Have you ever tried calling up a bank to inquire about a foreclosed property that interests you and actually forgot some of the questions you were supposed to ask? Don’t worry, you can use my list of questions to guide you.

I’ve been there and I know how it feels. You call, ask some questions, say thanks, hang up, only to realize you forgot to ask a number of important questions. And you’re too embarrassed to make another call. However, there is a solution for this.

All you need is practice and a ready set of questions that can serve as your script so you can ask questions like a seasoned real estate investor.

Let me explain with the video below

Video: 31 “Must Ask” Questions before you buy a foreclosed property (overview)

Now that you know how to use these questions, you can proceed to the 31 questions below:

31 Questions you need to ask before buying a foreclosed property…

- What are the payment terms? You need to find out what’s the minimum down payment, how long are the payment terms, interest rates, and whether the interest rates are fixed, and the monthly amortization.

- Can you give details about the property like the exact address, type of property (single detached, town house, multi-door apartment etc.) number of bedrooms, toilet and bath, parking slots, etc? You can confirm all of these when you visit the property (check the location for other properties for sale to see if it really is cheaper). Read: Are foreclosed properties cheaper in the Philippines

- Can I buy the property without the need to go through a public auction? This is an offshoot of my experience with pre-auction bids.

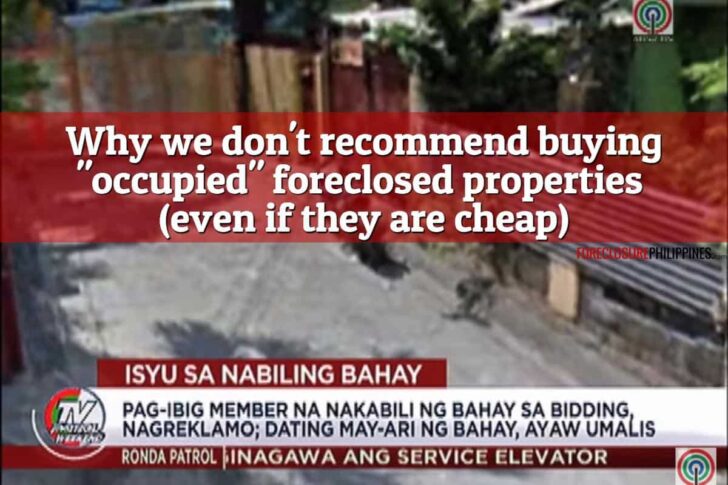

- Is the foreclosed property occupied? Read: Why we don’t recommend buying occupied foreclosed properties (even if they are cheap)

- If there are occupants, have they already agreed in writing that they are leaving the property by the time it gets sold? If not, move on to your next property or say thank you and hang up. Trust me on this!

- If the occupants will be leaving, what is the buyer’s assurance? You need to determine if the seller will give back all the money you may have paid by then like your show money and down payment if in case the occupants don’t honor the agreement to leave.

- Does the property have a clean title?

- Can I have a copy of the Title?

- You will need this to get a certified true copy at the registry of deeds plus trace-back (a trace-back is the previous TCT or CCT which has been cancelled and replaced by the current one due to a transfer of ownership), including a copy of the mother title if the title is a CCT.

- When you get a certified true copy, check for any annotated mortgages, liens, encumbrances, adverse claims, etc. The new TCT/CCT should be clean while the trace-back would normally include the mortgage amount, which is what the bank needs to recover. Hint: This helps when deciding how much you are willing to pay when submitting an offer.

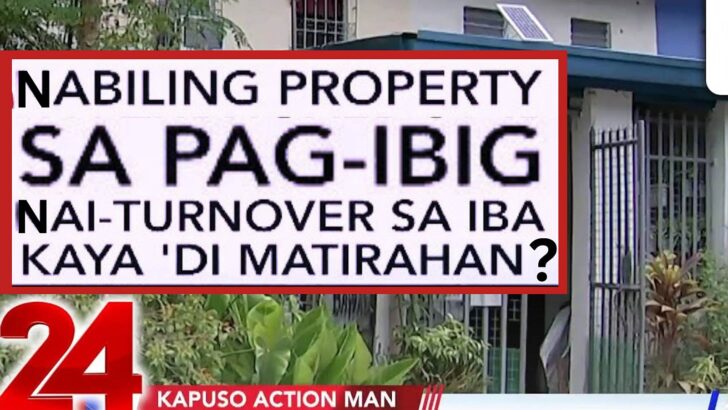

- If the title is still under the name of the previous owner, the bank is most probably still in the process of consolidating the title (examples: Buena Mano Yellow Tag and Red Tag Properties). For a more detailed explanation about title consolidation, read this: Pag-IBIG Acquired Assets: For Title Consolidation Meaning (Safe To Buy?)

- Who shoulders the Capital Gains Tax (CGT) or Creditable Withholding Tax (CWT)?

- If the buyer shall be shouldering the CGT or CWT, how much would it be? You should ask the bank or the seller to come up with the computation so that there will be no surprises and you can include this in your analysis. To learn more about CGT and CWT, you may want to read my previous posts about CGT and CWT.

- How much is the Documentary Stamp Tax? Ask for a computation and verify if it’s correct.

- How much is the annual real property tax and is it updated?

- Is the real property tax or amilyar updated? If not, who shall shoulder the updating of the real property tax up to the time you buy the property? Usually, real property taxes of foreclosed properties are left unpaid for a number of years resulting in a significant amount in arrears and penalties. It might even get included in a tax delinquent property auction. Normally the seller does the updating to avoid these, but you should verify this. To learn more about real property tax or amilyar, read this: Amilyar in the Philippines: A Simple Guide to Real Property Taxes

- Are there any other taxes applicable to the purchase of the property like VAT, etc? If yes, how much? Again, you should avoid any surprises that could eat up all your profits and could even result in a loss for you.

- If the property you are looking at is a condo, are there any arrears in the monthly dues?

- If there any arrears in monthly dues, who shoulders the updating?

- How much are the monthly dues per square meter of floor area and how much per month in total? This is essential for you to check how the property compares to other similar properties (is it cheap or expensive compared to others?). You can actually use these info to calculate the After Repair Value or ARV, which is a future market value of the property.

- For properties in subdivisions or villages, Are there any arrears in the homeowners’ association dues and who shoulders this?

- Aside from homeowners’ association dues, are there any other expenses you will have to pay and how much?

- Are there any arrears for utilities like water/electricity?

- If there are arrears for utilities like water/electricity, who shall shoulder the updating of the arrears?

- Are there service entrances for electricity/water connections for the property to begin with?

- If electricity/water connections are not available, How much would it normally cost for a connection to become available for your property?

- If electricity/water connections are available, how much would a reconnection cost?

- When shall the buyer be given authority to renovate the property or take control of it? The earlier you can renovate a property and have it ready for occupancy so it can be sold or leased, the better. Some banks give control of the property once the Contract-To-Sell (CTS) has been finalized or when the title has been transferred to the name of the buyer in case bank financing is through a mortgage.

- How much can I have the property rented out or what are the rentals for comparable properties in the same area?

- How old is the property? Of course a newer property is more desirable but an old property that is in good shape could also indicate a high build quality that could mean the property is built to last.

- What is the condition of the property? You need to find out early on if major repairs are needed.

- Is the property accessible? You can also ask for a copy of the vicinity map and directions.

- Are there any schools, churches, markets, hospitals, etc. nearby? You can verify this using the info you’ll get from question #29.

- Ask for any details about the property that may affect finding tenants or buyers, etc. For example, has there been a murder/suicide on the premises of the property, etc. I got this tip from my broker. She told me her experience in having difficulty selling one foreclosed property where someone had died and she swore she will avoid such cases in the future. I made sure that she was not talking about the property I got through her. =)

Why I am sharing this list of questions

This is the set of questions I use as part of my due diligence. I just added some more after reviewing my recent acquisition of a foreclosed property and noticed that I overlooked some of the details. I’m just lucky that things turned out okay for me.

I’m sharing this list so that it can help you avoid making the same mistake I did when I missed important property details, when it’s your turn to do your due diligence.

Tips when using this list

You can use this list of questions as is, or you may choose to add or remove questions to suit your needs, just print this and have it handy when you call the bank to inquire.

Don’t forget to take down the answers you get (so you won’t forget) and always ask questions while smiling so you’ll come across as friendly and build rapport.

Try to keep the conversation free flowing and the call should only take about 10 to 15 minutes.

Got anything to add?

I really believe this list of questions would be a big help especially to new real estate investors, I just wish I had a similar list when I was starting.

Do let me know if I may have left out anything by leaving a comment below so I may add it here.

Thanks!

Hi,

Paano po process kung yung property is under consolidation? Need ko po agad mag pay ng transfer tax? Paano pag di muna ako magbayad dahil hindi pa po consolidated ang title, mag kapenalty po ba ako?

Salamat.

Kung wala pa po yung deed of absolute sale between you and the seller, hindi pa po due yung transfer tax.

Hi Sir Jay,

salamat po. ask ko lang po kung anong document po and pipirmahan ko para katunayan na nabili ko na po ung property na under consolidation?

Nung nakabili ako ng foreclosed property na unconsolidated ang title, hindi naman ako humingi ng proof na unconsolidated siya, kasi nga, nung kumuha ako ng certified true copy nung titulo sa registry of deeds, tapos kita naman dun na nakapangalan pa sa previous owner. Yun na bale ang proof or katibayan ko na hindi pa consolidated.

Napa isip tuloy ako, technically pwede mag execute ng deed of sale kahit hindi consolidated, pero hindi pwede i-transfer ang ownership kasi sa ibang party pa nakapangalan ang titulo.

Pero kung may deed of sale na, yung deadline ng transfer tax ay 60 days from the notarization date of the deed of sale.

Yun ang ingatan niyo, hindi dapat mag execute ang seller ng deed of sale.

Foreclosed property po ba ito ng Pag-IBIG?

Salamat po sa paglinaw.

Sa bank po.

You’re welcome po!

Contract-to-sell po ba ang agreement niyo with the bank? Dapat po may nakalagay dun kung kelan at sino ang magbabayad ng taxes.

Good day, Sir Jay.

I watched one of your videos where you mentioned that as long as you have a down payment (DP) and funds for renovation, you can start investing. I’m planning to buy a foreclosed property and already have the budget for both the DP and renovation.

However, I’m concerned about flipping the property since it won’t be fully paid yet. My main concern is that when I sell it after the renovation, the buyer might question the Title, which will still list PAG-IBIG as the owner.

Would it still be possible to flip the property in this situation? I’d greatly appreciate your advice on how to handle this.

Thank you so much for your time.

Hi April,

Thanks for watching my video, much appreciated.

Kudos to you for saving capital for your first foreclosed property!

With regard to flipping a property from Pag-IBIG even if the it is not yet fully paid, here are my suggestions.

1. Fully disclose that the title is not yet under your name. Some buyers will get turned off and backout, while most are okay with this as long as you explain everything.

2. To flip a property at this stage (it is not yet under your name), you really have to transfer it under your name. What I have done before is I paid off the loan in advance so that I can get the title and proceed with the transfer under my name.

Good luck with your first property, I hope your everything goes smoothly!

Magandang araw po Sir Jay,

Pls educate me on this po – medyo di ko po kasi maintindihan na maski foreclosed property na siya ay masyado pa ring mataas ang indicated value. Pls explain further po because it looks like the basis is the prevailing market value whilst the property had been already partially paid by the owner of the foreclosed property. Bakit po hindi na lang balance amount ang ipakita sa minimum bid amount?

Good day po Ms. Neng,

Ganun na po kasi ang karamihan sa banks/sellers ng foreclosed properties, ang basehan ng selling price is the latest appraised value (based sa current market value).

Posible pa rin mangyari na based sa book value (malapit na po yan sa balance na hindi nabayaran ng previous owner), pero once may bagong appraisal, yun na ang gagamitin nila.

Thank you for sharing this vey precious list to us Sir Jay. May God bless you more abundantly than ever! And may He bless your health and your heart more too!

Hi Ms. Donna, you’re welocme and thank you also for the kind words. God bless you too!

Hi Good day, what is the meaning of unoccupied only in Pag ibig?

Hi Girly, it means as of the last time Pag-IBIG checked, the property has no illegal occupants. However, please take note that it is possible for properties classified as unoccupied actually have illegal occupants later, especially if the property has no caretakers from Pag-IBIG.

I have this same question. Thank you for making this list and for answering the questions in the comment section Mr. Jay Castillo. May God Bless you more abundantly than ever! And may He bless your health and your heart more!

Thanks again Ms. Donna!

Hello Sir Jay!

If the remarks for an acquired asset is “for title consolidation” does the new home owner needs to settle the title consolidation? Or is it the Pag-Ibig Fund who will process the title consolidation? Please advise. Thank you and God Bless!

Hi Jem,

Pag-IBIG will process the consolidation, but it can take a very long time as mentioned in the FAQ for Pag-IBIG foreclosed properties:

God bless you too!

thank you Sir Jay. Binasa ko from the start up to end, madali namang intindihin. SAVE ko po ito for future reference. Nag plaplano rin po kasi akong bumili ng foreclosed hours&lot kaya kumukuha kuha na po ako ng mga knowledges and ideas thru google, thanks GOD at nabasa ko itong sa inyo. Pahingi po ng

EXAMPLE ng Title Consolidated para po mas maintindihan ko yung term na yun.

Hi Joy, you’re welcome and salamat din for dropping by!

Eto example ng consolidated title, nakapangalan na sa bank na nag foreclose ng property:

salamat po uli. God bless you

Welcome and God Bless you too!

Hi Sir Jay, thank You for this, i would like to ask if it is ok to purchase a forclosed having Title for consolidation status,?

Thank You, More power 🙂

Hi Arvie, depends on the reason. If it’s just a matter if time (Title consolidation is ongoing), this is okay.

However, if the title remains for consolidation because the bank is looking for a document (or a document is missing) required for the title consolidation/transfer, be very careful before proceeding with the purchase because it can take years (based on our experience for one property we purchased). If you intend to keep the property for your own use for a long time and you don’t need to the title transferred under your name quickly, this is also okay. But if you are going to flip the property quickly, the delay can cause complications.

Could explain what is consolidated title?

Hi Josephine, consolidated title is the term the banks’ use to say that the property title has been transferred already and is under their name.

Sir gosto ko sana makabili ng mga forclouse property nyo ano po mga papers na kaylangan..

Hi Michael, hindi pa masyadong ginagamit escrow services dito sa pinas, kahit kami, hindi kami-nag-e-escrow. Ina-outsorce lang namin yung paglakad nung pag transfer ng titulo. Dati sa OMI (pag within Metro Manila nasa Php15K per transfer yung service fee nila), pero may bago na silang company, will feature it here pag nagstart na sila.

Hiwalay pa yung pag survey. Yung last relocation survey naim nung 2016, nasa 15K yung binayad namin sa geodetic engineer.

Sir Jay, kapag bumibili po ba kayo ng property. How do you handle the closing? Gumagamit po ba kayo ng escrow services or title company? Kung oo po, anong company po and how much ang service nila sa inyo kasama land survey (kung meron)? Salamat po!

Pingback: Are You Frustrated With Getting Foreclosed Property Details? Here's How To Do It...

Good Day Mr. Jay Castillo, your blogs is really very nice and informative I was considering buying foreclosed house and lots in our subdivision in the foreseen future hence I found the price of the house and lots too costly. Does the posted Selling Price of the house and lot can be bidded less 40% and be able to get it. Honestly, I am aware of the price of the house and lot since I am leaving in the same subdivision and the bank marked up by 1 Million Pesos from the original price (10 years ago) knowing that not much upgrading was done in the past. Kindly guide me on what will be the justifiable bid that I can submit to the bank that will allow me to win and be able to get my selected property. Thanks and God Bless. e-mail me please at luisgonzagal@yahoo.com

Hi Sir Jay,

Thank you very much for this, so informative and so helpful especially to people like me who is still learning about foreclosed properties. Like others, I hope you can also send me a copy of rent-to-own contract(Contract of Lease w/ Option to Purchase) my email add: armisaq@yahoo.com.

Hi Jay. Thank you for this very informative website, especially to beginners like me.

Can you guide me with wholesaling RE specifically on pre forclosure? What are the things not to do? Thanks in advanve. More blessings to you!

Hi Sir. Just wanna ask for some piece of advice. I am currently working for a landholding company selling foreclosed properties. Now for this instance, we have a landlocked property somewhere in the north. Luckily we got a serious buyer for the property. The buyer offered half of the Market Value and a quarter of the (assumed) Zonal Value. My question is:

1. What is the normal discount a seller can give to a buyer of a landlocked property?

2. The Zonal value that we assumed were for the properties along the highway. In our case, the property is behind a lot that is fronting the highway. Does a property being landlocked affect its Zonal Value?

Thank you and regards,

Nikko

Pingback: The importance of due diligence in real estate investing