We all know that real estate investors are anxious about whether the Philippines will soon have a popped real estate bubble, similar to that which happened in the US. This has also crossed my mind lots of times, and I’m glad to see someone is trying to do something to address this. But before that, let me share some of my observations.

We all know that real estate investors are anxious about whether the Philippines will soon have a popped real estate bubble, similar to that which happened in the US. This has also crossed my mind lots of times, and I’m glad to see someone is trying to do something to address this. But before that, let me share some of my observations.

I noticed that there are a lot of condominiums and developments in the pre-selling stage now, and the prices are not within the reach of the average Philippine-based Filipino worker. Sometimes even I wonder whether there are really people who will be able to pay for those units. Are those units not overpriced?

If there is an asset price bubble, the market will naturally correct itself eventually. No one wants to be left holding a property that is worth much less than what you bought it for.

In the past, the possibility of a Philippine real estate bubble was discussed by Ms. Angie Espiritu in her guest post which aims to answer the question Will there be a real estate bubble in the Philippines? Her main reasons for concluding that there will not be a real estate bubble in the Philippines is that banks are stricter in granting loans, and that buyers are mostly end-users who pay their monthly amortizations regularly because it’s for their home. Under those circumstances, I agree that a real estate bubble may be unlikely.

However, there may be an area where an asset price bubble may arise, and that area involves in-house financing. This was discussed in a recent yahoo news article, and the Bangko Sentral ng Pilipinas (BSP) is currently formulating policies to monitor in-house financing schemes.

In-house financing schemes

It is quite common nowadays that developers offer easy payment terms for the downpayment, for example, as low as 10% over 36 months, and then afterwards they offer in-house financing at very high rates for those who do not qualify for bank loans. If the buyers do not qualify for bank loans, it is very likely that they will not be able to afford the monthly payments since the in-housing financing interest rates are very high.

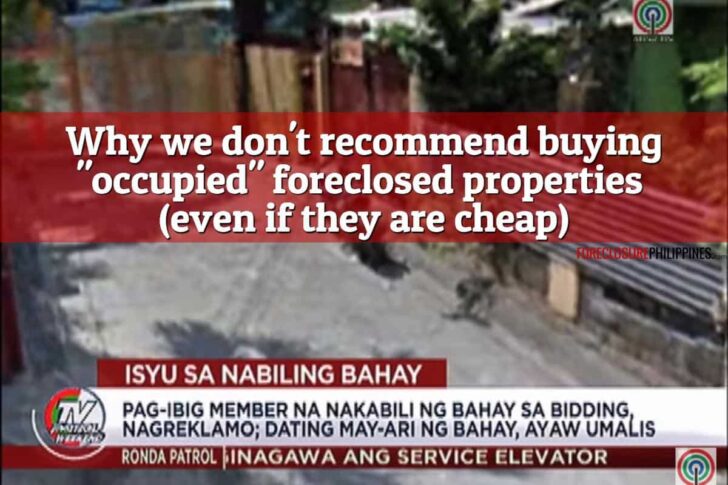

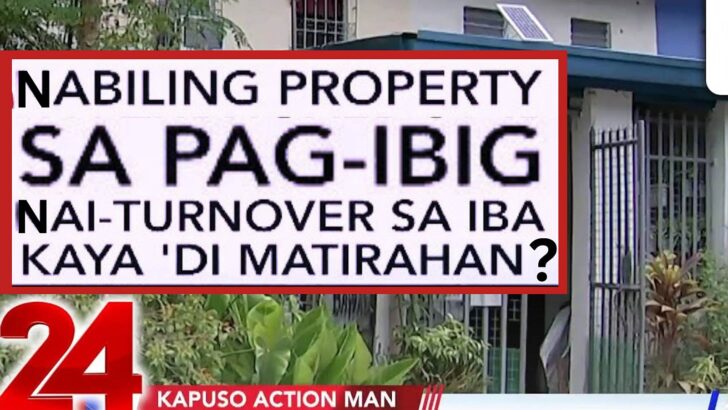

This may involve a case where the buyer was encouraged to engage in some speculation, thinking that by the time the condominium or property is ready for occupancy, the value would have increased significantly and the property may already be sold at a profit at that point. Sadly, there are instances when the property is not sold and the buyer’s previous payments are forfeited and the developer repossesses the property.

Even if the other buyers are able to pay for their own units, when there are several other units left unsold, the market will self-correct and the price of the units may end up being lower than what the legitimate buyers originally paid for it.

You may say that a lot of the buyers are OFW’s who are investors who have more than enough capability to pay the monthly amortization under the in-house financing schemes. But of course there may be unavoidable and unanticipated instances when the money for the amortization needs to be used for another purpose, or the job is suddenly lost and he is unable to pay (this applies equally to Philippine-based buyers of course).

It may be also that they were encouraged to buy with the expectation that when the building is ready for occupancy, it may be leased out at a rate more than the amortization, and unfortunately the projections are not met. While of course no one should think negatively, it may be good to have prudent and conservative forecasts to avoid the situation earlier described, where the market price effectively goes lower.

Note too that when there are several units which are taken back by the developer, and the developer in turn is unable to pay its loan to the bank, the bank may likewise be unable to be liquid enough to serve the needs of its depositors and thus fold up in the case of a bank run.

BSP takes proactive stance versus a real estate bubble

Considering the above unfavorable possibilities, I commend the BSP for being proactive in safeguarding the stability of our economy. Hopefully, the sellers will price their products competitively and reasonably considering its true value, and buyers will not be swayed into buying a property which they really can’t afford, and the Philippine economy remains stable in both the short and long run.

*This post is my simple understanding of the situation, please let me know your thoughts. I am not an economist and I don’t even particularly like economics.

~~~

To our success and financial freedom!

Cherry Vi M. Saldua-Castillo

Real Estate Broker, Lawyer, and CPA

PRC Real Estate Broker License No. 3187

PRC CPA License No. 0102054

Roll of Attorneys No. 55239

Text by Jay Castillo and Cherry Castillo. Copyright © 2008 – 2012 All rights reserved.

Full disclosure: Nothing to disclose.

Hi Jay, great article. Would you know the index tied to variable rate loans? Anf furthermore what the banks use here? I was mortgage lending in the US and we used these popular indices. the prime lending rate, the one-year constant maturity treasury (CMT) value, the one-month, six-month and 12-month LIBORs, as well as the MTA index, which is a 12-month moving average of the one-year CMT index. What do Philippine banks use?

Thank you!

James

What the BSP is doing is good for our real estate industry. Every potential investor, may it be local or foreign should benefit from it. And with due respect to some developers, some have priced their spaces quite fairly. I don’t want to sound biased since I am a property investment consultant from AyalaLand but I have compared our price from other developers and I must say, Juan is really getting value for his buck. Even if we check the pricing and value through BIR’s Zonal Value table, it’s right there – dead on. And since we (the Philippines) are now rated as Investment Grade, we are expecting huge influx of foreign investors, property seekers and even domestic buyers. The government, specifically the Bangko Sentral should closely monitor and safeguard our economy.

Read more about BSP’s stance on this particular topic:

http://business.inquirer.net/118271/bsp-tightens-watch-on-property-loans

God Bless Us All

I think for me, the developers are abusive towards Filipinos since it’s obviously that they’re main target is not the regular intelligent Juan Dela Cruz who works in the Philippines, but to those who don’t have an idea in real estate industry but earning more, which are OFW. We are the only country where the residents cannot even afford to buy our house in our own native land, or can’t even foot a downpayment if you’re just a regular employee. Come to think of it, why do we have a same amount of price of house regardless where you live in the Philippines. As it said, a good location is more costly than a mountain. But in our country, a lot in Manila and a lot in Sulu are pretty much on the same price. These developers put up their own value and we dont have appraiser, nor insurance to check on our building. I guess, it’s not yet the right time to buy houses, since all developers are opt for competition. I’ll just wait until all of the people can’t afford their houses, developers can’t pay their loan, and start bargaining the houses directly from the bank, and ditch those middleman that adds burden to our pockets.

Hi Arianne,

I am trying to understand your context. It appears to me that you are not buying estates during your lifetime?

“…a lot in Manila and a lot in Sulu are pretty much on the same price…”

Sorry but I don’t believe this. In Sta Ana Manila for example, there are vacant lots for sale at Php15K/sqm. We don’t have to go as far as Sulu, let’s take Bulacan for example, there are vacant lots for sale for less than Php5,000/sqm and agricultural lots can even go at Php1,000/sqm. Price per square meter all over the country are very different.

Hi, im a real estate agent. We’re promoting the Trump Tower Manila and The Milano by Versace Home. Any advices?

Trump is very costly, and if you can’t afford your unit, and wants to sell it back to Trump organization, they buy it back at 75% off from the market price. That’s the way he dealt, and he admits he was guilty about it.

Did you mean he admitted that rich people are generous?

In giving to charity, yes…but in buying real estates, he wants everything on bargain. So, it’s up to the owner if he wants it to sell back to Trump Organization at 75%off.

I couldn’t agree more Cherry ^^

QE3 will give a lot of money to the current holders of MBS (Mortgage Backed Securities), those banks (mainly) will move the money to assets with better perspectives, that was the BRICS before, not anymore, I think they are looking to the next ones… Philippines included in the list.

The goal of US is to devaluate the USD, but at the moment they were not successful doing it, as the USD is seen as a safe heaven in difficult times.

US is on the way to recovery with low unemployment, inflation won’t come in US with low employment, but it might come in other countries, and real state is a good protection against inflation, gold is already quite expensive and it doesn’t produce any rent.

I think that the bubble in real state has a long way to continue if the government doesn’t stop it.

Are the prices to high in Philippines? It is difficult to see… there are a lot more of people in the new middle class that can afford expensive condos, is it there plenty of credit to sustent the growth in prices? I doubt it, is it there a lot of foreign investment? I doubt it… then is real money being poured into the real state market, right?

Sorry I missed reading your comment Dalamar. Care to comment on my new post on the Philippine Property Outlook for 2013?

Best regards,

Cherry

I think,real state bubble will come soon. Just few weeks ago. FED anounced QE3 this means they will print $40B a month of fiat currency to the infinity until they written all the depts and reset the economy.

just thinking aloud..

Hi giant,

Thank you for your comment. I checked out what you said and read this:

http://money.cnn.com/2012/09/13/news/economy/federal-reserve-qe3/index.html

Interestingly, it said that it may actually good for the housing market:

“That said, it’s possible the Fed’s move could help the housing market slightly. New construction and home prices have already started picking up recently, and should mortgage rates fall further, that could fuel a quicker housing recovery.”

Another effect of the currency debasement is increase in the prices of gold, silver, and other precious metals:

http://www.businessinsider.com/fed-currency-debasement-3-qe3-sees-gold-and-silver-surge-2-and-43-2012-9

If the value of the dollar will be much lower because of this, it dawned on me that the BSP was already anticipating this when it lent the Philippines’ $1B in dollar reserves to “lock in” its value and ensure that it will be earning interest for the country. So I think the BSP really has the country’s interests at heart.

I hope an economist drops by and helps us analyze the effects of these announcements on the Philippine economy and real estate industry.

Best regards,

Cherry

This is terrible news for an aspiring Real Estate Entrepreneur, But its good to see my countries Financial Leaders are taking action and avoiding what happened to U.S.

God Bless the World, specially Philippines and Japan.

For me this is welcome news as they are planning to do something even BEFORE the bubble happens. However, it remains to be seen if the bubble can really be prevented by the BSP, if it is indeed coming.

Dear Kevin,

I actually think this is good news. The Philippines is doing very well. It’s always good to have safety nets.

Best regards,

Cherry

I would say that 2 million pesos is affordable for a OFW or for the new middle class in Manila, now there are a few people with business and good salaries and those people are more and more… of course the are only a small percentage of the population, but Manila is a huge City and there are condos only for a small percentage of people.

If you compare the price of luxury condos in Manila with prices of luxury condos in other places, they are still cheap, I can see luxury condos in third world countries way more expensive than in Philippines, like in some countries in southamerica, India etc… If you compare condos in Manila with condos in Singapore you can see that they are cheaper in Manila even if you adjust by the salaries.

But, yes looks like there are too many condos and the price is raising too fast.

Dear Dalamar,

Thank you for your very valuable comment. It is good to know how the Philippines is faring compared to other countries. I really appreciate you taking time to comment and help us in analyzing the situation. Thank you very much!

Best regards,

Cherry

Can the In house financing interest rates be regulated?

Hi Bryan,

The SEC regulates financing companies while the BSP regulates overall credit and liquidity. Together, I believe the SEC and BSP can regulate in-house financing interest rates. This is my humble opinion, based also on the announcement of BSP head Mr. Tetangco on yahoo news as cited in the post above.

Best regards,

Cherry

Hi Jay and Cherry,

I’m an avid reader of your blog and I should say that you guys rock! Anyway, about this post, I too observed that some new developments are waaaay OVERPRICED. Even those who claim to be “affordable living” cost around 1.8 to 2 million php! What’s so affordable about that? You can’t consider that to be middle income housing because middle income earners only earn around 20-25 thousand pesos a month deductible of taxes and contributions. Anyway, this is just a comment. Thanks and may you have more blessings to come!

Chris

Hi Chris,

Thank you for your kind words. Indeed, prices of real estate developments have increased. There are some who take on more than they can chew and sadly end up with their homes being foreclosed. If indeed they are overpriced now, do not worry as the prices will self-correct in time.

Blessings to you too,

Cherry

The entire problem with the US economy is that it is a scam.

The US dollar as the reserve currency is a scam.

We need honest money again, not paper digits in computers where the banks can own your property from thin air.

When “currency” can be printed from thin air without regard of the economic consequences this creates these bubbles.

It would appear that a BSP may be on the side of the people of the Philippines, but we have to see how this actually works out.

God bless everyone, Marc

Hi Marc,

Yes the US currency has been taken off the gold standard, but not the Philippines. In general, I would say that the Philippine finance authorities have been very conservative. I have full faith in the BSP and in Finance Sec. Purisima (He was the Chairman of SGV/Ernst & Young Manila when I was there). But yes, we have to see how it works out.

Hoping for the best,

Cherry

I am a foreigner who owns property with my wife & totally agree that most of the new condominiums are way overpriced. We are always looking but have found nothing of value for a couple of years. The exception being bank foreclosed sales for which we are very grateful to you jay for your postings & advice. The last new property that we bought & was good value was from DMCI with large rooms & very affordable.

Thank you for your comment Mark. It is really hard to pin the value of a pre-selling condominium, and for many who are used to living in houses, the price of a small condo unit is indeed high. I did notice that there are many condo units that were sold at a price which I thought was high during the pre-selling stage and yet the prices increased upon completion and later still. Hard to predict really. Glad you are happy with your purchases!

Best regards,

Cherry

Hi Jay,

I want to ask, because I want to become an accredited real estate broker.

Can you tell me the processing? And if incase, that i didnt pss the exam.. is there any solution or way to still become an accredited agent?

Thanks,

Reign

The bubble in Dubai was mainly produced by In-house financing schemes, when the owners understand that the price is lower than what they already paid, they’ll stop paying and the buildings stop unfinished that is what happened in a number of projects in UAE.

Thank you Dalamar. It is good to have an international perspective. Will look into the Dubai bubble.

Good day Ms. Castillo,

I managed to read this article of yours and found it truly informative and helpful.

In this regard, could you clarify if this move by the BSP once finalized and made official, will then require local real estate developers to significantly lower down their in-house financing interest rates, thus making it more reasonably affordable for consumers?

And, if you believe this to be the case, when do you think will the BSP implement these new policies?

Thank you very much for your time.

Best regards,

Bon A.

Good day din po sir,

Inattempt kong basahin ang highlights of the BSP meeting on monetary policy at nahirapan ako ma-digest agad (http://www.bsp.gov.ph/downloads/MB/2012/mb09132012.pdf). It says that the next meeting will be on Oct. 19 so baka ma-discuss nila ang in-house financing schemes ulit bukas. Ang binabantayan ng BSP ay interest rates and their relation to inflation. Sa ngayon kino-connect ko pa sa utak ko ang relation ng in-house financing rates sa inflation. Posibleng ipababa ang interest rates, posibleng sa bandang pasko kasi marami na namang perang papasok sa Pilipinas na kailangang ilabas.

Sana may economist na mag-comment.

Best regards,

Cherry

Good day Ms. Cherry,

My apologies for the late response for I have been quite busy as of late and thank you again for taking time out to reply to my query.

Have you heard of any updates regarding BSPs’ plans of lowering current developer interest rates for in-house financing and how it relates to inflation?

Maraming salamat po ulit Ma’am.

Best regards,

Bon Albarillo

” I am not an economist and I don’t even particularly like economics.”

Lol

I’m not sure but it seems my wife also does not like economists, particularly former President Gloria Macapagal Arroyo. 😉

Economics lang sinabi ko no, wala akong sinabing GMA. Let the courts decide on what to do with her.

Nice info po. Kakalula naman po nang inyong qualifications. Sana magkaron at nang maka-afford naman na makabili. Para kasi talagang overpriced yung iba.

Sana nga po magkaroon ng regulations, palagay ko makabubuti po yun para sa lahat.