As 2010 comes to an end, I can’t help but look back and list down just some of the most significant and sometimes painful lessons I personally learned during the past year. I hope these lessons would help us all move forward in 2011.

Here are my top 20 lessons learned for 2010:

1. Real estate investing should be fun

If it ain’t, then there’s a problem somewhere. Find it, and correct it fast, before you lose interest or get burned out.

2. Real estate investing should be treated as a business.

The whole process of real estate investing should be defined, streamlined, and be made into a system, and then maybe it can become a business in the true sense as described in the book “The E-Myth Revisited” by Michael Gerber. We tried to do this but someone told us top drop it and just focus on making money by doing more deals… never mind if it stresses you out and burns you out. Yeah right, words of wisdom indeed (If you don’t notice it, I’m being sarcastic)! A better approach would be to build a sustainable real estate business (that you will actually love to grow for the long term).

3. Always deal with the decision maker.

Yes, we already know this for buyers, but I learned how important this was with sellers as well. Imagine how you would feel if you had a buyer for a property and the seller backs out just as your buyer is about to pay? Imagine how you would feel if this happened twice?! Ouch!

4. It is easier working with banks than with individual sellers

Unless the individual seller is really motivated, I would rather get my deals from banks. So I guess the key lies in finding really motivated sellers.

5. Don’t let “things” distract you from the goal.

Yes, real estate investing is a numbers game, but who cares if you always meet to discuss progress reports and some numbers but never close any deal? It’s like being efficient but ineffective.

6. A lot of things are better outsourced.

It is really better to outsource and delegate some things to people who can do it better than you, even if you need to pay a premium. The time that you free up for you to do more important things through outsourcing is well worth it.

7. Focus on your strengths.

It would be pointless to exert too much time and effort to do something you are not good at. Learn to outsource or delegate, see #6 above! Focus not only on what you are good at, you also need to focus on the highest and best use of your time.

8. If it aint broke, don’t fix it. But if something is broken, then by all means, fix it!

If something does not work, or takes a heavy toll on you, your family, your health, (sounds like being back in the rat race), etc, do something to fix it!

9. Follow your instincts.

Remain to be optimistic and open minded but also learn to trust your gut feel, and read between the lines. I will listen more to my wife’s “women’s intuition”.

10. Always be humble…

And yet do things that you can be proud of. This is kinda hard to explain, but based on observations, I can assure you all that this is very true. Stay away from those self-proclaimed gurus! Consider yourself warned!

11. Be proactive!

We always have a choice, believe it or not! We are responsible!

12. Learn to say “No!”, or “Thanks, but no thanks!”

We always have a choice, see #11 above! It is up to us to make that choice, and if it does not feel right (among other things) then just say no!

13. Integrity is an all or nothing deal.

It is either you have it or you don’t. Act with it integrity at all times or lose it. Walk the talk because talk is cheap, and people will know.

14. When an opportunity comes, and it is the right one for you, grab it!

As long as it is neither illegal, nor immoral, nor unethical, go for it! It can snowball into a series of advantages and lead to even more opportunities.

15. Always do your due diligence, even with people.

Checking with the NBI might seem overkill, but at times it is necessary.

16. Ready-Fire-Aim can be confused with Fire-Aim.

Don’t ever forget that you still need to get Ready before you Fire! Yes, Ready-Aim-Fire has become Ready-Fire-Aim for a lot of people, but in both cases, one still has to get “Ready”! “Think before you act”. “Look before you leap”.

17. The end does not justify the means.

This may sound like common sense but I have observed that common sense is not so common after all.

Rather fail with honor than succeed by fraud. – Sophocles

18. You cannot change people

Don’t ever believe that you can change people. You can try, but you can only do so much. However, you always have a choice (see # 11), and you can choose to avoid people who don’t want to change. In the end, what you can do is change yourself and what you do. One more thing, while the past does not necessarily define one’s future, what someone did to other people in the past is a good indication of what he/she will do to you if that is their true nature.

19. Don’t be too hard on yourself and others.

Believe it or not, most people did the best they could at that particular point in time. I was reminded of this during one of Bo Sanchez’ talks during The Feast at the PICC.

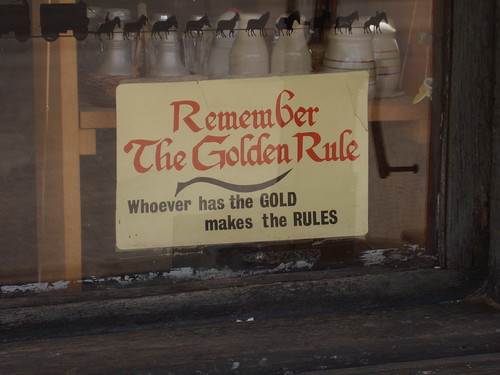

20. Always remember the Golden Rule.

After all, what goes around comes around.

For in the same way you judge others, you will be judged, and with the measure you use, it will be measured to you. ~ Matthew 7:2 New International Version

Sigh, such a long list, and yet there are more. But this should do for now. I hope this helps other real estate investors out there to have an even more successful 2011.

Of course, there are also so many things to be thankful for in 2010, and these will be covered in another post. In the meantime…

I wish you all a Happy and Prosperous New Year!!!

To our success and financial freedom!

Jay Castillo

Real Estate Investor

PRC Real Estate Broker License #: 003194

Blog: https://www.foreclosurephilippines.com

Follow me in Twitter: http://twitter.com/jay_castillo

Find us in Facebook: Foreclosure Investing Philippines facebook page

Text by Jay Castillo and Cherry Castillo. Copyright © 2010 All rights reserved.

PS. Don’t be the last to know, subscribe to e-mail alerts and get notified of new listings of bank foreclosed properties, public auction schedules, and real estate investing tips.