When it comes to real estate investing, one cannot ignore the importance of due diligence. More so with foreclosed properties, which are all for sale on an “as is where is” basis. But what does “as is where is” mean in real estate? Continue reading to find out.

What does the term “AS IS WHERE IS” mean in real estate?

In a nutshell, the term “as is where is” means the buyer will inherit all of the physical and legal conditions of the property he’s going to buy, as is! In other words, you get everything that comes with a property, in its present state and condition, and the seller makes no warranties, if you buy it.

To give you an idea, answer the following:

Does a property need lots of repairs?

Does the property have defects?

Does it have illegal occupants?

Does the property title have problems/issues (is the title consolidated)?

Is the property located beside a garbage dump or cemetery, etc?

Does the property have any arrears (unpaid bills for electricity, water, dues, real property taxes, etc.)?

If the answer to any of the above questions is yes, then the buyer expressly agrees to buy the property in such condition(s), and any costs related to fixing any of these problems will be for the account of the buyer.

Tip: There are banks who shoulder arrears for real property taxes, condo or homeowners association dues, electricity, water, etc., up to the date the property was purchased. You just need to verify this in the “conditions of sale” before you enter into a binding agreement, or before you make a bid during an auction.

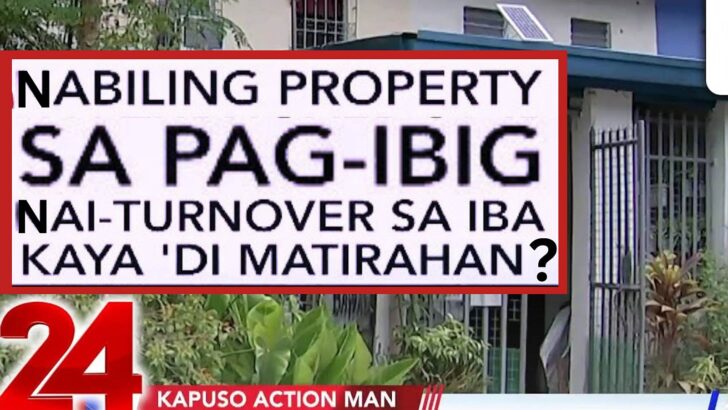

This is the reason why banks and other sellers of foreclosed properties (like Pag-IBIG) highly encourage interested buyers to inspect and verify the physical and legal conditions of the foreclosed properties before they buy.

Banks expect interested buyers to have already done their due diligence, including an “ocular” or visual inspection, BEFORE the auction, or before signing a binding purchase and sale agreement.

This leads to another common question:

“But shouldn’t the bank just tell me upfront if a foreclosed property has any problems, issues, special concerns, etc?”

The answer to the above question is “Yes”, you can expect banks to have a “Full disclosure Policy”.

But while interested buyers can expect banks to fully disclose any information they have about their foreclosed properties for sale, I still believe that it is the buyer’s duty to do his/her own due diligence, let me explain below.

You still need to do your own due diligence

You need to do your own due diligence to check both the physical and legal condition of the property for problems and/or defects.

Physical Conditions

You need to have a good understanding of how much repairs are needed, or if the property has any physical defects to begin with.

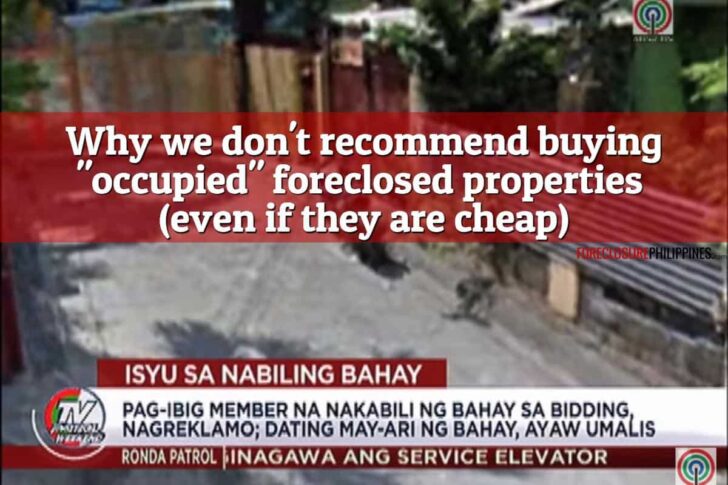

Most importantly, you need to verify if a property is vacant or occupied, or who has possession of the property.

I remember one time my wife and I inspected a foreclosed property, and we thought we were talking to the caretakers of the bank. Turns out they were relatives of the previous owner. Scary right?

Anyway, to do all of the above, you have to personally inspect the property.

Here’s a video of how I did a foreclosed property inspection.

Legal Conditions and other aspects

You also need to check for any pending court cases or “lis pendens” related to the property being sold.

If it turns out there is a pending or ongoing court case, and you decide to buy the property, you will take over the court case from the seller. You better talk to your lawyer and seek legal advice first so you’ll know what you’re getting into if you buy the property.

Other things to check: Does it have any liens, encumbrances, or any technical problems/discrepancies, etc?

You need to check just in case the bank was not aware of them, if any.

As the famous Russian proverb goes:

Want to get notified when this is updated? Subscribe for free updates!

Get new/updated foreclosed listings, auction schedules, property buying tips, and more, sent straight to your email inbox. It's free!

Trust, but verify!

In other words, while you can expect the bank to tell you things as they are based on the information they have, you still need to do your part by asking the right questions and finding answers on your own, just to be sure.

You need to verify the answers that you will get as part of your due diligence.

Related: 31 Questions you need to ask when inquiring about a foreclosed property

Happy with the property condition?

After you have visited the property for proper due diligence, all the information you have gathered should help you in deciding whether to go ahead and accept the property.

If you’re not happy, you can try to negotiate with the seller for a purchase price that would help offset any cost involved with fixing any problems/defects you have found. Do this before you finalize the purchase.

Once you agree and sign a purchase contract, the property is considered sold in its current condition, and you won’t be able to negotiate with the seller anymore.

Conclusion

Remember, any foreclosed property you buy shall be sold on an “as is where is” basis, and I hope I have answered the question “What does as is where is mean?”.

This highlights the importance of due diligence. Once you purchase the property and later find problems you missed, you shall not be entitled to any refunds if you back out (any payment you’ve made will be forfeited).

It does not matter if you are a real estate investor looking for a property to flip/keep as a rental, or if you are just looking for your own home, you still have to do your due diligence. It can help you distinguish a horrible property from a good one.

If you still have questions, please go ahead and ask them by leaving a comment below!

Note – To help you with your due diligence, a copy of Version 1.0 of our Due Diligence Checklist is now available for all our e-mail subscribers. Not yet a subscriber? Click here to subscribe

~~~

To our success and financial freedom!

Jay Castillo

Real Estate Investor

PRC Real Estate Broker License No. 3194

Text by Jay Castillo and Cherry Castillo. Copyright © 2023 All rights reserved.

Full disclosure: Nothing to disclose.

P.S. – Don’t forget to subscribe to get alerted when new posts about foreclosed real estate investing are published, along with updated listings and public auction schedules.

Photo Credit: Jardin des Tuileries @ Paris by *_*, on Flickr

Hi! What do we need to do to visit the foreclosed property? Do I need to ask the bank for authorization to do ocular or do you just visit the property? Thanks!

Hi Cat, it depends on the condo/subdivision where the property is located. If the HOA/Condo admin is strict, you will have to secure an authorization letter from the bank. However, some would allow interested buyers to visit such properties without any authorization letter, especially if the property has a caretaker from the bank. My suggestion, call up the bank to be sure so you won’t waste time going to a property only to find out you can’t inspect it because you need to have an authorization letter.

Hi, how about the personal things inside the foreclosed property like old refrigerator, old washing machine, small couch, old electric fans, utensils, slippers clothes, blankets, curtains, etc? The whereabouts of the previous owner of the house (also his wife and son) can not be determined because the email address and mobile number is no longer working. It’s been 5 months of search but no progress. They can’t be found on social media as well. I even posted the picture on Facebook but no progress. I am looking for the previous owner because i wanted him to collect his personal things so that I can proceed with minor renovation works. However, the search is unsuccessful. The last time that the previous owner (Seaman) visited the property according to the neighbors was 4-5 years ago. What shall I do with their personal things? Brgy & HOA officials turned down the responsibility of safe keeping.

Hi Alyka,

Based on past transactions where the property still had personal things inside, the bank told us it’s up to us to decide what to do with the personal things. A client of ours also had the same experience and they simply disposed the personal things. I admire you for trying to contact the previous owner, but it seems they are no longer interested with the stuff they left behind. One idea I have is for you to sell the stuff and just in case the previous owner returns, just give them the proceeds.

Good luck!

Pingback: 177 PNB Foreclosed Properties slated for public auction on August 30-31, 2017

Pingback: Another PDIC foreclosed properties auction slated on September 4, 2017

Pingback: PDIC foreclosed properties auction slated on August 31, 2017

Pingback: Why we don't recommend buying foreclosed properties that are occupied (even if they can be very cheap)

Pingback: GSIS Foreclosed Properties public biddings slated on July and August 2017

Pingback: UCPB Foreclosed Properties for sale as of June 2017

Pingback: Pag-IBIG to sell 2,533 Foreclosed Properties through 7 public auctions in March 2017

Pingback: Sterling Bank foreclosed properties for sealed bidding on February 9, 2017

Pingback: Asia United Bank and Subsidiaries Foreclosed Properties and Repossessed Cars for sale as of November 2016

Pingback: 255th Unionbank Foreclosed Properties Auction Slated on September 24, 2016

Pingback: PSBank Foreclosed Properties for sale (as of August 2016)

Pingback: 338 HGC Foreclosed Properties For Sale and Rent-to-own as of July 18, 2016

Pingback: 379 PSBank Foreclosed Properties for negotiated sale as of June 30, 2016

Pingback: AUB Foreclosed Properties and Repossessed Cars for sale as of July 2016

Pingback: UCPB Foreclosed Properties and Repossessed Cars for sale as of June 2016

Pingback: Download this list of Cavite United Rural Bank Foreclosed Properties for sale as of June 2016

Pingback: Rural Bank of Angeles Foreclosed Properties for sale as of June 2016

Pingback: Asia United Bank Foreclosed Properties and Repossessed Cars for sale as of June 2016

Pingback: More Than 1,000 Foreclosed Properties For Sale From Philippine Investment Two (SPV-AMC)

Hi Jay,

I have a small question. We are planning to buy a small piece of property in the Philippines for my parents. In the original document, the first owner had donated the land to a church in the condition that it will only be used as a church many years ago, the owner had died and hence it is now the property of the church. In the mean time, the property had become too small and so the church had purchased another bigger property to replace it. This old property is the one we are buying. It should have been smooth-sailing since the papers are all in order. But there are gossips that some relatives of the deceased original owner are planning make claim in the property. Do they have a legal reason? The purchase papers include the clause “as is, where is” in the sale. I am just concerned that there could be problems in the near future. In your opinion, can there be some legal problems? I would appreciate if you can please give me some info. Thank you

are unpaid.utility bills included in the “as is where is ?”

Yes, unless it is the bank/seller’s policy to shoulder this up to the time of purchase. You need to verify this as part of due diligence.

Hi Sir, is the disclaimer, “as is where is basis” pertains only to foreclosed property? Or it is also applicable to a propert which was purchased during pre-selling? Thanks!

Hi Lotzkie. For pre-selling properties, reputable developers usually offer at least 1-year warranty against defects, etc. My suggestion is to clarify this with the developer in writing.

Gud pm po, ask ko lang po kung halimbawa na nakabili ako ng foreclosed property tapos po may nakatira pa sa property na nabili ko, Sino po mag papaalis doon sa nakatira? Sana po masagot nyo, kc po talagang sinusubaybayan ko lagi ang mga list nyo ng foreclosed…please reply po, tnx in advance! 🙂

Good day sir.

Last 2010, nakabili po si mister ng townhouse sa taytay, rizal. Dahil po sa kagustuhan naming ma-relocate sa Visayas as soon as possible, nag desisyon syang iwan na lang ang bahay na iyon kahit wala pang nakakabili at sumulat sya sa bank na voluntary surrender na yung bahay na naka-mortgage. Kaya lang hindi naman po pala agad ibebenta ng bank yung property para i-compensate sa outstanding balance ng loan, hihintayin pang mag lapsed yung period para ma-forclose yung property. Ang tanong ko po, maaapektuhan po ba credit rating ng husband ko, di na po ba sya makaka-loan uli sa kahit na anong bank gaya ng home loan kahit kaya ng income?

Lagi po kaming updated magbayad ng amortization pati yung property tax, bago namin hindi bayaran last november 2014 yung amort ay nagvoluntary surrender na sya ng property at vacant na yung bahay..

Isa pa po, pwede nyo po ba kaming tulungan na maibenta yung property, naka pose na po sya sa internet pero wala pa ring buyer. in good condition at newly renovated po yung bahay, mas malaki kaysa sa bagong units and i can say mas maganda po dahil sa pinalitan ko po yung ilang fixtures sa kitchen and bathrooms, from steel window without screen, pinalitan ko to analok sliding window with screen and secured with gate na yung bahay.

Maraming salamat po sa pagbabahagi ng mga kaalaman ninyo sa real estate! More power!

Good evening po!

We bought a lot auctioned by unionbank which was mortgaged by the previous owner of the subdivision. The lot is where the water reservoir and its pump are being located. We bought it at “as is where is” basis.

Our problem is we are being intimidated by the residents already in the area claiming the water system as still owned by the subdivision.

We’re planning to take control of the water distribution thereat and also plan a water refilling station. Can we claim it as part of the package and owning it? Do we have d legal rights to do so? Pls advise.

Hi sir jay! Just wanted to tell you that I always find it interesting and informative every blog you post. Thank you and more power! Btw, I’m one of the nervous examinees last March 17 and waiting for that “miraculous” result. Hehehe… 🙂

Sir, Good afternoon. lagi ko pong inaabangan ang inyong mga post at matanong ko lang po kung magkano ang pagtantiya sa winning bid ng isang property kung ang minimum bid ng bangko ay 1 million pesos? salamat po.

Hi Tonie, salamat! Depende kung may ibang bidder for the same property. Pag may ibang bidder, usually tumataas ng a few hundred thousand pesos, although very rare nakakita na ako ng halos nag double ang winning bid. Pinaka common, walang ibang bidder, so ang minimum bid price at winning bid ay the same. FYI, lahat ng winning bids ko ay same as minimum bid price. 🙂

Sir Jay, Thank very much your generous and helpful reply. Your website is so helpful.

More, more blessings to you and your entire family.

what does this mean, can the bank clear this. we are interested in buying this REMARKS: Documentation – With annotation of Sec. 4 Rule 74. No TD under MBTC.; Physical – With possession, posted with caretaker.; Legal – With pending case as of 10.20.11, (1) Declaration of Nullity of the Amendment of REM and Foreclosure Proceedings, Reconveyance, Damages and Attorney’s Fees. -Amado A. Cipriano vs MBTC, et. al. Civil Case #CV-371-MN, RTC Malabon City, Br. 74, status: Bank’s answer has been filed on 6.28.11 (2) Falsification and use of Falsified Docs. Under Article 171 & 172 of the revised Penal Code – Amado A. Cipriano vs Enrique Santos, et.al, NPC Docket #XV-10-INV-11H-00470, Office of the City Prosecutor Malabon City, status: complaint-affidavit filed.

What I understand is that the bank has possession, and there is an extrajudicial among heirs. is it safe to buy this. or have to wait until a supreme court decision on the case.

Good day!

I am wondering what is the maximum number of years a government could impose arrears on a real property. I have a friend who failed to pay his real estate taxes for about 12 years now and the assessor is asking him to pay Php 250,000.00 to settle his obligations. Is there a way for him to avail a discount? This is such a huge amount. Hope you can help us in this.

Thank you so much and more power

Hello goodevening sir,

I would like to make an inquiry regarding the possibility of buying properties. Is it legit that I buy the properties in behalf of my husband who is residing in Canada–also a Citizen, (borne and worked there for years) even if he is the only one who works and I on the other hand is currently unemployed and have never experienced working? Or do I need to pass requirements to the bank such as income tax returns, etc? please do reply to my inquiry so i can have more knowledge about this kind of investment. thank you so much. will be waiting for your response.

Hi Crisel, I believe you cannot buy properties on behalf of your husband, you will have to buy properties as spouses, which is perfectly legal. As spouses, you will have to pass the bank’s requirements as spouses, and it is okay if only your husband is working at the moment. Of course, since your husband is abroad, you would need a Special Power of Attorney or SPA that is duly consularized in order for you to sign contracts/documents on his behalf. I hope this helps, cheers!

Good Morning. I just want to ask why the Quezon City Hall is denying payment of Real Property Tax for properties acquired through auction from Union Bank. The properties in question are still under the name of International Exchange Bank which was acquired through merger by Union Bank.

Hi Cesar, did the people from Quezon City Hall give any reasons why they do not want to accept RPT payments? I suggest you coordinate this with the bank where you bought the property from, I believe they would be able to assist you.

hello sir, I am very much interested to invest in foreclosures but I don’t know how to go about this? should i go through this thru a real state broker or I can go through this by myself?

Pls. help. Thanks.

Hi, I just want to ask regarding a property I bought that was foreclosed. I bought a unit at ga skysuites. As you already know I think the said property was foreclosured by RCBC. They sent me a letter on how to claim the payments I’ve made directly to RCBC. I’ve made some payments to Globe Asiatique before it was acquired by the bank. Can I get the payments I made to Globe Asiatique?

Hi Ramon, I can only assume it would be very difficult toe get a refund from Globe Asiatique considering their current situation.

I know it will be difficult to get the refund. Do you think that it is still possible? I am thinking of getting a legal advise for it’s not a small amount (more than 1 million). Thanks!

Frankly speaking, I can’t think of a way GA can give a refund because as far as I understand, they are already bankrupt. Even if you take legal action and win, they might not be able to pay anything. I’m really sorry about your purchase.

Hi po, we bought a lot in a subdivision in cavite which we didnt know (and we were not informed) na may lis pendins pala. Now, we’re asking for refund but the board says denied ang request namin. Can we take legal action against the developer? Thanks po.

Hi Carla, I highly suggest you check with the HLURB what legal action you can take. I believe they can help you with such cases with developers.

As mentioned on their website (https://hlurb.gov.ph/)

Saka po bago po nabili ang lupa na e check po ng family ko sa pinas sa RD sabi okey nman po at binigyan pa kmi ng certificate na walang problem ung lupa tpos ngaun biglang may kaso at naka name pa sa republika ng pilipinas…

Panu nangyari un means tanga ung nagwowork sa RD?

Pwede po malaman kung anong kaso ang nakasampa? Tsaka pwede rin po malaman kung paano siya naging property ng Republika ng Pilipinas? Baka naman undergoing expropriation yan ng gobyerno at hindi pinaalam ng seller, at habang hindi pa final eh hindi pa nareregister sa RD. Tapos biglang nafinalize pero nabenta na sa inyo.

Sir tanung ko lang po bakit po nagpapa bid ng lupa na ang nagmamay ari tlga ng lupa eh republika ng pilipinas?

Kawawa nman po ung nakabili ng lupa na di mapapatayuan ng bahay kasi may kaso pa pala…

Lumapit na po kami sa lawyer at tinatanung kong anu pede gwin nmin pra maibalik ung full payment nmin sa lupa.. at kung anu pedeng kaso ang e pa file sa knila sa ganitong company…

Kokontak na rin po ang mother ko sa media pra malaman ang lokohan na nangyayari sa ganitong company…

Thank u po..

Janice

Good afternoon Ms. Janice, one scenario that comes to mind is as follows: The property has arrears in real property taxes and was later foreclosed by the local government, without the knowledge of the buyer. Can you please confirm if this was how it became a property of the Republic of the Philippines?

Otherwise, it might be a syndicate who sells land owned by the government. It would be a good idea to bring this to the attention of the media to put an end to their scam.

Q May inalok pong lupa sa amin parang interested po kmi binigay na po xerox copy ng tct pero wala po syang authorization binigay sa akin para mkakuha ako ng certified true copy ano po bang dapat kong gawin para makakuha ako ng certified true copy help naman po at saan ako dapat pumunta LRA Q.C.po iyung property .hindi po ito foreclossed. Thanks if you can refly me asap ….