the resulting differences to your monthly amortization using those different loan terms with our mortgage calculator: https://www.foreclosurephilippines.com/mortgagecalculator/

In addition to the resulting monthly amortization, you should also consider the services these banks can give you, and you will have a feel for this only when you apply for the loan. My suggestion, apply with several banks and proceed with the one that offers the best service (the one who makes the who process easier for you).

This is what we felt when we got our recent loan approved, and we went with the bank that was more responsive to us.

Thank you!

hi victoria, my i know which bank did you choose? thank yu

Hi Victoria,

Is that true chinabank 5.75%? Who is your contact?

Chinabank offer us 6.50% for 5 yrs. 🙁

Thanks.

Hi, Apricelda. Yes, my loan in Chinabank was approved at 5.75% fixed for 5 years. They do have a promo at the moment with 5.50% interest rate fixed for 5 years. You may contact me at vmespina@gmail.com so I can send you my loan officer’s contact details.

Hi, Mr. Jay.

I would like to seek for your advice re: home loan. I am intending to avail home loan for the condo unit that I purchased. Na-aapprove na ko sa 3 banks – Chinabank, Robinson Bank and PS Bank. But since 1st time ko to get a loan, hindi ako makapagdecide if sang bank ako magpo-proceed ng loan. Here are the terms of each bank.

Chinabank – 15 years / fixed for 5 years 5.75%

PS Bank – 20 years / fixed for 3 years 6.50%

Robinson Bank – 20 years / fixed for 5 years 6.75%

Hindi kasi ako sure if ano magandang terms. So gusto ko sana malaman yung reviews sa above banks.

Thank you.

Best Regards,

Vic

Hi Jay,

May I know which bank offers BIGGER LOANABLE value. Our property is Sofia Townhouse, Mahogany at Acacia Estates.

Thanks,

EPM

Hi Esther, any of the big banks should be able to handle this (BPI, BDO, Metrobank, PNB, etc.)

Sir Jay, With the upcoming Christmas season and election next year, what’s your projected interest rate schedule for the next 3-6-9 months ahead?

hi jay nice info! . do you have a fb page or website. im checking for the best deal for housing loan, planning to get one this coming feb or march. whats the best? for closure or brand new for house and lot if you can send me a message through mail that would be awesome riveroaronbenzon41@gmail.com

Hi Jay,

Can you add Unionbank? I believe they have around 6.5% annual interest fixed for 3 years.

Thanks.

Hi guys, I have a question, let’s say you have a loan term of ten years with 5 years fixed interest rate, on the 6th year, will the interest rate be repriced every year or you still have the option to choose whether yearly repricing, two years or fixed for another 5 years? I inquired with BPI they say after the fixed interest rate for a certain period, it would be yearly repricing na. You are not given the option to choose anymore. How about with other banks?

Hi jay, my wife got a Real Estate Loan at AFPMBAI for P3,200,000.00 in 2007. Lately this month i noticed that her payslip did not contain any deduction for MRI. I verified at AFPMBAI REL DIVISION, and i was informed that my wife has to undergo medical examination(which she failed to take action) so AFPMBAI REL will apply for reinsurance from another third company. What if she failed the medical exam for diabetes & hypertension? will the MRI REINSURANCE be denied ? is it not MRI is a mandatory action of AFPMBAI REL to protect its borrowers. ?? is it not a govt that MRI is mandatory upon approval of real Estate loan for the protection of buyer/borrowers?.Pls advice.Thanks

How about from UCPB? What’s their interest rate for Home Loan? TIA

Hi Sir Jay,

I have purchased a condo unit and it is due for turnover in September. I only plan to loan less than half of the contract price, about P800,000.00 for 5-7 years. Are the rates above also applicable to this type?

Thanks!

Hi Renee, yes, the rates above should apply if your target loan amount is 800K.

Pingback: Pag-IBIG Lowers Interest Rates For Housing Loans Under End-User Financing Program

Hi Jay! I just plan for housing loan to BPI for 5 years term. What do you mean by tenor housing ? It is better for fixing term plan? Thanks and God bless to you.

Hi Eduy, tenor is the length of the payment term. Fixed is better in my opinion because you are not at the mercy of sudden fluctuations in interest rates. Please read this to learn more: https://www.foreclosurephilippines.com/low-home-loan-rates-what-you-need-to-know/

Thank you Jay for this information. Hope there’ll be opportunities to work together in the future.

You’re welcome Ed. Thanks!

Hi Jay. I would like to correct the interest rates you have posted for Pag-IBIG Fund. The rates you posted was the rate from July 2, 2012 to December 31, 2013. The present interest rates are as follows:

a. 3-Year Fixing 6.985%

b. 5-Year Fixing 7.825%

c. 1O-Year Fixing 8.775%

d. 15-Year Fixing 9.385%

e. 20-Year Fixing 9.675%

f. 25-Year Fixing 10.000%

g. 30-Year Fixing 11.375%

i’ll update you later on the new rates effective July 1, 2015. Thanks

Thanks a lot Nick! I’ll update this asap.

Pag-IBIG new rates effective June 1, 2015:

a. 3-Year Fixing 6.500%

b. 5-Year Fixing 7.270%

c. 10-Year Fixing 8.035%

d. 15-Year Fixing 8.585%

e. 20-Year Fixing 8.800%

f. 25-Year Fixing 9.050%

g. 30-Year Fixing 10.000%