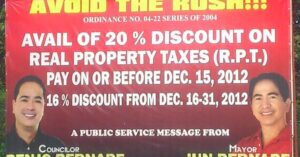

Real Estate Taxes and fees

Donation As An Estate Planning Tool (A Discussion on Donor’s Tax)

The donation of properties can be used as a tool for estate planning. One just needs to be aware that donations are subject to donor’s tax. Read this to find out how much donor’s tax you need to pay when donating a property as part of estate planning.