Since we don’t have a TV at home (by choice), my son and I spend time together watching YouTube videos, and we love watching cartoons. But what if there were cartoons that can help with teaching kids about money, saving and investing, personal finance, those things that can help kids make sound financial decisions as they grow up?

Thankfully, someone very bright came up with a cartoon show which teaches financial literacy for kids and I highly recommend that you watch it together with your children – Cha-Ching Money Smart Kids.

What is Cha-Ching?

According to their Facebook page,

Cha-Ching is a financial literacy program that provides a platform for 7 to 12 year old children to learn (with their parents) the knowledge, tools and practice they need to make informed financial decisions to reach their own personal goals and dreams.

Considering that many money habits are already set by age 7, this program is truly a welcome development.

Cha-Ching is actually a project of Pru Life UK. According to a gmanetwork.com article, Pru Life UK signed a Memorandum of Agreement with the Philippine Department of Education in April 2012 for the integration of the Cha-Ching Financial Literacy for the Youth Program in the Grade 2 curriculum. They already conducted the Cha-Ching Financial Literacy Teachers’ Training for partner public schools all over the Philippines.

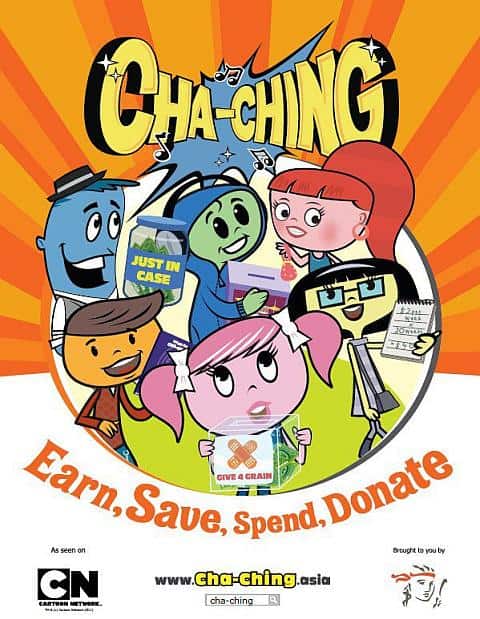

Cha-Ching is a band composed of friends with different personalities. Here is a short video which introduces the characters of Cha-Ching and discusses its main thought for kids and money, which is to “earn, save, spend, and donate”.

I like Cha-Ching because the videos are only around 3 minutes long, and the lessons are learned through music. The songs are very catchy, and I can’t help but memorize the message. It’s been giving me LSS (last song syndrome) in a good way.

Here are some of the videos which I think are good to watch and discuss with our kids.

What to do when you get money

This episode is like an introduction to money management, what kids should do with money they receive.

Saving for Success

This is an introduction to saving and making money work for you, instead of the other way around. Of course, we know that the interest earned through a savings account in a bank are too small nowadays, and it can earn more through other investment vehicles.

Budgeting

Ahhh, budgeting… this episode teaches the importance of having a budget, spending wisely, and adjusting along the way, especially when things don’t go according to plan…

Think before spending

Needs vs. Wants/ Spend your money wisely

Emergency Funds

Money has to be earned

Entrepreneur

Charity

Growing Money

Investing in stocks

Using credit cards

It’s really nice when kids are not bratty and “bilmoko” (“buy me this, buy me that”) because they are learning about how to earn and spend money. These videos are also good reminders for us adults to discipline ourselves and set good examples for our children.

~

Cherry Vi M. Saldua-Castillo

Real Estate Broker, Lawyer, and CPA

PRC Real Estate Broker License No. 3187

PRC CPA License No. 0102054

Roll of Attorneys No. 55239

2013 Internal Education Head, REBAP-LMP

Text by Jay Castillo and Cherry Castillo. Copyright © 2008 – 2013 All rights reserved.

Full disclosure: Nothing to disclose.

Picture from Cha-Ching Money Smart Kids facebook page

P.S. Those who missed the past articles on Financial Education for Kids may click on these links:

Part I, Part II, Part III, Part IV: Summer Activities for 2013, Part V: Getting Used to a Simple Lifestyle, and Part VI: Have a Role Model.