To transfer the ownership of a property title in the Philippines, transfer tax must be paid. In this blog post, I’ll share everything you need to know about transfer tax based on our experience with our own real estate transactions.

What is transfer tax?

A transfer tax is imposed on the sale, donation, barter, or any other mode of transferring ownership or title of a real estate property. It is a tax paid to the local government.

Please don’t confuse this with transfer taxes that are paid to the BIR (which are donor’s or estate taxes).

By the way, the acronym TT is often used for transfer tax.

How to compute for Transfer Tax

To compute for Transfer Tax, we must first find the Transfer Tax Rate we should use.

According to Section 135 of the Local Government Code of 1991, Transfer Tax is at most 50% of 1% or 0.50% (It is up to 75% of 1% or 0.75% in the case of cities and municipalities within Metro Manila) of the total consideration involved in the acquisition of the property or of the fair market value in case the monetary consideration involved in the transfer is not substantial, whichever is higher.

Here’s a copy of section 135:

“SECTION 135. Tax on Transfer of Real Property Ownership. (a) The province may impose a tax on the sale, donation, barter, or on any other mode of transferring ownership or title of real property at the rate of not more than fifty percent (50%) of the one percent (1%) of the total consideration involved in the acquisition of the property or of the fair market value in case the monetary consideration involved in the transfer is not substantial, whichever is higher. The sale, transfer or other disposition of real property pursuant to R.A. No. 6657[2] shall be exempt from this tax. xxx”

Source: Local Government Code of 1991 via Chan Robles Virtual Law Library

However, we have noticed that some LGU’s follow the tax rate for Metro Manila, even if they are outside Metro Manila. One example is Santa Rosa, Laguna (their tax rate is 0.60%). For better understanding, refer to sample computation below.

Transfer Tax Computation (actual transaction)

Let’s take for example a foreclosed residential house and lot in Santa Rosa, Laguna. The Selling Price (SP) was Php1.8M (as per deed of absolute sale). The existing market value (as per Tax Declarations) is Php480,000.00 for the land and Php979,316.93 for the improvement (The total market value is Php1,459,316.93).

I actually did the title transfer for this foreclosed property to the buyer and I am using actual values ~ Jay Castillo

Since SP of the property being transferred is higher than the Market Value, we shall use SP to compute the TT:

Santa Rosa, Laguna TT Rate: 0.60% [that is, 60% of 1%]

TT = 0.60% x 1,800,000

= 0.006 x 1,800,000

=Php10,800

Note: In addition, they added a certification fee of Php30.00 for this particular property

In the above transaction, the tax base was easy to determine because SP was higher than market value on the tax declarations.

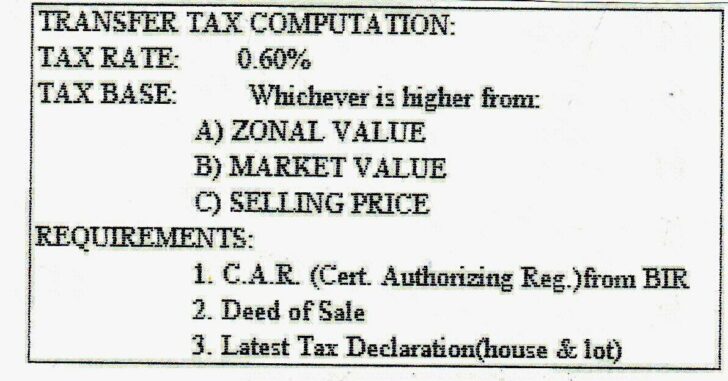

Tax Base to use

To make it simple, the tax base is whichever is the highest of the following:

- Zonal Value (get this from from the BIR)

- Market Value (as stated in the tax declarations)

- Selling Price (on the deed of sale)

This was attached to the assessment we got, see below (from Santa Rosa, Laguna)

Why you need to pay

You need to pay transfer tax because the evidence of its payment is required by the Register of Deeds of the province concerned before you can register any deed or do a title transfer to get a new title under your name.

This is also required by the provincial assessor before they can issue a new tax declaration with the new owner (the old tax declaration is canceled).

Who should pay

The payment of Transfer Tax is the responsibility of the seller, donor, transferor, executor, and/or administrator.

However, the cost can actually be shouldered by either party, it depends on the agreement between the buyer and seller. I noticed that it is usually shouldered by the buyer or new owner, it seems this is the standard practice in the Philippines.

The legwork however is usually done by the seller. Don’t worry, the payment of transfer taxes may also be outsourced to a licensed real estate broker, or someone you trust who knows how to do this. For example title transfer companies like Conveyance Realty Inc. could transfer the title for you and the payment for TT is included.

Let me make it clear, while the cost for TT shall be paid or shouldered by the new owner, the seller is the one who does the legwork.

When to pay

The deadline for payment is sixty (60) days from the date of the execution of the deed or from the date of the decedent’s death.

Please note too that notaries public are required to furnish the provincial treasurers with a copy of any deed transferring ownership or title to any real property within thirty (30) days from the date of notarization.

Penalties and Surcharges for late payments

As per section 168 of RA 7160, here are applicable penalties, surcharges for late payments.

- Surcharge – No more than twenty-five percent (25%) of the amount of taxes, fees or charges not paid on time

- Penalty – No more than two percent (2%) per month of the unpaid taxes, fees or charges including surcharges, until such amount is fully paid, but in not to exceed thirty-six (36) months or seventy-two percent (72%).

Where to pay

The transfer tax is to be paid at the Treasurer’s Office of the city or municipality where the property is located.

Transfer Tax Requirements

In general, the requirements for making the payment (in addition to the money for payment of course) are the following:

- Certificate Authorizing Registration (CAR) from the Bureau of Internal Revenue;

- Realty tax clearance from the Treasurer’s Office; and

- Official receipt of the Bureau of Internal Revenue (for documentary stamp tax).

However, It would be wise to also have the following, which are also required in some cities/municipalities:

- Certified true copy of the transfer certificate of title (TCT) or condominium certificate of title (CCT)

- Deed of sale

- Latest tax declarations (land and improvment as applicable).

By the way, it’s really a must to check for any unpaid real estate taxes before buying a property because you will have to pay for any arrears before you can get a realty tax clearance from the Treasurer’s Office.

In addition, because of the requirement for the CAR from the BIR, the schedule can become too tight. This happened to us several times because of delays with the release of the CAR and we almost missed the 60-day deadline for the payment of TT.

Looking back, I’m just glad that the personnel at the concerned LGU accommodated our payment even without the CAR and we were able to avoid penalties.

What if you don’t agree with the Treasurer’s computation?

Assuming you disagree with the tax assessment made by a local treasurer, you may file a written protest thereof pursuant to Section 195 of the LGC, which provides:

“SECTION 195. Protest of Assessment. — When the local treasurer or his duly authorized representative finds that the correct taxes, fees, or charges have not been paid, he shall issue a notice of assessment stating the nature of the tax, fee, or charge, the amount of deficiency, the surcharges, interests and penalties. Within sixty (60) days from the receipt of the notice of assessment, the taxpayer may file a written protest with the local treasurer contesting the assessment; otherwise, the assessment shall become final and executory. The local treasurer shall decide the protest within sixty (60) days from the time of its filing. If the local treasurer finds the protest to be wholly or partly meritorious, he shall issue a notice cancelling wholly or partially the assessment. However, if the local treasurer finds the assessment to be wholly or partly correct, he shall deny the protest wholly or partly with notice to the taxpayer. The taxpayer shall have thirty (30) days from the receipt of the denial of the protest or from the lapse of the sixty-day (60) period prescribed herein within which to appeal with the court of competent jurisdiction, otherwise the assessment becomes conclusive and unappealable.”

Source: Local Government Code of 1991 via Chan Robles Virtual Law Library

In the case Romulo D. San Juan vs. Ricardo L. Castro, in his capacity as City Treasurer of Marikina City [G.R. No. 174617 dated December 27, 2007], one of the issues was the proper computation of the transfer tax base.

In this case, petitioner San Juan conveyed real properties to a corporation in exchange for its shares of stock[1]. Using as basis Section 135 of the LGC, San Juan wanted to pay the TT based on the consideration stated in the Deed of Assignment.

Respondent Castro, as the Treasurer, informed him that the tax due is based on the fair market value of the property. Petitioner Castro protested the Treasurer’s computation in writing, which the Treasurer also denied in writing.

Petitioner Castro then filed a Petition for mandamus and damages against the Treasurer praying that he be compelled to accept payment of the transfer tax based on the actual consideration of the transfer/assignment.

The bone of contention was the proper interpretation of Section 135 of the LGC.

Petitioner San Juan took the position that the transfer tax base should be the total consideration involved, because the intention of the law is not to automatically apply the “whichever is higher” rule.

He argued that it is only when there is a monetary consideration involved and the monetary consideration is not substantial that the tax rate is based on the higher fair market value.

His argument was that since he received shares of stock in exchange for the real properties, there was no monetary consideration involved in the transfer.

Respondent Castro, on the other hand, took the position that the transfer tax base should be the fair market value, because it is higher than the “monetary consideration” San Juan received in exchange for his real properties.

Castro argued that “monetary consideration” as used in the LGC does not only pertain to the price or money involved but also, as in the case of donations or barters, to the value or monetary equivalent of what is received by the transferor, which, in this case, Castro argued to be the par value of the shares of stock San Juan transferred in exchange for shares of stock.

As anticlimactic as this may sound, the Court did not rule squarely on the correct computation of the transfer tax base because it held that a Petition for Mandamus was not the correct remedy.

Mandamus lies only to compel an officer to perform a ministerial duty (one which is so clear and specific as to leave no room for the exercise of discretion in its performance) but not a discretionary function (one which by its nature requires the exercise of judgment).

In the case above, the Petitioner protested in writing against the assessment and Respondent denied it in writing as well. Petitioner should thus have either: 1) appealed the assessment before the court of competent jurisdiction, or 2) paid the tax and then sought a refund.

In my view, the Petitioner San Juan could have made another argument, that is, assuming that the “monetary consideration” would be equivalent to the par value of the stocks (which is still lower than the fair market value), that value is substantial and thus, there is no need for the “whichever is higher” provision to kick in.

Anyway, hopefully this issue would be decided upon squarely soon as there are really a lot of tax-free exchanges occurring and we really need guidance on the computation of transfer tax. Perhaps one day a taxpayer and his tax attorneys may decide to bring this issue up until the Supreme Court for a final decision.

Taking everything into consideration, personally, unless the difference in tax that you need to pay is really significant, it would be better to follow the computation of the Treasurer. Filing a case in court would require filing fees and fees for tax attorneys, not to mention taking up much of your time. If you will not pay the transfer taxes, you cannot transfer the title to your name and this would lead to problems with your buyer and the closing of your sale transaction. Weigh your options first before heading to battle. In real estate, as in everything, closing the deal fast is key.

Conclusion

The legal transfer of real estate property ownership can be tedious and costly. Transfer tax is just one of the many taxes and fees that need to be paid to do the transfer of title / ownership of a property.

Other transfer fees and taxes are as follows:

- Creditable Withholding Tax (CWT) or Capital Gains Tax (CGT), whichever is applicable (to be paid to the BIR)

- Value Added Tax (If applicable – to be paid to the BIR)

- Documentary Stamp Tax or DST (to be paid to the BIR)

- Business Tax (if applicable, depends on the LGU)

- Registration Fees (to be paid at the registry of deeds)

- IT Fees (to be paid at the registry of deeds)

Yes, while the cost to transfer the condominium or land title plus CGT or CWT, DST, transfer tax and registration fees can really add up, owning real estate in the Philippines can be rewarding and worth it… if chosen wisely!

[1] We will discuss the mechanics of a tax-free exchange in a later post

[2] Comprehensive Agrarian Reform Program

—–

Disclaimer: While great effort has been taken to ensure the accuracy of the discussion here as of its writing, this is not intended to replace seeking professional services. Always consult with your tax attorneys and read up on the relevant laws and regulations also.

To our financial freedom!

Jay (and Cherry) Castillo

Real Estate Investor

PRC Real Estate Broker License #: 3194

Blog: https://www.foreclosurephilippines.com

Text by Jay and Cherry Castillo.Copyright © 2023 All rights reserved.