In this video from the Youtube channel of Serbisyong Bayan ni Tatay Rannie, a buyer of an occupied Pag-IBIG Acquired Asset seeks assistance. Watch the video below for details.

Video: Foreclosed Property purchased from PAG-IBIG Fund still occupied 1 year after buyer pays monthly amortization

Here’s a link to the video in YouTube: https://www.youtube.com/watch?v=k5zD3iAD8Hc

Summary

I really feel sad for Ms. Katrina (the buyer) because even after paying her monthly amortizations for a year, she still cannot move-in.

The occupant simply refuses to vacate the property.

And she can’t expect much help from Pag-IBIG (more on this below).

If this video does not convince you to stay away from occupied properties from Pag-IBIG, then good luck to you!

Pag-IBIG charter does not give them the power to eject/evict the occupants of their acquired assets

Another thing that caught my attention was the question raised by Lady I and the answer from Domingo Jacinto, Jr. – Department Manager III, Pag-IBIG. Please refer to the excerpt of the video transcript below:

Tagalog transcript (excerpt)

Here is the tagalog excerpt where this was mentioned in the video:

“(06:39) Lady I: So eto po talagang pagpapaalis sa mga andoon pa na nakatira sa mga bini-bid na bahay dahil hindi nababayaran, ito po hindi talaga sa Pag-IBIG yung pagpapaalis sa kanila?”

“Domingo Jacinto, Jr.: Opo, sapagkat po sa ating charter hindi po tayo binibigyan ng power na paalisin yung andun po sa unit. Kaya po, at the onset, sa simula pa lamang ng ating mga bidding processes, ay ‘yan po ay agad natin pinapaalam sa lahat po ng buyers natin.”

Source: NABILING BAHAY SA PAG-IBIG HOUSING LOAN, MAY NAKATIRA PA? | SERBISYONG BAYAN NI TATAY RANNIE

English translation

If you prefer an english transcript, here you go:

“(06:39) Lady I: So when it comes to the eviction/ejection of those who are still living in the houses for sale through bidding because they were not able to pay, this is really not handled by Pag-IBIG?”

“Domingo Jacinto, Jr.: Yes, because under our charter we are not given the power to evict/eject those who are still in the unit. That is why, from the onset, right at the very start of our bidding processes, we immediately inform all our buyers about this.”

This means, buyer’s cannot expect much from Pag-IBIG when it comes to assistance with evicting/ejecting any illegal occupants.

I also confirmed this with additional information I found on Pag-IBIG’s website, see below.

Want to get notified when this is updated? Subscribe for free updates!

Get new/updated foreclosed listings, auction schedules, property buying tips, and more, sent straight to your email inbox. It's free!

What help can you expect from Pag-IBIG if you buy an “Occupied” acquired asset/foreclosed property?

According to FAQ #18 on Pag-IBIG’s website:

“18. What if the Acquired Asset I want to buy is “Occupied”?

If the property is occupied at the time it is awarded to you, you – as the new legal owner – have the right to initiate the necessary steps to regain possession.

You may pursue this by:

- Coordinating with the local Barangay for mediation, or

- Filing a legal case in court, if needed.

Pag-IBIG Fund will provide all necessary documents to prove your ownership and, upon request, may assign a representative to serve as a witness in court proceedings.“

Source: Pag-IBIG acquired assets page as retrieved on August 26, 2025

What I highlighted in yellow above is the assistance you can expect from Pag-IBIG when it comes to ejecting/evicting illegal occupants.

Another possible option: Replace the occupied unit with an “unoccupied” one from Pag-IBIG?

Thanks to the very helpful comment from Earl, I just want to add another possible option for Ms. Katrina.

First, let me share what Earl said:

“if the buyer/borrower already exhausted all legal remedy then last option is to give up the property and request approval for PAGIBIG to substitute another foreclosed unit with the consideration that all the equity put in including the loan amortization will be accounted. In this way, all the buyer lost is his/her TIME element ( which is unfortunately cannot be reimbursable )”

This was actually alluded to in the video, starting at 08:22.

Here’s what they said:

“Lady I: Siguro pwedeng ano no, na palitan na lang yung unit. Pwede naman yun sir no? Is that possible?

Domingo Jacinto, Jr.: May mga ganyan pong pagkakataon. Iyan po ay titignan ho natin kasi talaga pong kasama po yan yung maaring i-explore para po makatulong po kay ma’am Katrina.”

In english:

“Lady I: Maybe it’s possible to just replace the unit instead. That can be done, right sir? Is that possible?”

“Domingo Jacinto, Jr.: There are indeed situations like that. We will look into it because that is something we can explore in order to help Ma’am Katrina.”

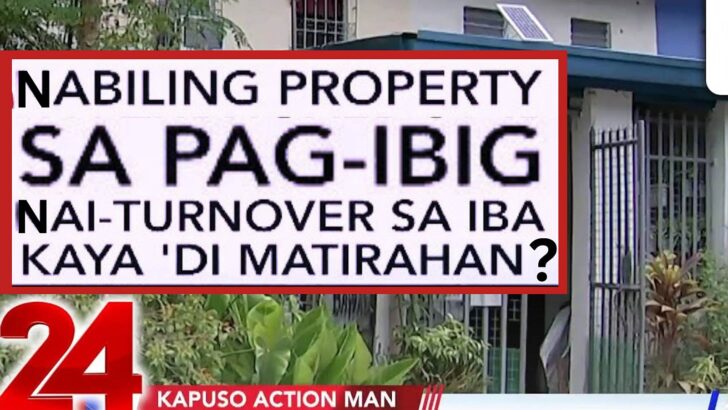

This reminds me of the Pag-IBIG acquired assets that was turned-over to the wrong buyer. Pag-IBIG fixed this by offering a replacement house and lot with equal size and value, located in the same subdivision.

You can read more about this/or watch the video here: Pag-IBIG Acquired Asset Turned Over To Wrong Buyer, Real Buyer Can’t Move-in (And How To Avoid This)

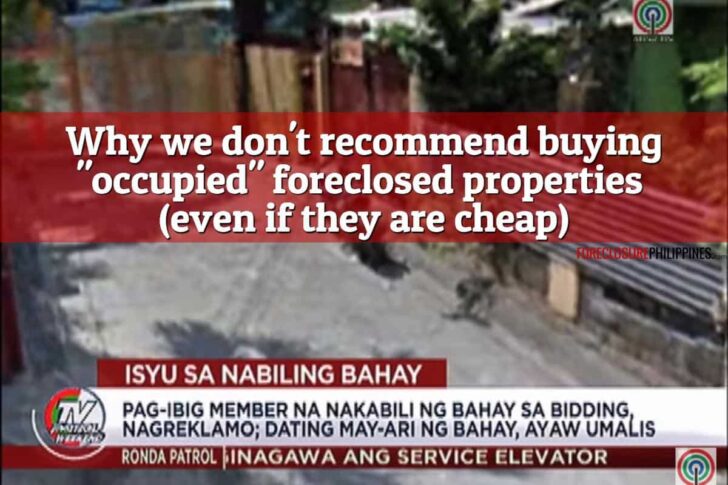

Conclusion: Never buy “Occupied” Pag-IBIG acquired assets/foreclosed properties

I hope Katrina’s experience makes it very clear why we do not recommend buying occupied foreclosed properties from Pag-IBIG, even if they are cheap.

Yes, Pag-IBIG foreclosed properties/acquired assets might come with a huge discount (Pag-IBIG’s latest promo gives 40% off for occupied properties), but if you cannot move-in and use the property you purchased, then what’s the point?!

I’ve said it before and I’ll say it again, if you find an occupied Pag-IBIG foreclosed property/acquired asset, just walk away!

Hello sir Jay,

id like to add my 2 cents worth of advice to the case wherein one bids for an occupied unit and even paid regular monthly amort but still the buyer/borrower was not able to occupy same unit.

Been there and i must confess that i got overwhelmed by the huge discount and the attractiveness of the unit, but looking at the hindsight now , Ive learned a lot of lessons .

Im sharing this so one may catch a lesson or two – if the buyer/borrower already exchausted all legal remedy then last option is to give up the property and request approval for PAGIBIG to substitute another foreclosed unit with the consideration that all the equity put in including the loan amortization will be accounted. In this way, all the buyer lost is his/her TIME element ( which is unfortunately cannot be reimbursable ) . More power to your advocacy of helping small investors 🙂

Hi Earl,

Thanks for sharing your experience, this is very helpful!

I noticed this was alluded to at 08:22:

“Lady I: Siguro pwedeng ano no, na palitan na lang yung unit. Pwede naman yun sir no? Is that possible?

“Domingo Jacinto, Jr.: May mga ganyan pong pagkakataon. Iyan po ay titignan ho natin kasi talaga pong kasama po yan yung maaring i-explore para po makatulong po kay ma’am Katrina.”

Siguro isa ka dun sa nabanggit ni Mr. Domingo na mga “pagkakataon” na pinalitan na lang yung property. 🙂

I’ll update the article to include this as another option. Thanks again for sharing your insights, really appreciate it!

your welcome po. Will do anything no matter how small to help / assist anyone so they wont have to go through same predicament that i went through.

But mind you, there are a lot of lessons that i got from the experiences. And if someone ask me if i will risk doing the same – my reply will be affirmative. However, it should pass on my ‘ internal checklist ‘ / strict filtering process before committing to buy an occupied one.

Worthy to mention though that replacement is within HDMF internal guidelines -unless may update /changes that i m not privy .

regards

Thanks again Earl!