One of the most important documents that you need in order to transfer a title of a property from the seller to the buyer is the Certificate Authorizing Registration (CAR) and Tax Clearance (TCL) from the Bureau of Internal Revenue (BIR). In this post, I’ll share a step-by-step on how to secure them.

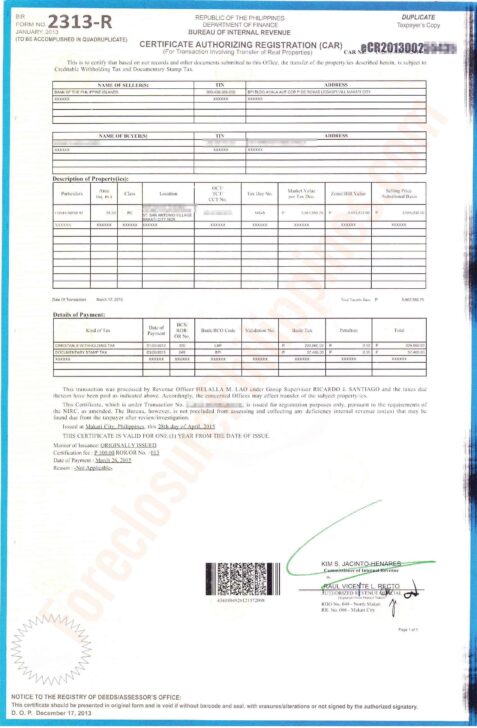

The CAR and TCL is your proof that the proper taxes on the transaction have been paid. The Register of Deeds requires the presentation of these documents as a pre-requisite for title transfer. See sample CAR below, which is from one of my husband’s transactions (with details blurred out).

What is the process?

The first step is to have a notarized document evidencing the sale of the real property classified as a capital asset, usually a Deed of Absolute Sale. You may find samples of this document through google, including here and here.

Next, the taxes need to be paid. You may refer to previous posts on Capital Gains Tax (CGT) and Documentary Stamps Tax (DST).

After you have paid the taxes, you need to request for the issuance of a CAR and TCL from the Revenue District Office where the real property is located. You need to submit the documents supporting the transaction, as well as proof that the correct taxes (both the type of tax and amount of tax), have been paid. The Checklist of Documentary Requirements is in the annexes of Revenue Memorandum Order (RMO) No. 15-03, in particular, Annex “A”. For additional documents, refer to Revenue Memorandum Circular (RMC) No. 76-07 dated October 25, 2007.

The process flowchart is in Annex “L” of the Annexes of RMO 15-03.

Please take note that the CAR for the transfer of real property shall be released by the Revenue District Office (RDO) where the real property is located. Thus, it is important for you to determine the correct RDO since you will be paying the taxes in the Authorized Agent banks (AAB’s) of such RDO.

It is possible that you may think a property falls under the jurisdiction of one RDO when in fact it is under another RDO. If you have already paid the taxes in an AAB of another RDO, you may have to undergo certain processes to transfer your payments to the correct RDO. So, my advice is to look at the map of the coverage of each RDO (there should be a big map at the RDO) to check if indeed the property falls within the jurisdiction of the said RDO.

Mandatory Requirements

For a sale of real property considered as a capital asset subject to capital gains tax (CGT), the mandatory requirements are as follows:

- Tax Identification Number (TIN) of buyer and seller [If one of them does not have a TIN, get a TIN by filling out and submitting BIR Form No. 1904]

- Notarized Deed of Absolute Sale/Document of Transfer. Bring the original and at least two photocopies. The photocopies will be compared against the original and the BIR will retain only the photocopies.

- Notarization fee is usually 1% of the selling price, but some notaries public may charge a lower fee. Just make sure that the notary public is a real one.

- Prepare at least five copies of the Deed of Absolute Sale (one for the notary, one for the buyer, one for the seller, one for the BIR, and one for the Registry of Deeds).

- Prepare photocopies of two government-issued ID’s each of the buyer and the seller. You need the information in the said ID’s in the acknowledgment of the Deed (indicate the name, ID number, date issued, place issued, date of validity).

- Owner’s copy of the Transfer Certificate of Title (TCT), Condominium Certificate of Title (CCT), or Original Certificate of Title (OCT). Bring the original and at least two photocopies. The photocopies will be compared against the original and the BIR will retain only the photocopies.

- You may also get a Certified True Copy (CTC) of the TCT, CCT, or OCT from the Registry of Deeds.

- For Quezon City, the Registry of Deeds is located behind the National Statistics Office (NSO) along East Avenue. Make sure that you have with you a photocopy of the title, authorization letter from the owner, and ID’s of the owner who authorized you to get the CTC of the title.

- When Jay secured a CTC last July 2012 from the Quezon City RD, the issuance fee was P144.00 and the IT Service Fee for the issuance was P643.88, for a total of P787.88 for one CTC.

- Make sure that you get a genuine title and not a fake one. Check the Guidelines On How to Detect Fake Titles from the LRA website.

- If applicable, Sworn Declaration of No Improvement by at least one (1) of the transferees or Certificate of No Improvement issued by the Assessor’s Office

- Format may be found on Annex “D” of the RMO 15-03.

- Get a Certified True Copy of the latest Tax Declaration from the City Assessor’s Office.

- According to the Quezon City government website, you will need:

- Authorization from the property owner;

- Photocopy of a Valid ID of the requesting party;

- Computer print-out from EDP or any reference such as realty tax payment, title, or old tax declaration for purposes of verification

- Certification fee of P50.00 plus P20.00 secretary’s fee (if to be used for BIR)

- According to the Quezon City government website, you will need:

- Official Receipt/Deposit slip evidencing receipt by the owner of the payment of the purchase price

- Duly validated tax return as proof of payment of taxes

Requirements as added by RMC No. 76-2007:

- Photocopy of the official receipts issued by the seller, for purposes of determining whether the sale of real property is on cash basis, a deferred payment sale (when payments in the year of sale exceed 25% of the selling price) or on installment plan (when payments in the year of sale do not exceed 25% of the selling price). The original copy of the official receipts shall be presented to the Bureau for authentication during the processing of the application for Certificate Authorizing Registration (CAR). However, if the seller is not engaged in business, the acknowledgement receipts issued by the seller to the buyer or any proof of payment shall be presented.

- Certified true copy of the original CAR (copy of the Registry of Deeds) pertaining to the transfer of property prior to the issuance of Original/Transfer Certificate of Title (OCT/TCT) or Condominium Certificate of Title (CCT) which is the subject of the current sale/transfer, or certification issued by the Registry of Deeds indicating the serial number of the CAR, date of issuance of CAR, the Revenue District Office Number of the district office that issued the CAR, the name of the Revenue District Officer who signed the CAR, the type of taxes paid and the amount of payment per tax type.

Additional requirements include:

- Notarized Special Power of Attorney (SPA), if the person who signed the document is not the owner which appears on the Title. You may find samples of this document through google – here is one.

- Certification of the Philippine Consulate, if the document is executed abroad. The SPA will be either consularized or authenticated. The document will usually have a red ribbon in front.

- Location plan/Vicinity map if the zonal value cannot be readily determined based on the documents submitted. I think using google maps (maps.google.com) may suffice.

- Such other requirements as may be required by law/rulings/regulations/other issuances

I suggest that you already have the checklist of documentary requirements ready, and have one file containing all the originals and two sets of photocopies so that the BIR One-Time Transaction (ONETT) officer will have an easy time evaluating your documents.

One-Time Transaction (ONETT) Computation

The BIR’s ONETT team will also be relying on this computation sheet so I suggest you make your own computation so you can compare it with the computation of the BIR. The computation sheet can also be found in Annex “B” of RMO No. 15-03.

If all documents are complete, the CAR and TCL should be ready after around two (2) weeks. Just call the contact person at the number on the Claim Slip or “CS” (Annex “C” of the RMO 15-03) and they will give you to inquire if the CAR is ready. When you call, be sure to have the claim slip with you so you are ready with the CS No., date filed, and the name of the transferor and transferee.

Hope this helps!

~

Cherry Vi M. Saldua-Castillo

Real Estate Broker, Lawyer, and CPA

PRC Real Estate Broker License No. 3187

PRC CPA License No. 0102054

Roll of Attorneys No. 55239

2013 Internal Education Head, REBAP-LMP

Text by Jay Castillo and Cherry Castillo. Copyright © 2008 – 2013 All rights reserved.

In Dumaguete/Negros Oriental I waited for five months for the eCAR to be issued

Good day po Mam Cherry and Sir Jay.

May binili po ang tita ko property residential lot sa developer. Natransfer na po sa name nya ang title pero ang Tax Dec po hindi pa po. Ngayon ito po ang inaasikaso namin matransfer sa name nya ang Tax Dec, one the requirement po para matransfer is C.A.R , wala pong binigay ang developer na copy ng CAR and upong requesting sa knila wala na daw po silang copy since 1990’s pa napurchase ang property. Nag request po kami sa RD Calamba , wala po sila pinabayaran hiningi lang po copy ng title at ang sabi nila magtetext pag nahanap na nila. Pero ilang buwan na po nakalipas wala pa rin po sila nahahanap at tuwing babalik po kami para magtanong ano po status ang sagot magtetext.

Question po ano po other way para po matransfer sa name ng buyer ang TAX Dec kung hindi po talaga makapag issue nag RD ng CTC C.A.R?

SALAMAT po sana po ay masagot

Good evening po Atty. Thanks po for the very useful information. I am overseas and I am selling a property in the Philippines. I already executed a SPA sa name father ko po. Ang agreement ko po with the buyer is sila ang magbabayad ng CGT and all other fees pati po pag transfer ng title sa pangalan ng buyer, ako na po magbabayad. Ano po ang dapat na nakalagay sa Deed of Sale sa ganung case?

Based po sa procedures nyo, ang may hawak lang po ng SPA ko ang pede magprocess ng CAR. Paano po yung kung yung buyer ang magbabayad?

Have a blessed day po Atty. ,

Nais ko po sana itanong about s CAR kung every land title po ba ay iisa lang ang CAR number o bawat land title ay may kanya kanyang CAR # kc po pinalakad ko po ng title ko sa kakilala ng pinsan ko, nung may nakausap ko ako sabi ipaverify ko daw po s BIR kung tama lahat. Lumabas po n ang CAR # ko po ay naka address s laguna at ndi po s akin nakapangalan. Ang property ko po ay nasa Cavite.

Sana po matugunan nyo po ang aking katanungan at kung ano po ang dapat kong gawin.

Marami pong salamat

And GOD bless you.

More power.

Hi Lora, sorry busy po ang wife ko, kaya ako na sasagot.

May CAR po kada transfer of ownership ng isang property. Kung may copy kayo nung mismong CAR, yun ang ipakita/ipaverify niyo sa BIR na sumasakop sa property niyo sa Cavite

Im buying a lot with an old house which was not declared at the assessors but only the lot. Can i request for cert of no improvement even if there is an old house or will i have it declared first at the assessors? Thanks po.

Hi Vina, if you request for a certificate of no improvement, they will inspect the house and see the old house, and they’ll probably deny your request. I believe the old house has to be declared but it may incur penalties for the years it was not declared and taxes were unpaid.

Hi Atty! Need your help Po. I have the title of the land I purchased 15 years ago but I was not able to transfer the declaration of tax under my name. Recently I had requested the transfer but they asked for Deed of sale which I don’t have in hand coz I have lost it. What should I do to produce the deed of sale? Should I ask the previous owner to make me another new deed of sale?

Hi Julie, my wife never checks the comments here (she’s always in facebook) so I’ll answer this. You can ask for a copy of the deed of sale from the Registry of deeds. When you transferred the title, you had to give a copy of the deed of sale to them. I just hope it is still intact and was not lost during their computerization project. Another option would be to go to the notary public who notarized the deed of sale and hope he/she still has a copy of the deed of sale. Good luck.

Does the Buyer shoulder the payment of CAR? The Developer of the Townhouse I am buying said that we have to split the payment of the CAR amounting to P50K. Plus the spelling of my Middle name in the 2313-R form is wrong. Even my address. Will that document be considered legit?

Are you referring to the taxes that are required to be paid for the filing of the CAR? Usually the payment the biggest tax (CGT or CWT) is shouldered by the seller, and the rest are shouldered by the buyer. However, it really depends on your agreement. For example, all taxes related to the purchase of Unionbank foreclosed properties are for the account of the buyer, it is their policy, and buyers have to agree to this.

Regarding the typo error on for 2313-R, you can check with the BIR officer of the day in the concerned RDO if you can make an amended return so you can correct the spelling of your name.

Hi, if I notarize the deed of sale today, do I have a deadline of until when I can get the eCAR processed?

As far as we know, the filing for eCAR has no deadline. However, The taxes will have their own deadlines: CWT or CGT (whichever is applicable), DST, Transfer Tax, business tax (if applicable).

My suggestion, once you have all the applicable taxes paid, proceed immediately to the concerned BIR office to file the eCAR.

Hi Po Sir. Please give me an advice Po I terribly need help.

Hi Atty! Need your help Po. I have the title of the land I purchased 15 years ago but I was not able to transfer the declaration of tax under my name. Recently I had requested the transfer but they asked for Deed of sale which I don’t have in hand coz I have lost it. What should I do to produce the deed of sale? Should I ask the previous owner to make me another new deed of sale?

Pingback: Time to outsource my title transfer

Hi Atty., may I also inquire on the timeline by which the processing takes place? Thank you very much.

Goo day! I would like to ask about the portion of land I just recently bought. Out of 1,113 sqm I bought 10×50 sqm (500sqm). I have all the documents like deed of sale notorized. The tax declaration was already transferred to me. Provincial assessor’so office processed the documents in order to transferred the tax declaration to me. I was the one who paid all the tax dues from 1995 to present. I keep all the origins receipts and original documents. I fully paid the seller who is the administrator of the land and the son of the owner whose name appeared in the tax declaration died already many years ago and out of 7 siblings 4 died also. The 1 sibling is a nun and the other one was living outside country. In other words, I bought the land in good faith. I build a small station for my plan business. Then after 2 weeks I returned back abroad for work. Unfortunately, just this morning I received a message that someone from the children of one siblings owners who was outside country was complaining and sent mail to the municipality and Barangay that he owned the land and requesting to cancelled the tax declaration under my name. Though, he doesn’t have the legal documents that he owned the land. He doesn’t have the deed of sale at least. He just proved himself thru his emails that he is the owner. Having said that, I would like to seek advise to you if you won’t mind what are my rights? I invested money for that land already. I fully paid the seller and I have the hand written by the seller that he received my cash. I build a station already, do they have the right to cancelled it? It’s possible to cancelled it even am outside country? Please advise. Whatever legal advise you can share is highly appreciated. Thank you in advance. Awaiting for you prompt response on this matter.

Good day

Sana po matulungan nyo ako,meron po kming property na ianaccquire here in Laguna, nag inquire na po ako sa BIR about paying of Capital Gain Tax, himahanapan pa po nila aq ng previous Car, so i asked the developer about the documents.. Pero almost a month na po wala pa rin ung documents na nireresquest q sa knila… Nag advise sila sa akin na itry ko daw po sa LRA kumuha ng copy… Is that possible na we can get a copy of Car in LRA?

Hoping for your answer. Thanks in advance..

It is posible to get old tax receipts? Kasi gitratransfer namen na un ryt of way mma nakapangalan sa tatay ko ngayn prblema kc 25 years na patay papa ko ang hnahanap ngayon ng bir is un tax receipt and estate tax na bnayaran namen para matransfer un orgnal na titlet namen kaya lang d na makta un old receipt nun 1990

Good day Maam, i would like to ask how long would it take to process the CAR in order for us get our clearance since as far as i know the TCL has already been forwarded to CAR as of today, now we are waiting for the release. Does it only take a day, a week ? coz the BIR Iloilo cannot say when. Thanks for any advise. God bless

Hi Atty. Castillo, good day! hope you can help me po. We are currently processing tax returns for the unit we bought from the first owner of the condo in BGC. I was asked to prepare the requirements like the Notarized deed of sale, TIN of the seller and buyer, certification from the developer that the condo has not been leased, and the certification of no assessment for taxation from assessor’s office. However upon requesting for the certification from assessor’s office we found out that the property has been assessed already and we also found out from the records of assessor’s office that the developer has not yet transferred the property tax declaration to the first owner. We checked with the developer but they said they are still processing the tax clearance for the transfer and we are running out of time because we will be penalized by the BIR if we file it later than October 5. Please advise what we should do to avoid the penalty. Thank you very much

Hi po,

Ask ko lang po pano po ang pagfile ng CAR online? Sabi po kc sa. BIR Tacloban, online na daw po ang registration.

Hi Catherine, sorry hindi po kami aware sa ngayon kung pwede or paano ang pagfile ng CAR online, will check and share any details will find. Salamat po sa heads-up!

I wonder why here in RDO 74 – Iloilo, it took 5 weeks to finish TCL and it is now on CAR typing status for a week. I hope it will not take another 5 weeks for typing the CAR.

” If all documents are complete, the CAR and TCL should be ready after around two (2) weeks.”

Thanks & God bless you.

Hi, I would like to know if CAR is needed to transfer the lot use as right of way. Thank you.

hi, naibigay sa iba ung car ko. nag kamali ung bir. what if hindi bumalik ung kumuha? what’s the next move? please advise. thank you..

Pingback: How To Compute For Registration Fees

Pingback: Our Top 10 Real Estate Investing Blog Posts For 2013

An owner claims that they do not have the CAR of the property as in 1995 when they bought the office unit, no CAR was being issued yet. Is this true? Is it really possible not to have CAR for a property bought and titled to you?

Gud day po! San po b mkukuha ang license to sell at exemption cert. Hinihingi po kcng reqs s BIR un from homeowners assoc pero ang bngay po s akin ng HOA ay secretarys cert at board resolution n nkpaloob n bnbgyan ng krapatan ang presidente ng HOA n pumirma at mgreceive ng papers pero hndi po inaprubahan ng BIR dhl hndi dw go exempt ung from association to beneficiaries.tulungan nyo po aq matagal n po kc nabili ng magulang q ung lupa hanggang ngaun wla png titulo.TCT lng po n nkpangalan p s association

Yung License-To-Sell, sa HLURB po nakukuha yon. Please get their contact details sa https://www.hlurb.gov.ph Pakitanong na din po sa kanila kung saan nakakakuha ng exemption certificate.

Good morning Miss Cherry,

BIR official is asking for the original copy of CAR for us to have a transaction with them. However i recall that they got the original copy and gave us the original duplicate copy. Can we transact with this original duplicate copy?

Thank you,

Jane

Hi Jane, yes, the original duplicate copy (the yellow copy) should suffice.

Thank you very much Atty. What should I do If they do not want to accept the yellow copy (CAR). They are asking for the Blue Copy (CAR).

Hi atty.

I am selling our family residence and as i gather info from BIR website it is exempted from payment of CGT provided proceeds of sale is utilized to purchase the new family residence. Upon inquiry with BIR, it seems such exemption does not exists. What are the requirements to avail of this exemption? I have read that there’s a time frame of 30 days from execution of deed of sale. When I approached another BIR personnel she told me to comply first with the requirements for CGT and after i comply them she’ll give me requirements for the tax exemption. What I am afraid of is that I might not be able to catch up with the time limit given from date of deed of Sale. Please help. Thanks

Good day, Ma’am Cherry & Sir Jay!

I wish you could impart your knowledge regarding this:

The owner of a a unit townhouse was able to acquire it while he was still single, so it was indicated on the TCT. Now, the wife is asking me, as her real estate broker, if they should change his status to “married to (wife’s name)” and what will happen if they didn’t change it?

As to my opinion… since there are supporting documents like their marriage certificate & children’s birth certificate, there would be no problem… but I don’t know if it’s really right. I thought also that if they wanted to change it, they may do so ( may also include wife as co-owner or even the children). But can you impart your knowledge as how it is done as well as the documents needed?

Thanks & waiting for your reply.

Hope to learn from you more.

God bless!

Dr. Ruth Caramoan

LREB#0013116