This is the third part of a series on Managing Finances. If you have not read the first 2 parts, head on over to Part 1 and Part 2!

In part 2 of my series of posts on managing finances, I mentioned that I would be discussing more about how I tracked my expenses and the tools I used to do these. For now, I’ll just focus on how I track my expenses. This is not rocket science. I only need to record exactly where my money is going, particularly my cash on hand. Based on experience, this is where my money gets “lost”.

How many times have you wondered where your money went when it was still more than a week to go before payday?! Have you ever tried but failed to remember exactly where you spent your money? Get my point?!

Other expenses that are paid through a credit card, online banking, and through checks are easier to track because these transactions are automatically recorded and these are all written on the statement that arrives every month. However, I still do my best to record all of these daily simply because I want to make sure that the monthly statements I get are accurate.

My first tool – a pocket notebook

Believe it or not, I started tracking my expenses with a small notebook which I had in my pocket wherever I went. No, it was not a small laptop but a real notebook where I wrote down my expenses everyday. I then transferred the data to an excel sheet later in the day. I used to do this everyday but things went out of hand, literally, when I misplaced the small notebook. You can imagine the anguish I felt when I lost my notebook and I still have not transferred a couple of weeks’ worth of data to excel. This is the reason why I gave up using a small notebook to track my expenses.

Pocket Excel to the rescue

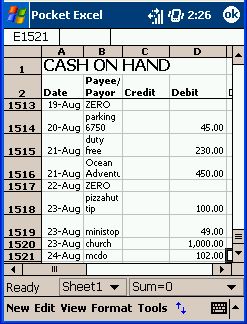

After I misplaced my pocket notebook, I decided to enter data directly to an excel sheet instead. Based on the the first entry on the excel sheet that I created for this purpose, I started doing this last August 22, 2007 and I have been doing this up to present day. You would think that this was very tedious because this meant that I had to be in front a computer everyday to do this right? Wrong! I didn’t have to. It just so happened that my sister had lent me her O2 XDA IIs when I accidentally crushed my Nokia 6280 in a moment of stupidity when I sat on it. Lo and behold, I now had a phone that had pocket excel. I copied the excel file from my desktop to my PDA. I have attached a printscreen of the excel sheet below. Ayos ba?! (Isn’t it nice?!)

Since I carry my PDA phone anywhere with me, I can input my expenses whenever I get the chance to do so. I can record money that goes into my pocket (the credits) and out of my pocket (the debits). As you can see on the printscreen above, the excel sheet I created simply includes the date, payee or payor, credit, and debit, and remarks (not visible on the printscreen).

Sometimes I would have to enter rough estimates of expenses if I forgot the exact amounts. I can later double check the amounts from all the receipts that I keep. By the way, I do throw away all those receipts once I transfer the data from pocket excel into MS Money. I see no point in keeping receipts, unless of course I would need them either for reimbursement purposes at the office, or for warranty. I’ll discuss more about MS Money in future posts about managing finances. By the way, I’m quite sure most new phones nowadays would have something similar to pocket excel and some like the iPhone would even have iPhone apps very similar to MS Money.

Why bother to track expenses?

It is quite obvious that it takes a lot of effort for me to track my expenses (though nowadays it takes just about 10 minutes a day). Why do I bother doing something which some would consider to be tedious and time-consuming? I do it simply because I want to show to the Universe that I am really managing my money and I intend to “win the money game” – a term I often hear when I listen to T Harv Eker.

I don’t track my expenses just to know where my money is going, I do it to ensure that the right percentages go to my “money jars” as discussed in my previous post. Before I even decided to track my expenses, I had already decided how much of my money was to go to my FFA, LTSS, Play, Tithe, Education, and Expenses accounts. Without this, tracking my expenses would be nothing but a waste of time. I also believe in the saying that “You cannot manage what you cannot measure”. When I see myself approaching the maximum amount for Expenses for example, I can adjust accordingly by stopping myself from spending more. By tracking my expenses, I help ensure that I am managing my money in such a way that I will definitely win the money game, get out of the rat-race, and become financially free!

It’s your turn

Still think you have no money to invest in foreclosed real estate? If I haven’t made it clear enough, you are supposed to build your FFA account and use it to finance your first real estate deal. The following is a summary of the steps you need to take:

- Commit that you want to manage your finances and act based on your decision. If you don’t act, you’re just dreaming.

- Decide the percentages you are to put in your money jars. I forgot to mention that these are flexible. It really is up to you.

- Start tracking your expenses and manage your money. Do you think you’ve got what it takes to handle the first 30 days?!

- Build your FFA until it can already finance your first real estate deal!

Conclusion

This post got delayed because I was pressuring myself to come up with a final post on managing finances that contained everything I wanted to say about the subject with the thought that once part 3 was published, it’s over and done with. However, I realized that this would not be right. Managing one’s finances is so big so I really can’t just condense all of it in just 3 posts. This simply means that this is not the end of it and I will continue to write about managing one’s finances as I have barely scratched the surface. Topics that come to mind: How I got out of credit card debt, How to finance your first real estate deal, managing personal finances resources in the Philippines, etc…

Please share your thoughts on this as I also appreciate all of your inputs! Thanks!

If you have not yet read the first 2 parts of this series, head on over to Part 1 and Part 2!

—–

To our financial freedom!

Jay Castillo

Real Estate Investor

Real Estate Broker License #: 20056

Blog: https://www.foreclosurephilippines.com

Social Network: http://foreclosurephilippines.ning.com

Mobile: +639178843882

E-mail: [email protected]

Text by Jay Castillo. Copyright © 2009 All rights reserved.

P.S. – If you are a new visitor, please start here to learn more about foreclosure investing in the Philippines.

Pingback: With Online Credit Card Payments, Real Estate Transactions Just Got Easier

thanks for this! two months ago i started tracking my finances but im not rly sure what my goal is i just wanna see where the money i got (~350k) since january this year went! but ill try the money jars and percentages and see how this works out. good thing im still single so a huge chunk of my salary and bonuses can be put to FFA where i currently invest in d stock market for over a year now. =)

Nice one Anna, congratulations!

Pingback: 4 Reasons Why We Need To Be Financially Literate Real Estate Investors

Ako i just write my expenses in a paper tucked in my wallet. Just like you sir, even tha parking expenses and other small ones get listed here. I just dont want to feel that after a day, i dont have money anymore and im wondering where all of it went

Great Jay! very informative. I’ll read all your article. Im inspired! whew. Many thanks.

This website is excellent very informative for anyone planning buying foreclose properties… Well Done!!!

jay,

thanks for this wonderful site, i read this everychance i have as i worked nights here in ireland, i am overwhelmed with all the information but half of the knowledge about saving i’ve done it already, all i need to know is how to apply the investing knowledge in real time. I have saved a few quid for deposit, i would like to purchase a property an apartment actually where I could make some passive income because i want to retire in 10 years time, I am still saving right now and i am torn between investing my money in mutual funds or property.

As i can’t manage the property personally right now i think mutual funds will be best for me at the moment but if i could depend on somebody for proper direction like you hope i could find the right property. i want a4 or 5 door apartment in novaliches specially in regalado, or in binan or sta. rosa if there are something like that i could buy in the future pls. advise. thank you and more power.

Hi Malourdes, you’re welcome and thank you for sharing! Mutual funds would be okay as long as you can unload your money when the need arises with very little deductions. I also invested in mutual funds where the management fees, etc, were frontloaded and when it came to a point for me to unload some of it for property investing, there was no longer any additional deductions.

My team mates would be happy to assist you in finding properties in the areas you mentioned…

Pingback: Manage your finances by becoming your own Chief Financial Officer

Hi Jay;

Im really glad to see someone who has thread the path that I am taking now towards financial freedom. I was pleasantly surprised to see that we are very very similar in how we started. All of your things that you wrote are the what I am doing now and similarly, the Kiyosaki series has changed my life significantly

I would like to meet you one day coz I am on the look for someone to talk to solidify the path that I am taking and have someone to share my best practices and learn from.

Thanks again for sharing your knowledge with us. I will be looking forward to meeting you.

Benny Benitez

Hi Benny, I’m always glad to find people who are also on the road to financial freedom! It would be an honor to meeting you one of these days. Please text or e-mail me so we can schedule it. Thanks!

I will definitely contact you Jay. Im really excited to show you the progress of my 2 year old excel file that basically is my financial bible now. Lets share best practices.

Thanks again Jay

You’re welcome Benny. I’m a little bit sad because after Ondoy I have not been able to track my spendings at all. It’s been a month already so I guess there are things which I won’t be able to recall anymore. Oh well, I’ll just classify all those missing expenses as Ondoy related. 🙂

Hi Jay. Your posts are very informative. I’ve started reading though pages on real estate investments (and I’m seriously looking into getting into one). Thank you so much for sharing your tips, thoughts and experiences.

In tracking cashflow, yes..I should seriously be working on this =) thanks again.

Well said and done.

Hi Jay! Great post you got here. MS Money works really well with me. Not only do I get to track my expenses, I also get to track how my investments are doing, including the pre-selling property that my fiance and I recently acquired. Thanks for the great read. Makes me want to write a similar post. 🙂

And BTW, I’ve tried a lot of those iPhone apps that are similar to MS Money. But so far, no app can beat MS Money yet. Hopefully someday, I will be able to develop an iPhone app that works exactly like MS Money.

Thanks for sharing, I guess it would take time for someone to come up with an app that can have all the features of MS Money. But who knows, maybe that can come sooner than we expect. Still thinking of getting an iPhone to replace my 4 year old XDA that has a broken LCD, or just having the XDA fixed. 🙂

Thanks for dropping by! You have a cool blog by the way!

Hi SoNn, thanks for the compliment! Wow, nice to know you and your fiance already have an investment, that’s the way to do it! I also track the cashflow of my properties in MS Money, MS Money rocks!

Pingback: To all OFW’s: Need To Earn Passive Income And Come Back Home For Good? Try Foreclosed Property Investing!

THANKS TUKAYO FOR SHARING YOUR IDEAS AND EXPERIENCES, REALLY LEARNING A LOT FROM THESE BLOG ENTRIES.

BY the way, i just enrolled Trace mentoring program last July 2009, and has since closed 2 deals in July 25 and Aug 14,2009. I operate here in Calamba & Los Bnos Laguna

Already find serious buyers for these 2 prop and expected to be sold& assign rights this month of Sept 2009. Trace advised me to seek lawyer’s advice in preparing the deed of sale and deed of assignment of right to the new buyer. I talked to 1 lawyer i know and asked for standard format for this type of real estate transactions.

My questions/ requests are:

Do you have a standard contracts you’re using in the deed of sale and deed of assignment of rights?

In the deed of sale, should my name and the new buyer’s name appear as principal buyers? Then I execute a deed of assigment of rights in favor of the new buyer to get my profit?

pls advise the steps to follow after finding buyers of wholesale deals, and may ask for a sample contracts you’re using.

Jay Villar

1) in closing Do you have a “Deed of Sale contract” standard format to be used in

Hi.. are you wholesaling houses??? can you mentor me??

Hi Jay! You’re welcome and thanks! Wow, 2 deals in 2 months, that’s excellent! For deed of sale, you can get a copy here: http://legal-forms.philsite.net/deed-of-sale.htm. Unfortunately, I don’t have a template for deed of assignment of rights yet.

I believe I have heard of a similar technique done in the US during an in interview conducted by Preston Ely with one of his friends. The investor and the buyer are on the deed of sale then after the deal is closed, the investor executes a waiver of rights(not a deed of assignment) and he just collects his profit. I’m not sure if the same technique can be done here though. If you will be using a deed of assignment, I believe you first need to have your “Exclusive option to purchase” accepted by the seller then you assign it to the buyer. Once the buyer pays, the seller gives you your markup.

Better consult this with an experienced lawyer that focuses on real estate. Good luck!

Hi Jay,

Thanks for sharing you steps in managing money. Hmmm..what was that 1,000 for the church? Is that a philantrophy? Wow, that’s so impressive.

Yes I agree that commitmment is vital for achieving any goal. We should be committed not only to our goals or destinations but also to our procedures / actions and to walk the road to our destinations.

Hi Vic, you’re welcome. The 1K is my tithe, just giving back and sharing blessings. =)

Thanks for dropping by!

Hi Jay! Mine is through a program called SplashMoney that can be downloaded to a PDA (mine is a Palm Treo) for a fee ($39, I think). It has graphs and pie charts but I suffer anxiety attacks whenever I look at the graphs because almost always, the big chunk would be on fun expenses (guilty!). But I call that a good anxiety attack because it gets me on the proper perspective, which, in turn, gets me back on the right track. What you focus on expands, says one author. And if you focus on money, well, get ready for a big payout. 🙂 More power to you and your blog!

Hi Issa, thanks for sharing, sounds like Splashmoney is a very robust application. It means you can input data directly and there is no need to use excel and transfer to MS Money right? Even though its not free, I think it’s still a bargain! I’m currently looking for a replacement for my XDA due to a cracked LCD screen as the cost for repair(about 3K) is not justified because I can buy a second hand O2 XDA for about 6K at tipidcp.com

I’m also thinking of finding a second hand and cheap iPhone, so I can choose to use similar iPhone apps.

“What you focus on expands”… a lot of books say this and this and I totally agree! Fun expenses are okay, just keep it within 10% of your income every month. =)

Thanks and the same goes for your blog as well!

Well said and done. Thank you for sharing and keep it coming… I’m looking forward how you get of the trap in credit card, which I think is the biggest problem of this day.

Hi Earth, Thanks! Yes, please watch for that post. I’ll share how I got out of credit card debt(this was just before I got married), and how I should have done it( I learned of a better way from the audio book of John Burley and Robert Kiyosaki… forgot the title but I listened to it about a year ago.

Hi Jay, I just would like to share my own way of tracking my expenses. I pay myself first by slashing a huge percentage of my net income. Of course, that’s by using the equation INCOME – SAVINGS = EXPENSES.

After slashing it, then I now have the money to be budgeted for expenses which can be transportation, food, entertainment, etc.

I don’t really itemize where my money goes as long as I can keep track of that huge percentage cut of my net income that goes to savings. 🙂

I think that’s the benefit of being single. Definitely, I think I cannot do it anymore when time comes for me to have my own family. 🙂

Hi Tyrone, yes, that’s the equation in effect when you choose to pay yourself first. I forgot to mention that when using the “money jars” approach, one should pay himself first. I was no longer able to discuss it in this post as it has already become too long. =)

By the way, when you already have a family, you have all the more reason to do this so I’m sure you can still do it when that time comes.

Hi Jay!

Quite a long time since our meeting. Thanks for sharing this strategy! I do this also using my Blackberry but only in notes. I input it again in an excel file I programmed. Hassle!:) But it helps me a lot to know how much I spend and where the bulk of the expenses come from. Like during Christmas, gifts ang lumalaki…

Thanks again!

Investment Opportunities for Pinoys

http://www.investingpinoy.blogspot.com

That’s great Bryan! Oo nga, Christmas is just around the corner, “ber” months na.

You’re welcome. =)

hi jay, does this mean that the 100% breakdown in your excel (above) is already net of paying yourself? how many % is recommended as “paying yourself”? and how is “paying yourself” different from “play”? sorry i have so many questions!

this is just so exciting, the road to financial freedom! thanks!

Sir Jay,

What do we do until we have saved up enough for our FFA? What if there is a great deal that I found but my FFA is not yet enough to finance it? Is it advisable to borrow?

I’m just starting on the money jars and still learning how to look at foreclosures so it’s just a hypothetical question. 🙂

Thank you!

Hi John, no need for “Sir” hehe. If while waiting for your FFA to be enough and you find a great deal, borrowing or using “Other People’s Money” (OPM) would be okay as long as the deal makes sense even if you consider the loan repayment+interest. OPM can be from banks, credit cards(yes this is possible but not recommended), or other passive investors. You basically just need to borrow enough money to cover the downpayment, repairs, taxes and closing costs, and holding costs while the property is yet to be sold.

Just make sure that if you decide to borrow money from other investors, make sure that both you and the investors are protected by a well written contract. If you can borrow from relatives, that would be better as there would be less complications.

Another option that comes to mind would be to “wholesale” the deal meaning you sell the rights or assign the deal to another investor for a fee so that he/she can take over and do the deal. In the US, they are doing this but in the Philippines, I am still learning how this can be done.

“you cannot track what you cannot measure” sums it up.

Will do this now na. Thanks a lot, Jay! 🙂

Hi Dinah, you’re welcome. I wish you a healthy positive cashflow! =)

Hi Jay!

I appreciate you coming up with these posts. Since me & my wife are looking for ways to become financially free. It has helped open our eyes and made us realize we spend more than what we earn. I am now in the process of consolidating all our expenses in an excel file from Jan 09 to present. To also give me an idea where I can cut on cost and at the same time increase income. I find it quite tedious, but rewarding. Knowledge is indeed power! :)Good luck and will be watching out for more of your valuable insights.

Hi Franz, glad to be of help. I believe you are even more committed than me when I started because I only tracked my expenses on the same month I decided to do this, in contrast you are doing it even for the past months starting from January 09 which is commendable! I wish you all the best!