In this video from Emil Sumangil, he helps a buyer of a Pag-IBIG Acquired Asset who cannot move-in, because the property was turned over to another buyer. It’s hard to believe, but this actually happened. Watch the video below for details.

Video: Property purchased from PAG-IBIG Fund turned over to someone else, buyer cannot move-in

Summary

In this video, Emil investigates a problem encountered by buyer who discovered that the Pag-IBIG foreclosed property/acquired asset he purchased was turned over to someone else.

What makes this more painful is the buyer has been consistently paying his monthly amortization for almost 2 years, and yet he cannot move-in to use the property.

Video Transcript

To make sure nothing is lost in translation, here’s is a full transcript in tagalog:

Tagalog

“(00:02) Napurnada ang paglipat sa sana ay home sweet home ng dumulog sa aming tanggapan dahil napag-alamang may ibang nakatira sa unit na magdadalawang taon na raw niyang hinuhulugan sa pag-ibig fund.

Inaksyonan yan ng team ng inyong Kapuso Action Man. [Musika] Mayo 2023 pa, pinahintulutang mag move-in ng pag-ibig fund si Abril sa nabili niyang house and lot sa Pasong Kawayan Dos, General Trias, Cavite.

(00:36) Mahigit kalahating milyon ang halaga ng property na nasa mahigit 3,000 ang monthly amortization sa loob ng halos tatlong dekada. Pero ang hinuhulugang home sweet home, naging pabigat lang pala sa bulsa.

Mag 2 years na ako naghulog ngayong May. Ang problema hindi ko nga mapuntahan/ ay matirahan nung na-process na tapos na take out na… yung pagpunta ko doon sa unit eh may nakatira.

(01:07) Ang dapat daw nakatira sa katabing property aba’y napunta sa bahay at lupa ni Abril. Sila naman po nagsabi na ang unit nila talaga ay lot 21 kasi yun ang binigay ng pag-ibig sa kanila.

Huli na daw nila nalaman na mali pala ang binigay sa kanila na unit. Sa kabila ng pagkakamali sa turnover, ayaw na raw lumipat ng nakatira dahil napagawa na nila yung extension sa unahan kaya yun ay hindi sila basta-basta aalis.

(01:37) Syempre po eh nakakalungkot na magbabayad ka ng mahal tapos hindi mo matirahan hindi mo lang malipatan.

Wala naman kaming kasalanan dito eh. Kasi huwag niyong sabihing dalawa ang inoocupy namin kasi wala kaming sala eh. Biktima kami.

Dumulog ang inyong Kapuso action man sa Pag-ibig fund. Nagkaproblema raw sa turnover ng housing unit pero sa ngayon ay nag-alok na sila ng kapalit na bahay at lupa.

(02:03) May katumbas din itong laki at halaga na matatagpuan din sa nasabing subdivision. Sumang-ayo naman dito si Abril. Tiniyak din ang ahensya na ang lahat ng naibayad ni Abril sa loob ng nakalipas na dalawang taon ay maipapasok sa kanyang bagong housing unit.

Lumapit ako kay Kuya Emil Sumangil at sa kanyang team ng Action Man at agad-agad naman nila [Musika] naaksyonan.

(02:35) Mission accomplished tayo mga Kapuso. Para sa inyong mga sumbong pwedeng mag-message sa Kapuso Action Man Facebook page o magtungo sa GMA Action Center sa GMA Network Drive Corner Samar Avenue Diliman, Quezon City. Dahil sa anumang reklamo, pangaabuso o katawalian, tiyak may katapat na aksyon sa inyong Kapuso Action Man. [Musika]

Source: Nabiling property sa PAG-IBIG Fund; nai-turnover sa iba kaya ‘di matirahan | 24 Oras

English

If you prefer an english transcript, here you go:

(00:02) The planned move to a “home sweet home” was dashed for a person who sought help from our office after discovering someone else was already living in the unit they had been paying for through the PAG-IBIG Fund for nearly two years. The Kapuso Action team took immediate action. [Music]

In May 2023, Abril was allowed by the PAG-IBIG Fund to move into the house and lot he purchased in Pasong Kawayan Dos, General Trias, Cavite.

(00:36) The property was worth over half a million pesos, with a monthly amortization exceeding PHP 3,000 over almost three decades. However, the home he was paying for became a burden.

“I have been paying for almost two years now. The problem is, I can’t even live there. Even though the processing and take-out are complete, when I visited the unit, someone else was already living there.”

(01:07) The occupants of the neighboring property ended up living in Abril’s house and lot. They said their unit was supposed to be lot 21, which PAG-IBIG had given to them. They only realized too late that they were given the wrong unit.

Despite the turnover error, the occupants refuse to move out because they already built an extension in the front. So, they won’t leave easily.

(01:37) “Of course, it’s heartbreaking to pay so much and still not have a place to live.

We didn’t do anything wrong here. Don’t say we are occupying two units; we are victims.”

Abril sought help from Kapuso Action Man and the PAG-IBIG Fund. It turned out there was a problem with the turnover of the housing unit, but now the agency has offered a replacement house and lot.

(02:03) The replacement property is of equal size and value, located in the same subdivision. Abril agreed to this arrangement. The agency also assured that all payments Abril made over the past two years would be credited toward his new housing unit.

I reached out to Kuya Emil Sumangil and his Action Man team, and they promptly took action. [Music]

(02:35) Mission accomplished, Kapuso! For your complaints, you can send a message to the Kapuso Action Man Facebook page or visit the GMA Action Center at GMA Network Drive Corner Samar Avenue, Diliman, Quezon City.

Because whatever your complaint you have about abuse or corruption—there is sure to be a corresponding action from your Kapuso Action Man. [Music]

Source: Nabiling property sa PAG-IBIG Fund; nai-turnover sa iba kaya ‘di matirahan | 24 Oras

Want to get notified when this is updated? Subscribe for free updates!

Get new/updated foreclosed listings, auction schedules, property buying tips, and more, sent straight to your email inbox. It's free!

Lesson Learned – Secure a foreclosed property immediately upon turnover

The biggest takeaway from this video is the importance of a proper turnover/acceptance

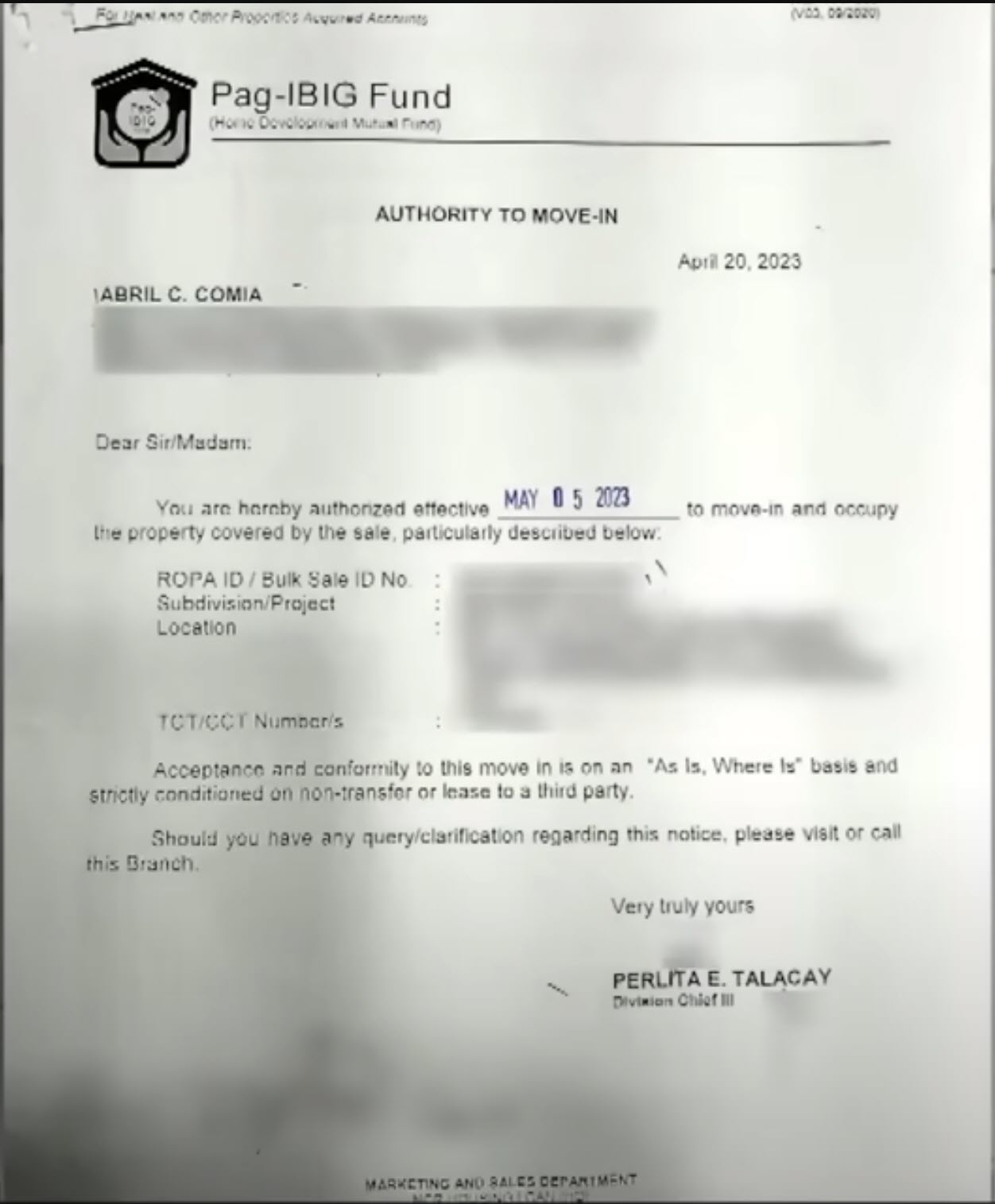

In the video, it appears there was no actual turnover to Mr. Abril Comia, the buyer.

If an actual turnover was done, he would have immediately discovered that another party was already occupying the property (if the wrong turnover was done before Mr. Comia received the Authority To Move-in letter).

Update: I just remembered that Pag-IBIG does not assist buyers with move-in. In their 2020 guidelines, it states “The winning buyer shall take possession of the property without seeking assistance from the Fund”. So they still have the same policy, even if this line was removed in their latest guidelines.

Or, Mr. Comia could have prevented the turnover to another party, if they secured the property upon turnover.

So the first lesson here is, when you buy a foreclosed property/acquired asset, and you get an “Authority To Move-in”, you should immediately go to the property and secure it.

To secure a property, you need to change the locks, make sure all doors/windows are locked, and take possession by moving in immediately.

If you cannot move-in immediately, you should at least get a caretaker who can move-in for you and take possession of the property.

This is the best way to avoid having the same problem if you buy a foreclosed property from Pag-IBIG.

Of course, I am still wondering and very concerned with how this happened in the first place!

How can Pag-IBIG turn over a property to the wrong buyer?

I’m just glad they solved this by allocating another comparable property to Mr. Comia within the same subdivision.

By the way, in case the wrong buyer was able to move-in prior to the receipt of his Authority To Move-in letter, I believe Mr. Comia should not accept the turnover of the property (more on this below).

Secure the property to prevent theft, burglary, illegal occupants, etc.

One last thing, by securing a property as soon as possible, you prevent the possibility of any break-in, burglary, and/or illegal occupants

Keep in mind, Pag-IBIG foreclosed properties do not have caretakers.

The soonest you can secure your property, the better.

I’m sure no one wants to buy a property only to end up with illegal occupants who can cannibalize it (just like what happened to another Pag-IBIG property: Pag-IBIG Foreclosed Property Cannibalized/Damaged by Former Owner).

With regard to illegal occupants, here’s a quick reminder: If a Pag-IBIG acquired asset/foreclosed property for sale is occupied, it would be better to just avoid them and find other properties that are unoccupied, especially since Pag-IBIG says it cannot evict/eject illegal occupants.

Other concerning things

1.Buyer cannot reject the acceptance of the property?

Please correct me if I’m wrong, but it seems that with the turnover process for Pag-IBIG foreclosed properties/acquired assets, the buyer cannot reject the property.

This is implied with the Authority To Move-in letter from Pag-IBIG above as shown in the video.

Based on the wording of the letter, it seems that acceptance of the property is automatic.

Just to give you an idea, for bank foreclosed properties, the turnover process includes the acceptance from the buyer. The buyer can defer the acceptance if there are issues.

For example, I remember a client of mine who could not accept the foreclosed property they purchased because the caretaker could not vacate the property on that day (they needed more time to haul all their belongings). The turnover/acceptance only pushed through the next day when the caretaker finally finished hauling all their stuff and vacated the property.

2.Pag-IBIG foreclosed properties cannot be leased to a third party?

If you will notice in the screenshot of the letter above, it states:

“Acceptance and conformity to this move-in is on an “As is where is” basis and strictly conditioned on non-transfer or lease to a third party“

Source: Authority To Move-in letter from Pag-IBIG from video

Does this mean you cannot buy a Pag-IBIG acquired asset for the purpose of using it as a rental property?

If it’s true that Pag-IBIG foreclosed properties cannot be used as rentals, then this is quite concerning.

This is the first time I have encountered something where buyers of a foreclosed property are NOT ALLOWED to lease out the property they purchased.

Anyway, I’ll search for more info regarding this and update this article with anything I find.

What do you think? If you or anyone you know has more info about this, please share in the comments section below.

Hello sir Jay, im one of your avid followers. regarding the issue below , you may find my 2 cents worth of advise – Stricly conditioned on non trasnfer or lease to a 3rd party

this was ( i think ) provided /imposed as a requirement on the context that the office is a provider for mass housing solely intended for end users and not for investors . The noble mission of the office prevails over other interest . Though in reality , many are playing the role as investors just like you and me and the office cannot totally eliminate such practice as there can be 101 reasons you and i can think to circumvent/justify the standing policy. In all fairness, investors are not the bad guys but we are reminded also of the core mandate /mission of the office and that is to totally give every Filipino a chance to have shelter on their own. Thanks and more power to your advocacy of empowering / uplifting small time investors like me. God bless

Hi Earl, thanks for being with us through the years, really appreciate it!

Thank you also for sharing your point of view about this, makes sense.

In relation to this, I hope Pag-IBIG will address the biggest question that is probably in the mind of a lot of people… why are there so many foreclosed properties from Pag-IBIG?

If Pag-IBIG’s mission is to provide housing for the masses, they should also exert more effort in solving the problem of the masses ending up in foreclosure.

Anyway, that’s enough of my ranting for the day. 🙂

God bless you too Earl!

We should be able to have it leased out. That provision sounds unfair. In fact, I feel that even the prices of Pag-IBIG ‘s foreclosed properties are too high considering the condition of many such houses. Millions of Filipinos are struggling to buy their own house, so why not sell foreclosed properties to them at lower price? I’m sure you’ve seen many foreclosed houses that now look very old and decrepit, and yet still priced at higher than prevailing rates. Nasasayangan lang talaga ako.

Yes RG, if true, this is unfair to buyers who should be able to use the property for something as basic as a rental.

Considering they don’t spend anything for caretakers, Pag-IBIG should be willing to sell at a lower price. I guess their appraisals become outdated when the property deteriorates, or maybe their appraisals are based on brand new properties. Although, they do give discounts depending on the payment terms.

Yes, sobrang dami nilang foreclosed, tapos dahil sa kanilang complicated process (yung limited number of properties per batch/tranche), tingin ko sobrang daming nilang inventory na hindi listed for sale at any given time.

Actually, dapat siguro tutukan din nila kung bakit sobrang dami ng properties na naka mortgage sa Pag-IBIG na nafoforeclose. Last July 2025, record breaking yung more than 10,000 foreclosed properties for sale (even if marami ang hindi naka schedule for sale). Parang padami ng padami habang tumatagal.

So ang tanung ko dito sir bale anu pala ang mangyayari doon sa nakatira doon sa unit eh mali yung ino occupied nila…? Parang magka problema din sila in the future since napagawa na nga nila yung bahay… At pangalawa yung buyer di nya binisita yung property or due deligence bago nya I purchase yun? At saka ganyan pala ang pag turnover sa pag ibig ng mga acquired assets nila… Bahala ka na kung tama yung napuntahan mo o hindi…. Walang nag aasist since minsan magkamali talaga yung tao.

Yun din advantage sa banko pala kasi yung banko may nag aasist talaga sa turnover.

Hi Japhet, sa tingin ko pinagbigyan na lang ng Pag-IBIG yung tumira sa maling bahay, kasi nga mukhang Pag-IBIG ang nagkamali.

Pwede rin na pinuntahan nila yung property bago binili as part ng due diligence, tapos later na nangyari yung maling turnover.

Yes, talagang ganun ang Pag-IBIG, bahala ang buyer mag move-in, since 2020 pa. Sabi sa guidelines “The winning buyer shall take possession of the property without seeking assistance from the Fund.”

Mas gusto ko talaga sa banks, talagang may mag a-assist sa turnover, pag may problem, pwede mong hindi muna i-accept hanggang ma-ayos yung problem.